Mastering the Seed Rounds: A Guide to Successful Web3 Investment Fundraising

18.05.2023

Share this post:

Vlad Svitanko

12 min

RELATED

Hey, cryptopreneurs! Today, we're going to discuss one of the most crucial topics that concern everyone starting a web3 startup: how to secure initial investments to launch a project.

It's no longer 2017 when investors were willing to pour money into anything labeled an ICO. The market has stabilized, and now, to attract investments, you need not only an innovative idea but also the ability to effectively sell it to investors.

We've prepared the ultimate guidebook, focusing on the key aspects you need to address in order to secure funding. Let's dive in!

It's no longer 2017 when investors were willing to pour money into anything labeled an ICO. The market has stabilized, and now, to attract investments, you need not only an innovative idea but also the ability to effectively sell it to investors.

We've prepared the ultimate guidebook, focusing on the key aspects you need to address in order to secure funding. Let's dive in!

Establishing a Solid Foundation

The first and foremost step is to position your project and establish its ideology. Your brand must have a captivating story that not only intrigues others but also entices them to become a part of it. Remember, investors are interested in the team's energy, so ensure that energy is directed in the right direction.

SUBSCRIBE TO OUR BLOG

Building a Strong Team

Why should investors believe in you? This is the initial question that will arise in an investor's mind when you present your pitch. To confidently answer this question and avoid getting caught off guard, you need to showcase your team's expertise in a smart and strategic manner. This goes beyond simply listing LinkedIn profiles. Highlight your team's synergy by emphasizing previous successful projects and industry experience, particularly in web3 ventures. If you lack such experience, focus on current achievements to demonstrate your ability to deliver results. By the end of the team presentation, investors should have no doubts about your team's potential to execute the project.

Marketing Fundamentals

Key Drivers of a Go-to-Market Strategy:

By having a solid strategy in place, you will know:

A clear and comprehensive go-to-market (GTM) strategy with calculated costs is essential. Your GTM strategy should align all the crucial elements that drive your business, including marketing, customer information, and brand development. It provides an actionable plan to effectively reach your target customers. A robust GTM strategy enhances market awareness and ensures that you don't waste valuable resources, time, and money by introducing an unnecessary product to the market.

Value: Clearly define what sets your product apart from competitors. Why would someone choose your product over what's already available?

Positioning: Determine your product's position in the market. How do you want people to perceive your product in relation to competitors?

Customers: Identify your target customers. Who are they?

Channels: Understand where your target customers make their purchases and where you should promote your products.

Price: Define your pricing strategy.

Positioning: Determine your product's position in the market. How do you want people to perceive your product in relation to competitors?

Customers: Identify your target customers. Who are they?

Channels: Understand where your target customers make their purchases and where you should promote your products.

Price: Define your pricing strategy.

- Who your market is.

- How well-timed your market entry is.

- The most effective channels to reach your target audience.

Business Model

Tokenomics

Basic Investment Parameters

Marketing Metrics

A well-defined and detailed business model is crucial for your project. It is essential to have a written plan outlining how your project will generate revenue and sustain itself for at least the next three years. This goes beyond tokenomics and focuses on what your users will pay for. You need to determine whether you'll adopt a freemium model or a subscription-based service, and provide specific details about how these models will work.

