Bitcoin Ecosystem: Dark Horse Keeps Galloping

03.10.2024

Gleb Specter

26 min

RELATED

SUBSCRIBE TO OUR BLOG

Bitcoin, as an on-chain ecosystem rather than just a trusted store of value, often gets overshadowed by the constant developments in and around EVM and SVM*.

But occasionally, something shakes things up, making Bitcoin feel much more ‘daily drivable,’ and taking Bitcoin excitement to a new level.

After sifting through Bitcoin’s landscape—from Layer 1 to side chains—we’ve rounded up the narratives and projects that stood out to us the most this year, whether they’re already dominating or patiently gearing up to make a splash.

Trust us, you won’t want to miss where $BTC is headed as an ecosystem.

But occasionally, something shakes things up, making Bitcoin feel much more ‘daily drivable,’ and taking Bitcoin excitement to a new level.

After sifting through Bitcoin’s landscape—from Layer 1 to side chains—we’ve rounded up the narratives and projects that stood out to us the most this year, whether they’re already dominating or patiently gearing up to make a splash.

Trust us, you won’t want to miss where $BTC is headed as an ecosystem.

The most prominent Bitcoin one is the Lightning Network widely used for microtransactions by merchants.

Share this post:

State Channels

Notable examples include Liquid Network, Stacks, and Rootstock.

The latter, launched way back in 2018 and supporting EVM, has over 14.5 million transactions and 30 dApps to date.

The latter, launched way back in 2018 and supporting EVM, has over 14.5 million transactions and 30 dApps to date.

Bitcoin's Layer 2 networks aim to address its core limitations similar to those the Ethereum blockchain faced a couple of years ago before the advent of Polygon and all the OP (Optimistic) + ZK (zero-knowledge) rollups—like slow transaction speeds and poor scalability—by processing transactions off the main chain.

L2s boost throughput, cut fees, and add programmability through smart contracts, all while preserving Bitcoin’s supreme security.

L2s boost throughput, cut fees, and add programmability through smart contracts, all while preserving Bitcoin’s supreme security.

*Ethereum and Solana Virtual Machines, respectively - the programmable environment enabling DeFi (decentralized finance) via self-executing smart contracts.

BitVM Computing Paradigm

They’re temporary off-chain ledgers (not standalone blockchains) between two parties, cutting BTC transaction costs by only recording final balances on the Bitcoin network.

Rollups are also separate chains, but unlike sidechains, they don’t have their own consensus mechanism and instead rely on the main chain’s security. They process transactions within their chain, compress the data, and periodically anchor cryptographic proofs to Bitcoin. Like other Layer 2 solutions, rollups boost the scalability and speed of the mainnet.

Rollups are the latest Layer 2 tech Bitcoin has gained. With developers eager to build the best implementation of ‘Bitcoin on EVM,’ many rollup layers have already entered the space.

This reflects both the strong belief that Bitcoin should play a role in DeFi and the genuine demand for Bitcoin by institutions and big investors as a hedge asset that should also be able to generate passive yield, instead of just sitting idle.

Just like on Ethereum, roll-up tech on Bitcoin can come in several forms:

Rollups are the latest Layer 2 tech Bitcoin has gained. With developers eager to build the best implementation of ‘Bitcoin on EVM,’ many rollup layers have already entered the space.

This reflects both the strong belief that Bitcoin should play a role in DeFi and the genuine demand for Bitcoin by institutions and big investors as a hedge asset that should also be able to generate passive yield, instead of just sitting idle.

Just like on Ethereum, roll-up tech on Bitcoin can come in several forms:

BitVM2 and Official Bridge Touted By Creators

- OP

- ZK

- Sovereign

- Entangled

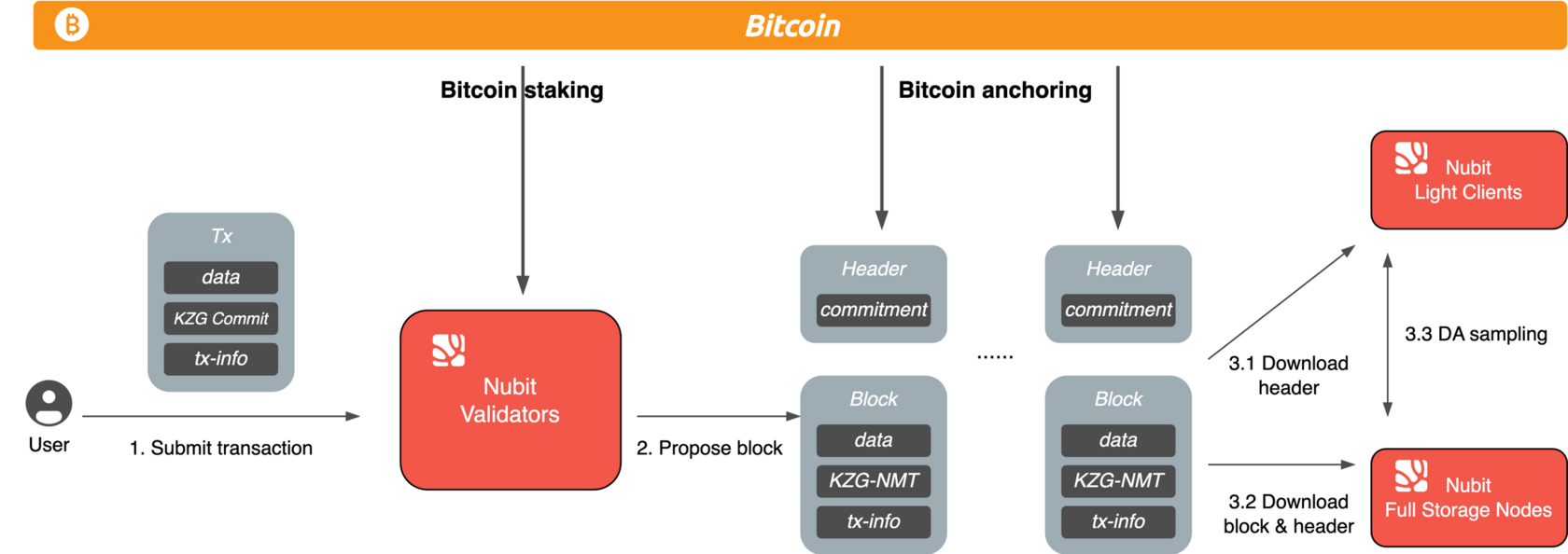

DA layers like Nubit are poised to be the backbone of scalable Bitcoin Layer 2s, empowering a new wave of Bitcoin-powered consumer apps.

More on it later in the article.

More on it later in the article.

Besides the long-standing and quite well-known layers and players like Lightning, Liquid, and Rootstock who we mentioned above, let’s uncover some of those innovation-driven protocols that entered the game more recently and are all trying to leverage EVM, smart contracts, and wrapped BTC to seamlessly connect Bitcoin to the vast DeFi landscape.

Bitlayer’s BitVM-Powered Bridge

Recently, Bitlayer raised $11 million in a Series A funding round, backed by Franklin Templeton (institution-lea\d funding, baby!) and ABCDE, to scale Bitcoin’s transaction capabilities and grow its ecosystem.

Citrea: ZK Rollup with BitVM2

BitcoinOS: ‘Superlayer’ of Multiple Rollups

Babylon Chain: Bitcoin Staking Sidechain

While most blockchains have embraced Proof-of-Stake (PoS) for its efficiency, Bitcoin continues to rely on its traditional Proof-of-Work (PoW) system, which comes with challenges like slower transaction speeds.

That’s where Babylon steps in with two key innovations:

That’s where Babylon steps in with two key innovations:

Narrative 1: Layer 2 Networks

Types of Layer 2s

Sidechains

Independent chains linked to Bitcoin via two-way pegs. Assets can be locked on the main chain and mirrored on the sidechain, where they can be transacted more efficiently. Good for running dApps (decentralized applications).

Rollups

BitVM is a system designed to bring smart contract capabilities to the Bitcoin blockchain, a feature that Bitcoin wasn’t initially built for.

Source: BitVM GitHub

Released in 2023 by dev Robin Linus, BitVM allows for more advanced computations on Bitcoin, but with key differences from EVM. While BitVM enables off-chain computations and uses a two-party system of provers and verifiers, it relies on fraud proofs similar to optimistic rollups.

However, unlike Ethereum’s EVM-based rollups, BitVM doesn’t fully integrate broader, decentralized applications and remains focused on individual interactions.

That said, BitVM is actively used to enable interoperability with EVM and other important virtual machines. Read on!

However, unlike Ethereum’s EVM-based rollups, BitVM doesn’t fully integrate broader, decentralized applications and remains focused on individual interactions.

That said, BitVM is actively used to enable interoperability with EVM and other important virtual machines. Read on!

In August, the BitVM devs have already introduced BitVM2, a new ‘permissionless’ iteration.

Robin Linus has released a whitepaper outlining BitVM2 and the official BitVM Bridge, highlighting major advancements over the original BitVM model.

Robin Linus has released a whitepaper outlining BitVM2 and the official BitVM Bridge, highlighting major advancements over the original BitVM model.

Robin Linus, one of the authors of BitVM | Source: Coindesk Website.

Bitcoin Layer 2s: Our Comprehensive Look

Bitlayer: OP-Like Rollup with BitVM2 and ZK Proofs

Bitlayer is an L2 that employs BitVM tech to bring smart contract capabilities to the Bitcoin network.

Acting similarly to an optimistic rollup, Bitlayer processes transactions off-chain, reducing the load on Bitcoin’s Layer 1. It supports multiple virtual machines, including EVM, enabling compatibility with Ethereum-based dApps.

Bitlayer’s innovative features include the DLC (Discreet Log Contract) framework, which enhances secure and conditional transactions.

Acting similarly to an optimistic rollup, Bitlayer processes transactions off-chain, reducing the load on Bitcoin’s Layer 1. It supports multiple virtual machines, including EVM, enabling compatibility with Ethereum-based dApps.

Bitlayer’s innovative features include the DLC (Discreet Log Contract) framework, which enhances secure and conditional transactions.

Source: Bitget Website

The Bitlayer bridge uses BitVM tech to facilitate seamless cross-chain operations between Bitcoin and EVM-compatible networks, minimizing trust assumptions.

It achieves this by harnessing BitVM’s optimistic computation model, where any user can challenge faulty operations, ensuring trustless and verifiable transactions.

It achieves this by harnessing BitVM’s optimistic computation model, where any user can challenge faulty operations, ensuring trustless and verifiable transactions.

Users link their BTC wallets, such as Unisat Wallet, to the Bitlayer network, and also connect an EVM-supported wallet like MetaMask.

Source: Bitlayer Blog

Citrea is another Bitcoin L2 taking advantage of BitVM.

The network is designed to scale Bitcoin using zkEVM, an EVM-equivalent virtual machine that employs ZK rollups for transaction verification. It expands Bitcoin’s capabilities without altering the base layer’s consensus rules, allowing for the development of complex applications.

A week ago, Citrea’s BitVM-based bridge, Clementine, was deployed on the Bitcoin testnet to facilitate more advanced smart contracts in the future.

The network is designed to scale Bitcoin using zkEVM, an EVM-equivalent virtual machine that employs ZK rollups for transaction verification. It expands Bitcoin’s capabilities without altering the base layer’s consensus rules, allowing for the development of complex applications.

A week ago, Citrea’s BitVM-based bridge, Clementine, was deployed on the Bitcoin testnet to facilitate more advanced smart contracts in the future.

Source: Citrea Blog

Like Bitlayer, Citrea uses BitVM technology for secure cross-chain transactions, integrating fraud proofs and pre-signatures to mitigate trust risks.

Citrea raised $2.7 million in seed funding led by Galaxy.

Citrea raised $2.7 million in seed funding led by Galaxy.

A network of interoperable rollups, smart contracts, and near-trustless BTC payment rails, all reinforced by Bitcoin’s security. It should soon turn Bitcoin ‘into a global operating system’.

BitcoinOS says it has everything with minimal tradeoffs: scalability (able to handle large volumes of transactions while keeping the costs low), programmability (runs dApps), interoperability (communicates value with other blockchains), and a near-trustless security model (highly decentralized).

BitcoinOS says it has everything with minimal tradeoffs: scalability (able to handle large volumes of transactions while keeping the costs low), programmability (runs dApps), interoperability (communicates value with other blockchains), and a near-trustless security model (highly decentralized).

Source: Sovryn Website

BitcoinOS Intriguing Partnerships

BitcoinOS has been partnering with some projects we’ve handpicked to feature in this read. It’s a promising sign.

Source: Nubit Blog

For example, it’s collaborating with Nubit to solve Bitcoin’s data storage challenges, making the limitations of 4MB blocks a thing of the past.

Hemi Network: Supernetwork Ambitions

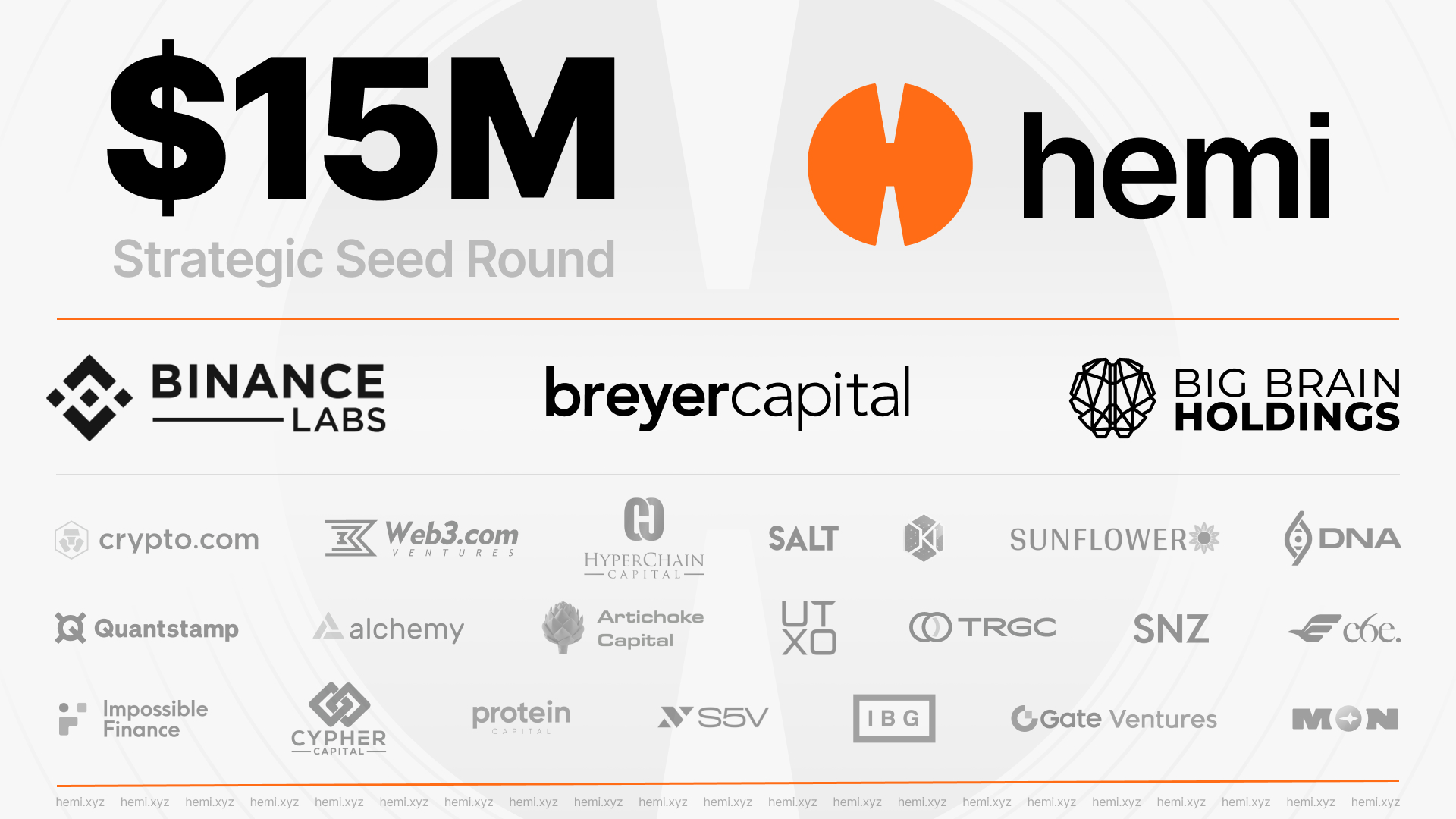

Hemi Network is a modular Layer-2 blockchain. Founded by Jeff Garzik, an early Bitcoin developer, and Max Sanchez, a blockchain security expert, Hemi employs a unique Proof-of-Proof (PoP) consensus protocol, achieving “superfinality” for faster and more secure transactions.

‘Superfinality’ simply means that transactions on the Hemi Network reach finality (the point at which they are considered irreversible) faster than on Bitcoin’s mainnet, without compromising security.

A key novelty of Hemi is its ‘Tunnels’ technology, which enables secure and trustless cross-chain transfers of assets without relying on traditional crypto bridges, significantly reducing risks associated with hacking and fraud.

In September, Hemi Labs raised $15 million in a funding round led by Binance Labs, Breyer Capital, and Big Brain Holdings, supporting its vision of combining the strengths of Bitcoin and Ethereum into a powerful ‘supernetwork’.

Bitcoin Staking

Bitcoin holders can securely lock their Bitcoin and choose which PoS chain(s) to stake for and earn yields from—without any third-partycustody/bridge/wrapping.

Bitcoin holders can securely lock their Bitcoin and choose which PoS chain(s) to stake for and earn yields from—without any third-party

Bitcoin Timestamping

Babylon uses Bitcoin’s blockchain to anchor concise, verifiable timestamps, allowing PoS chains to identify the canonical chain. This helps prevent long-range attacks.

Babylon uses Bitcoin’s blockchain to anchor concise, verifiable timestamps, allowing PoS chains to identify the canonical chain. This helps prevent long-range attacks.

BEVM: EVM-Compatible PoS Sidechain

BEVM is a Bitcoin Layer 2 sidechain that capitalized on Taproot technologies and a PoS consensus system to provide EVM compatibility, enabling dApps and smart contracts on the Bitcoin network.

It uses a cross-chain bridge powered by Bitcoin’s Musig2 and MAST protocols to manage BTC transactions and assets between Bitcoin and BEVM.

It uses a cross-chain bridge powered by Bitcoin’s Musig2 and MAST protocols to manage BTC transactions and assets between Bitcoin and BEVM.

Source: CryptoGlobe Website

Through its architecture, BEVM facilitates using Bitcoin to pay gas fees and supports further Bitcoin-based DeFi applications.

GOAT Network: Entangled Rollup

Unlike some Bitcoin Layer 2s, whose network and revenue are controlled by project teams or foundations, GOAT Network said it will launch with a decentralized sequencer model.

There, sequencer node operators will be helping to secure the network while earning a yield on their Bitcoin and fees for activities including block production, transaction ordering, and maximal extractable value (MEV) opportunities.

There, sequencer node operators will be helping to secure the network while earning a yield on their Bitcoin and fees for activities including block production, transaction ordering, and maximal extractable value (MEV) opportunities.

BOB: OP Rollup Evolving Into ZK + BitVM

BOB is a hybrid EVM-compatible Layer 2 solution built on the Optimism OP Stack. It integrates Bitcoin via Rust zkVM to enable cross-chain applications like Bitcoin-Ethereum bridges.

BOB plans to make use of BitVM for Bitcoin as its settlement layer, which, let us remind you, merges Bitcoin’s security with Ethereum’s flexibility.

BOB plans to make use of BitVM for Bitcoin as its settlement layer, which, let us remind you, merges Bitcoin’s security with Ethereum’s flexibility.

Zulu Network: Utilizing ZK Proofs for DePIN L2

Zulu Network works to make Bitcoin habitable for DePIN (Decentralized Physical Infrastructure Networks).

Zulu Network is EVM-compatible too. It tokenizes computing power, allowing users to monetize resources while staying on Bitcoin’s blockchain for secure transactions.

Zulu Network is EVM-compatible too. It tokenizes computing power, allowing users to monetize resources while staying on Bitcoin’s blockchain for secure transactions.

Source: Zulu Network Medium

Moreover, Zulu is currently working on the first trust-minimized decentralized bridge implementation for BitVM.

BitVM is a recurring topic in this article, and for good reason.

Merlin Chain: New Multi-Featured Layer 2

Merlin Chain is one of the newly emerged L2s that integrates the ZK-rollup network, decentralized oracle network, DA, and on-chain BTC fraud-proof modules.

Noteworthy Mentions

Rollkit Framework

Rollkit was the first tool to let developers build their own rollups (sovereign type), using Bitcoin’s strong security for storing data.

With this feature, even running EVM applications on a rollup in the Bitcoin ecosystem even became possible.

This helped Bitcoin stay secure and created more ways for people to use it, made possible by updates like Taproot and Ordinals that make storing extra data on Bitcoin easier.

With this feature, even running EVM applications on a rollup in the Bitcoin ecosystem even became possible.

This helped Bitcoin stay secure and created more ways for people to use it, made possible by updates like Taproot and Ordinals that make storing extra data on Bitcoin easier.

PWR Labs’ Bitcoin+: Part of Unique L0 Blockchain

Though a part of another L1, or even L0, blockchain, PWR Lab’s EVM-compatible Bitcoin+ sidechain deserves a bit of your attention today.

Bitcoin+ claims extremely low fees, near-instant finality, and exclusive use of BTC for transactions, eliminating the need for extra tokens, which keeps the ecosystem simple and efficient.

This makes Bitcoin+ ‘one of the cheapest and fastest Bitcoin Layer 2 solutions.’

Bitcoin+ claims extremely low fees, near-instant finality, and exclusive use of BTC for transactions, eliminating the need for extra tokens, which keeps the ecosystem simple and efficient.

This makes Bitcoin+ ‘one of the cheapest and fastest Bitcoin Layer 2 solutions.’

Narrative 2: Liquidity Aggregation

Bitcoin’s evolution has focused on addressing its limitations in scalability, smart contracts, and liquidity. Layer 2 solutions like rollups help a lot but can fragment liquidity across networks, complicating interoperability. This placed liquidity aggregation on the agenda of the Bitcoin ecosystem.

Several initiatives are working to enhance liquidity and streamline asset transfers across Bitcoin’s L1 and L2 networks.

Several initiatives are working to enhance liquidity and streamline asset transfers across Bitcoin’s L1 and L2 networks.

exSat: Docking Layer for BTC Ecosystem

Powered EOS’ by Antelope, exSat is a pioneering protocol that enhances Bitcoin’s data consensus and interoperability.

As a “docking layer,” it connects different Layer 2 solutions, helping to address liquidity fragmentation by enabling seamless transfers across Bitcoin’s extended ecosystem. Through its Data Consensus Extension Protocol, exSat incorporates mechanisms like PoW (Proof of Work), PoS (Proof of Stake), and DPoS (Delegated Proof of Stake) to synchronize block data between Bitcoin miners and the exSat network.

As a “docking layer,” it connects different Layer 2 solutions, helping to address liquidity fragmentation by enabling seamless transfers across Bitcoin’s extended ecosystem. Through its Data Consensus Extension Protocol, exSat incorporates mechanisms like PoW (Proof of Work), PoS (Proof of Stake), and DPoS (Delegated Proof of Stake) to synchronize block data between Bitcoin miners and the exSat network.

By supporting full EVM compatibility, exSat allows for the creation of scalable smart contracts with lower fees.

BITLiquidity

BITLiquidity aggregates diverse liquidity pools to maximize trading efficiency across both Bitcoin’s Layer 1 and Layer 2 networks.

By acting as a trading aggregator, bridge, earning platform, and lending/borrowing solution, BITLiquidity offers a comprehensive approach to solving liquidity fragmentation.

By acting as a trading aggregator, bridge, earning platform, and lending/borrowing solution, BITLiquidity offers a comprehensive approach to solving liquidity fragmentation.

Source: BITliquidity X

It sources liquidity from multiple on-chain and off-chain venues to ensure the best rates and trading conditions. This integrated approach enhances liquidity across the Bitcoin ecosystem, making asset transfers more efficient.

Bitflow

Bitflow is another DEX (decentralized exchange) aggregator making waves within Bitcoin’s DeFi space, particularly on the Stacks chain.

It combines liquidity from multiple DEXs, AMMs (Automated Market Makers), and order books to provide users with optimal trading routes and lower slippage.

It combines liquidity from multiple DEXs, AMMs (Automated Market Makers), and order books to provide users with optimal trading routes and lower slippage.

By linking fragmented liquidity across Bitcoin layers, Bitflow enhances user experience and trade execution, ultimately contributing to a more liquid and efficient Bitcoin network.

Narrative 3: DeFi

Bitcoin’s ecosystem is moving pretty fast toward offering some serious DeFi opportunities and being more versatile within dApps and financial protocols.

$BTC, wrapped and not, is actively flowing into EVM and other environments’ liquidity platforms.

Traditionally viewed as a ‘store of value,’ Bitcoin’s role is improving as it finds new uses, unlocking yield opportunities and expanding liquidity across multiple blockchains.

$BTC, wrapped and not, is actively flowing into EVM and other environments’ liquidity platforms.

Traditionally viewed as a ‘store of value,’ Bitcoin’s role is improving as it finds new uses, unlocking yield opportunities and expanding liquidity across multiple blockchains.

Wrapped Bitcoin, cbBTC, and RBTC

Initially, one of the key developments enabling this shift was wrapped Bitcoin ($wBTC), which allowed $BTC to interact with Ethereum and other smart contract-based blockchains.

$wBTC and other versions of wrapped Bitcoin are ERC-20 tokens (or equivalent) backed 1:1 with mainnet $BTC, preserving Bitcoin’s value while making it usable in DeFi protocols.

$wBTC and other versions of wrapped Bitcoin are ERC-20 tokens (or equivalent) backed 1:1 with mainnet $BTC, preserving Bitcoin’s value while making it usable in DeFi protocols.

Sushi Tastes Bitcoin DeFi

A DeFi platform SushiSwap integrated with Rootstock this Summer, allowing users to leverage $RTBC—$BTC on Rootstock—within DeFi ecosystems by providing liquidity and earning yields directly on BTC.

Source: Sushi Website

That’s a Wrap for Coinbase

Recently, Coinbase introduced its own version of wrapped Bitcoin, $cbBTC, allowing users to hold Bitcoin on both the Ethereum Layer 1 and Coinbase’s Base Layer 2.

Users can now take out loans, earn yield, and trade on decentralized exchanges without sacrificing their exposure to Bitcoin’s price appreciation. What makes Coinbase’s offering stand out compared to earlier versions of wrapped Bitcoin like $wBTC is its emphasis on trust and ease of use.

You see, when users wrap Bitcoin, they effectively send it to a custodian who holds the original Bitcoin while issuing an equivalent amount of wrapped tokens.

Users can now take out loans, earn yield, and trade on decentralized exchanges without sacrificing their exposure to Bitcoin’s price appreciation. What makes Coinbase’s offering stand out compared to earlier versions of wrapped Bitcoin like $wBTC is its emphasis on trust and ease of use.

You see, when users wrap Bitcoin, they effectively send it to a custodian who holds the original Bitcoin while issuing an equivalent amount of wrapped tokens.

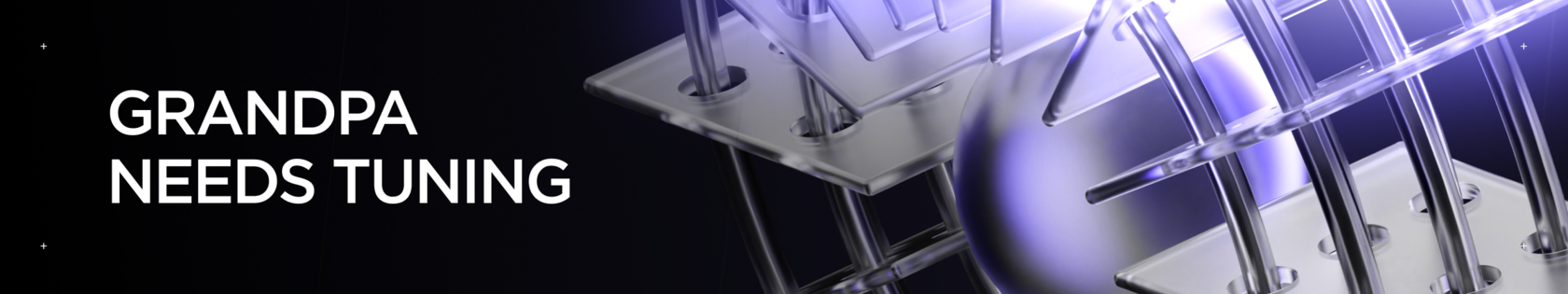

Source: @SaniExp

With Coinbase holding 10% of the total Bitcoin supply, it has established itself as one of the most trusted custodians in the crypto space, providing a level of security that many other services can’t match.

In terms of ease of use, Coinbase simplifies the conversion process, allowing users to send Bitcoin directly from their app to Ethereum or Base addresses and have it automatically converted to $cbBTC.

In terms of ease of use, Coinbase simplifies the conversion process, allowing users to send Bitcoin directly from their app to Ethereum or Base addresses and have it automatically converted to $cbBTC.

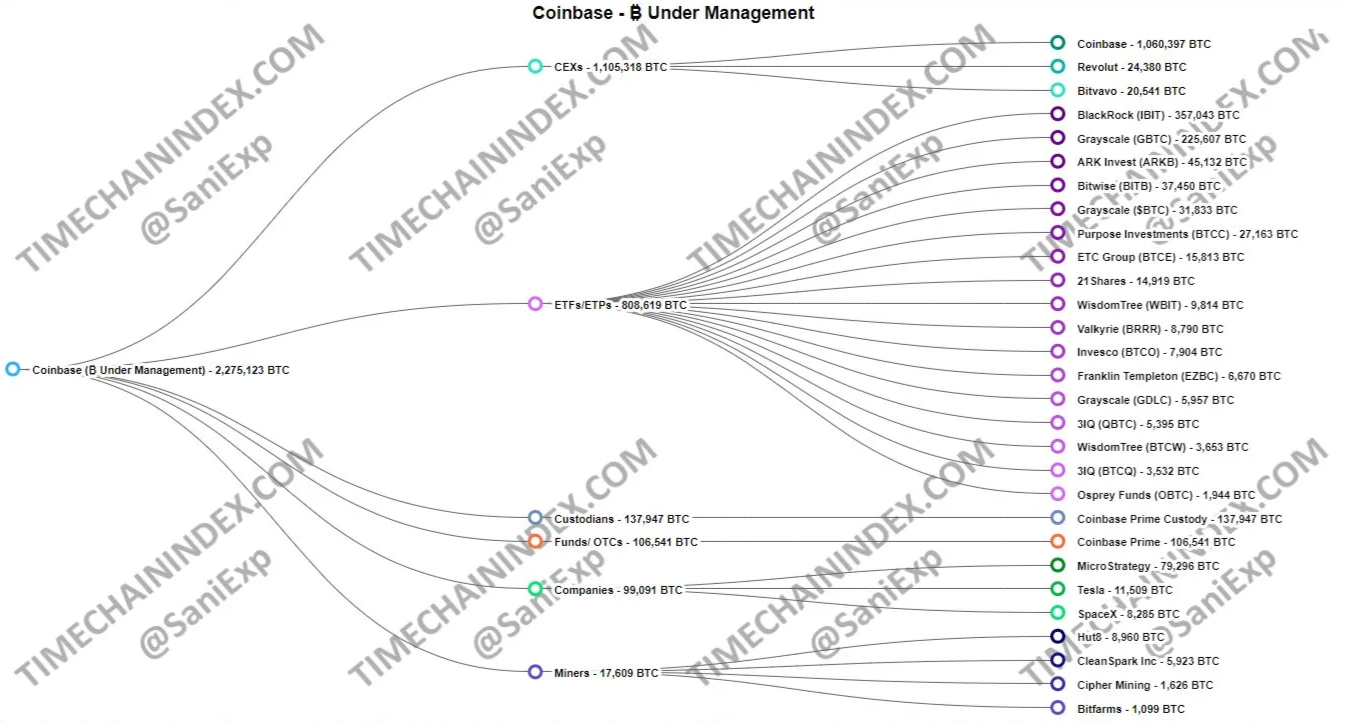

15-Day Stats

In just 15 days since the launch of $cbBTC on Base and Ethereum, its circulating supply has reached 3,887 cbBTC, with a market cap of $254M.

The total DEX volume for cbBTC has hit $850M, representing 49% of all wrapped Bitcoin volume.

The total DEX volume for cbBTC has hit $850M, representing 49% of all wrapped Bitcoin volume.

Pendle’s Bitcoin Yield

On another front of Bitcoin DeFi, Pendle Finance offers a juicy route for Bitcoin holders to generate yield on their assets.

Pendle’s BTC Yield Pools allow users who hold Bitcoin on centralized exchanges like Binance or Bybit to earn high APYs by converting their Bitcoin into wBTC and depositing it into Pendle’s liquidity pools.

Pendle’s BTC Yield Pools allow users who hold Bitcoin on centralized exchanges like Binance or Bybit to earn high APYs by converting their Bitcoin into wBTC and depositing it into Pendle’s liquidity pools.

'You see 56% APY for $BTC on Pendle.’

The platform offers two main options for generating yield: providing liquidity and earning through fixed-yield products.

Liquidity providers on Pendle can earn rewards with minimal risk of impermanent loss if they hold their positions to maturity, while fixed yield products offer a predictable return on investment by locking up Bitcoin and returning a higher amount at the end of the term.

This structure allows Bitcoin holders to increase their Bitcoin holdings over time without actively trading, adding another layer of value to Bitcoin’s utility in the DeFi space.

Liquidity providers on Pendle can earn rewards with minimal risk of impermanent loss if they hold their positions to maturity, while fixed yield products offer a predictable return on investment by locking up Bitcoin and returning a higher amount at the end of the term.

This structure allows Bitcoin holders to increase their Bitcoin holdings over time without actively trading, adding another layer of value to Bitcoin’s utility in the DeFi space.

IP and RWA Vaults

IP (intellectual property) and RWAs (Real-World Assets) are crucial in expanding Bitcoin's ecosystem by enabling the tokenization of physical assets and IP rights on Bitcoin the world’s oldest and most trusted public crypto ledger.

This brings greater liquidity, transparency, and security, allowing assets like real estate or patents to be easily traded, owned, and verified.

This brings greater liquidity, transparency, and security, allowing assets like real estate or patents to be easily traded, owned, and verified.

COVAULT

COVALT is an emerging decentralized platform. It’s aimed at managing and investing in IPs (intellectual properties) and RWAs (real-world assets) through smart vaults on Bitcoin’s layer 1 blockchain.

And the platform offers a variety of them. Among others:

And the platform offers a variety of them. Among others:

Structured Vaults

These allow users to bundle IPs or assets into customizable instruments with governance and profit-sharing capabilities. Investors can use Rune tokens for decision-making rights and profit shares.

Airdrop Vaults

These enable seamless token distribution.

These allow users to bundle IPs or assets into customizable instruments with governance and profit-sharing capabilities. Investors can use Rune tokens for decision-making rights and profit shares.

Airdrop Vaults

These enable seamless token distribution.

Multisig Vaults

These facilitate secure group transactions that require multiple signatures.

These facilitate secure group transactions that require multiple signatures.

COVALT also features:

Liquidity & Market Efficiency

Vault positions can be traded on a decentralized marketplace.

Vault positions can be traded on a decentralized marketplace.

Transparency & Analytics

The platform offers blockchain-backed transparency and AI-driven pricing to ensure fair pricing and reduce transaction costs through smart contracts.

The platform offers blockchain-backed transparency and AI-driven pricing to ensure fair pricing and reduce transaction costs through smart contracts.

Narrative 4: Data Availability Layers

DA (data availability) is becoming a crucial aspect of Bitcoin’s progression, just like it has been for smart-contract-capable blockchains across the board too.

It’s crucial to enable efficient access to transaction data for Layer 2s, price oracles, Ordinals, and other solutions. Why?

It’s crucial to enable efficient access to transaction data for Layer 2s, price oracles, Ordinals, and other solutions. Why?

Why Data Availability Matters

DA ensures blockchain transactions remain verifiable by all participants. Without it, the integrity of the system is compromised—similar to losing access to vital ownership documents.

Key Challenges

- Data Withholding

- Scalability vs Security

- Technical Barriers

How DALs Help

Data Availability Layers (DALs) like the multi-compatible Celestia network enhance scalability by ensuring decentralized and reliable data storage using cutting-edge techniques like erasure coding and DASampling.

Nubit: DAL Secured by Bitcoin

One exciting development in this space is Nubit, a scalable and cost-efficient DAL designed specifically for Bitcoin.

Nubit builds on top of Bitcoin’s robust security to significantly expand the network’s data capabilities for applications like Ordinals, Layer 2 solutions, and price oracles to flourish.

Nubit is designed to align with Bitcoin’s native architecture:

Nubit builds on top of Bitcoin’s robust security to significantly expand the network’s data capabilities for applications like Ordinals, Layer 2 solutions, and price oracles to flourish.

Nubit is designed to align with Bitcoin’s native architecture:

- Security Inheritance from Bitcoin

- Trust Minimization

- Scalability

Source: @specweb3

Bitcoin Is Getting Connected – Ready to Be There?

As the Bitcoin ecosystem evolves from a simple store of value into a thriving DeFi hub, its growth potential becomes undeniable when you look beyond the surface and uncover the multitude of innovations developers are tirelessly building.

From Layer 2 scaling solutions to DeFi integrations and liquidity aggregation, Bitcoin is rewriting the rules of what’s possible within an ecosystem that’s no longer just a basic network with limited programmability.

The projects we’ve highlighted are actively laying the groundwork for Bitcoin’s future, cementing its new, prominent role in web3 and DeFi.

From Layer 2 scaling solutions to DeFi integrations and liquidity aggregation, Bitcoin is rewriting the rules of what’s possible within an ecosystem that’s no longer just a basic network with limited programmability.

The projects we’ve highlighted are actively laying the groundwork for Bitcoin’s future, cementing its new, prominent role in web3 and DeFi.

Build with Us, Grow with Bitcoin

We’re here to help you and your project leverage the dynamic Bitcoin landscape.

Are you building a Bitcoin rollup, a dApp poised to dominate BTC yields, or something else Bitcoin-related? Runes? Ordinals?

We’ve got the expertise and tools to help you gain the buzz and connect with the community that your project deserves.

Are you building a Bitcoin rollup, a dApp poised to dominate BTC yields, or something else Bitcoin-related? Runes? Ordinals?

We’ve got the expertise and tools to help you gain the buzz and connect with the community that your project deserves.

Syndicate Vaults

These provide a mechanism for investors to pool funds and share returns.

These provide a mechanism for investors to pool funds and share returns.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL