SUBSCRIBE TO OUR BLOG

Share this post:

How to market DeFi project

Come on, from every possible source information flowing just about community, advertising, and PR. But guess what? How I can attract liquidity? How DeFi projects may increase TVL? Are there any tips to push up the number of active wallets?

Today we will go over the leading tips about DeFi project marketing, and we’ll figure out how to set a metric-based approach in web3 marketing.

Today we will go over the leading tips about DeFi project marketing, and we’ll figure out how to set a metric-based approach in web3 marketing.

13.04.2023

Vlad Svitanko

16 min

RELATED

DEFI RN. WHERE WE ARE AT?

Let's start with a small backstory.

Do you remember DeFi TVL in 2020? It was $1B.

Then just in 2 years, we ended up in 2022th with $250B TVL. Tremendously big numbers. 250X growth just in 2 years due to the brilliant technology of DeFi itself, the next chapter was.. bear market..

At the moment this article is being written DeFi has $50 TVL.

Then just in 2 years, we ended up in 2022th with $250B TVL. Tremendously big numbers. 250X growth just in 2 years due to the brilliant technology of DeFi itself, the next chapter was.. bear market..

At the moment this article is being written DeFi has $50 TVL.

So it is worth mentioning, that liquidity moved away because people are scared about their assets, up to the significant downtrend, and that’s pretty logical.. And guess what? You can not just push ads for DeFi projects and beg users to lock some liquidity in. Bullshit.

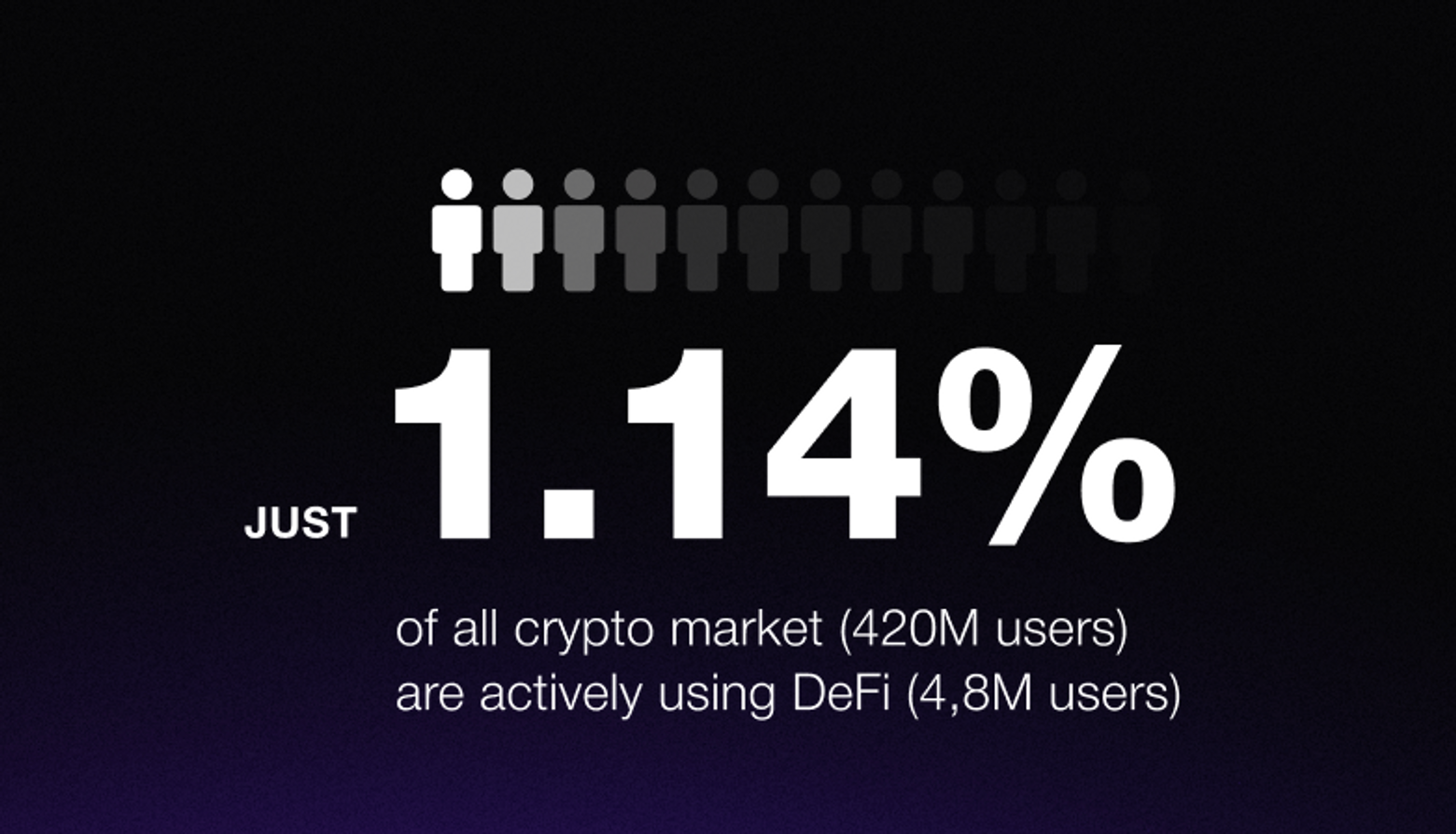

Everyone talks about mass adoption and a bright future. But, come on, only 1,14% of web3 folks are using DeFi, I even don’t speak for those, who are profitable and have their assets further than Binance & CoinBase.

Everyone talks about mass adoption and a bright future. But, come on, only 1,14% of web3 folks are using DeFi, I even don’t speak for those, who are profitable and have their assets further than Binance & CoinBase.

Space is pretty dispersed and barriers are still high to overcome.

And here we are. Just wanted you to understand, that all the ‘strategies’ proposed by experts regarding putting more cash on ads, pr, and influencers suck.

Understanding the market sentiment and timing - is the most important thing in such a fresh market as DeFi itself.

Let’s dig into some strategies and worthy ideas about marketing your DeFi project. I'm sitting in the chair of DeFi project Founder and CEO, so I will talk about relevant things that the protocol sticks with.

And here we are. Just wanted you to understand, that all the ‘strategies’ proposed by experts regarding putting more cash on ads, pr, and influencers suck.

Understanding the market sentiment and timing - is the most important thing in such a fresh market as DeFi itself.

Let’s dig into some strategies and worthy ideas about marketing your DeFi project. I'm sitting in the chair of DeFi project Founder and CEO, so I will talk about relevant things that the protocol sticks with.

ENSURE TRANSPARENT FUNDAMENTAL

It all comes up to users’ funds, and everyone wants to be protected and avoid any risks. So, before any promo activities will be launched, the best marketing for DeFi projects starts from early scratch and writing clear documentation.

Protocols need to prioritize security to attract more users. Users want to be sure that their funds are safe when they provide liquidity to a protocol. Therefore, protocols should have strong security measures in place, such as multi-signature wallets, bug bounties, and regular security audits.

Ensure that the security part is well described and there are no questions regarding potential risks for users.

Protocols need to prioritize security to attract more users. Users want to be sure that their funds are safe when they provide liquidity to a protocol. Therefore, protocols should have strong security measures in place, such as multi-signature wallets, bug bounties, and regular security audits.

Ensure that the security part is well described and there are no questions regarding potential risks for users.

Describe which chain your protocol is built on, and provide more mechanisms about where exactly yield comes from. If this a DEX you should show up why its much better (let’s imagine lower transaction fees) and due to what exactly.

"DeFi loves to be specifically covered."

Simplify Technical Jargon.

From whitepaper to in-app UX, from one pager to docs, from tokenomics to the project mission — provide as much clarity as you can, and trust me it will pay you off.

bRANDING, AS A PART OF BEING CATCHY

Web3 doesn't forgive being boring. DeFi has a lot of problems with unlocking the interesting user experience, by removing all complexities. A bunch of chains, transactions, fees, hundreds of pages of documentation, serious ‘tradFi’ voicing and so.

Come on. These ‘template behavings’ are just driving to the bottom, market is pretty much saturated, so mixing your messaging with others will turn DeFi project into just another gray noise.

Come on. These ‘template behavings’ are just driving to the bottom, market is pretty much saturated, so mixing your messaging with others will turn DeFi project into just another gray noise.

Tips to improve branding: create a brand hero, use unique coloristic and tone of voice, mix up your writeups, change the angles of messaging, and test some formats of content delivery.

Protocols should have a user-friendly interface that is easy to use and navigate. This can help attract more users and make it easier for them to provide liquidity. Give them the opportunity to easily overcome DeFi complexity.

Protocols should have a user-friendly interface that is easy to use and navigate. This can help attract more users and make it easier for them to provide liquidity. Give them the opportunity to easily overcome DeFi complexity.

A good example is Trader Joe — the biggest DEX on Avalanche. How cool and fun they’ve built the atmosphere with kind farmer Joe which is super glad to meet each user and help them swap & multiply their assets.

This atmosphere is fully empowered by the brand platform. Don’t underrate it.

This atmosphere is fully empowered by the brand platform. Don’t underrate it.

The easiest way to initially get bootstrapped is to start acting with other projects from the same chain.

Underline what chain you built on the top, and start reaching the first projects to collaborate with & having some partnerships.

Underline what chain you built on the top, and start reaching the first projects to collaborate with & having some partnerships.

CHAIN FAMILY BELONGING

"t's a truly liquidity-driven activity, that unlocks a true potential of liquidity flows between the projects and accumulating higher TVL."

Remember, that web3 is about collaboration, it's super differentiated from web2 where startups compete with each other. And being built in the same chain is obviously a good starting ground to collaborate on because you both will be in the WIN position if the chain gets bigger.

ACTIVITIES TO HAVE INITIAL EYEBALLS, GET EM HOOKED.

These are some of the activities & hooks that can be used to attract liquidity to a DeFi protocol.

- A whitelist form application is a way to limit the number of participants in a DeFi project. This can create a sense of exclusivity and scarcity, which can attract users to participate.

- Airdrops can be used to attract new users to a DeFi protocol by distributing tokens for free. This can create a sense of excitement and interest, which can attract users to participate.

- Offers can be used to attract users to a DeFi protocol by providing incentives, such as higher interest rates for lenders or lower fees. This can create a sense of value and benefit, which can attract users to participate.

- Testnets can be used to demonstrate the functionality and security of a DeFi protocol. This can create a sense of trust and confidence, which can attract users to participate.

- Locking some liquidity can be used to show that the DeFi protocol is serious about its security and its users' funds. This can create a sense of trust and confidence, which can attract users to participate.

- A huge upcoming drop of X: A huge upcoming drop of gov tokens & NFTs or other incentives can create a sense of excitement and anticipation, which can attract users to participate.

All of these activities can help attract liquidity to a DeFi protocol, but it's important to remember that they should be used in combination with other marketing strategies and a solid fundamental approach to security and transparency.

Everyone remembers the huge Uniswap airdrop and how did it affect the whole space, using methods such as such activity Uniswap became a leading DEX.

INCENTIVE PROGRAM

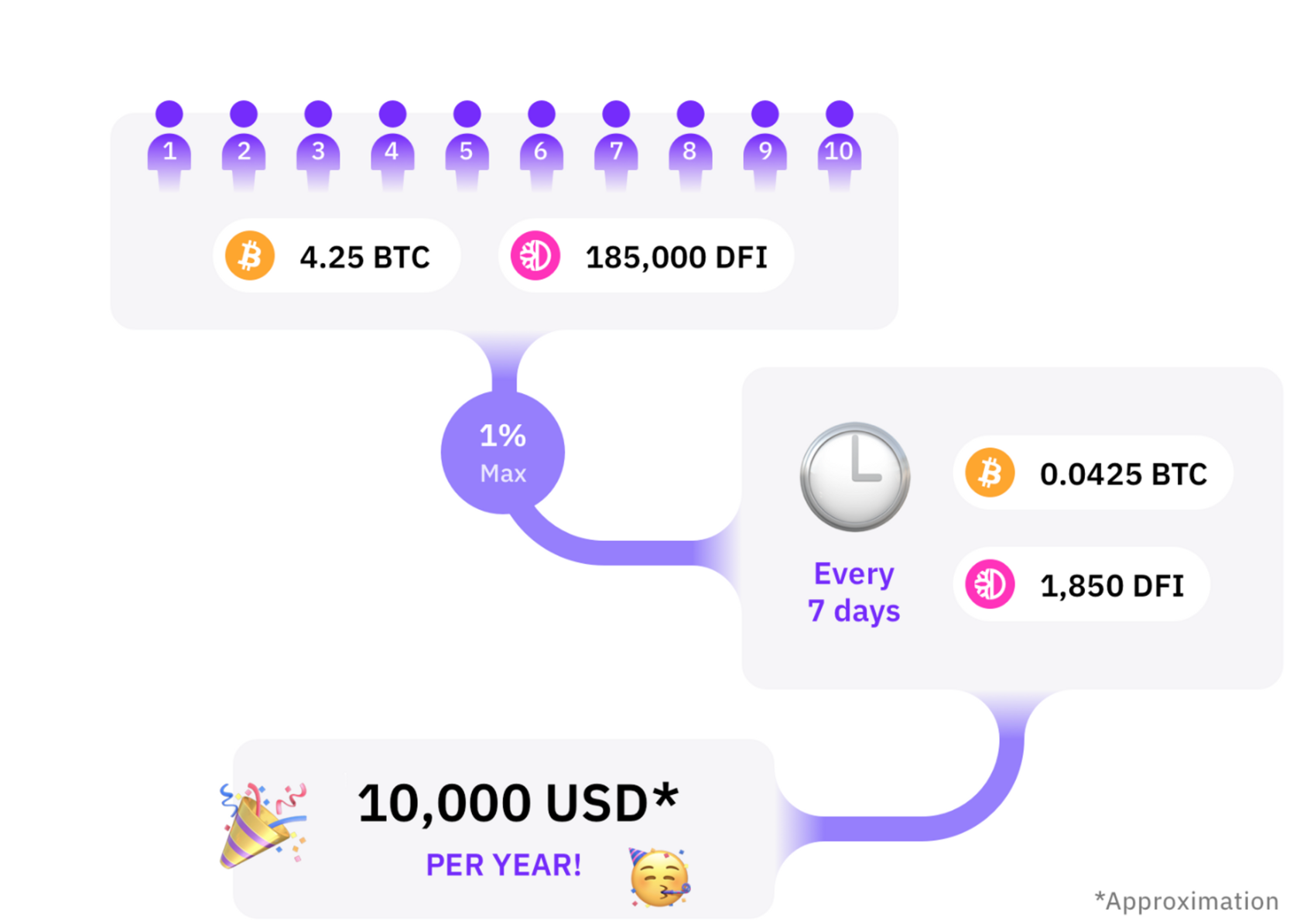

The incentive program for DeFi protocols to gain more TVL includes wallet registration, liquidity addition, and Zealy campaigns itself with a bunch of options inside (UGC, follows, members activity and so on).

By incentivizing users to register their wallets, protocols can expand their user base and increase the TVL. Liquidity addition can be used to attract new users to a DeFi protocol by providing incentives, such as higher interest rates for lenders or lower fees. This can create a sense of value and benefit, which can attract users to participate.

Zealy is a program that rewards users for bringing in new participants, further expanding the user base and increasing TVL. Implementing these incentive programs can help attract liquidity to a DeFi protocol and increase its adoption.

By incentivizing users to register their wallets, protocols can expand their user base and increase the TVL. Liquidity addition can be used to attract new users to a DeFi protocol by providing incentives, such as higher interest rates for lenders or lower fees. This can create a sense of value and benefit, which can attract users to participate.

Zealy is a program that rewards users for bringing in new participants, further expanding the user base and increasing TVL. Implementing these incentive programs can help attract liquidity to a DeFi protocol and increase its adoption.

BAKE YOUR HITMAN, THAT WOULD ATTRACT A CROWD

For example, Flashstake.io was provided the killer feature as a flash taking, meaning that users might get yearly yield immediately without any need to wait time, but %APY is going to be cut partly and given to the users that are feeling good to wait time until the period ends.

DeFi protocols can attract more liquidity by offering unique features that are not available on other protocols. For example, some protocols offer flash loans or options trading, which can attract users looking for specific features.

Here is a thing..

By incentivizing users to bring in new participants, the protocol can expand its user base and increase its TVL. What should you keep in mind while launching ref program?

By incentivizing users to bring in new participants, the protocol can expand its user base and increase its TVL. What should you keep in mind while launching ref program?

It works on both ends (for the invitee and inviter). So, everyone has some interest on the line to take a part.

Actually, it’s important to design the program carefully, develop a tracking system, and monitor its performance to ensure that it is effective and sustainable.

The story needs to be proven through some real example proof, and let’s consider AAVE:

Aave, a popular lending platform, has a referral program that rewards users with Aave tokens (AAVE) for every new user they refer who deposits a minimum of $10 worth of cryptocurrency. The referrer receives 0.25% of the referred user's interest earned on the platform for the first 6 months.

Actually, it’s important to design the program carefully, develop a tracking system, and monitor its performance to ensure that it is effective and sustainable.

The story needs to be proven through some real example proof, and let’s consider AAVE:

Aave, a popular lending platform, has a referral program that rewards users with Aave tokens (AAVE) for every new user they refer who deposits a minimum of $10 worth of cryptocurrency. The referrer receives 0.25% of the referred user's interest earned on the platform for the first 6 months.

REFERRAL PROGRAM

Ambassador program launching

This point shouldn't be taken as a KOLs acquisition. While Influencer's promo posts are something to be paid upfront and then hoping to get some exposure, the Ambassador program stimulates guys with the DeFi target audience literally supplying protocol with new liquidity and rewarding them after.

Why is this so cool?

1. Helps recognize the interested prospects who are ready to sweat a bit in terms of delivering value for the project;

2. The Ambassador program helps to pop with brand name across various channels and reach users multiple times through web3 communities;

3. A long-term statement of work is obviously much more sustainable for DeFi projects than short-term acquisitions for a couple of shill posts.

By designing a careful ambassador program it might turn into a great liquidity-attracting campaign, that steadily increases TVL.

Why is this so cool?

1. Helps recognize the interested prospects who are ready to sweat a bit in terms of delivering value for the project;

2. The Ambassador program helps to pop with brand name across various channels and reach users multiple times through web3 communities;

3. A long-term statement of work is obviously much more sustainable for DeFi projects than short-term acquisitions for a couple of shill posts.

By designing a careful ambassador program it might turn into a great liquidity-attracting campaign, that steadily increases TVL.

Integration with DeFi & Web3 academies / Creating own front-end edTech

DeFi is a rapidly growing sector. However, the complexity of the DeFi ecosystem can be daunting for newcomers. To attract new users and onboard liquidity, many DeFi projects invest in education and resources.

DeFi academies provide educational materials, tutorials, and other resources. This helps users get started with DeFi more quickly and confidently, building trust and confidence. By building their own academies, projects can customize their materials for their specific goals.

Investing in education and resources helps DeFi projects onboard liquidity more efficiently and build stronger communities. This drives the growth and adoption of DeFi, making it more accessible for everyone.

Investing in education and resources helps DeFi projects onboard liquidity more efficiently and build stronger communities. This drives the growth and adoption of DeFi, making it more accessible for everyone.

Remarketing Content Game

Remarketing is crucial for DeFi protocol marketing. It helps protocols reach users who are already interested in their project & just touched on marketing campaigns and haven't been converted, increasing engagement and conversion rates.

Retargeting ads on social media platforms like Facebook and Twitter is a good way to launch a remarketing campaign. These ads show to users who have visited the protocol's website or social media pages. They can reinforce the protocol's brand and encourage users to take action, like providing liquidity or participating in governance.

Email marketing is another effective method for launching a remarketing campaign. Regular newsletters and updates can keep users engaged and informed about the latest developments, building trust and encouraging participation.

Cryptorsy team has created a bunch of marketing campaigns for protocols and might admit, that remarketing is a key component of DeFi protocol marketing and should be included in any comprehensive marketing strategy.

Retargeting ads on social media platforms like Facebook and Twitter is a good way to launch a remarketing campaign. These ads show to users who have visited the protocol's website or social media pages. They can reinforce the protocol's brand and encourage users to take action, like providing liquidity or participating in governance.

Email marketing is another effective method for launching a remarketing campaign. Regular newsletters and updates can keep users engaged and informed about the latest developments, building trust and encouraging participation.

Cryptorsy team has created a bunch of marketing campaigns for protocols and might admit, that remarketing is a key component of DeFi protocol marketing and should be included in any comprehensive marketing strategy.

That’s a wrap! We hope you guys were enjoying reading this article about DeFi marketing tips, hacks, and strategy.

Shot-outs & feedbacks are always welcome. Share content and follow Cryptorsy to don’t miss any leading web3 marketing content.

Shot-outs & feedbacks are always welcome. Share content and follow Cryptorsy to don’t miss any leading web3 marketing content.

Today we will go over the leading tips about DeFi project marketing, and we’ll figure out how to set a metric-based approach in web3 marketing.

Final word

BORED OF THIS SH*T ABOUT DEFI MARKETING, THE TIME TO CHANGE IT HAS ARRIVED!

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

SCHEDULE YOR FREE CONSULTATION NOW