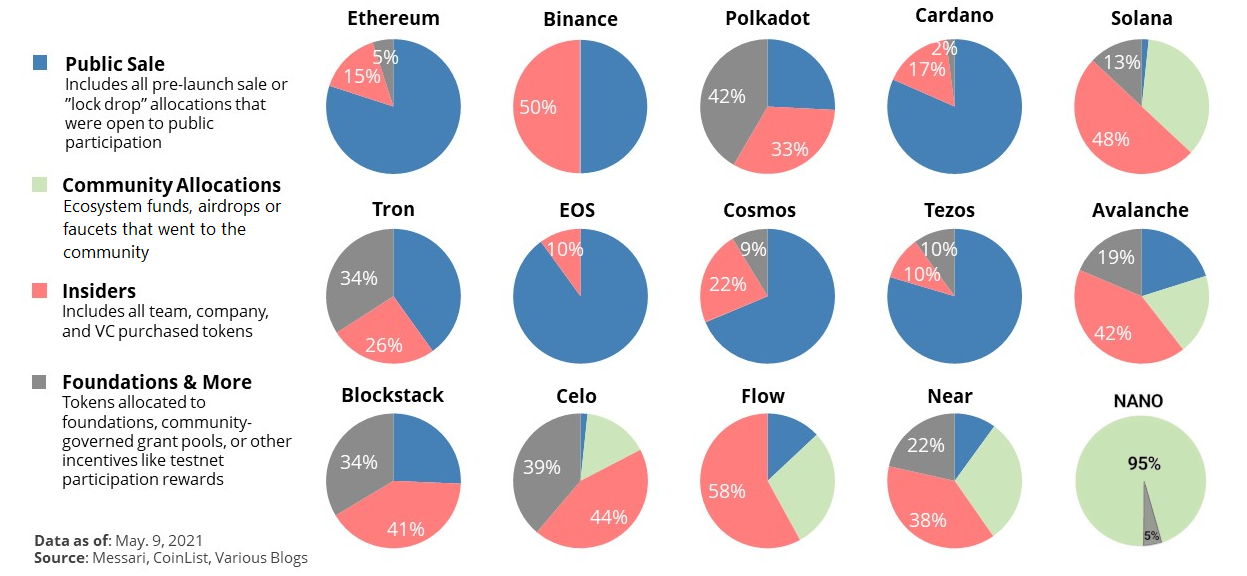

Experienced investors pay close attention to tokenomics, as it is an area where fatal mistakes can easily turn off their interest in your project. Your tokenomics should be designed to protect against inflation and provide a clear understanding of how the token's value will grow in the long term. Additionally, ensure that you have included vesting and cliff provisions for team tokens to avoid any skepticism from investors. It is also important to clarify the liquidity arrangements for your tokens.

In addition to tokenomics, it's crucial to provide other investment parameters to align with the evolving market and fundraising practices in web3. These parameters go beyond token price and include:

By addressing these basic investment parameters, you can provide investors with a comprehensive overview of your project's financial structure and potential for growth.

- Pre-money valuation: Estimate the value of your company in tokens before raising funds in seed, private, strategic, and public rounds. For example, if $1 million has been raised with a 10% TGE token generated event allocation, the pre-money valuation of your startup would be $1 million.

- FDV (Fully Diluted Value): Transparency is key, so it's important to disclose the fully diluted value of your token. This helps investors understand the proportion of tokens in the market at each stage.

- Coefficient of variation: Show the variation in token price for each funding round (seed/private/public) to provide investors with an understanding of the risks involved. Early-stage investors take on more risk, and they should have clarity on the potential returns, considering the waiting time until listing.

- Vesting: Specify the token lock-up mechanism for tokens purchased by investors to demonstrate a serious commitment to long-term growth and stability.

- Utility: Highlight how the token will be utilized, ensuring that it serves as more than just a superficial asset but rather an engaging and valuable component of the ecosystem.

By addressing these basic investment parameters, you can provide investors with a comprehensive overview of your project's financial structure and potential for growth.

To showcase your achievements and demonstrate investor interest, provide concrete metrics such as the number of followers and engagement rate on platforms like Discord, Twitter, and Telegram. Highlight metrics like signed whitelists and connected wallets to demonstrate community involvement. Additionally, mention any partnerships, collaborations with other projects, signed ambassadors, and listings on web3 platforms, as these strengthen your project's credibility in the eyes of investors.

Transitioning from marketing metrics to product metrics, share information about your product's development stage. If you have an Alpha or PreAlpha version, mention how many users have tested it and provided feedback, which informs your product improvements. If you have already released an MVP version and generated revenue from it, emphasize these early successes.

Transitioning from marketing metrics to product metrics, share information about your product's development stage. If you have an Alpha or PreAlpha version, mention how many users have tested it and provided feedback, which informs your product improvements. If you have already released an MVP version and generated revenue from it, emphasize these early successes.

Examples of Popular Business Models in Web3:

- Trading: Facilitating the buying and selling of digital assets or cryptocurrencies.

- Merchandising: Selling branded merchandise related to your project.

- Dress/Skin: Providing digital clothing or skins for avatars or game characters.

- Land: Offering virtual land or property for users to purchase and develop.

- Mining: Allowing users to mine or earn tokens through specific activities or tasks.

- Staking: Providing opportunities for users to stake their tokens for rewards or governance rights.

- Work/Farm/Create: Enabling users to earn tokens by contributing their skills, labor, or creative work to the platform.

- Collectibles: Creating and selling unique digital items or collectibles.

Each of these business models can be explored in greater detail if desired. Let us know if you'd like to delve further into the topic of business models in web3!

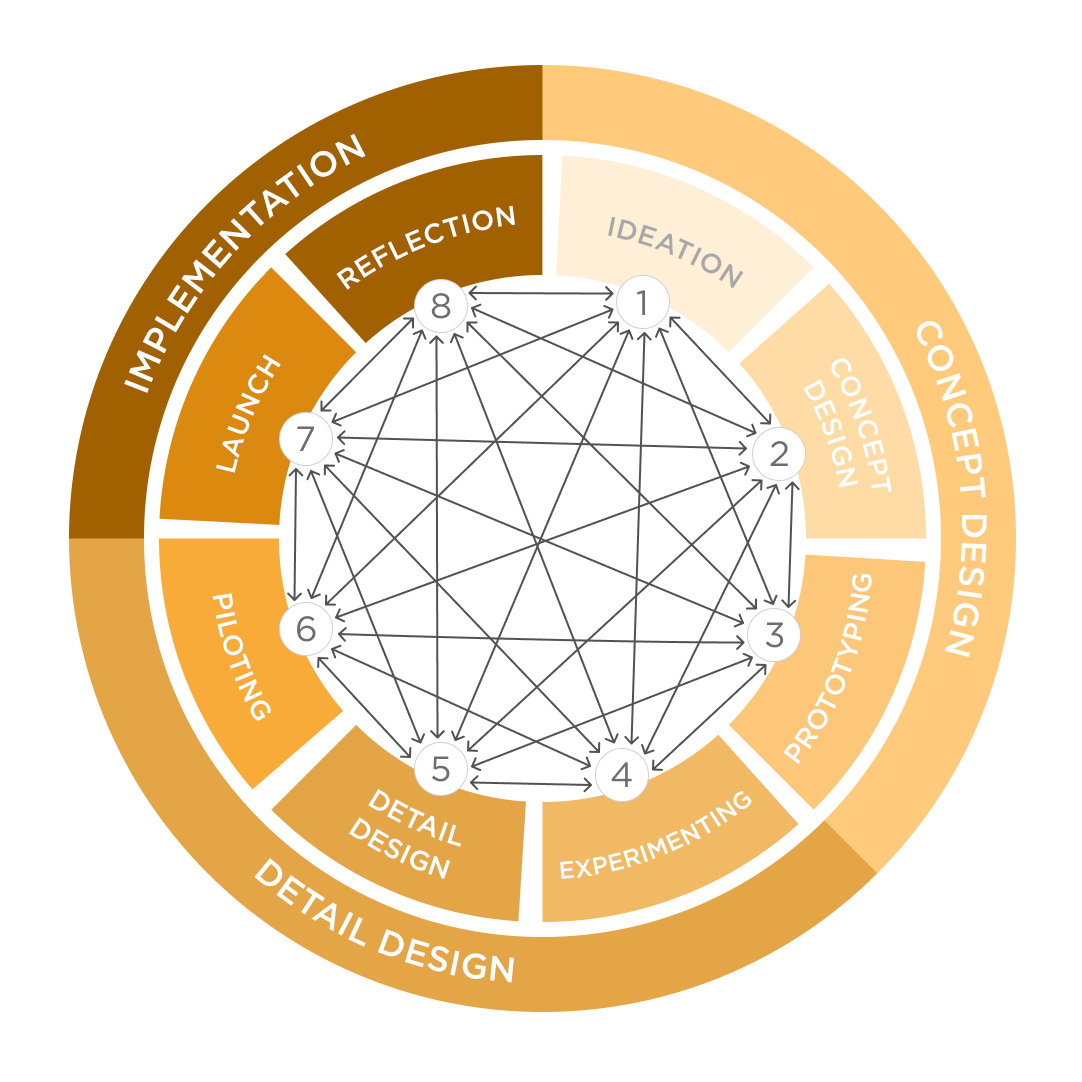

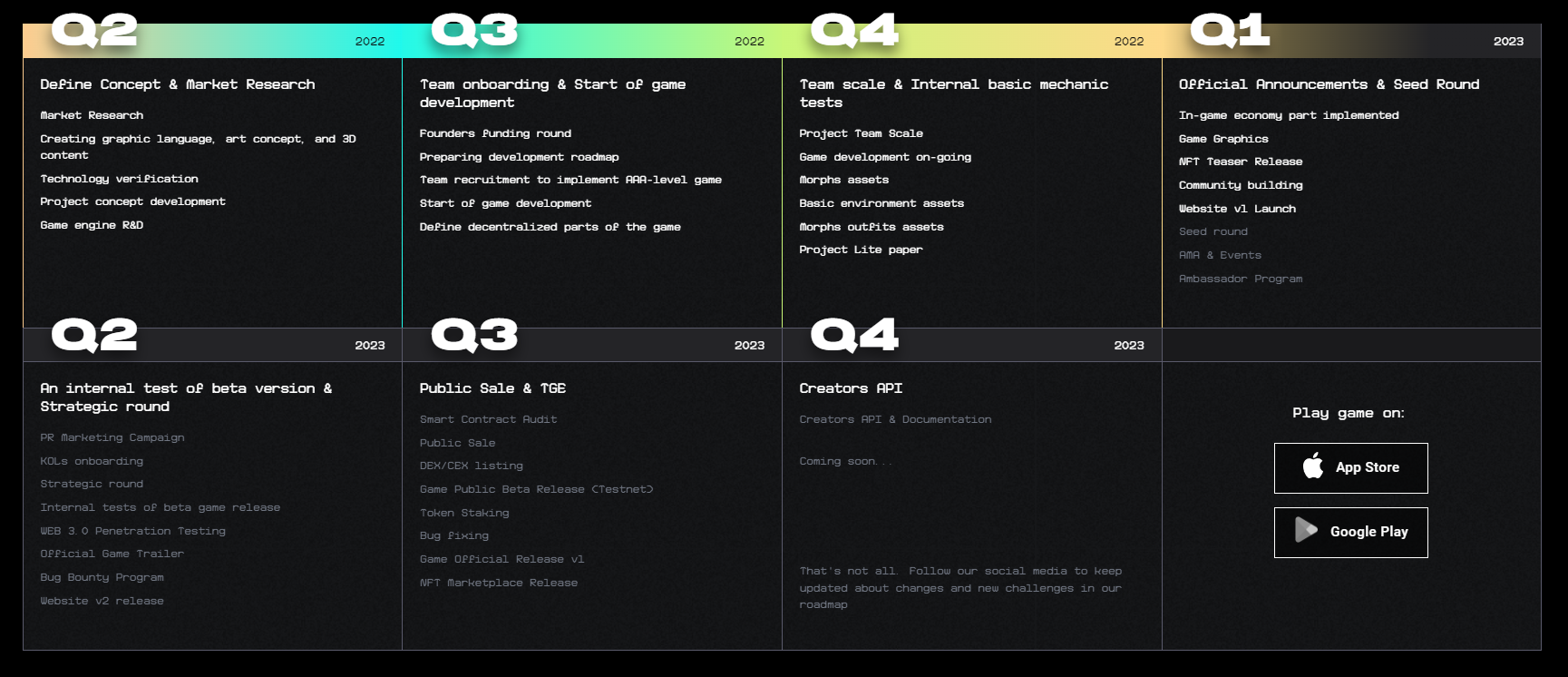

Roadmap

Accelerators/Grants

Ecosystem

Legalization Process

The Pitching Process

Finding Investors

Conclusion

It's important to highlight key points for investors. They are interested in the progress your project has made thus far and, more importantly, the future plans. Investors evaluate the potential value and profitability of the token based on projected events and achievements. Clearly outline your roadmap to provide transparency and instill confidence in potential investors.

Participating in reputable accelerator programs or securing grants is a positive sign for investors. These programs validate your project's potential and increase the likelihood of success. Highlight any notable accelerator programs or grants you have received, as they can significantly enhance your project's credibility and attract investor interest.

Choosing the right ecosystem for your project, unless you are building your own blockchain, is crucial for long-term success. Investors want to see that you have established partnerships or agreements within the chosen ecosystem, as this adds credibility and shows alignment with industry players. Demonstrating ecosystem support strengthens investor confidence in your project's potential.

The increasing importance of project legalization, particularly in the United States, necessitates expertise in navigating legal and regulatory aspects. Prepare yourself with knowledge on the legal requirements specific to your project and the countries involved. Investors will appreciate your understanding of the regulatory landscape and the steps you have taken to ensure compliance.

Preparing for the pitching process is essential to present your project effectively. Pay attention to quality packaging of information in your PitchDeck, ensuring there are no mistakes or missteps. Double-check all details multiple times. Organize meetings promptly, whether in-person or through virtual platforms like Zoom or Google Meet. Pay attention to the appearance and professionalism of your team during the presentation.

Connect with a wide range of fundraisers who can introduce your project to investors and venture capitalists (VCs). It's important to pitch your project consistently and frequently. The more pitches you make, the better prepared you become, and each pitching session can provide valuable insights for improvement. Additionally, reach out to VCs through cold calls, but focus on building relationships rather than a simple "give us money" approach. Regularly update them on your progress, and with persistence and iterations, you may capture their interest and secure a call to discuss details.

Keep in mind that investors prioritize the safety of their investments over potential returns.

Concentrate on demonstrating the seriousness of your intentions and the development of a high-quality product that will meet market demand. By emphasizing these aspects, you increase your chances of success in attracting investment.

If you're ready to take the leap and skyrocket your startup to Crypto RockStar status, don't wait any longer! Hit that button below and let us guide you through the thrilling journey of securing the investment you need.

Concentrate on demonstrating the seriousness of your intentions and the development of a high-quality product that will meet market demand. By emphasizing these aspects, you increase your chances of success in attracting investment.

If you're ready to take the leap and skyrocket your startup to Crypto RockStar status, don't wait any longer! Hit that button below and let us guide you through the thrilling journey of securing the investment you need.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

SCHEDULE YOR FREE CONSULTATION NOW