Choosing the Best Chain for Web3 Project

The blockchain industry is blowing up and is set to hit a whopping $67.4 billion by 2026. It's moving at lightning speed, with new innovative approaches popping up left and right. With so many platforms out there, choosing the best one for your business is crucial.

But let's be real - it's not an easy task. Yet, the question of how to choose a proper blockchain for your next product is painfully relevant for business owners and reasonably complex. Different blockchain architectures can make products better or worse.

Mind that, it's also important to choose blockchain in terms of an ecosystem that will push and support you along the way. Every major blockchain already has an established audience whose attention and liquidity will make life much easier for you in the early stages of development.

Let’s deconstruct the matter of choosing a blockchain for your project. In this article, Cryptorsy team shares its insights based on experience in crypto marketing, fundraising and consulting for our clients. We will help you go through the necessary factors to choose a blockchain and eventually decide which ecosystem to use. LFG!

Alright, let's spice things up a bit and talk about key factors you should keep in mind before making your choice:

But let's be real - it's not an easy task. Yet, the question of how to choose a proper blockchain for your next product is painfully relevant for business owners and reasonably complex. Different blockchain architectures can make products better or worse.

Mind that, it's also important to choose blockchain in terms of an ecosystem that will push and support you along the way. Every major blockchain already has an established audience whose attention and liquidity will make life much easier for you in the early stages of development.

Let’s deconstruct the matter of choosing a blockchain for your project. In this article, Cryptorsy team shares its insights based on experience in crypto marketing, fundraising and consulting for our clients. We will help you go through the necessary factors to choose a blockchain and eventually decide which ecosystem to use. LFG!

Alright, let's spice things up a bit and talk about key factors you should keep in mind before making your choice:

28.04.2023

Vlad Svitanko

17 min

RELATED

SUBSCRIBE TO OUR BLOG

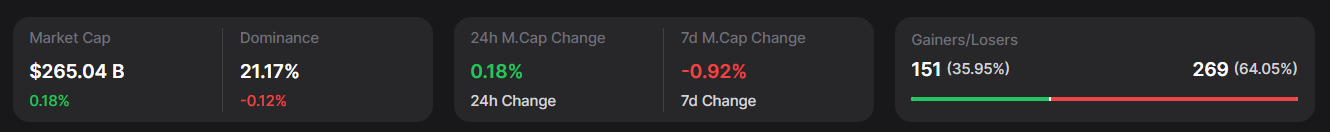

When choosing blockchain, pay particular attention to such game-changers, which help make a quantum leap at the very beginning of the path and gain a huge amount of native chain audience.

Community

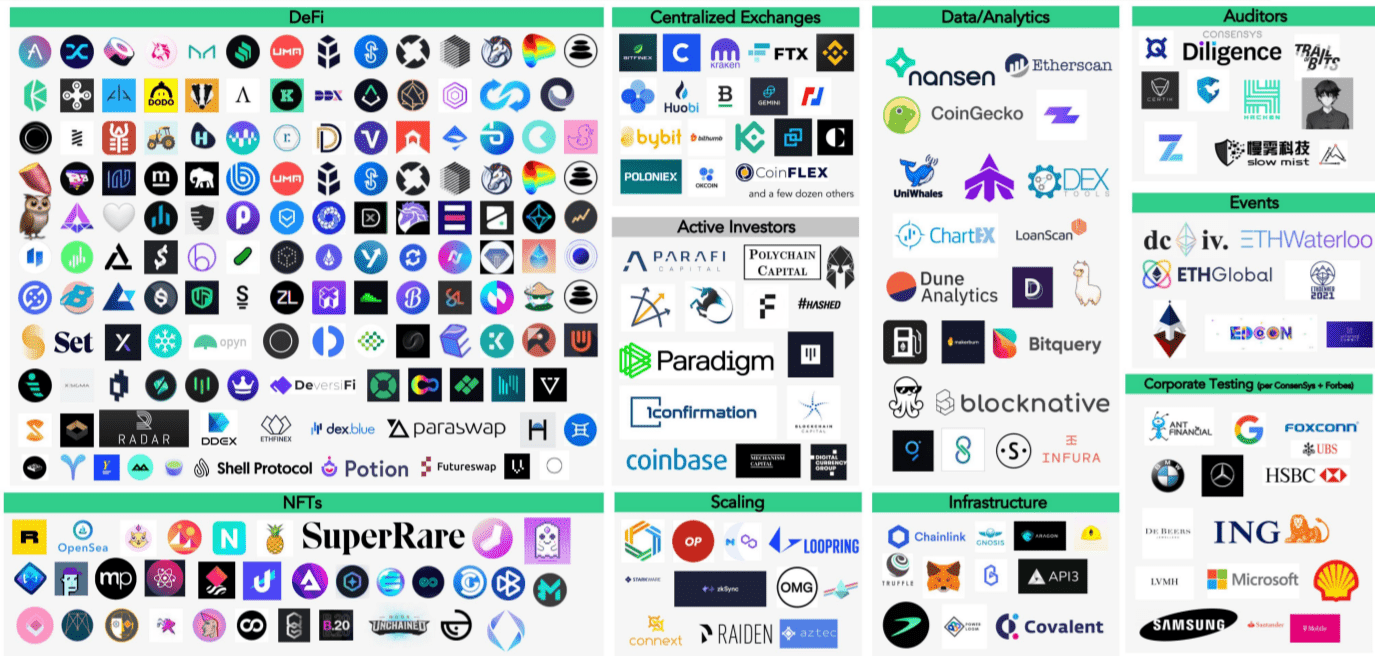

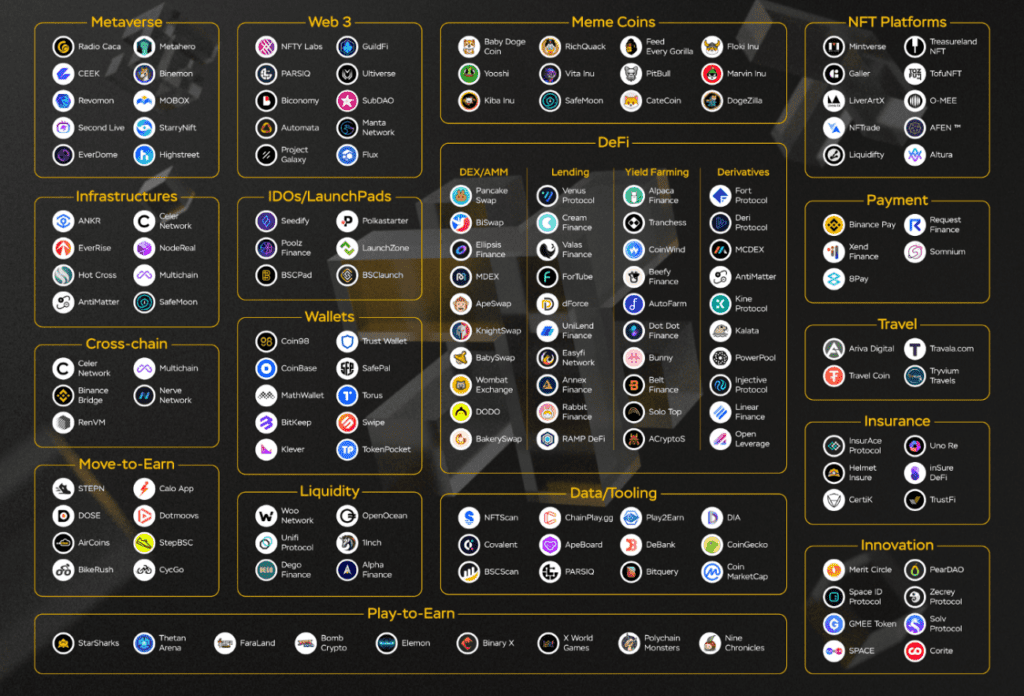

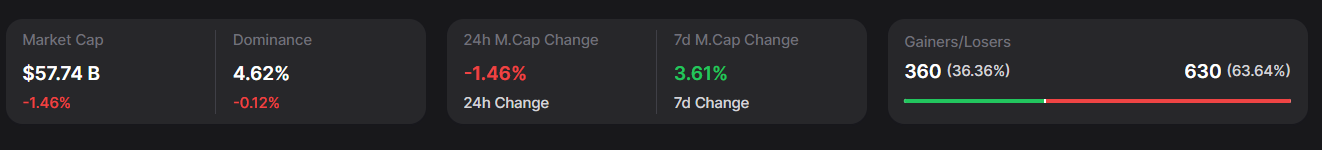

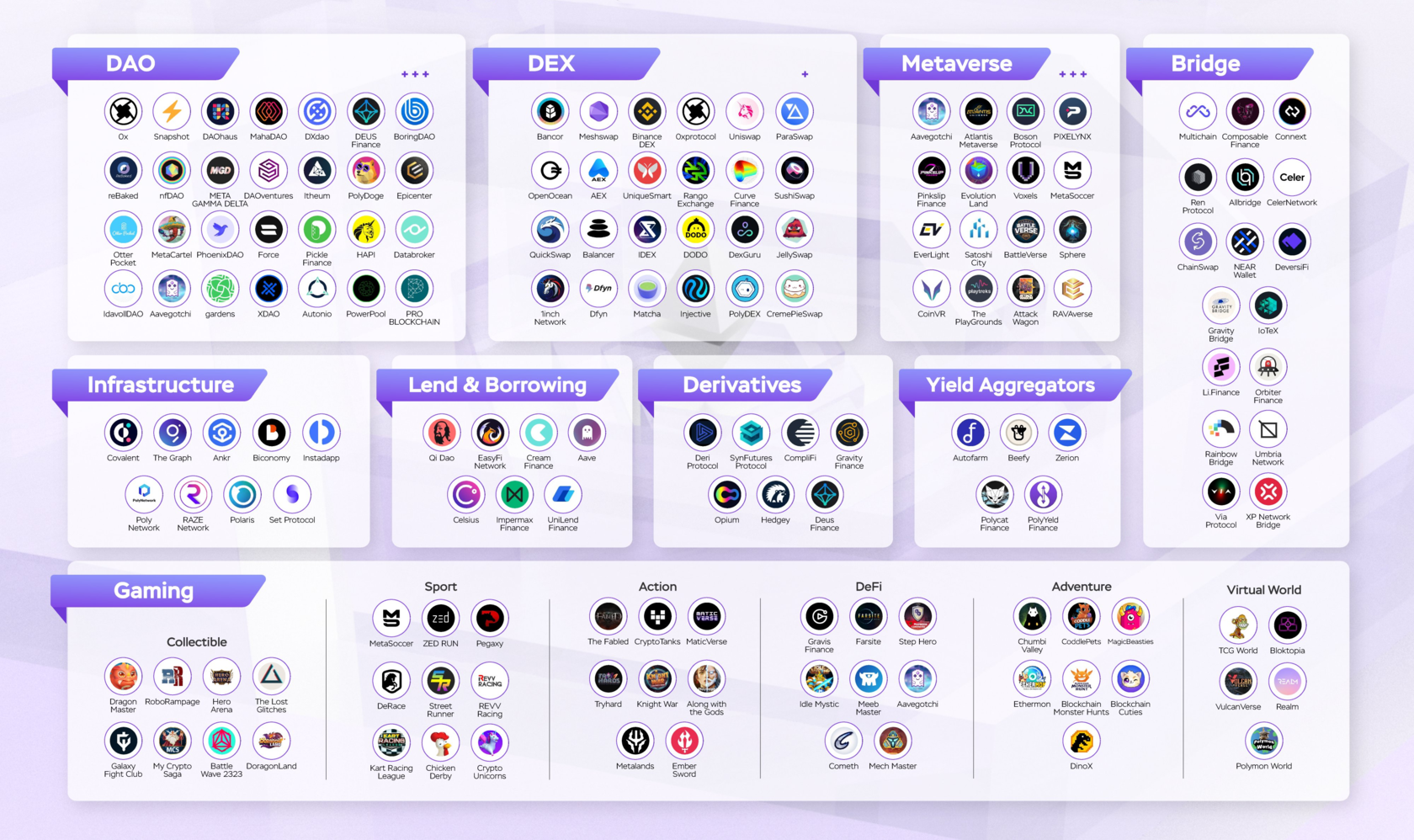

Traditionally, certain segments of the crypto audience concentrate on certain blockchains. For example, Arbitrum (L2 solution for Ethereum) has a lot of DeFi projects, and Solana & Avalanche has a lot of NFT related projects. Before choosing, you should analyze in detail who mainly uses this chain, and choose the most suitable one.

Not to be verbose, Cryptorsy recommendation is to favor the ecosystem that has more users and online activity. In the initial stages of development, you will have a very hard time gathering the first users around the project and helping to build an initial audience, something that differentiates great ecosystems from just good ones.

Not to be verbose, Cryptorsy recommendation is to favor the ecosystem that has more users and online activity. In the initial stages of development, you will have a very hard time gathering the first users around the project and helping to build an initial audience, something that differentiates great ecosystems from just good ones.

Grants & Accelerators

The blockchain and cryptocurrency industry has seen significant growth in recent years, leading to startups exploring new applications and use cases for these emerging technologies. To support this growth, grants, and accelerators have been created around the world to give early-stage blockchain startups access to funding, mentoring, and specialized resources to turn their ideas into successful web3 businesses.

Privacy & security

Share this post:

When it comes to blockchain, security should always be top of mind. Take a deep dive into the hacking history of any blockchain you're considering, and pay close attention to the damage that's been done and why it was possible. By the way, Solana was repeatedly subjected to technical problems over the past 2 years. This does not mean that it is a bad blockchain, but you should consider that if you choose it, you run the risk that one day no one will be able to use your product because of a technical failure.

Scalability

This crucial factor in blockchain networks refers to a network’s ability to support higher transaction throughput. Among other things, choosing which blockchain to use also depends on how extensively the ecosystem will grow in the future.

