2024 Trends That Changed Crypto Forever

30.12.2024

Gleb Specter

16 min

Michael Saylor’s MicroStrategy has been aggressively acquiring Bitcoin since at least August 2020, elevating his company into the largest corporate holder of the currency.

As of December 16, 2024, MicroStrategy holds 439,000 BTC, acquired at a total cost of $27.1 billion, averaging $61,725 per Bitcoin. As a result, MicroStrategy’s stock ($MSTR) has shown exceptional growth in 2024 when $BTC skyrocketed, closing at $408 on December 16—a 614% increase over the past year and a staggering 2,713% rise over five years.

As of December 16, 2024, MicroStrategy holds 439,000 BTC, acquired at a total cost of $27.1 billion, averaging $61,725 per Bitcoin. As a result, MicroStrategy’s stock ($MSTR) has shown exceptional growth in 2024 when $BTC skyrocketed, closing at $408 on December 16—a 614% increase over the past year and a staggering 2,713% rise over five years.

Source: The Sui Blog

Key 2024 Milestones

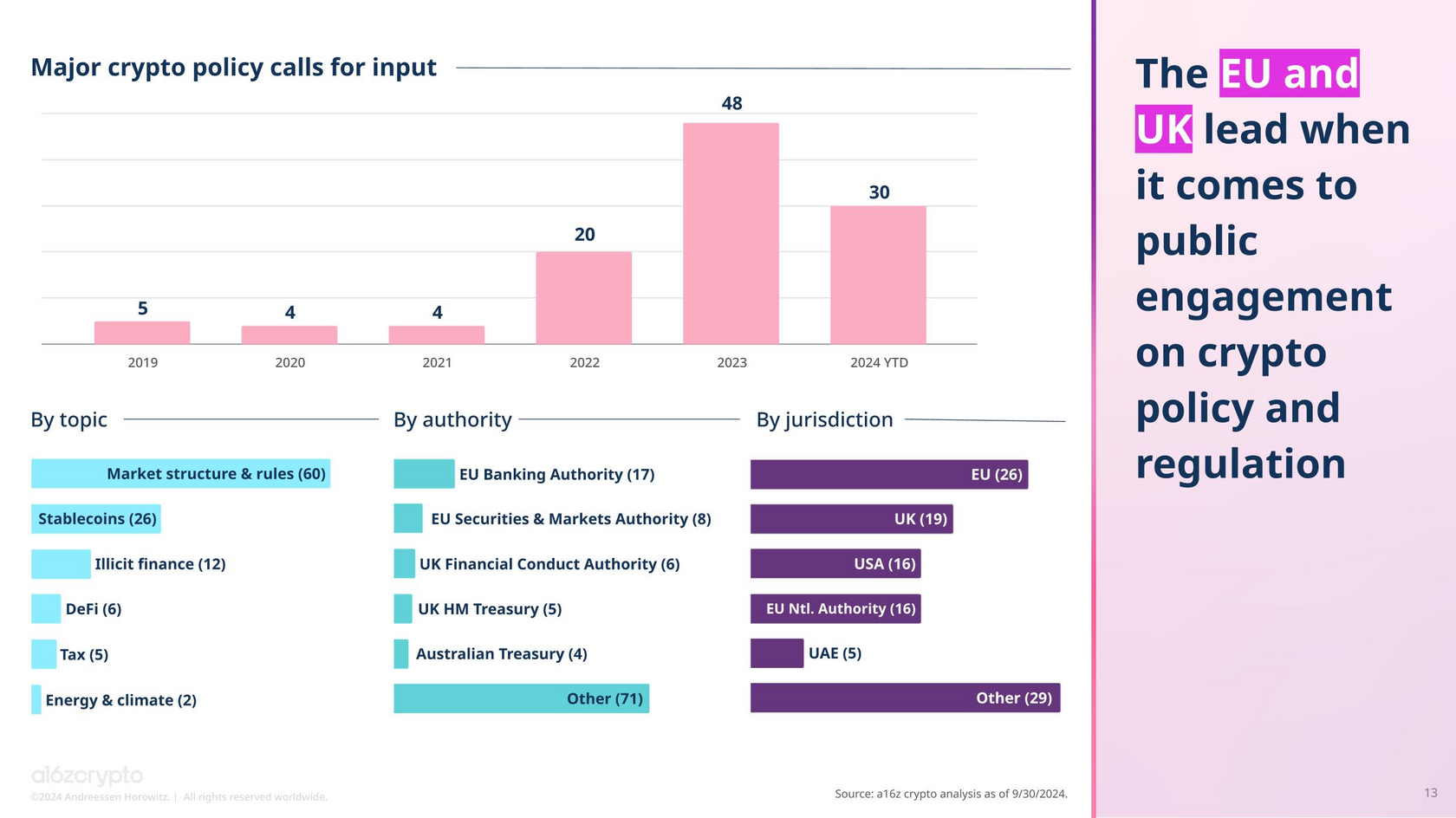

Crypto Meets Policy and Politics

We worked through multi-page reports from titans like a16z crypto (Andreessen Horowitz), Electric Capital, Hashdex, and SimpleSwap, blending their insights with our own observations to bring you a bite-sized recap of 2024 in the on-chain space.

Here’s a breakdown of this year’s crypto achievements, challenges, and what lies ahead.

Here’s a breakdown of this year’s crypto achievements, challenges, and what lies ahead.

2024 has been a defining year for the crypto industry, marked by an unprecedented Bitcoin resurgence that fueled explosive growth across the crypto landscape, the advent of AI in crypto (now in earnest), and significant regulatory milestones.

Adoption soared, driven by institutional investors through RWA (real-world asset) tokenization and web2 retail users embracing the fun of memecoins. Blockchain has become more deeply integrated into the fabric of the Internet, with operating costs dropping—or even disappearing—and UX (user experience) reaching new heights like offering no-seed-phrase Google logins while preserving privacy.

The message is clear: legacy platforms must adopt blockchain or risk obsolescence.

Adoption soared, driven by institutional investors through RWA (real-world asset) tokenization and web2 retail users embracing the fun of memecoins. Blockchain has become more deeply integrated into the fabric of the Internet, with operating costs dropping—or even disappearing—and UX (user experience) reaching new heights like offering no-seed-phrase Google logins while preserving privacy.

The message is clear: legacy platforms must adopt blockchain or risk obsolescence.

In March, Wyoming enacted the DUNA Act, granting legal recognition to DAOs (decentralized autonomous organizations) by allowing them to register as decentralized unincorporated nonprofit associations.

The law provides a regulatory framework for their operations, enabling them to engage in contracts, pay taxes, and even receive limited liability protections similar to those of traditional corporations.

The law provides a regulatory framework for their operations, enabling them to engage in contracts, pay taxes, and even receive limited liability protections similar to those of traditional corporations.

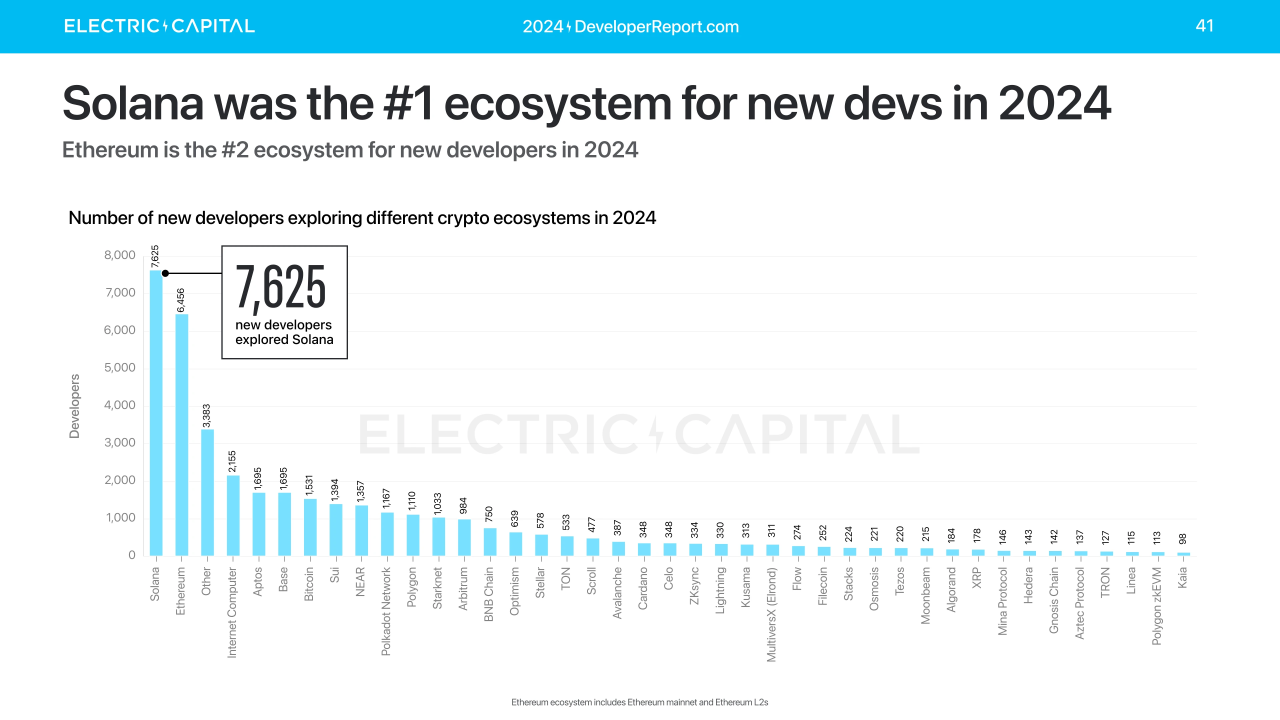

Solana surged to new heights in 2024, cementing its position as the leading ecosystem for on-chain culture besides all the DeFi (decentralized finance) advancements goin on there. For the first time since Ethereum’s dominance began in 2016, another blockchain ecosystem took the top spot, with 7,625 new devs choosing Solana.

Binance plans to integrate USDC across its platforms and adopt it for corporate treasury operations, offering a stronger alternative to USDT. This move is compounded by regulatory challenges for Tether, particularly in regions like the EU (European Union) and Canada, where USDC has gained approval and compliance, while Tether has been reluctant to meet regulatory standards.

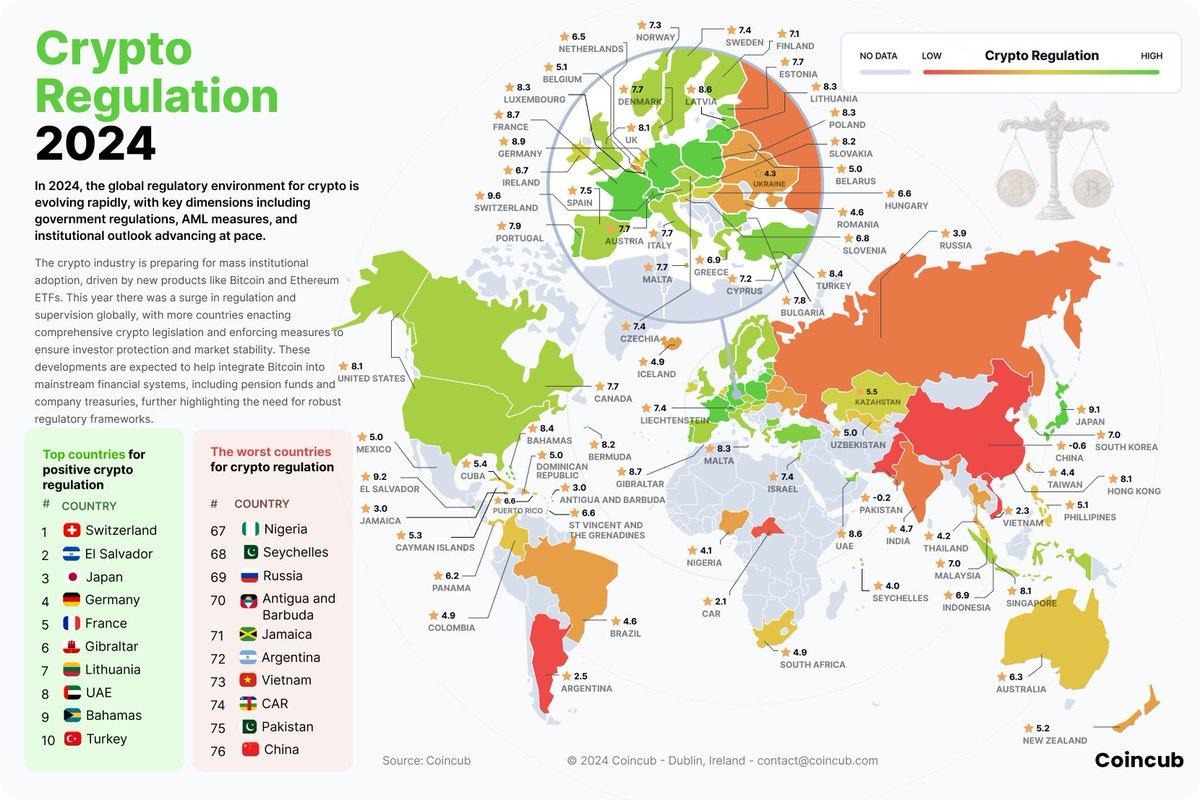

Set to fully take effect today, on December 30, 2024, MiCA lays out the legal playbook for CASPs (crypto-asset service providers), MiCA is intended to align crypto markets with TradFi (traditional finance) standards.