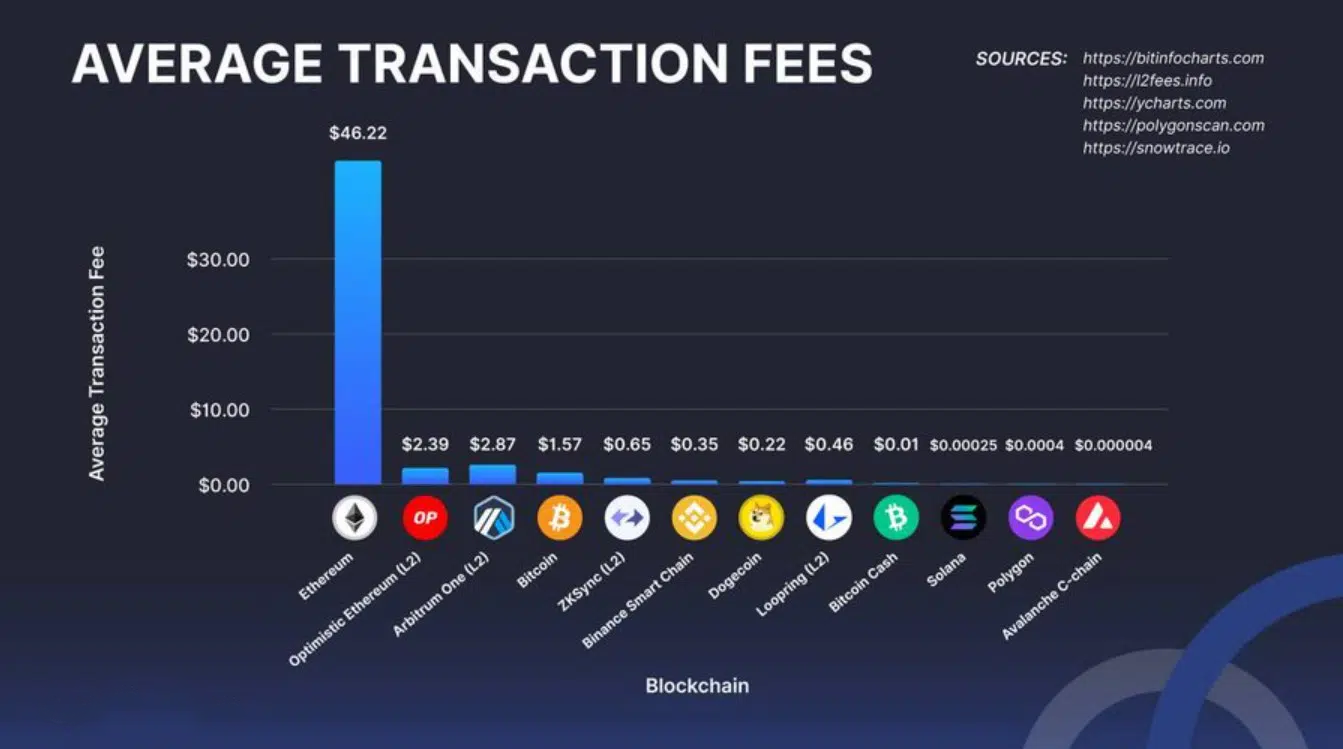

Transaction cost

Finally, don't let transaction costs be the deciding factor. Sure, everyone wants lower commissions, but it's more important to base your decision on the factors we've already discussed. After all, if you don't have any users, you won't have anyone to pay commissions to, no matter how low they are!

Choosing the right blockchain for your project is a daunting task that requires a great deal of responsibility and effort. To help you make an informed decision, we've compiled a list of top blockchain platforms to guide you through the selection process.

ETHEREUM NETWORK

This platform is one of the pioneers on the market and a popular choice while selecting a blockchain platform for project development. Additionally, Ethereum network has already become a home for a long list of dApps, including OpenSea, Uniswap, MetaMask Swap, 1inch Network, and so on. The unique input of Ethereum was the contribution to an EVM invention and, therefore, a wide application of smart contracts.

PROS OF ETHEREUM

- The most actively used and commonly known blockchain framework;

- Provision of a large kit of developer tools, ready-made models, and functions;

- A large community that maintain the network (the number of active nodes has beaten the ones of Bitcoin network);

- Accumulated reliability (the more blockchain exists, the more trust it gains).

CONS OF ETHEREUM

- Quite a low transaction speed;

- High transaction and deployment costs;

- Not scalable on its own, only through additional 2nd-layer solutions.

Ethereum is the go-to choice for any DeFi project, providing a solid ecosystem with a vast array of tools, ample liquidity, and plenty of plug-and-play solutions to help you get your product up and running quickly. Plus, it's a well-known and reliable blockchain, giving your new venture the credibility it needs to attract users.

But let's keep it real here: maintaining and updating Ethereum's complex toolset can be a major headache. And don't even get us started on the wildly fluctuating gas prices that can make active use a total pain in the neck.

Still, as things stand, Ethereum is hands down the best option for dApps. The network already hosts the likes of Uniswap, Compound, Synthetix, Maker, Curve, AAVE, and more. So if you're looking to create the next DeFi powerhouse, we highly recommend giving Ethereum serious consideration. It's the key to unlocking a smooth integration with other DeFi solutions down the line.

But let's keep it real here: maintaining and updating Ethereum's complex toolset can be a major headache. And don't even get us started on the wildly fluctuating gas prices that can make active use a total pain in the neck.

Still, as things stand, Ethereum is hands down the best option for dApps. The network already hosts the likes of Uniswap, Compound, Synthetix, Maker, Curve, AAVE, and more. So if you're looking to create the next DeFi powerhouse, we highly recommend giving Ethereum serious consideration. It's the key to unlocking a smooth integration with other DeFi solutions down the line.

But hey, if you're one of those hardcore crypto anarchists who refuse to bow down to any central authority, then maybe BSC isn't for you. After all, Binance is a centralized exchange that isn't afraid to stand up to regulators.

But let's be real here, BSC has a lot going for it. The ability to create robust and secure smart contracts coupled with its high transaction speeds makes it a tantalizing choice for developers. And let's not forget about Binance's massive user and investor base, which could give your project a serious boost in popularity.

But let's be real here, BSC has a lot going for it. The ability to create robust and secure smart contracts coupled with its high transaction speeds makes it a tantalizing choice for developers. And let's not forget about Binance's massive user and investor base, which could give your project a serious boost in popularity.

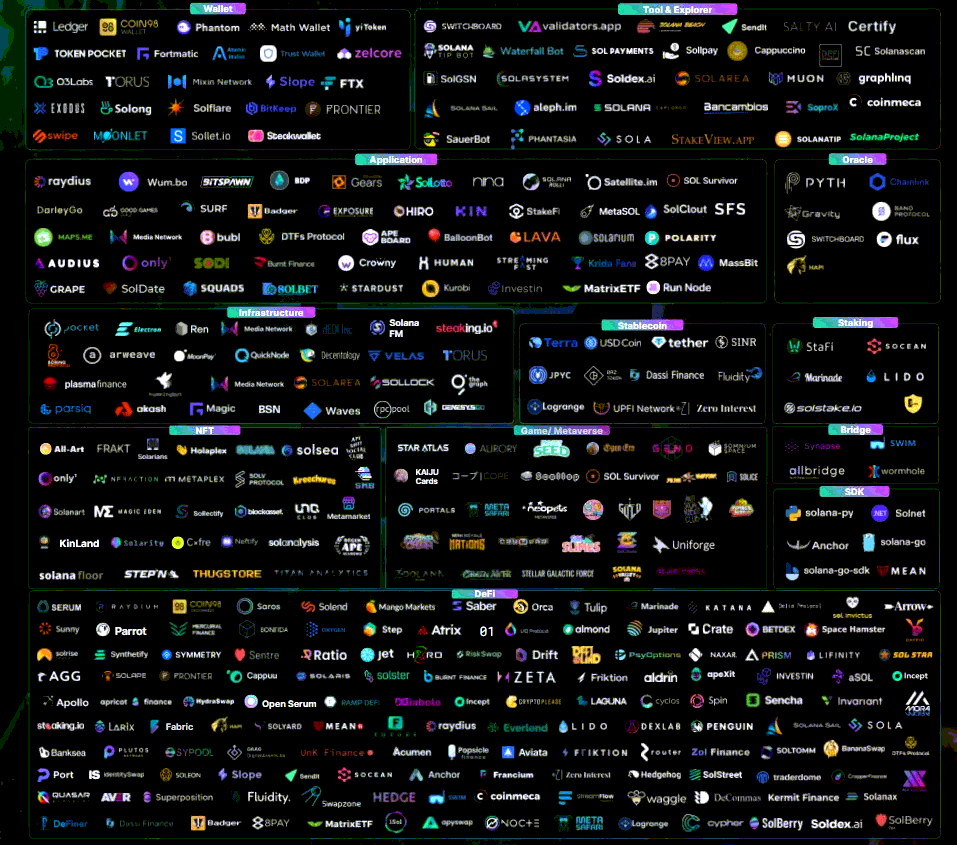

The platform is capable of processing 65,000 transactions per second, making it the first choice for many blockchain app developers and their clients. With the hosting of more than 19K dApps, it has already been widely adopted by businesses for infrastructure development.

Polygon might be the easiest blockchain platform for Play2Earn games development, so you should definitely take it into consideration when working on your project.

Polygon might be the easiest blockchain platform for Play2Earn games development, so you should definitely take it into consideration when working on your project.

Of course, Solana isn't perfect. But with its growing ecosystem, it's quickly becoming the blockchain of choice for many developers. So, if you want speed, efficiency, and scalability, then Solana might just be the right blockchain for you to build on.

BINANCE SMART CHAIN

This blockchain is a top-notch option for those who want to get their DApps up and running with lightning-fast transaction speeds and low fees. Developed by the crypto-exchange giant Binance, BSC uses the Proof of Stake (PoS) consensus algorithm, which means you'll be saving money and time without compromising on security.

PROS OF BSC

- Smart Contracts: Binance Smart Chain is a fork of Ethereum with some changes. Hence it has smart contract functionality and compatibility with Ethereum Virtual Machine. It's perfect to host DeFi & NFT applications;

- Interoperability: BSC and Binance chain are running parallelly and they are interconnected. It means that users can easily transfer their tokens from BSC to Binance chain and vice versa. Also, BSC is an independent chain that will run even if Binance Chain stops;

- User Experience: BSC has better speed and low gas fees as compared to Ethereum. While Ethereum kills the user experience with high congestion and gas fees, Binance is able to squeeze in more transactions in one block;

- Adoption: Since it is an exact copy of Ethereum and compatible with EVM, Ethereum based DApps can easily switch to BSC. There are multiple cross-chain bridges available by Binance and other third parties which makes the transition quite easy;

- Community: Apart from high performance and better User Experience, Binance has a huge user base that provides enough support to their new projects. Binance's community is one of the biggest reasons for BSC's success. BSC has already flipped Ethereum in a number of transactions.

CONS OF BSC

- Dependence On Ethereum's Dev Community: Binance Smart chain is heavily dependent on ethereum's dev community which means not much innovation is happening on BSC but it is carry forwarded from Ethereum;

- Centralization: Just like Binance chain, BSC is also centralized. It used PoSA (Proof of Staked Authrority) mining in which 21 validators are required to keep the chain online. Most of the Binance Chain top validators are directly or indirectly owned by Binance;

- Security: Since BSC is centralized, it is prone to hacks and 51% of attacks and also system failures since network validators are required to be approved by Binance's internal team.

POLYGON NETWORK

Polygon was created as a stack of protocols designed to fix Ethereum’s scalability issues. This network addresses challenges by handling transactions on a separate Ethereum-compatible blockchain. In other words, Polygon provides an easy framework for new and existing blockchain projects to build on Ethereum without scalability issues.

PROS OF POLYGON

- The network provides a framework for developers to create their own scaling solutions;

- Ethereum’s large community is loyal to Polygon, too;

- Rather low gas fees;

- High transaction speed;

- The chain is extremely developer-friendly;

- Since Polygon is quick and cheap, it fits NFT projects and Play2Earn games well;

- A lot of media storage providers are focused on this chain.

CONS OF POLYGON

- Polygon is dependant on Ethereum;

- High competition among other scaling solutions;

- Gas wars – pretty irregular gas price fluctuations, especially during the NFT mint.

SOLANA

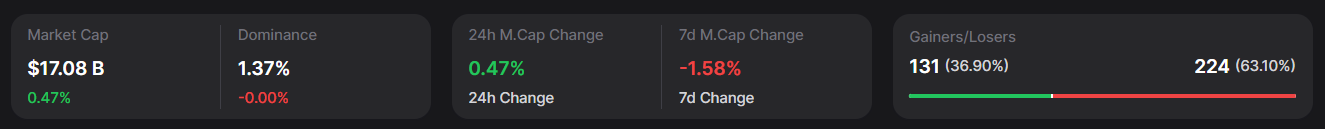

Solana, baby! This blockchain is the real deal with its impressive 2000 transactions per second (TPS). No wonder it's attracted the attention of so many developers, who are now hosting decentralized applications, NFTs, and blockchain-based games on it. Move over Ethereum, Solana is taking over!

What sets Solana apart from the competition is its exceptional scalability. It's achieved this by adopting a cutting-edge technology called Proof of History (PoH) to complement its PoS consensus algorithm. And let's not forget, Solana is an independent layer-1 blockchain network with no para chains to hold it back. This means it's faster, cheaper, and more eco-friendly than many other blockchain platforms out there.

What sets Solana apart from the competition is its exceptional scalability. It's achieved this by adopting a cutting-edge technology called Proof of History (PoH) to complement its PoS consensus algorithm. And let's not forget, Solana is an independent layer-1 blockchain network with no para chains to hold it back. This means it's faster, cheaper, and more eco-friendly than many other blockchain platforms out there.

PROS OF SOLANA

- Solana is really fast! Transactions Per Second (TPS) refers to the capability of the blockchain to carry out transactions. If you’re looking for a shing shing and a vroom vroom for your transactions, Solana might just be the right blockchain for you;

- Transactions on Solana cost fractions of cents. Cheap cheap goes the bird. Yes, you read that right. Solana is so cheap when it comes to its transaction fees that you can play around on Mainnet (but don’t!);

- Getting started on Solana is easy for users. In contrast to using Metamask for Ethereum, using Phantom with Solana is relatively easier for the end-user. You don’t have to worry about networks like you would in Ethereum, just change clusters between localhost, devnet, testnet, and mainnet-beta then you’re good to go;

- The Solana ecosystem is thriving. When you think of Non-Fungible Tokens (NFT) you would think of Ethereum. I know you did because I did too. However, just last May 2022, Solana was able to overtake Ethereum in NFT trading volume with $24.3 million in total volume compared to Ethereum’s total of $24 million. This is a strong sign of Solana’s thriving ecosystem, not just in developers, but also with consumers.

CONS OF SOLANA

- Decentralization? Solana has faced multiple global outages in one year, raising concerns about its long-term reliability. Its speed and efficiency come at the cost of being less decentralized than Ethereum, with 3,400 validators across six continents compared to Ethereum's 422,000 validators globally. However, Solana is working on adding more validators to become more decentralized and reliable;

- Difficult. Solana's reputation as a "difficult" blockchain to develop on has persisted, despite recent efforts to make it more accessible for developers. While resources like soldev.app, Solana Cookbook, and StackExchange have made it easier to learn and build on the platform, there is still a perception that Solana is not for the faint of heart.

ARBITRUM NETWORK

Arbitrum is a layer-2 project that aims to improve the speed and scalability of Ethereum smart contracts while also adding additional privacy features.

While still taking advantage of Ethereum’s superior layer-1 security, the platform is intended to make it simple for developers to execute unmodified Ethereum Virtual Machine contracts and Ethereum transactions at layer 2.

While still taking advantage of Ethereum’s superior layer-1 security, the platform is intended to make it simple for developers to execute unmodified Ethereum Virtual Machine contracts and Ethereum transactions at layer 2.

PROS OF ARBITRUM

- High EVM compatibility – the project can be compatible with EVM at the bytecode level, and any language, such as Solidity and Vyper;

- Minimized transactions costs;

- Powerful developer tools;

- Well-developed ecosystem, which allows you to find new partners with established projects;

- Hyped affect.

CONS OF ARBITRUM

- Composability and multi-chain issues, as a chain is still growing.

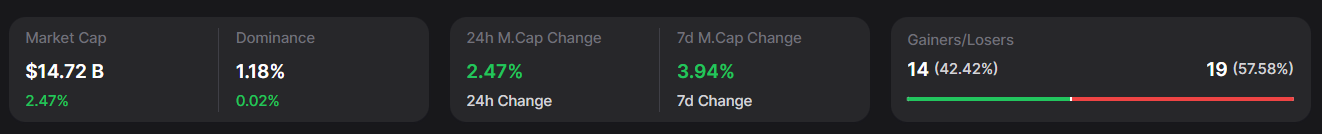

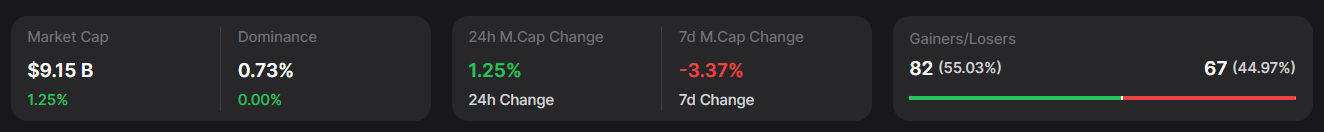

RIPPLE

Many financial institutions use Ripple, a blockchain technology emphasizing banking, to guarantee transparency, cheap transaction costs, and quick response times. Its clients include Bank of America, Banco Rendimento in Brazil, and Singapore-based global payments processor Nium.

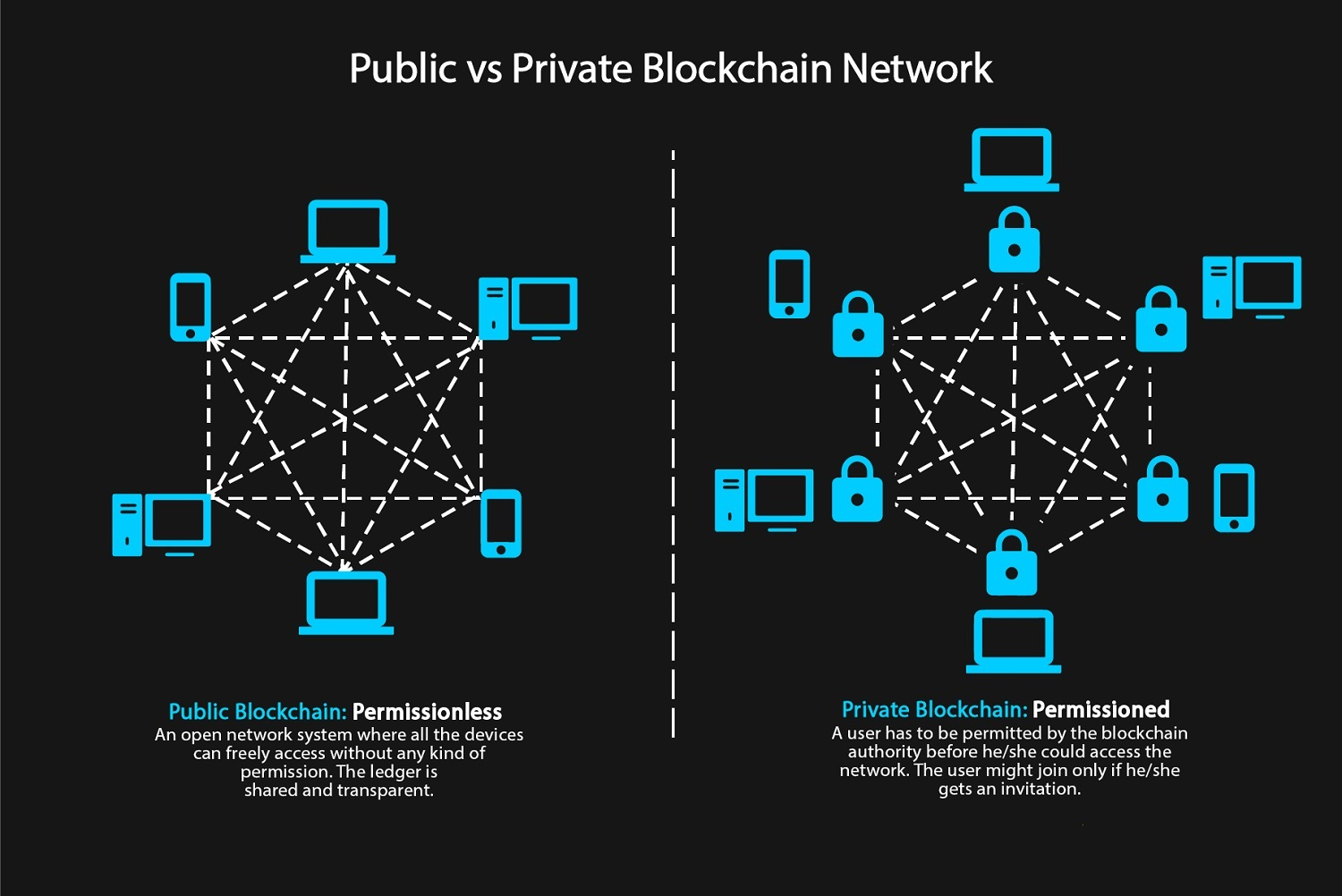

Ripple is a private blockchain, which is why it’s very centralized compared to other blockchains. It also keeps a default list of transaction validators.

Ripple is a private blockchain, which is why it’s very centralized compared to other blockchains. It also keeps a default list of transaction validators.

PROS OF RIPPLE

- Ripple takes only 0.0001 XRP as fees for validating transactions;

- It takes only 4 or 5 seconds to complete transactions;

- Ripple’s exchanges network also allows completing transactions from other cryptocurrencies;

- Large financial institutions also use Ripple, making it a reliable method for transactions.

CONS OF RIPPLE

- It is not easy to track XRP’s value as investors are not aware of when its large quantities could be issued into circurlation;

- It is less decentralised compared to other cryptocurrencies because it keeps a default list of transaction validators.

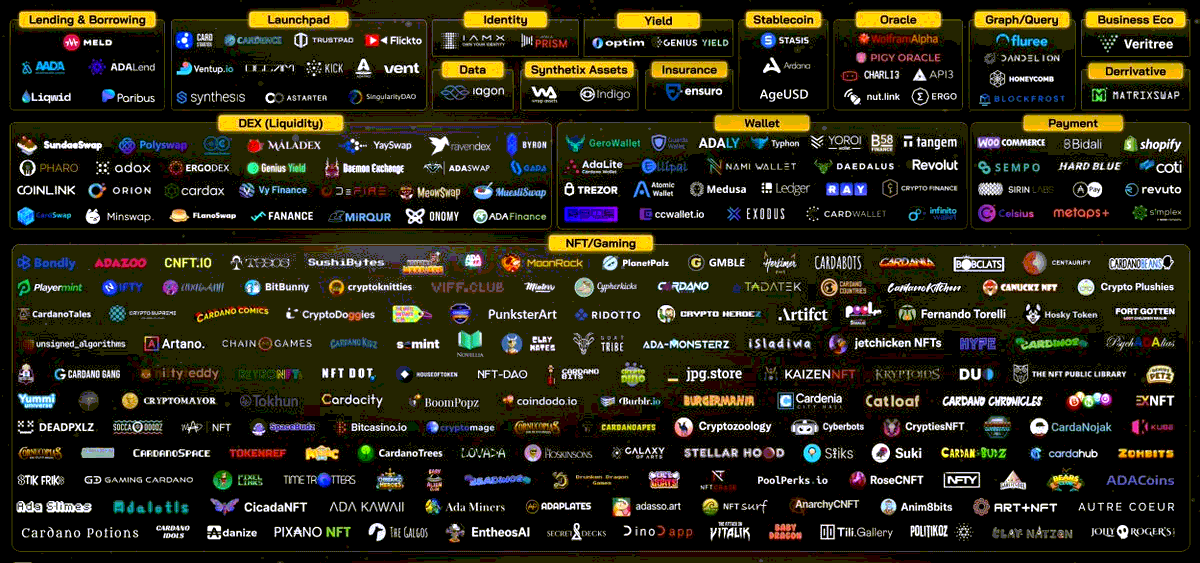

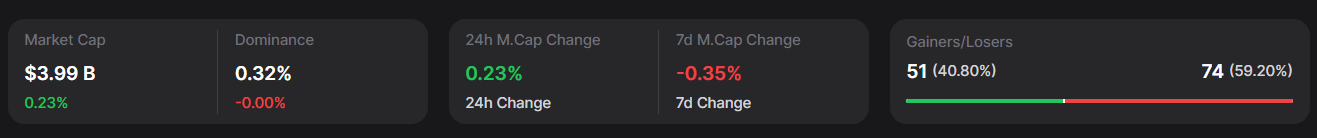

CARDANO

The breadth of what Cardano is trying to achieve makes it difficult to sum up in a few sentences. Hoskinson calls it the "Swiss army knife of protocols" that solve real problems.

Think of Cardano as a platform where people can build applications that address a whole host of issues. From preventing counterfeit medicine to enabling access to microfinance, the Cardano network opens the way for people to use blockchain technology to improve the world we live in.

Think of Cardano as a platform where people can build applications that address a whole host of issues. From preventing counterfeit medicine to enabling access to microfinance, the Cardano network opens the way for people to use blockchain technology to improve the world we live in.

PROS OF CARDANO

PROS OF AVALANCHE

PROS OF COSMOS

PROS OF OPTIMISM

PROS OF APTOS

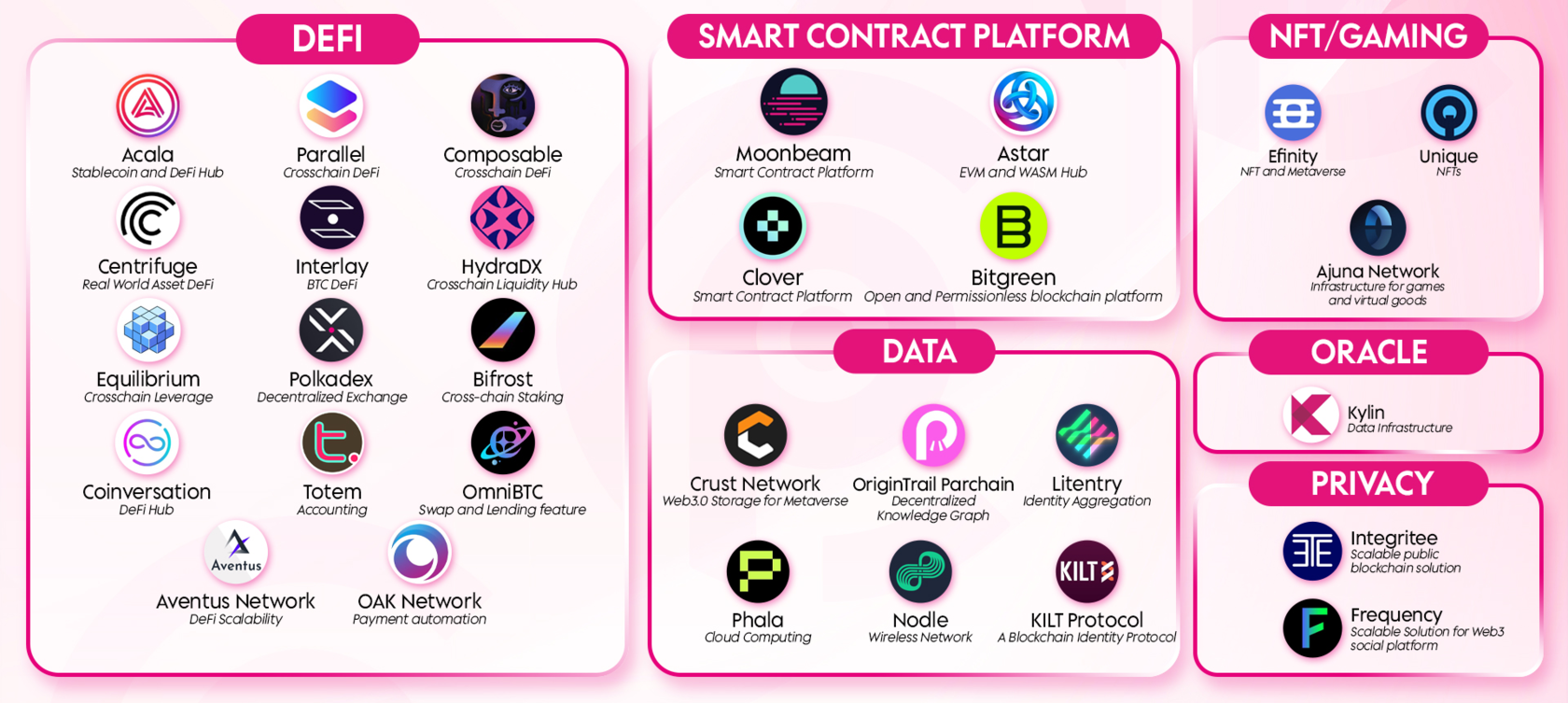

PROS OF POLKADOT

- Reputable team;

- Environmentally friendly;

- It has academic backing and involves academic, peer reviews;

- Cardano solves the issue faced with scalability and ensures fast transaction speeds;

- Great mission of making chain permissionless for every dApp builder.

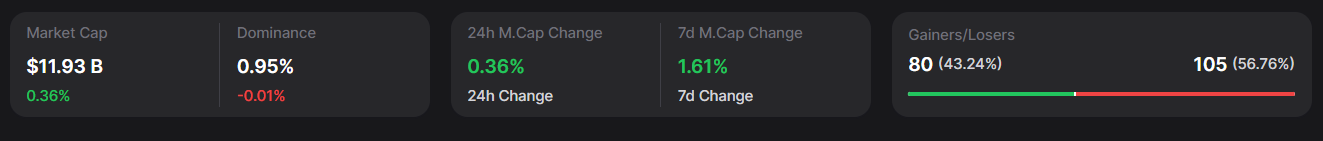

- Secure, powerful, reliable applications as well as customizable public and private blockchains that can be created;

- Ability to create assets on existing ecosystems along with the ability to create a new network that has defined parameters for validators;

- High speed and scalable for DApps;

- High trading volume with more than 4,500 transactions per second.

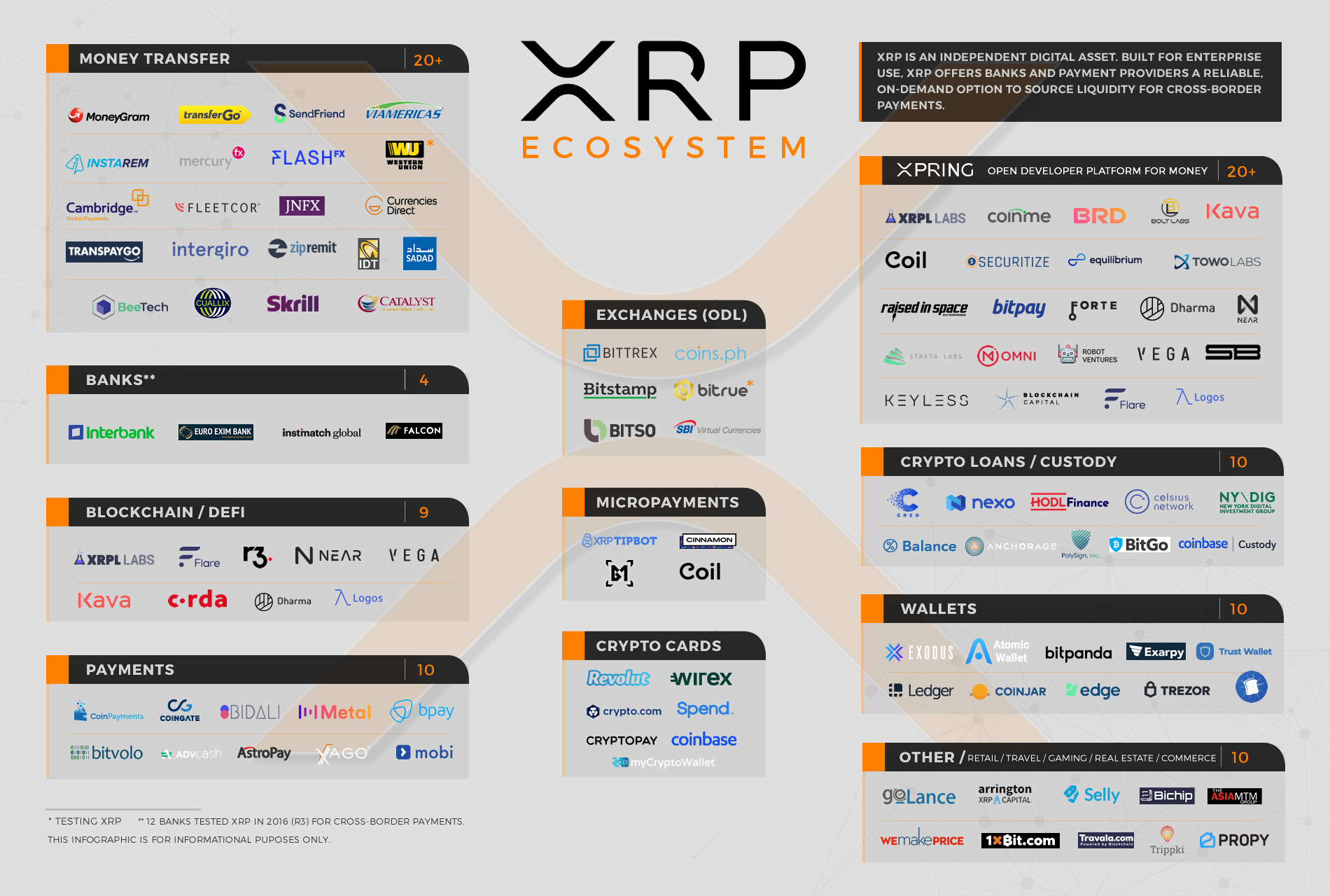

- Cosmos is a fully open-source project;

- The protocol used by Cosmos ensures easy connections between different stand-alone blockchains;

- Cosmos is a community-governance system where users are identified according to their keys;

- Independent work of stand-alone blockchains that can keep their sovereignty and security parameters.

- Easy to use and develop on;

- High computational flexibility;

- Turing-complete and can be used with EVM;

- Highly Scalable.

- Competent founding team: The Aptos community is led by a founding team that has previous experience in the crypto space;

- Strong development team: With over 350 skilled developers the blockchain has a strong tech foundation;

- Unique consensus mechanism: The BFT protocol provides an edge in blockchain speed;

- Transaction throughput: With its testnet proving to be significantly fast, it can enable crypto for everyday use.

- It is scalable. The existence of fragmented chains allow parallel executions of transactions.

- It has great interoperability. Thanks to the Relay Chain or main chain that interconnects the different blockchains it hosts, it also allows bridges with other blockchains such as Ethereum;

- Decentralized governance. It incorporates a voting system for users, as well as being able to invest in parachains through auctions. In addition each subchain can have its own gorbenance protocol independent of Polkadot’s;

- High trading volume with more than 4,500 transactions per second.

CONS OF CARDANO

- Cardano is known as the “academic” blockchain which has undergone a lot of review and testing, and it is still being developed slowly;

- Cardano is not fully decentralized yet.

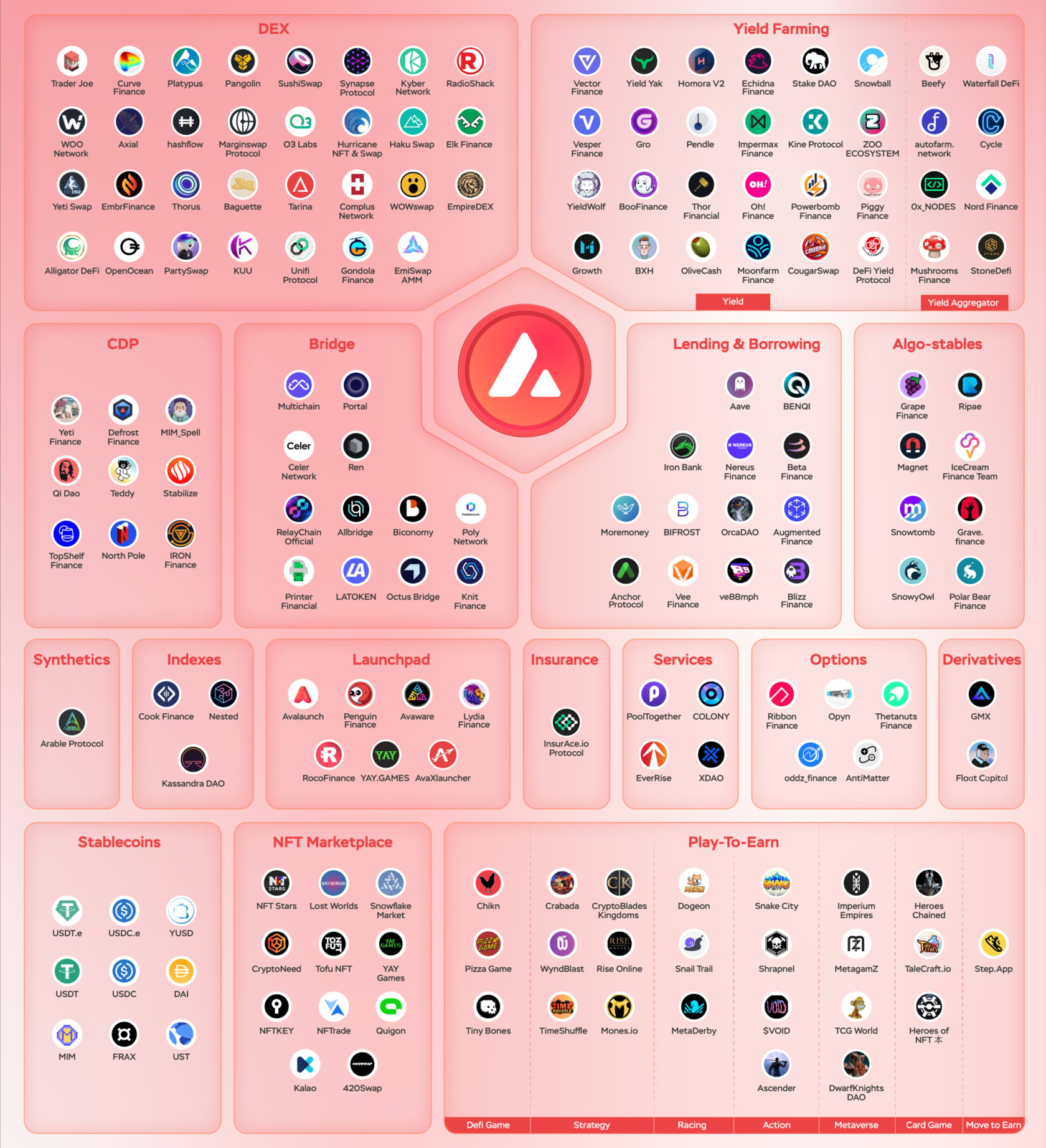

AVALANCHE

Avalanche is often called the “Internet of Finance” as the platform serves as a meeting point between traditional markets and decentralized applications. AVAX allows for interoperability between third-party tokens at low costs, helping to improve the DeFi environment with a permissionless system where users can create private or public customized blockchains.

CONS OF AVALANCHE

- Transactions may be delayed if validators are not in agreement on the status;

- There is no liveness guarantee where conflicting transactions are concerned.

COSMOS

Cosmos works to facilitate communication, scaling, and interoperation between independent blockchains. It is known as the “Internet of Blockchains” and has the following features and key takeaways:

The Cosmos Hub aims to interconnect blockchains in the ecosystem while ensuring that they remain secure. It ensures that there is seamless interoperability as well as a new token economy, with each blockchain working independently, in a parallel manner, so that tokens can be exchanged freely without friction.

The Cosmos Hub aims to interconnect blockchains in the ecosystem while ensuring that they remain secure. It ensures that there is seamless interoperability as well as a new token economy, with each blockchain working independently, in a parallel manner, so that tokens can be exchanged freely without friction.

CONS OF COSMOS

- Delegated staking results in ATOM being frozen while validators carry out their duties;

- Staked ATOM are locked in a minimum of 3-weeks.

OPTIMISM

Optimism (OP) is a layer-two scaling solution blockchain built on top of Ethereum. Optimism provides benefits to the Ethereum mainnet by using Optimistic Rollups, a scaling solution that relies on off-chain computation to trustlessly record transactions while still relying on the security of Ethereum.

CONS OF OPTIMISM

- Lower throughput than other layer 2 solutions;

- Limited Smart Contract Functionality;

APTOS

Aptos is a layer-1 blockchain which aims to be safe, scalable and upgradable. It has been developed by more than 350 programmers and aims to be a foundational block to Web 3.0 developments of the future.

Aptos has garnered a lot of attention due to its history. The blockchain is developed by the developers of the Diem blockchain, which was an initiative of Meta( formerly Facebook). While the Diem project was abandoned, Aptos aims to build over the advantages of the Diem blockchain.

Aptos has garnered a lot of attention due to its history. The blockchain is developed by the developers of the Diem blockchain, which was an initiative of Meta( formerly Facebook). While the Diem project was abandoned, Aptos aims to build over the advantages of the Diem blockchain.

CONS OF APTOS

- Security: While the BFT protocol puts speed as its top priority, it should still prove to be secure. Sequential consensus mechanisms like POW and POS are highly secure;

- Structure: While Aptos is certainly decentralised in theory, a sizable amount of APT is being held by Aptos foundation and Aptos labs.

POLKADOT

SUMMARY

so...

Polkadot is an open-source blockchain network designed to enable various separate, siloed blockchains to become interconnected, application-specific sub-chains called parachains. Each chain built within Polkadot uses Parity Technologies' Substrate modular framework, which allows developers to select specific components that suit their application-specific chain best. The Polkadot network is the entirety of all parachains that plug into a single base platform known as the Relay Chain.

What's the ultimate blockchain solution, you ask? Well, hold on to your hats, folks, because the answer to that question depends entirely on the unique purpose and requirements of your project. There is no one-size-fits-all solution when it comes to blockchain technology.

Lucky for you, Cryptorsy has provided an extensive guide with examples of the best blockchain platforms for specific types of projects. But don't you dare think that the listed options are the only ones available - the possibilities are endless!

So if you're serious about taking your project to the next level, take the time to carefully evaluate each blockchain platform and select the one that aligns perfectly with your needs.

Lucky for you, Cryptorsy has provided an extensive guide with examples of the best blockchain platforms for specific types of projects. But don't you dare think that the listed options are the only ones available - the possibilities are endless!

So if you're serious about taking your project to the next level, take the time to carefully evaluate each blockchain platform and select the one that aligns perfectly with your needs.

To ease the task of deciding which blockchain technology to use, let’s shortly sum up each platform’s potential.

CONS OF POLKADOT

- Inflationary model. Being subject to the votes of the user community they can decide to increase the DOT issuance, currently the annual inflation rate is 10%;

- Complicated system for staking. If you are not experienced or knowledgeable about the Polkadot project it can be cumbersome to take the role of nominator to choose a validating node.

Public or private?

Public blockchains are open to anyone and are great for DEXes and projects that don't require heavy data control. On the other hand, private blockchains have permissioned entry and are more secure, making them perfect for SaaS applications and niche NFT marketplaces.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

SCHEDULE YOR FREE CONSULTATION NOW