The EU has positioned itself as the de facto leader in digital asset regulation, with a strong focus on AML (anti-money laundering), KYC (know your customer), licensing, and market abuse prevention. While compliance may challenge smaller players, and concerns linger over Europe’s CBDC ambitions with the Digital Euro, MiCA’s clear framework marks a significant milestone in legitimizing and growing the crypto ecosystem.

The EU has positioned itself as the de facto leader in digital asset regulation, with a strong focus on AML (anti-money laundering), KYC (know your customer), licensing, and market abuse prevention. While compliance may challenge smaller players, and concerns linger over Europe’s CBDC ambitions with the Digital Euro, MiCA’s clear framework marks a significant milestone in legitimizing and growing the crypto ecosystem.

Globally, the EU’s MiCA regulation set a new standard for crypto policies. Its well-structured approach, spanning stablecoins, DeFi, RWA tokenization, and NFTs has positioned the EU as a leader in the global bid to work out clear and functional crypto laws while ensuring consumer protection.

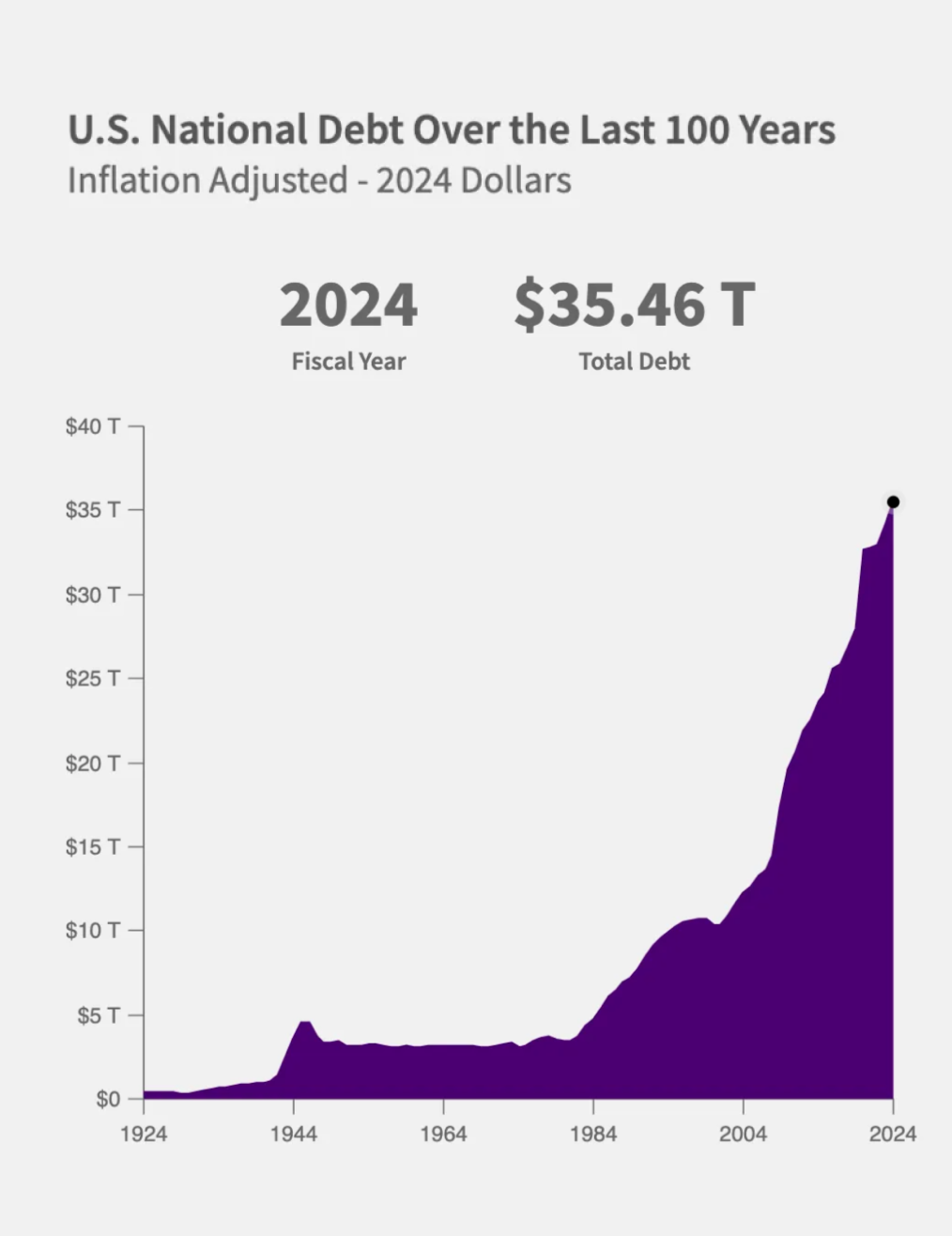

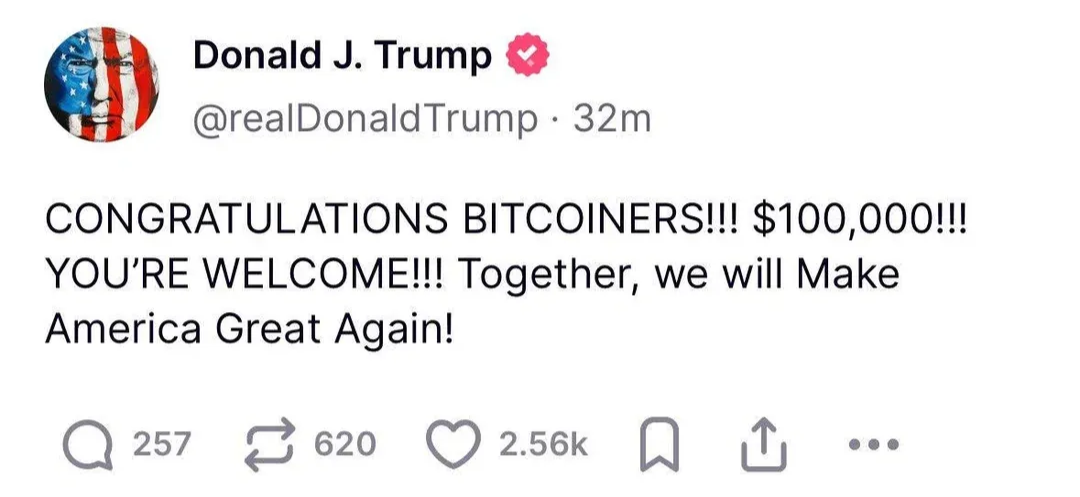

Senator Cynthia Lummis has introduced the BITCOIN Act, which suggests acquiring 1 million bitcoins over five years to address the $35 trillion national debt. This announcement has fueled speculation of Bitcoin surpassing gold’s $16 trillion market cap, driving its price beyond $100,000 following Trump’s election victory.

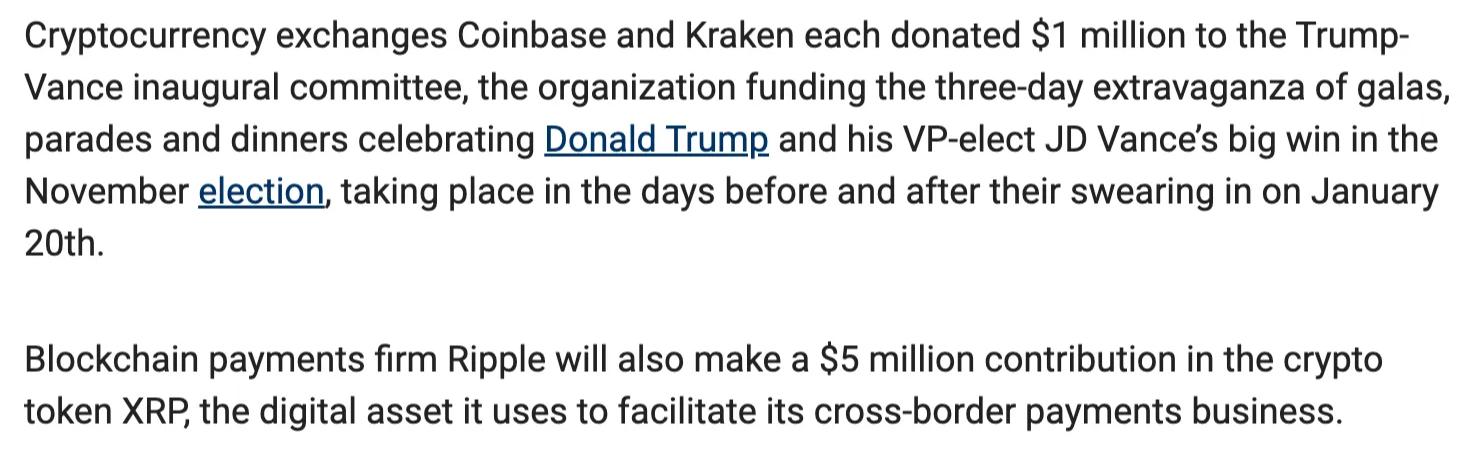

The crypto community’s substantial election spending and advocacy for favorable legislation have cemented its status as a formidable political force. As the new admin takes charge, the interplay between politics and crypto likely to become even more significant, with potential implications for regulation and the broader financial landscape.

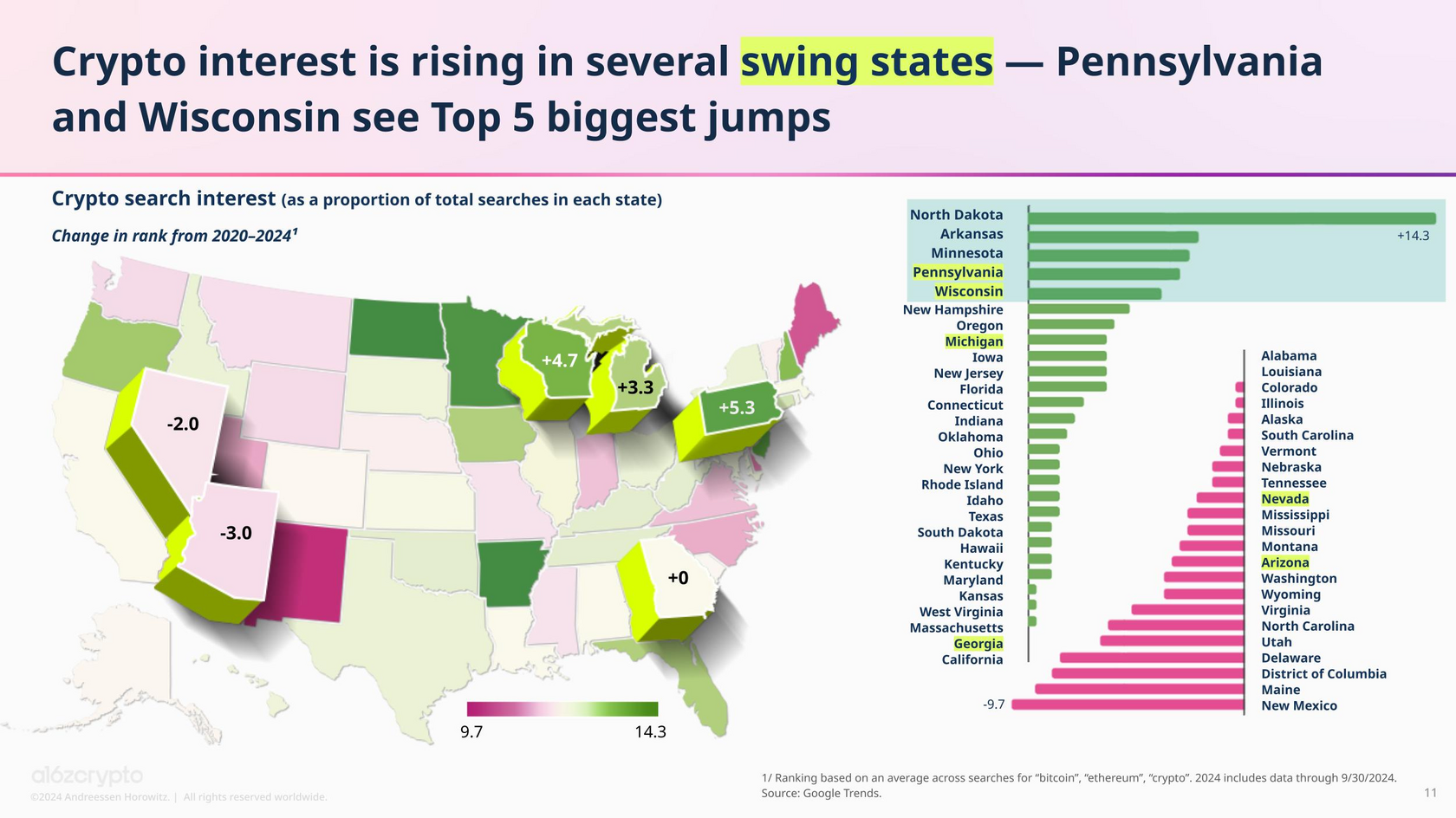

Crypto became a huge political issue in the USA.

Additionally, bipartisan US legislation such as the FIT21 Act laid the groundwork for a clearer regulatory framework, like defining roles for the CFTC and SEC while promoting innovation and consumer protection.

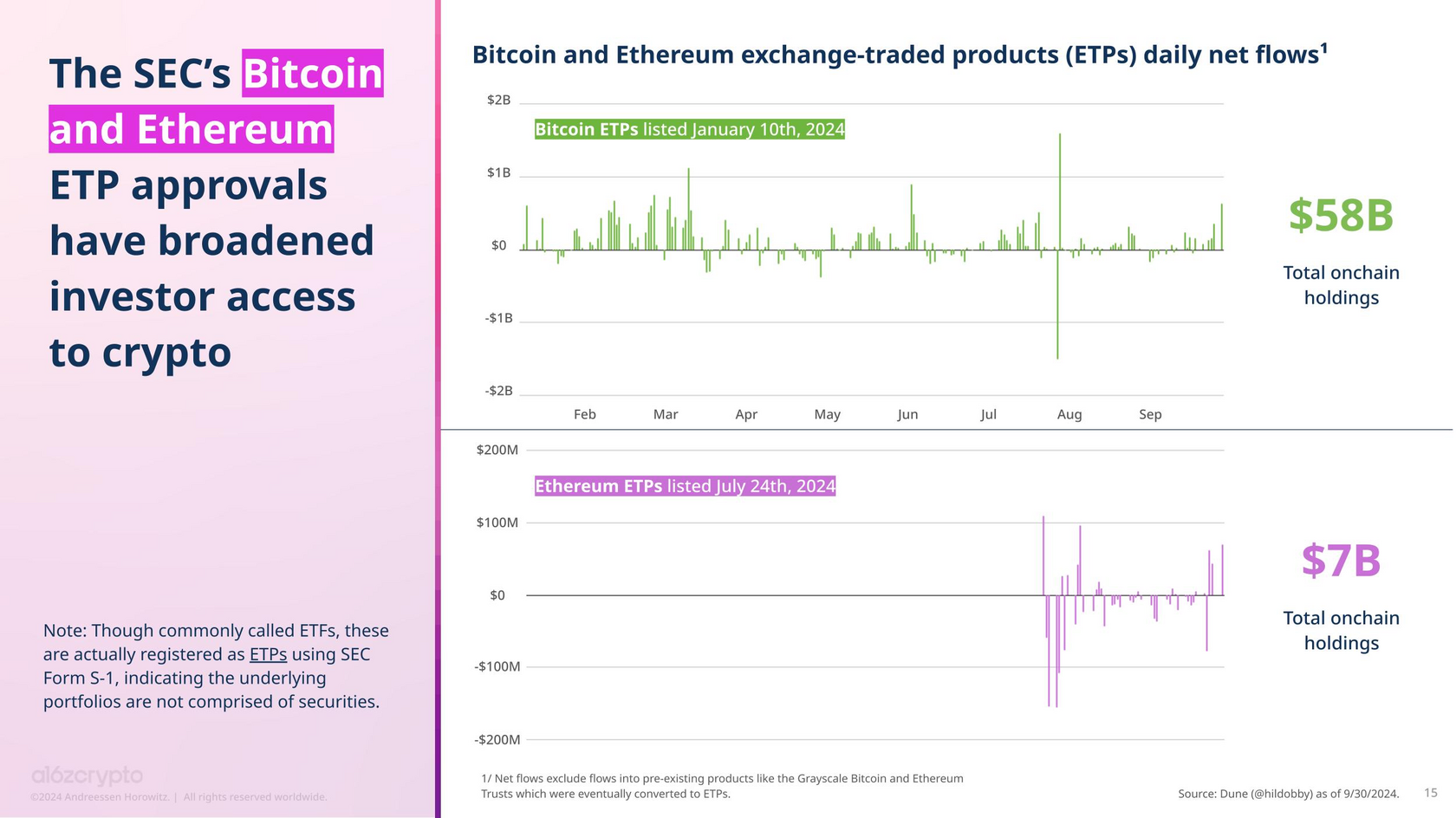

Together, these ETPs hold over $65 billion in on-chain assets.

In the US, the approval of Bitcoin and Ethereum ETPs (exchange-traded products, including ETFs or exchange-traded funds) marked a significant regulatory milestone. It unlocks new avenues for much-needed institutional adoption, which gives blockchain-powered assets a ton of credibility.

2024 witnessed an unprecedented convergence between crypto and global politics.

ZK rollups have grown substantially, with deployments increasing 16x since 2020, costs down and efficiency up. Notably, 2,054 monthly active developers now support ZK ecosystems, reflecting strong momentum in ZK-based innovations like zkSync and Scroll.

ZK technology holds immense promise, offering developers affordable and verifiable blockchain computation. However, our full disclosure is that zkVMs (zk-based virtual machines) still have significant progress to make before matching the performance of traditional computers.

ZK technology holds immense promise, offering developers affordable and verifiable blockchain computation. However, our full disclosure is that zkVMs (zk-based virtual machines) still have significant progress to make before matching the performance of traditional computers.

In 2024, ZKP (zero-knowledge proof) developments showcased how instrumental the technology is both to baking blockchain in under the hood of web2 to enable all the on-chain experiences AND securing user privacy despite players like Google or Meta (Facebook parent company).

Why? Because ZK L2 networks enable large-scale off-chain computations with verifiable results.

Why? Because ZK L2 networks enable large-scale off-chain computations with verifiable results.

This allowed Ethereum as an ecosystem—and particularly its rollups—to onboard founders and retain users more effectively. With reduced congestion, faster execution, and significantly lower transaction costs, the enhanced scalability has paved the way for seamless user experiences.

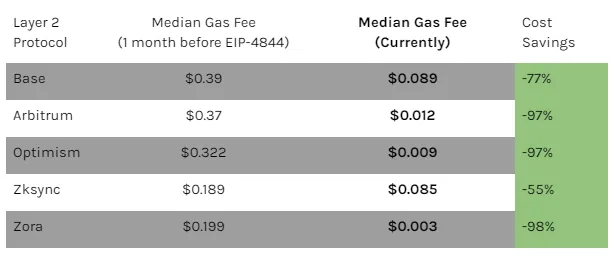

Ethereum’s ‘Dencun’ upgrade in March marked a pivotal moment for Ethereum’s scalability. By implementing proto-danksharding (EIP-4844), L2 (Layer 2) networks saw transaction fees drop dramatically, even as activity increased. It’s now dirt cheap to run diverse dApps (decentralized applications), including on-chain gaming microtransactions, various DeFi protocols, or even social networking platforms.

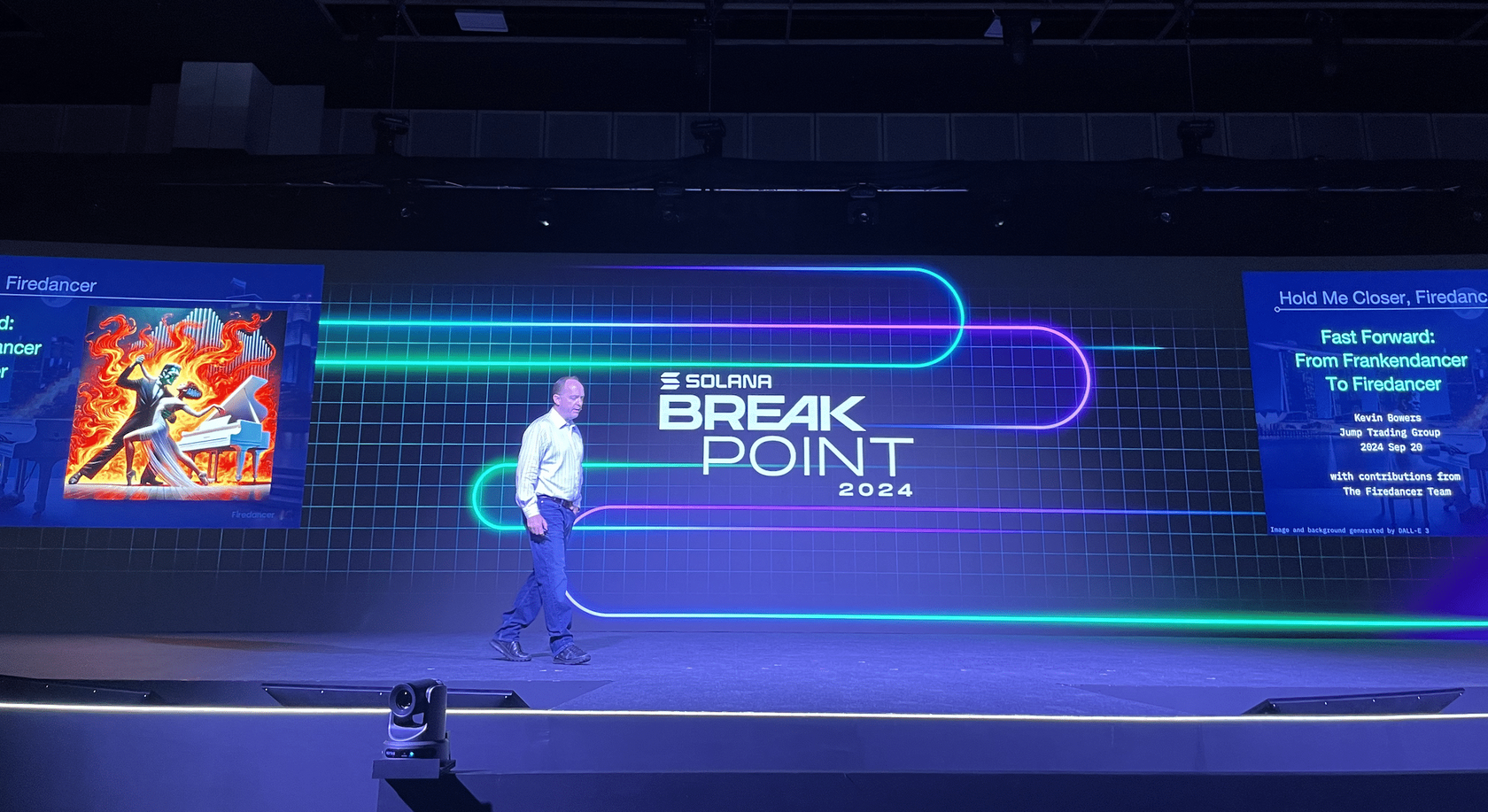

This year’s two-day Solana Breakpoint no-nonsense ecosystem conference deserves a separate mention as one of the greatest crypto events of 2024 with multiple huge announcements and Apple-like refinement.

The whirlwind of activity on Solana was driven by adoption across DeFi, wire payments, and consumer apps. The ecosystem also saw major advancements in tokenizing RWAs and countless memecoin launches, now costing as little as $3—further diversifying its use cases.

If we were to try and squeeze the sheer volume of Solana developments this year:

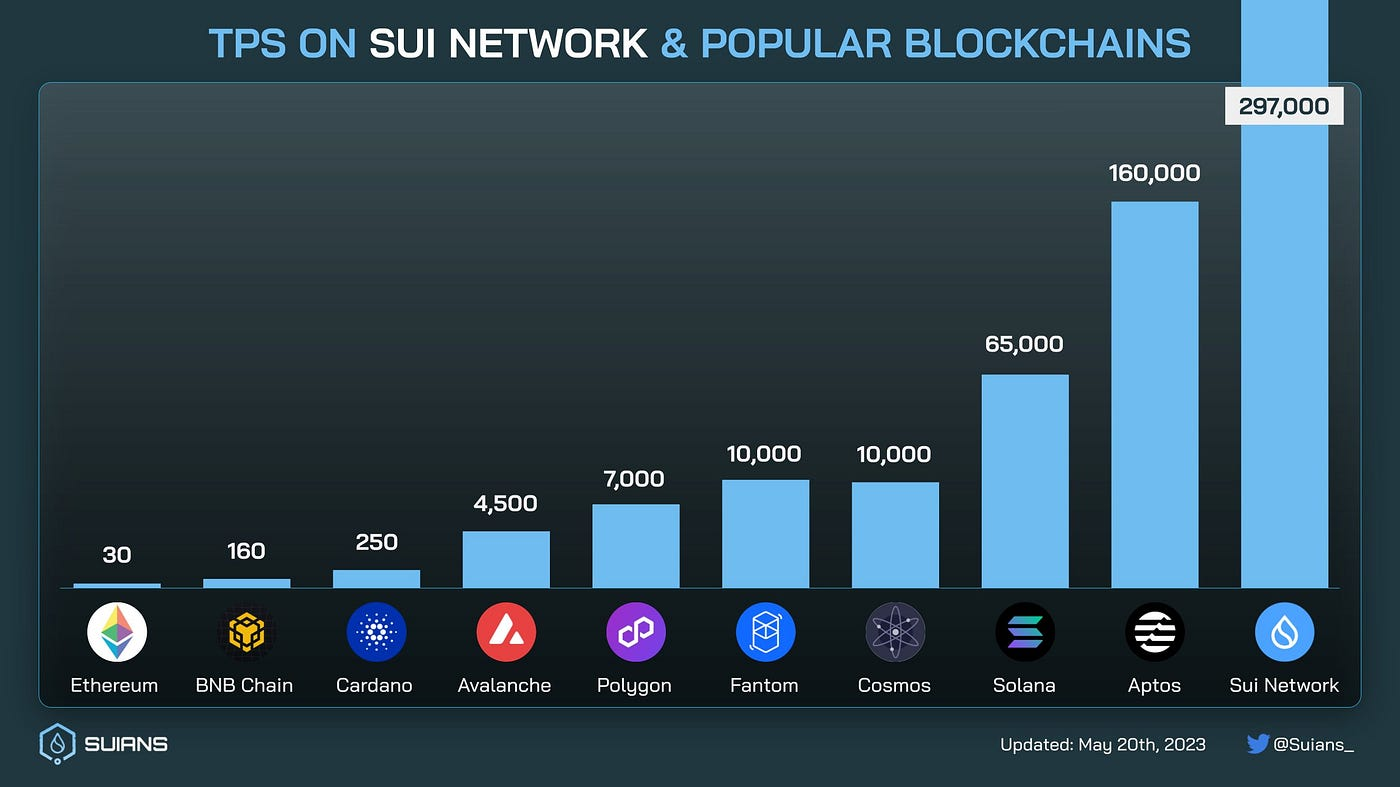

Solana was primed for this boom with its high transactions-per-second (TPS) capabilities, hovering around 3,000, and no unexpected surprises like the extensive downtimes of the past.

To be clear, by modern standards—such as Sui’s or Aptos’ parallel processing, theoretically capable of tens of thousands of simultaneous transactions—Solana is somewhat behind. However, it still outperforms Ethereum, no doubt.

- It achieved 83% YoY (year-over-year) growth in monthly active devs, the fastest among ecosystems with 2000+ developers.

- Dominated in global metrics, ranking as the top ecosystem in India and second across the U.S., U.K., Canada, and China.

- Powered 81% of all DEX transactions and 64% of NFT mint transactions across blockchains.

- Surpassed Ethereum in DeFi on-chain settlement volume, with $574 billion settled on Solana’s DEXs.

Solana was primed for this boom with its high transactions-per-second (TPS) capabilities, hovering around 3,000, and no unexpected surprises like the extensive downtimes of the past.

To be clear, by modern standards—such as Sui’s or Aptos’ parallel processing, theoretically capable of tens of thousands of simultaneous transactions—Solana is somewhat behind. However, it still outperforms Ethereum, no doubt.

Moreover, Binance has hinted at removing USDT from its European offerings due to Tether’s non-compliance with the EU’s MiCA (Markets in Crypto Assets) regulation. With Circle’s aggressive expansion and Tether’s ongoing controversies regarding transparency and compliance, USDT’s position is increasingly under threat.

Tether’s dominance in the stablecoin market is facing increased pressure as Binance and Circle have formed a strategic partnership to promote the adoption of USDC.

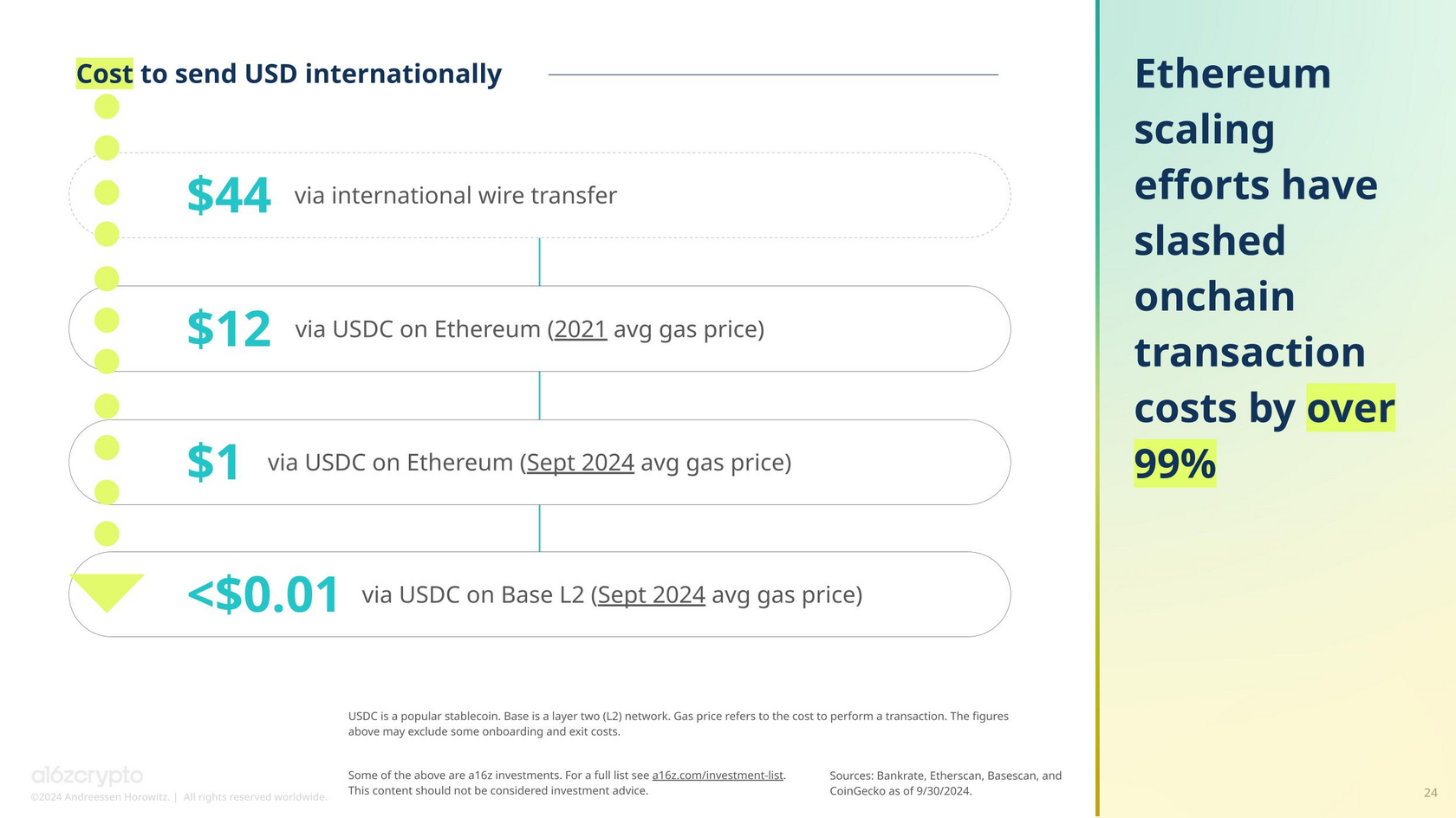

This means the affordability of stablecoin transfers today is democratizing financial services like never before (it’s not even $1 now to send stables), especially in regions struggling with high remittance fees or unstable currencies.

For instance, sending USDC on Base now costs less than one cent.

Lower transaction costs, particularly on Solana and Layer 2 networks like Base, have made stablecoin adoption even more accessible.

They now facilitate cross-border remittances, corporate treasury management, and retail transactions with ease and efficiency.

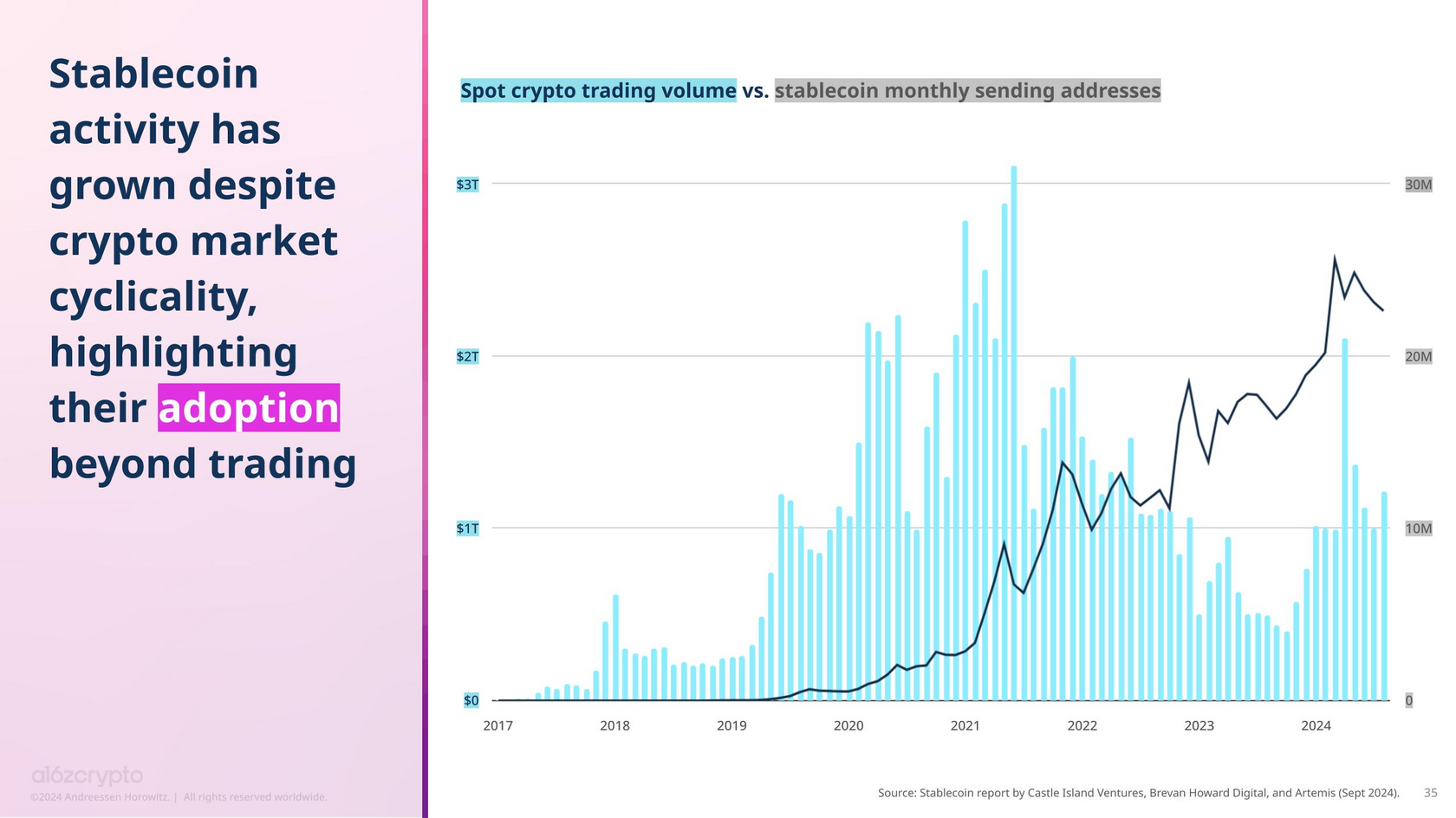

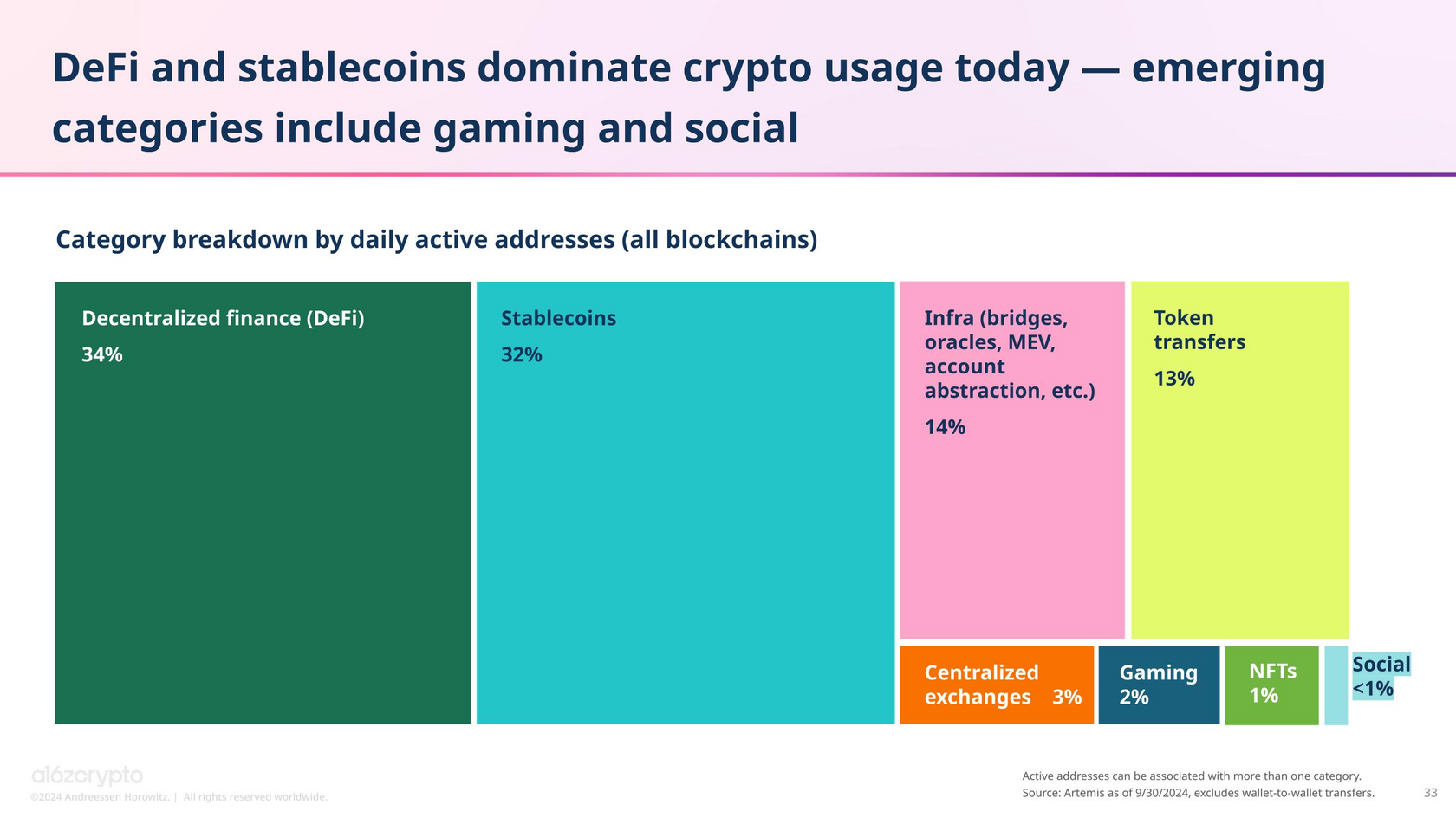

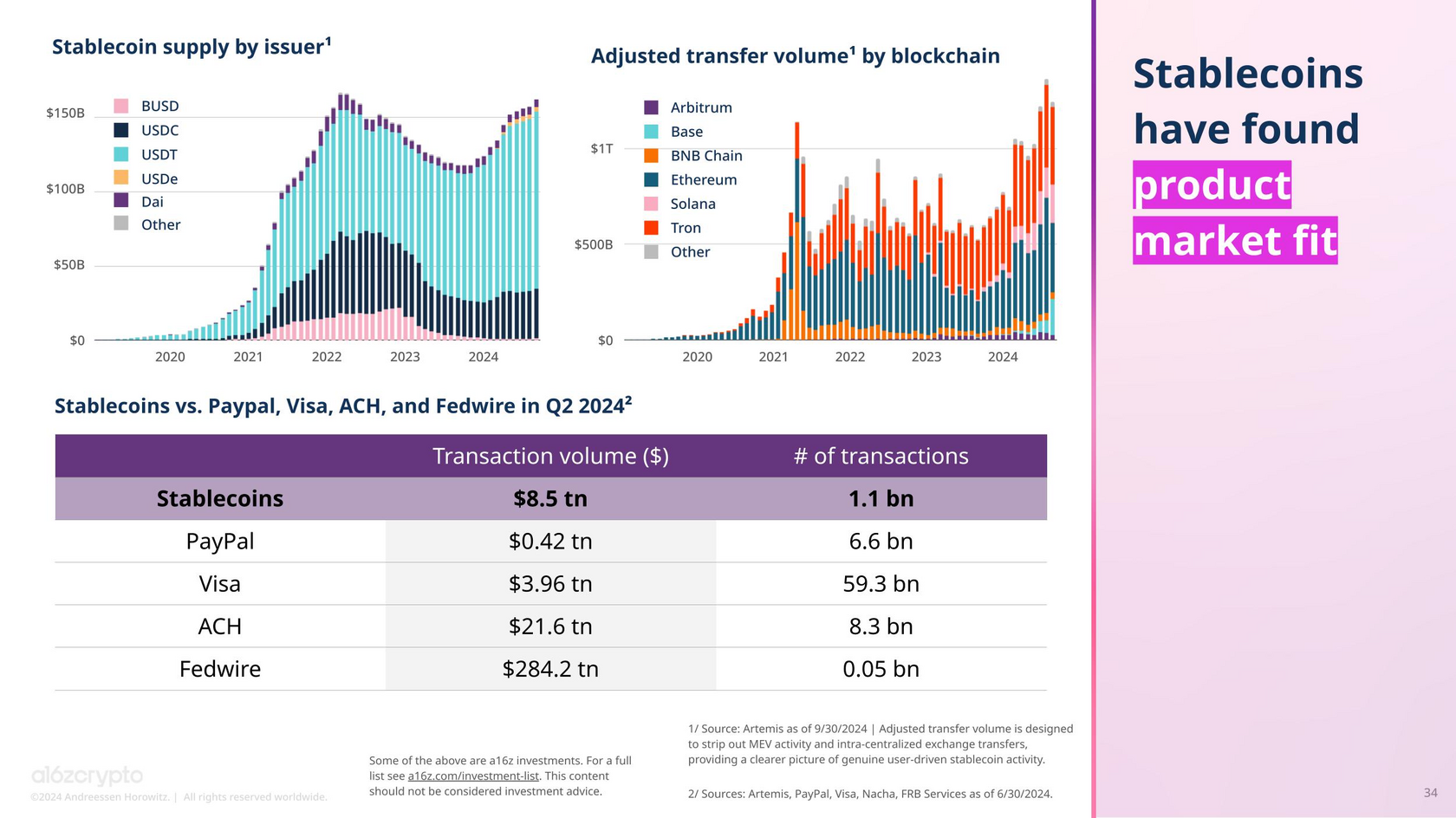

Stables solidified their position as a critical component of the crypto ecosystem. With transaction volumes exceeding $8.5 trillion in Q2—more than double Visa’s—stablecoins have demonstrated their utility beyond trading.

Notably, Ethereum retained its dominant position, reflecting the sustained appeal of its ecosystem among developers.

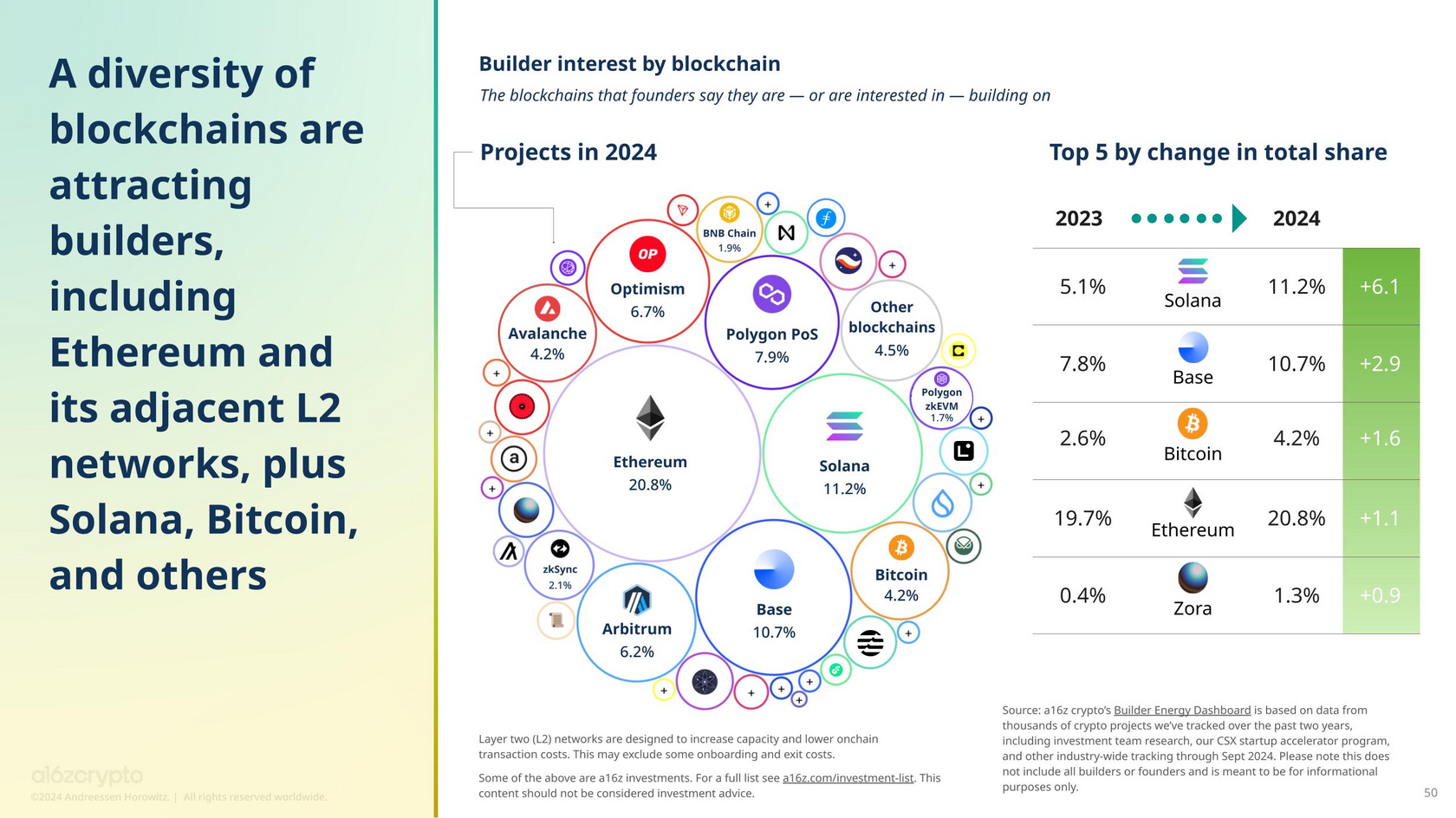

The Builder Energy dashboard revealed a seismic shift in developer focus, with Solana’s share of interest doubling from 5.1% to 11.2%. Base followed closely, indicating robust competition in attracting talent.

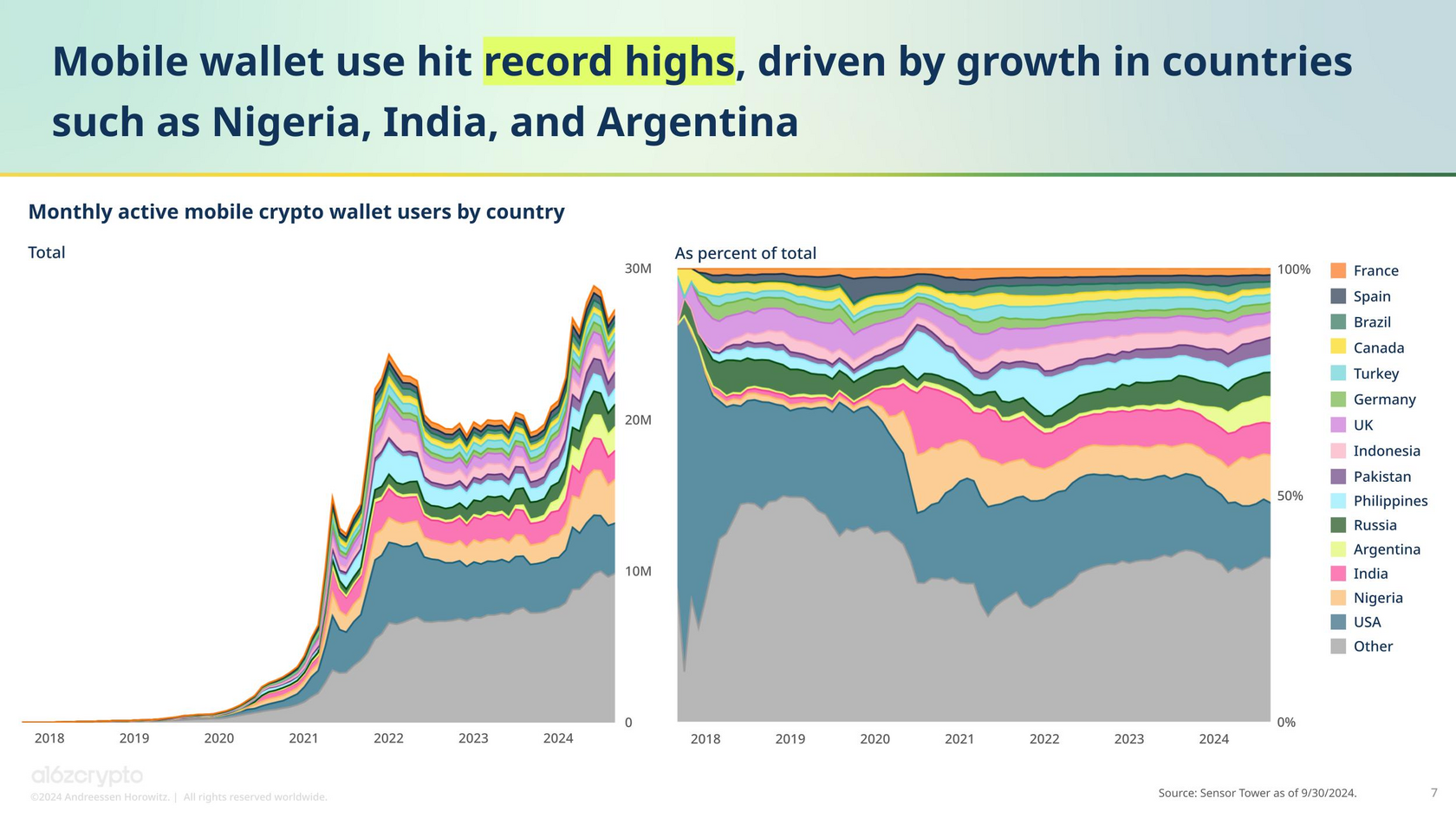

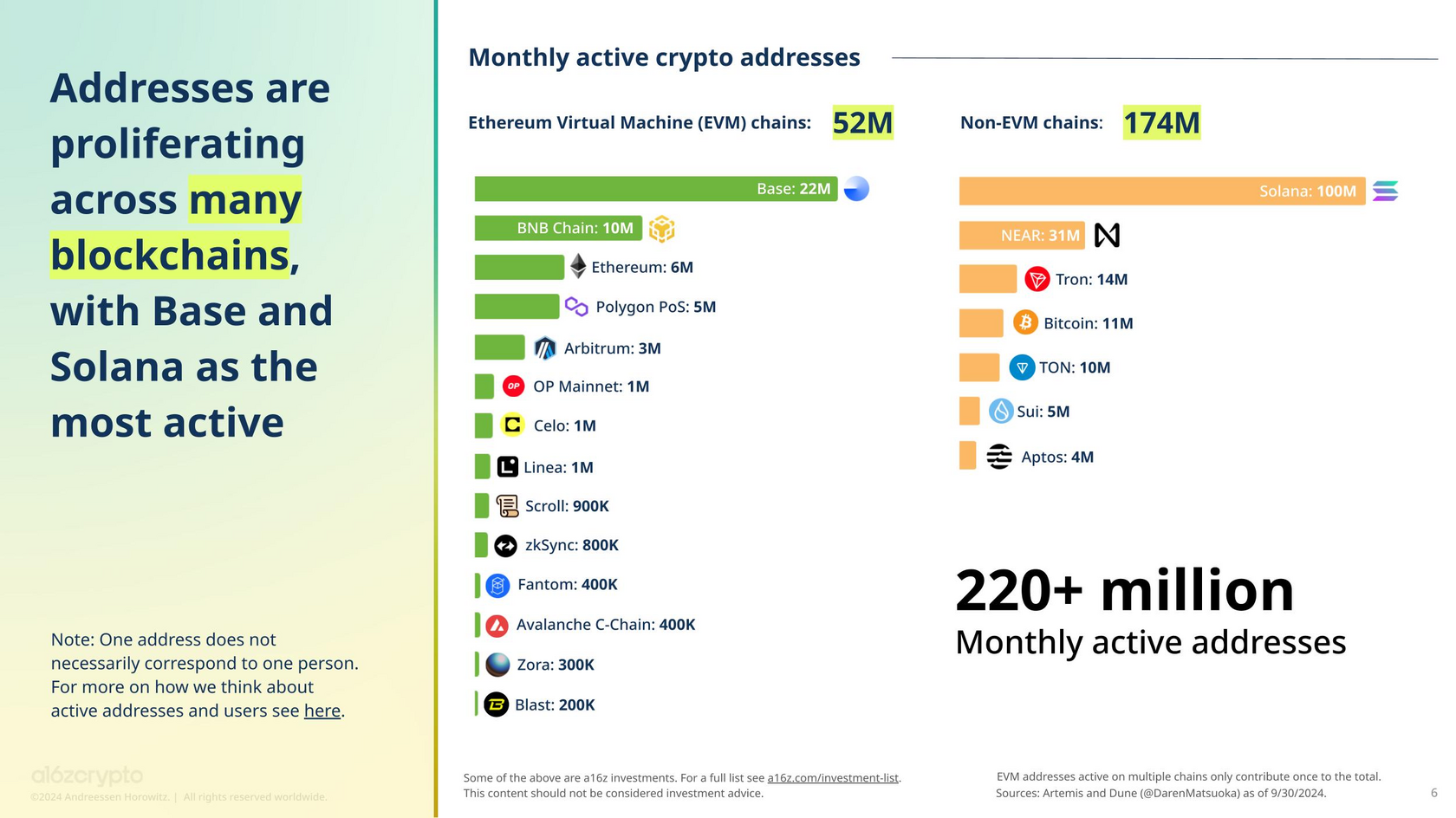

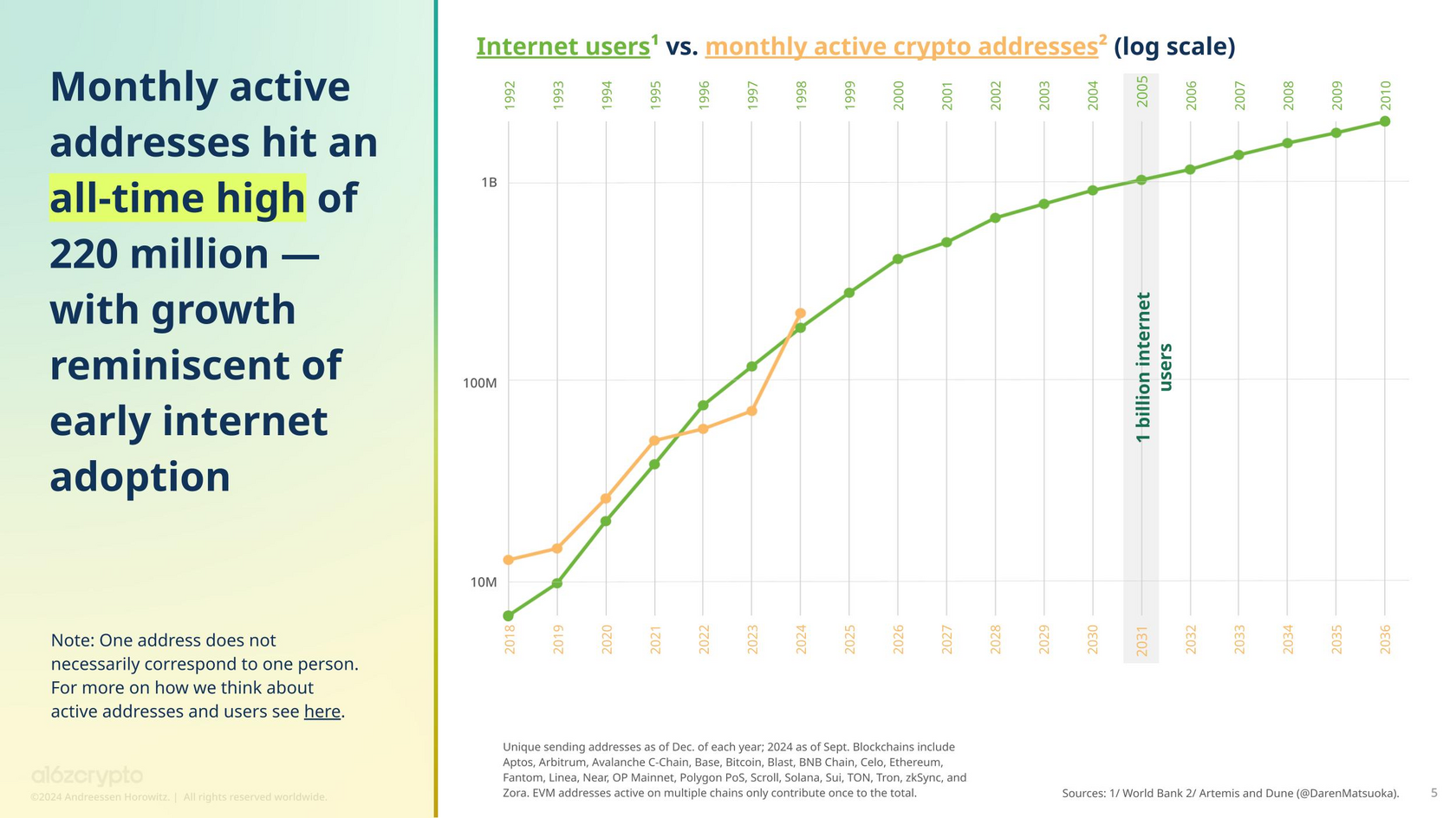

This explosion in activity is primarily driven by Solana, which alone accounted for 100 million addresses. NEAR, Base, Tron, and Binance’s BNB Chain also contributed significantly to this surge. In tandem, mobile wallet usage climbed to 29 million active users by mid-year, with growing adoption in emerging markets such as Nigeria, India, and Argentina.

Crypto adoption has reached unparalleled levels, with monthly active blockchain addresses surpassing 220 million.

The question is, does $ETH speculative price really matter that much when the tech has vastly expanded?

Yes, with a T.

The rumor—and the punchline—is that Gary Gensler allegedly offered to serve as an informal advisor to Binance, according to the exchange’s lawyers.

Apparently, he didn’t get the gig… and the rest is history.

Apparently, he didn’t get the gig… and the rest is history.

Some time has passed since the release of the State of Crypto Report 2024, and as of the latest data from ETF.com, crypto ETF AUM (assets under management) now stand at around $69B.

Notably, Ethereum as an asset, $ETH, notoriously underperformed compared to $BTC throughout 2024 despite, or, most likely, because of all the optimizations that reduce the volume of $ETH used for transactions.

The days of paying tens or even hundreds of US dollars for a simple crypto transfer are long-long gone!

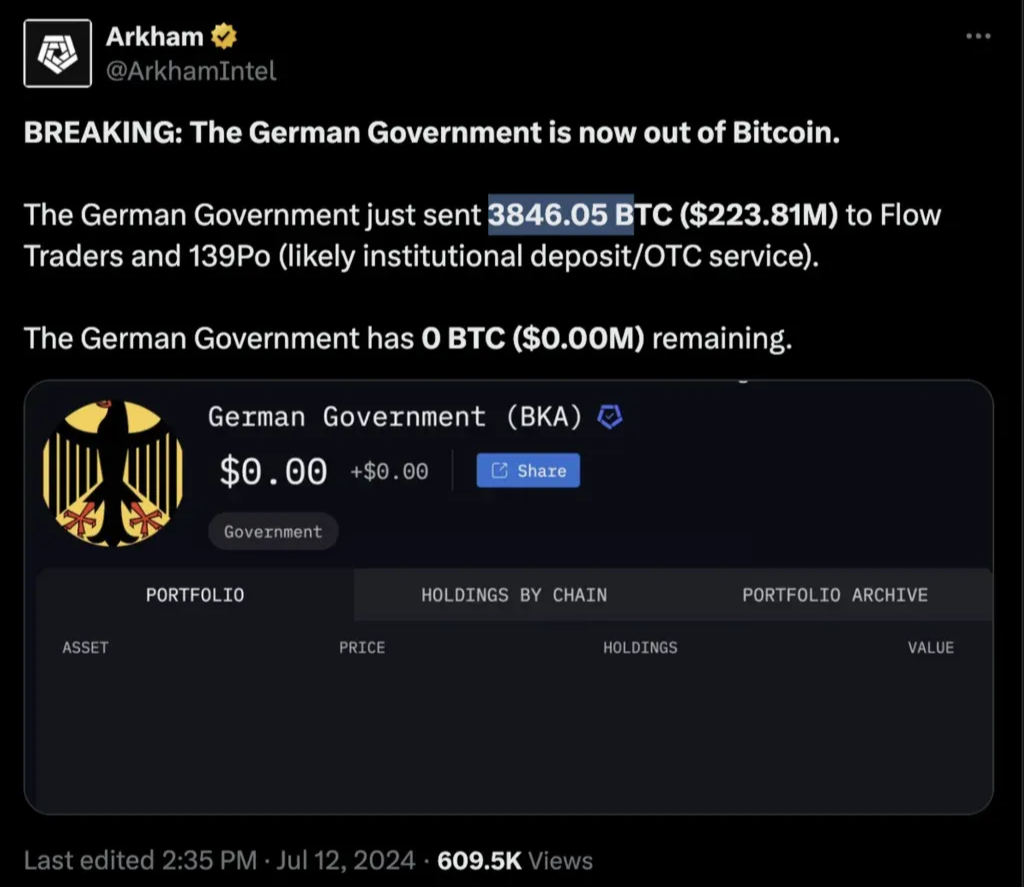

However, this wasn’t a decision influenced by speculation or politics. Under German law, assets confiscated in criminal proceedings—including Bitcoin—must be sold promptly, whether they are cryptocurrencies, fiat money, or real estate. The Generalstaatsanwaltschaft, not politicians or investment advisors, handled the sale, adhering strictly to these legal requirements.

Critics might focus on the missed financial windfall, but it’s important to understand the context: prosecutors are not crypto investors. Keeping the Bitcoin for speculative purposes was never an option. The law mandates liquidation of seized assets, ensuring fairness and compliance, even if it means forfeiting potential future gains.

While the decision might seem frustrating to crypto advocates, it highlights the challenges of reconciling legal frameworks with the fast-evolving nature of digital assets.

Critics might focus on the missed financial windfall, but it’s important to understand the context: prosecutors are not crypto investors. Keeping the Bitcoin for speculative purposes was never an option. The law mandates liquidation of seized assets, ensuring fairness and compliance, even if it means forfeiting potential future gains.

While the decision might seem frustrating to crypto advocates, it highlights the challenges of reconciling legal frameworks with the fast-evolving nature of digital assets.

Did You Know?

The German government, through the Office of the Public Prosecutor (Generalstaatsanwaltschaft) in Dresden, sold 50,000 BTC at $57,600 per coin, missing out on approximately $1.7 billion in potential profits as Bitcoin reached new all-time highs.

The German government, through the Office of the Public Prosecutor (Generalstaatsanwaltschaft) in Dresden, sold 50,000 BTC at $57,600 per coin, missing out on approximately $1.7 billion in potential profits as Bitcoin reached new all-time highs.

SUI’s ZK Login to Blend with Web2

ZKs Boosting Bitcoin

EU’s Legal Framework

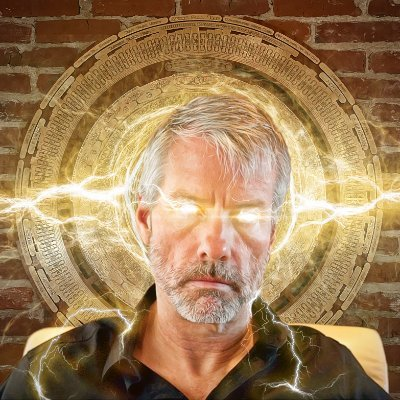

State-Level Bitcoin Reserves

US Bitcoin Reserve

Crypto Swayed US Presidential Elections

Welcome, Crypto ETFs. Hi, Institutions

ZK Tech’s Best Year

Ethereum Scaled Massively

Solana Exploded

USDT Dominance Under Threat

Stablecoins As the Industry’s Cornerstone

Record-High Activity and Usage

Source: Citrea Blog

Last September, the Sui ecosystem unveiled zkLogin, which is nothing short a groundbreaking feature that leverages ZKPs to deliver a secure and seamless registration process.

It enables users to access Sui wallets using just their Google, Facebook, or other social media accounts.

By bridging web2 familiarity with Web3 functionality, zkLogin significantly lowers the barriers to entry for new users—those who have yet to experience crypto but are about to become the direct beneficiaries of the web3 ecosystem being built today.

It enables users to access Sui wallets using just their Google, Facebook, or other social media accounts.

By bridging web2 familiarity with Web3 functionality, zkLogin significantly lowers the barriers to entry for new users—those who have yet to experience crypto but are about to become the direct beneficiaries of the web3 ecosystem being built today.

From Old Challenges to New Opportunities

On-Chain’s Quantum Leap

Source: Crypto Briefing

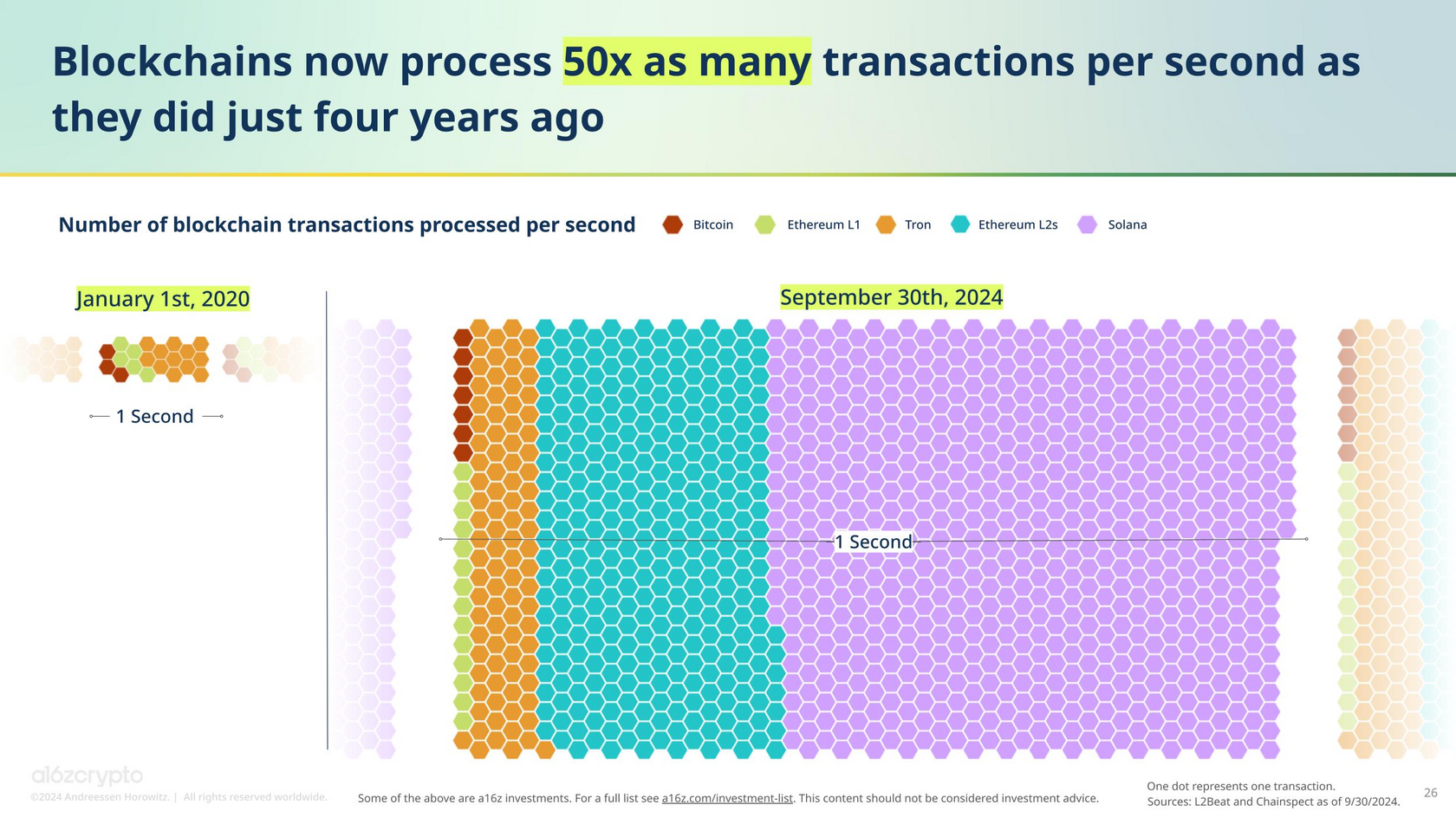

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: Horizen

Source: Fumbi Network

Source: GARY $GONESLER on Twitter

Source: Michael Saylor’s Twitter Profile Pic

Source: Bitcoin Magazine

Trump preaching at the Bitcoin 2024 Nashville conference this July, 2024. | Source

Source: Fox Business

Source: Truth Social

Source: a16z crypto

Source: Unchained Crypto

People’s hopes that Solana could one day become the go-to backbone for decentralized internet and e-commerce were reinforced with Jump’s Firedancer, a prototype of its transaction validator client launched on the Solana mainnet. The firm aims to scale the network to an ambitious 1 million TPS, with the full Firedancer client teased on the testnet.

Source: thernoah on Medium

Over 7,600 new developers wrote code in the Solana ecosystem in 2024, the first time any blockchain ecosystem has surpassed Ethereum since 2016.

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

Source: State of Crypto Report 2024 by Andreessen Horowitz Crypto

And Day 2 here:

Check out our executive summary of Day 1 of the event here:

Source: Luke Nolan with CoinShares Research Blog

Financial backing from the crypto industry further fueled his campaign - evidence to the sector’s growing political clout.

Under the previous administration, the SEC (Securities and Exchange Commission), led by Gary Gensler, had adopted a stringent approach toward cryptocurrencies, initiating enforcement actions against both major US crypto companies such as Coinbase and Kraken, as well as smaller founders, tokens, and NFT collections.

Gensler’s SEC viewed the crypto industry as rife with corruption, advocating for regulation under existing federal securities laws.

Gensler’s SEC viewed the crypto industry as rife with corruption, advocating for regulation under existing federal securities laws.

Trump’s approach was particularly effective in swing states like Pennsylvania, Michigan, and Wisconsin, where voters saw his policies as potentially transformative, promising economic growth in a country increasingly frustrated with its struggling economy and a national debt exceeding $35 trillion.

The US President-elect Donald Trump has confirmed plans to establish a United States Bitcoin Strategic Reserve, marking a historic shift in the nation’s approach to blockchain-hosted assets. The proposal, likened to the country’s strategic oil reserve, aims to position the U.S. ahead in global crypto adoption while countering competitors like China and Russia.

Pennsylvania’s proposed Strategic Bitcoin Reserve Act allows the state treasurer to invest up to 10% of state funds in Bitcoin as a hedge against inflation. In Texas, the Texas Strategic Bitcoin Reserve Act would enable residents to pay taxes in Bitcoin, allowing the state to build a reserve through voluntary donations and payments, with a five-year holding period.

Ohio’s Bitcoin Reserve Act gives the state treasurer the option to invest in Bitcoin or build a reserve from seized assets. These state-level proposals come as President-elect Donald Trump’s federal Bitcoin reserve plan stirs debate, fueling excitement and uncertainty in the crypto market.

Ohio’s Bitcoin Reserve Act gives the state treasurer the option to invest in Bitcoin or build a reserve from seized assets. These state-level proposals come as President-elect Donald Trump’s federal Bitcoin reserve plan stirs debate, fueling excitement and uncertainty in the crypto market.

Several U.S. states, including Pennsylvania, Texas, and Ohio, are taking the initiative to establish their own Bitcoin reserves, opting not to wait for federal action. The emergence of an openly pro-crypto administration has highlighted the strong enthusiasm at the state level for adopting Bitcoin as a strategic asset and further normalizing the on-chain space.

In contrast, Trump’s administration signaled a shift toward a more crypto-friendly regulatory environment. Following his election, crypto markets surged, with Bitcoin reaching new highs, reflecting optimism about a supportive regulatory future.

The nomination of Paul Atkins, a known crypto advocate, as the new SEC chair further bolstered this sentiment, suggesting a move away from the stringent policies of the Gensler era.

The nomination of Paul Atkins, a known crypto advocate, as the new SEC chair further bolstered this sentiment, suggesting a move away from the stringent policies of the Gensler era.

In the 2024 US presidential election, crypto emerged as a pivotal issue, with Donald Trump’s pro-crypto stance playing a significant role in his victory. His campaign’s promised to position the US as a leader in Bitcoin mining and to provide regulatory clarity resonated with tech-savvy voters and retail crypto investors across the nation.

ZK rollups are now in the works for Bitcoin’s ecosystem to improve #1 crypto’s scalability, speed, and security and fully include in DeFi and dApps. They compress transactions off-chain and anchor cryptographic proofs to Bitcoin’s main chain, similar to Ethereum’s.

For example, Citrea uses zkEVM for advanced smart contracts without modifying Bitcoin’s base layer, while its BitVM-based bridge supports secure cross-chain transactions.

Similarly, Rollkit enables developers to run EVM dApps on Bitcoin, increasing its compatibility with Ethereum-based apps.

For example, Citrea uses zkEVM for advanced smart contracts without modifying Bitcoin’s base layer, while its BitVM-based bridge supports secure cross-chain transactions.

Similarly, Rollkit enables developers to run EVM dApps on Bitcoin, increasing its compatibility with Ethereum-based apps.

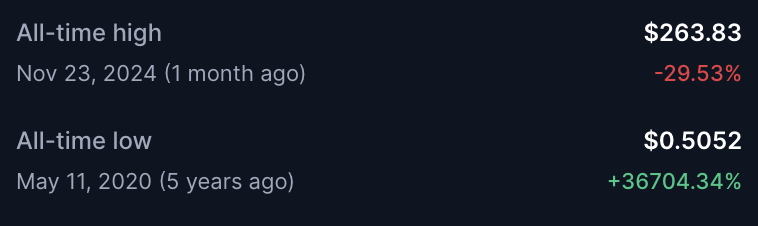

Source: CoinMarketCap

As an asset, $SOL has made an astonishing recovery, surging from last year's low of $15 to posting a new ATH (all-time high) of $264 earlier this year.

RELATED

Learn more about prediction market tools in our breakdown here: https://cryptorsy.io/blog/growing-crypto-reach

AI memes and agents brought the heat to crypto in Q4 2024.

Dive into our full breakdown here: https://cryptorsy.io/blog/ai-agents

Dive into our full breakdown here: https://cryptorsy.io/blog/ai-agents

Check out our review of the autumn memecoin landscape: https://cryptorsy.io/blog/state-of-memes

Is Bitcoin the next frontier for the best DeFi opportunities?

We answer in our recent read: https://cryptorsy.io/blog/bitcoin-ecosystem

We answer in our recent read: https://cryptorsy.io/blog/bitcoin-ecosystem

SUBSCRIBE TO OUR BLOG

Share this post:

The Year Ahead

Key Trends in 2024

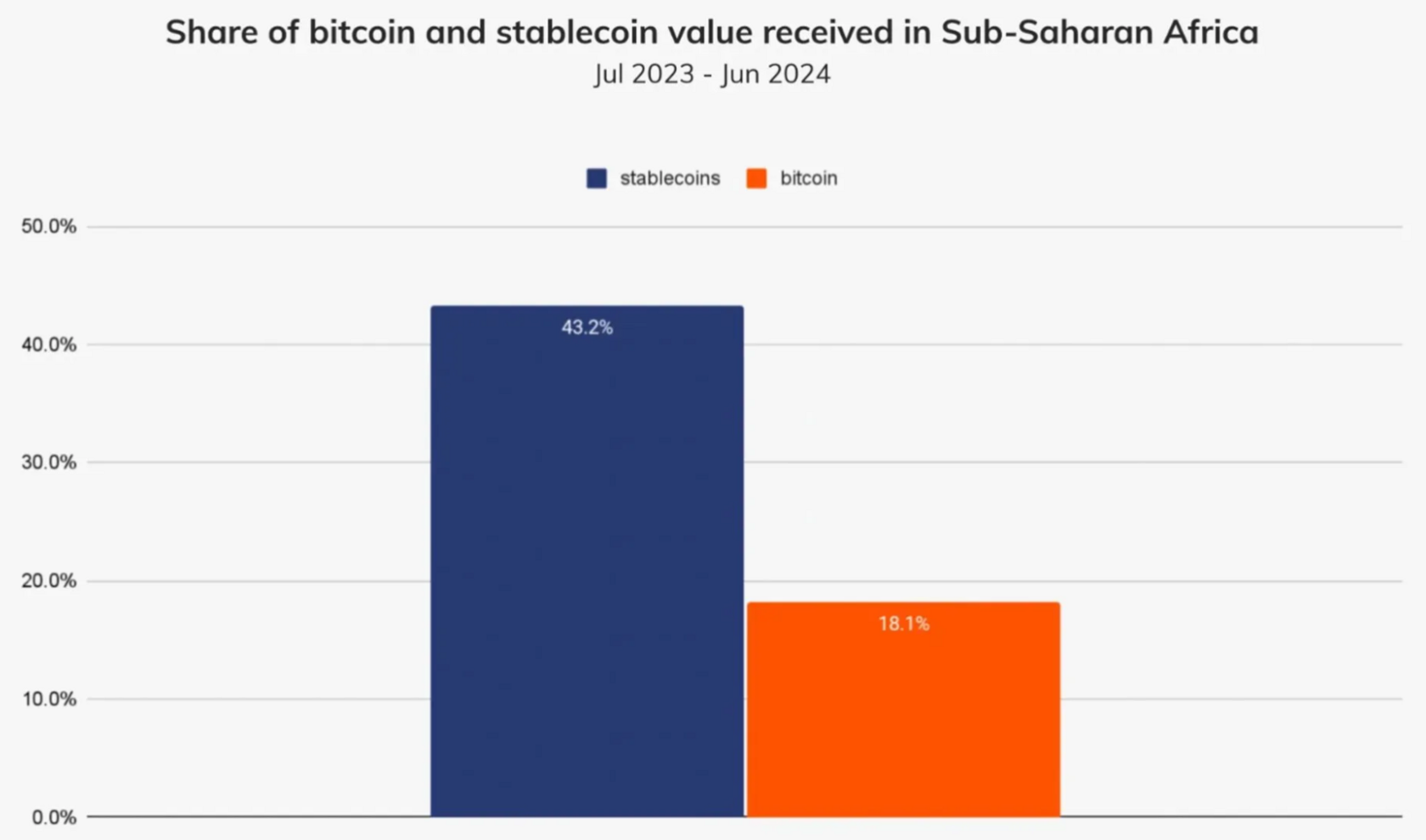

Emerging Market Impact

Political-themed, or PolitiFi, tokens such as $MAGA, AI-fueled memes like $FARTCOIN and $ZEREBRO, and celebrity-backed coins like Iggy Azalea’s $MOTHER, demonstrated the power of memeable political storytelling, the demand for hope-providing narratives, and the persistent hope-building efforts of famous personalities, respectively.

Despite ongoing rug pulls and looming market saturation, Solana, Ethereum’s ecosystem, TON, and even TRON have become hotspots for this high-risk, high-reward trend.

Despite ongoing rug pulls and looming market saturation, Solana, Ethereum’s ecosystem, TON, and even TRON have become hotspots for this high-risk, high-reward trend.

How does Cryptorsy stay ahead of these trends? By being right there in the trenches with its web3 clients and partners! Best of all, we’re ready to share our years of crypto market and marketing expertise to help YOUR on-chain gem shine.

Let’s get your project into the thick of the action so that 2025 becomes the year it’s featured in the annual recap by industry leaders, including ours.

Let’s get your project into the thick of the action so that 2025 becomes the year it’s featured in the annual recap by industry leaders, including ours.

As we wrap up 2024, it’s clear this year wasn’t merely a chapter in crypto’s story—it was a full-blown plot twist.

From Solana stealing the spotlight to ZK tech reshaping scalability, and Trump’s pro-crypto moves rewriting US regulations, the industry sprinted toward mainstream adoption. We saw blockchain slip into everything: AI, real-world assets, and even your grandma’s memecoin portfolio.

2024’s message? The crypto train isn’t slowing down—it’s racing full steam ahead into 2025.

Buckle up.

From Solana stealing the spotlight to ZK tech reshaping scalability, and Trump’s pro-crypto moves rewriting US regulations, the industry sprinted toward mainstream adoption. We saw blockchain slip into everything: AI, real-world assets, and even your grandma’s memecoin portfolio.

2024’s message? The crypto train isn’t slowing down—it’s racing full steam ahead into 2025.

Buckle up.

Despite regulatory scrutiny and a market downturn mid-year, NFT trading remained active, with 7.5 million unique buyers—a 62% increase from 2023. Low-cost minting on platforms like Base and Solana have been all the rage, while Ethereum, Bitcoin, and, once again, Solana collections drove a late-year recovery.

Finally, the NFT ecosystem faced challenges but demonstrated resilience and adaptability.

Prediction markets stood out for their ability to dynamically price outcomes in real-time, offering an edge over traditional polls prone to delays and biases. As their adoption grows, crypto-powered real-world event betting platforms are set to play a pivotal role in shaping public discourse and providing actionable insights across countless sectors.

On-chain prediction markets emerged as a key use case for crypto in 2024, combining transparency, security, and crowd wisdom to speculate on real-world events. Platforms like Polymarket on Polygon and Drift Protocol on Solana have gained significant traction, with Polymarket boasting $390.6 million in trading volume this August alone, fueled by political and financial speculation.

As memecoins like $GOAT and virtual influencers like Luna demonstrate, AI agents have proven useful both on the front end by enhancing visibility and community engagement and on the back end by unlocking new economic opportunities, making them central to the next wave of web3 adoption.

This year, AI agents have emerged as the next logical step in the expansion and evolution of the crypto world.

They are autonomous entities are redefining on-chain experiences and community dynamics, driving innovations from memecoins and KOL personas to DeFi automation. AI agents dynamically adapt, leveraging blockchain's open infrastructure for trading, governance, and resource allocation while engaging users with tailored content and cultural resonance.

They are autonomous entities are redefining on-chain experiences and community dynamics, driving innovations from memecoins and KOL personas to DeFi automation. AI agents dynamically adapt, leveraging blockchain's open infrastructure for trading, governance, and resource allocation while engaging users with tailored content and cultural resonance.

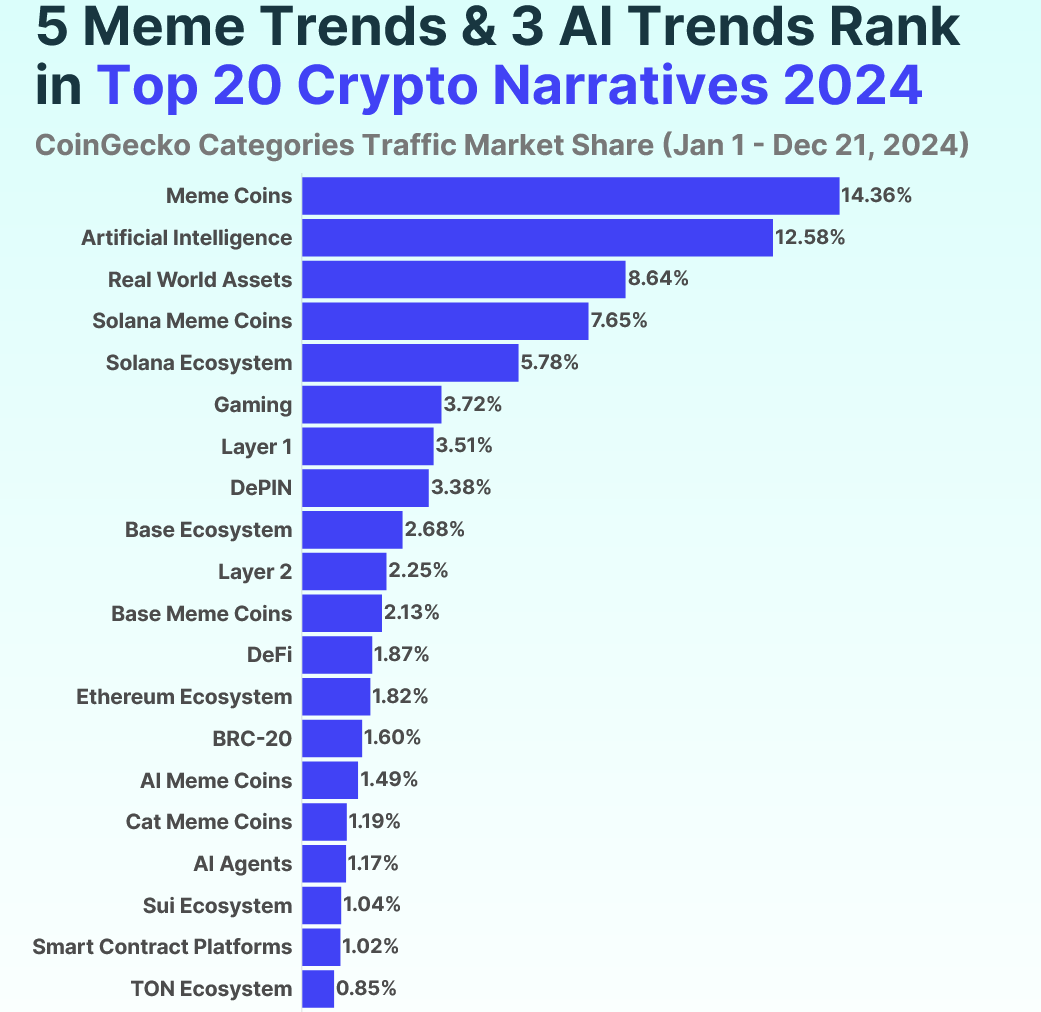

Memecoins captured nearly 1/3 of investor interest in 2024, according to CoinGecko.

Memecoins solidified their position as a dominant force in crypto by blending cultural relevance, speculative mania, and community-driven tokenization.

While early leaders like $DOGE and $SHIB saw their influence wane, a new wave emerged through low-cost platforms like Pump.fun on Solana and its derivatives on other chains, which use community hype to determine whether a created token ultimately deserves a DEX launch.

While early leaders like $DOGE and $SHIB saw their influence wane, a new wave emerged through low-cost platforms like Pump.fun on Solana and its derivatives on other chains, which use community hype to determine whether a created token ultimately deserves a DEX launch.

The rise of L1 and L2 solutions drove scalability and adoption, with ever more cross-chain bridges streamlining interoperability.

In 2024, DeFi has undergone decisive growth, reshaping the on-chain ecosystem.

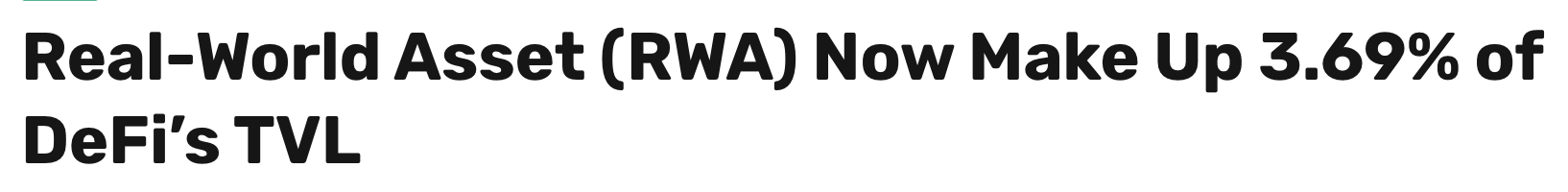

Liquid staking and restaking maximized yield and boosting network security, while tokenization of RWAs bridged conventional finance with blockchain, amplifying liquidity and inclusivity.

Liquid staking and restaking maximized yield and boosting network security, while tokenization of RWAs bridged conventional finance with blockchain, amplifying liquidity and inclusivity.

Meanwhile, in Argentina, where the peso faces relentless devaluation, stablecoins like USDT have become essential for safeguarding savings and facilitating everyday transactions, offering a lifeline in an otherwise unstable economic environment.

Crypto’s impact in emerging markets has been both profound and practical. In Nigeria, where inflation is rmpant, the country boasts one of the highest shares of mobile wallet users globally. This growth has been fueled by efforts to provide regulatory clarity, including incubation programs, and significant consumer adoption for everyday uses like bill payments and retail purchases.

Similarly, in India, the combination of a booming population and widespread mobile phone adoption has driven rapid integration of crypto and digital payments into daily life.

Similarly, in India, the combination of a booming population and widespread mobile phone adoption has driven rapid integration of crypto and digital payments into daily life.

Projects like Gensyn and Story are already pioneering these intersections, tackling issues ranging from AI compute democratization to intellectual property management.

Conversely, the integration of crypto with AI presents vast opportunities. AI-driven analytics are enhancing on-chain data interpretation, while blockchain’s decentralized infrastructure is addressing concerns around AI centralization.

Additionally, the rise of rug pulls and fraudulent schemes has highlighted the need for stronger consumer safeguards.

While 2024 was marked by growth, it also underscored persistent challenges. Regulatory uncertainty remains a major hurdle, particularly in jurisdictions where policymakers struggle to balance innovation with risk mitigation.

Join Us to Enter the Crypto Epicenter

NFTs Moved Beyond Collectibles

Prediction Markets

AI: From Memes to Agents

Memecoins and Market Shifts

DeFi and the Emergence of Restaking

Pudgy Penguins, the top-performing PFP NFT collection with strong long-term growth, is also running several successful business ventures, including plush toy production. | Source: Decrypt

Source: Polymarket

Source: Cryptopolitan

Source: Cointelegraph

Source: Crypto News Flash

Source: AMBCrypto

Source: Coingeek

Source: Boxmining

Source: Coincub on Twitter

Source: HACKREAD

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL