New King Is in The Making, and It Isn’t Solana

15.11.2024

Vlad Svitanko

14 min

Proverbial floodgates were opened.

Memes

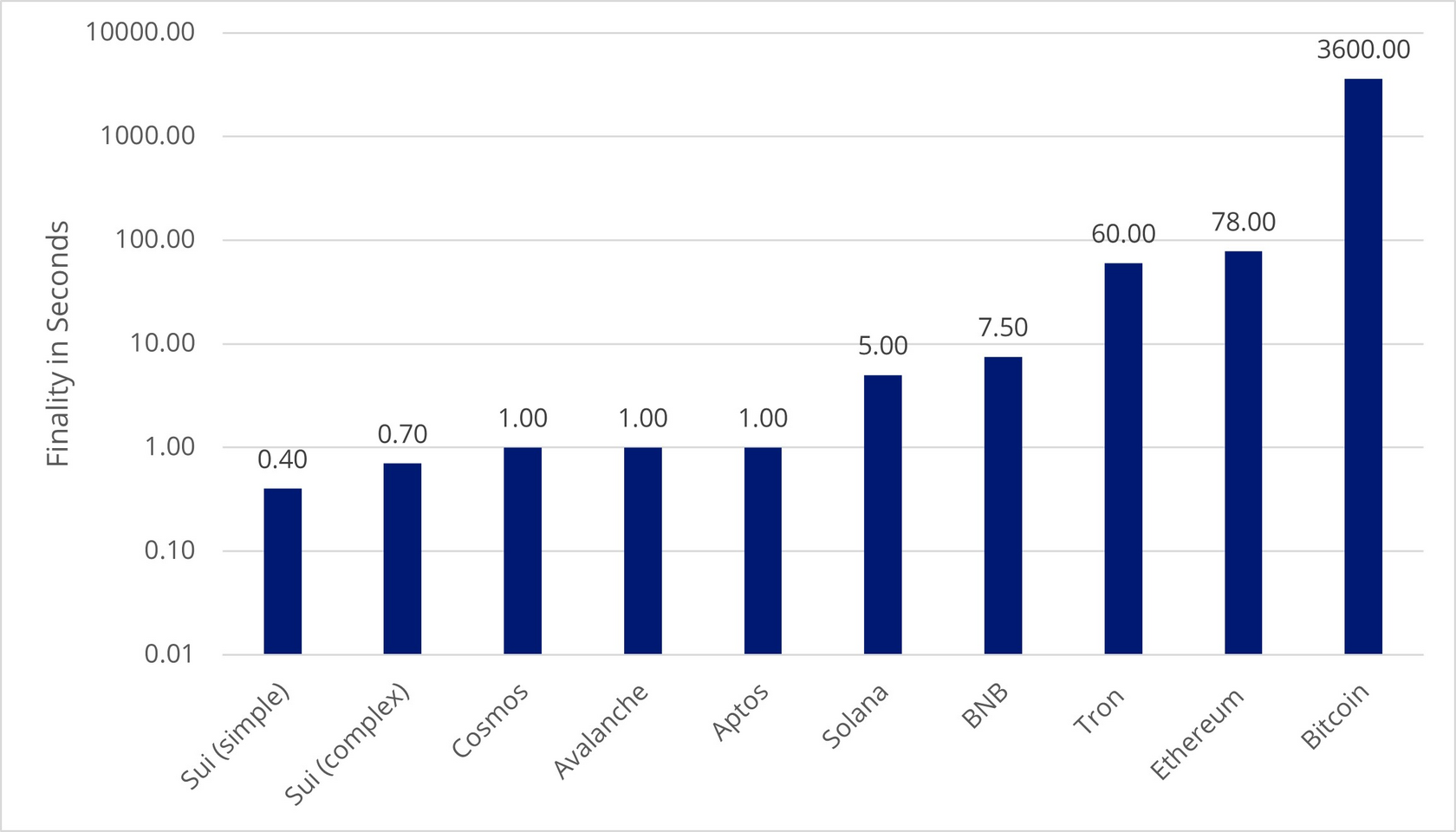

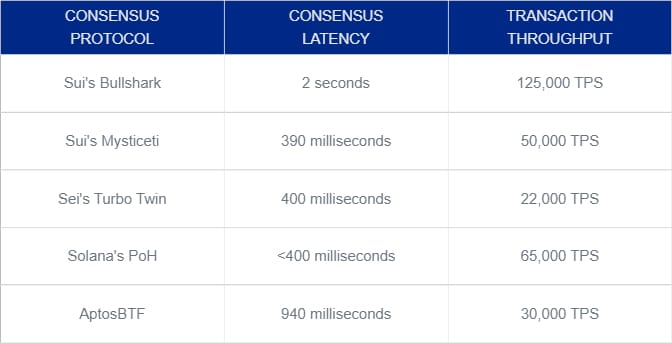

Sui’s transaction time is now nearly instant, at just 390 milliseconds (4/10ths of a sec).

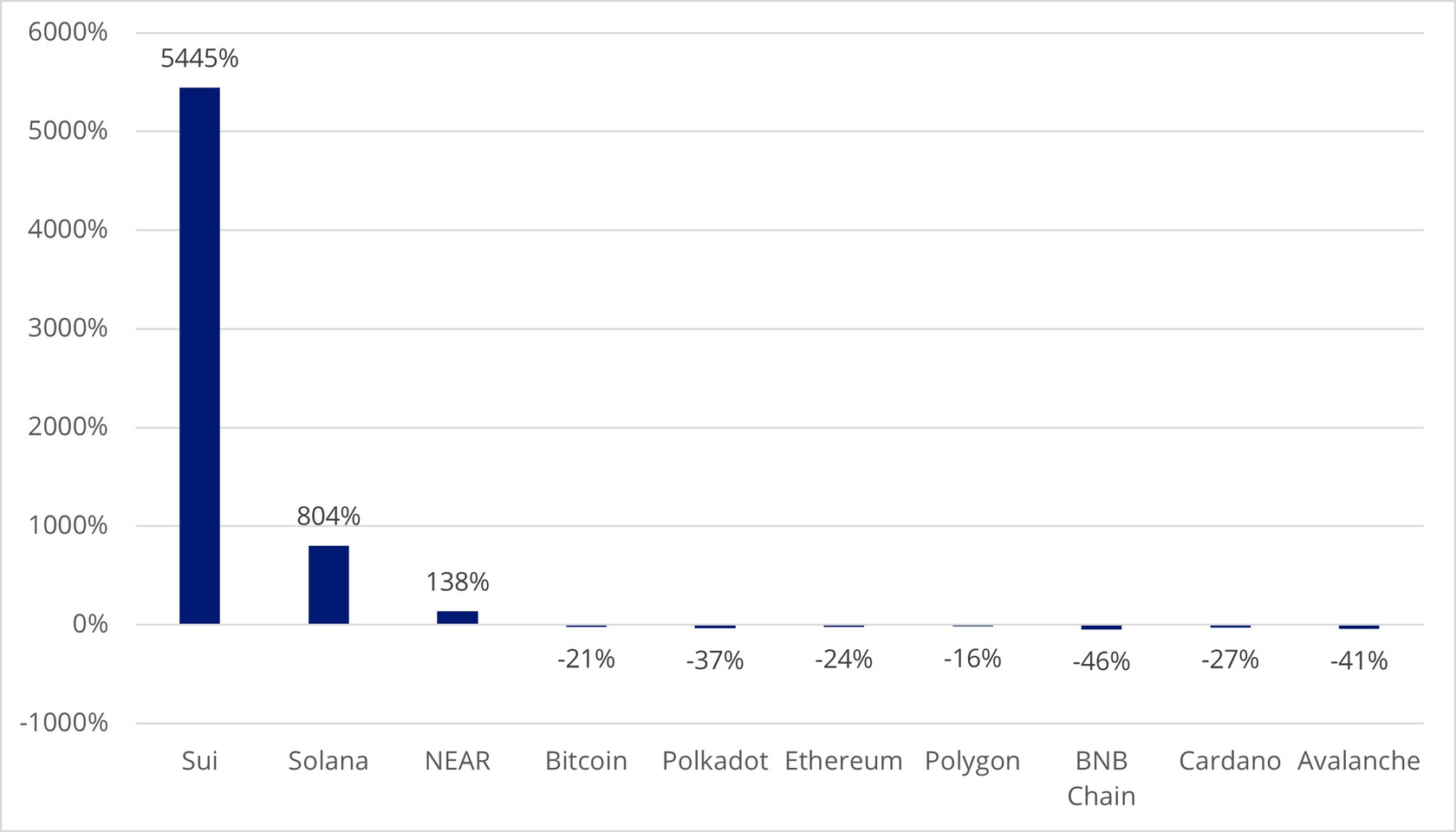

Sui, a Layer 1 blockchain, built by a team originally involved in Meta’s (Facebook at the time) ambitious but ultimately shelved because of government pushback digital currency, Libra (later Diem), has drawn significant attention since its launch back in 2023, and especially in the past 3 months.

With superior fundamentals, recent cutting-edge tech upgrades, strategic partnerships, and early adopters flocking to the ecosystem bringing hype and memes, the SUI blockchain is solidifying its status as a major player in the crypto market, reigniting last year’s comparisons to Solana’s meteoric rise.

With superior fundamentals, recent cutting-edge tech upgrades, strategic partnerships, and early adopters flocking to the ecosystem bringing hype and memes, the SUI blockchain is solidifying its status as a major player in the crypto market, reigniting last year’s comparisons to Solana’s meteoric rise.

Don’t miss our recent breakdown of the memecoin scene, with a special focus on Tron!

Cryptorsy's SUIte for Comprehensive Growth

Suilend ($SEND - to be launched)

Lending Protocol

Lending Protocol

The Sui network’s explosive adoption is also evident in active user addresses that soared from 8.5 million in January to nearly 27 million on November 12, along with record-breaking daily transaction volumes surpassing 100 million.

On August 7, Grayscale launched its $SUI trust product, marking a significant step in gaining mainstream financial recognition for Sui.

This move has single-handedly increased $SUI’s visibility among institutional investors, providing a new channel for investing in Sui through the fund. The announcement led to a 42% surge in $SUI’s price on August 8, the largest single-day increase to date.

This move has single-handedly increased $SUI’s visibility among institutional investors, providing a new channel for investing in Sui through the fund. The announcement led to a 42% surge in $SUI’s price on August 8, the largest single-day increase to date.

Builders, founders, visionaries—this bull run is your moment. The missing piece? A growth plan worthy of your project’s potential.

At Cryptorsy, we’ve driven successful launches across ecosystems and vastly different market conditions. Now, we’re channeling that expertise into what has all the makings to become the next crypto king: Sui.

Ready to craft a strategic roadmap for partnerships, listings, and community-driven growth? Let’s make your Sui launch a SIUUU one.

At Cryptorsy, we’ve driven successful launches across ecosystems and vastly different market conditions. Now, we’re channeling that expertise into what has all the makings to become the next crypto king: Sui.

Ready to craft a strategic roadmap for partnerships, listings, and community-driven growth? Let’s make your Sui launch a SIUUU one.

So, what developments that have crowned $SUI the ‘prince with eyes on the throne’?

Let’s find out if the hype’s really worth it!

Let’s find out if the hype’s really worth it!

Sui Co-Founder, Evan Cheng | Source: Forbes Argentina

Source: CoinMarketCap

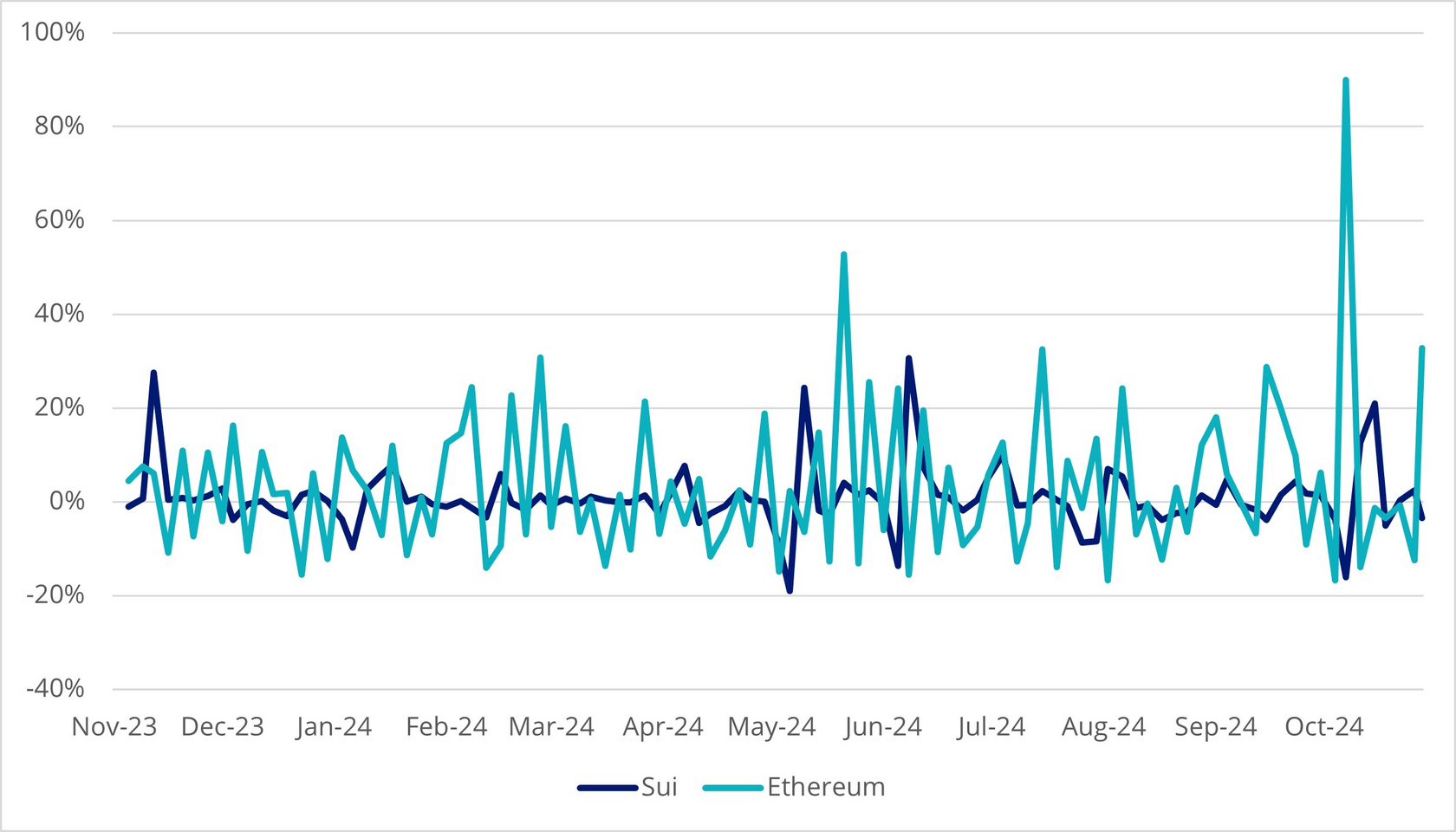

- Daily Gas Fee Variability (1D % Change)

No ecosystem has surged as dramatically and comprehensively as Sui since August—not even Tron with its $TRX-reviving memecoin craze.

With nearly $1.4 billion in TVL as of November 12, marking a new all-time high, Sui is quickly ascending the ranks of top chains to build, launch, fundraise, and market your narrative on.

With nearly $1.4 billion in TVL as of November 12, marking a new all-time high, Sui is quickly ascending the ranks of top chains to build, launch, fundraise, and market your narrative on.

Source: SuiVision Statistics

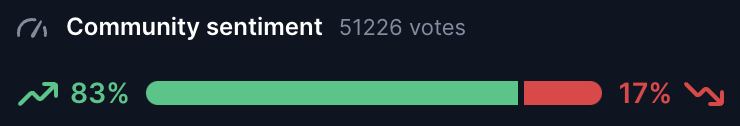

The $SUI token experienced a remarkable rally, rising over 600% to reach a historic high of $3.93 on November 17.

This surge has propelled $SUI’s market cap into the top 20 and 15 blockchain networks.

This surge has propelled $SUI’s market cap into the top 20 and 15 blockchain networks.

$SUI Community Sentiment, as gauged by CoinMarketCap.

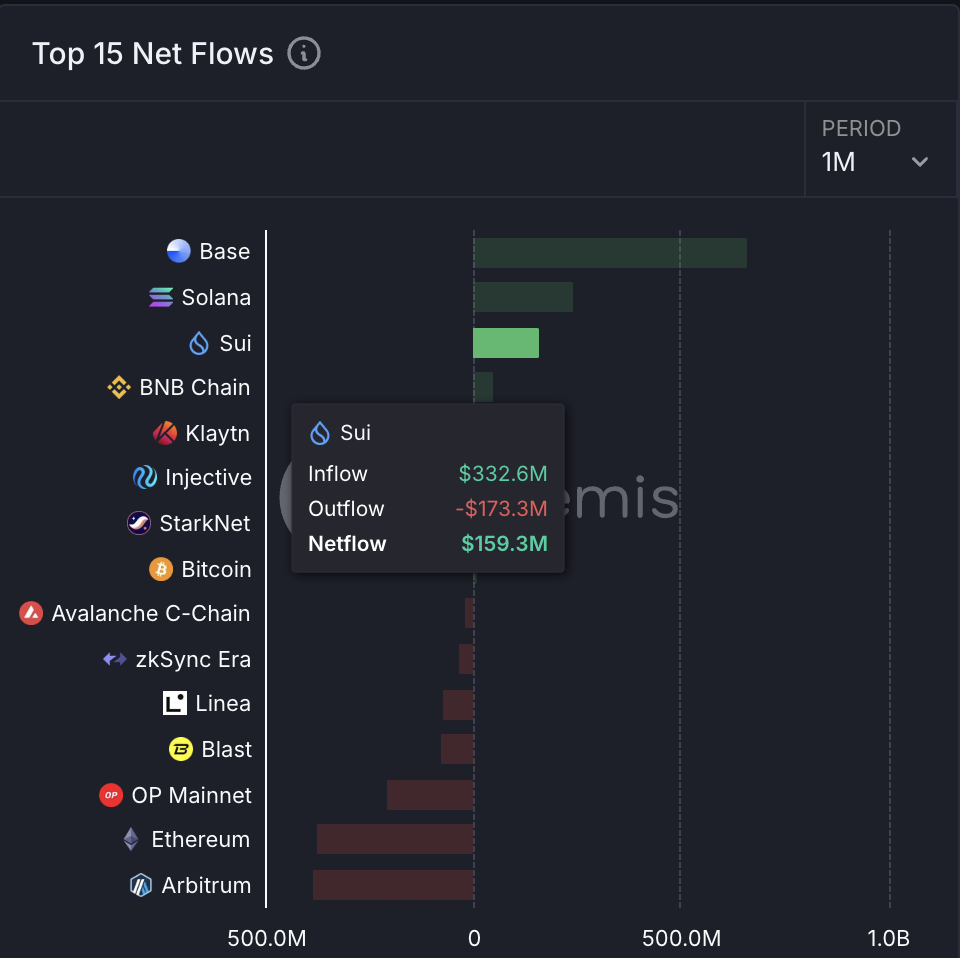

Sui’s Netflow Entered the Top

Sui’s meme highlights include:

$HIPPO (currently valued at $140 million), Sui’s answer to Solana’s beloved hippo-themed token, $MOODENG.

$HIPPO (currently valued at $140 million), Sui’s answer to Solana’s beloved hippo-themed token, $MOODENG.

- $FUD the Pug, one of the first to kick off Sui’s memecoin wave.

- $BLUB, a meme token “bringing the chaotic energy of the Boy's Club (Pepe the Frog creator Matt Furie’s comic series.)

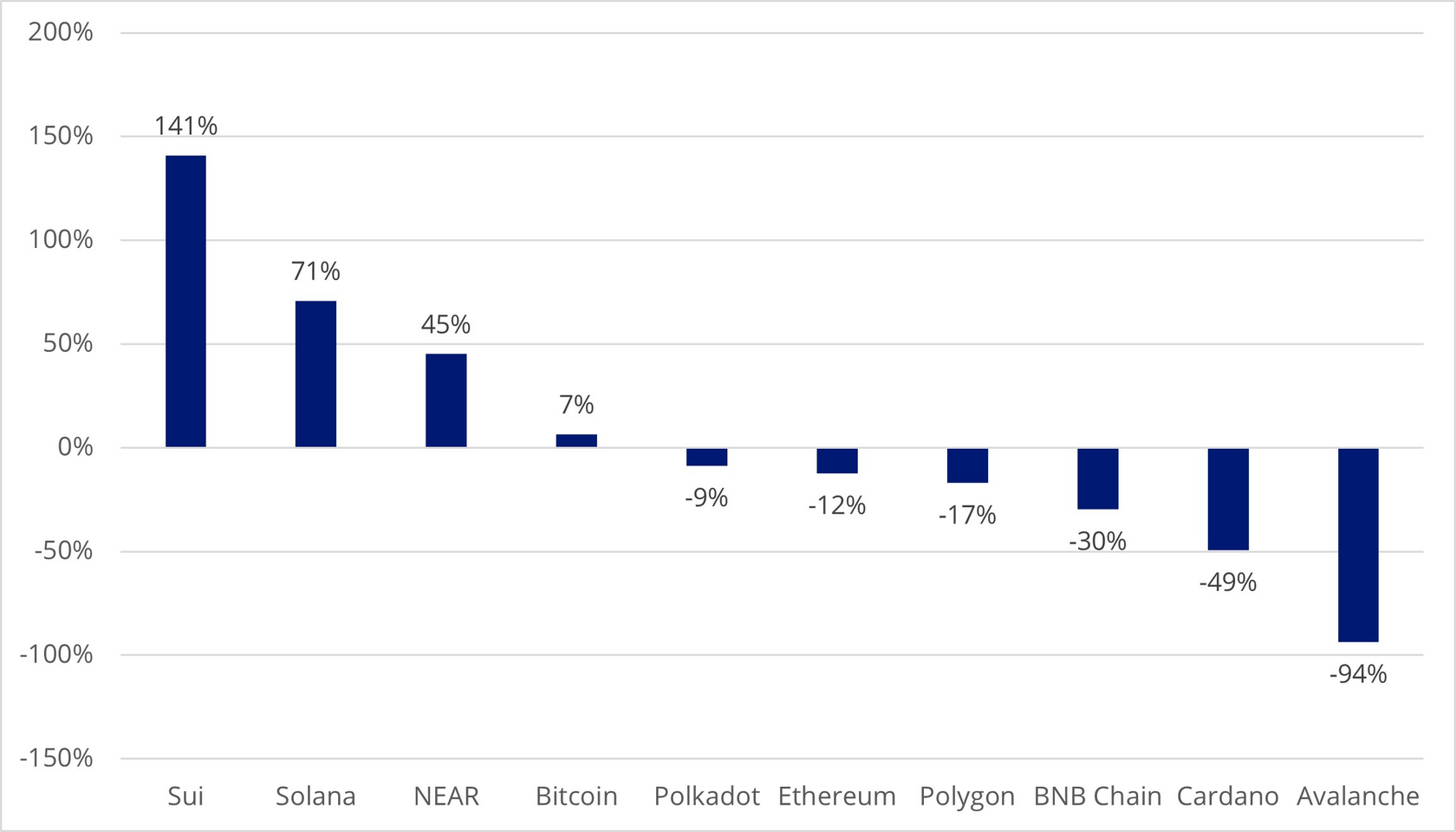

- Sui's Developer Activity is Up 53% YTD

Source: Artemis

Source: Cointelegraph Article

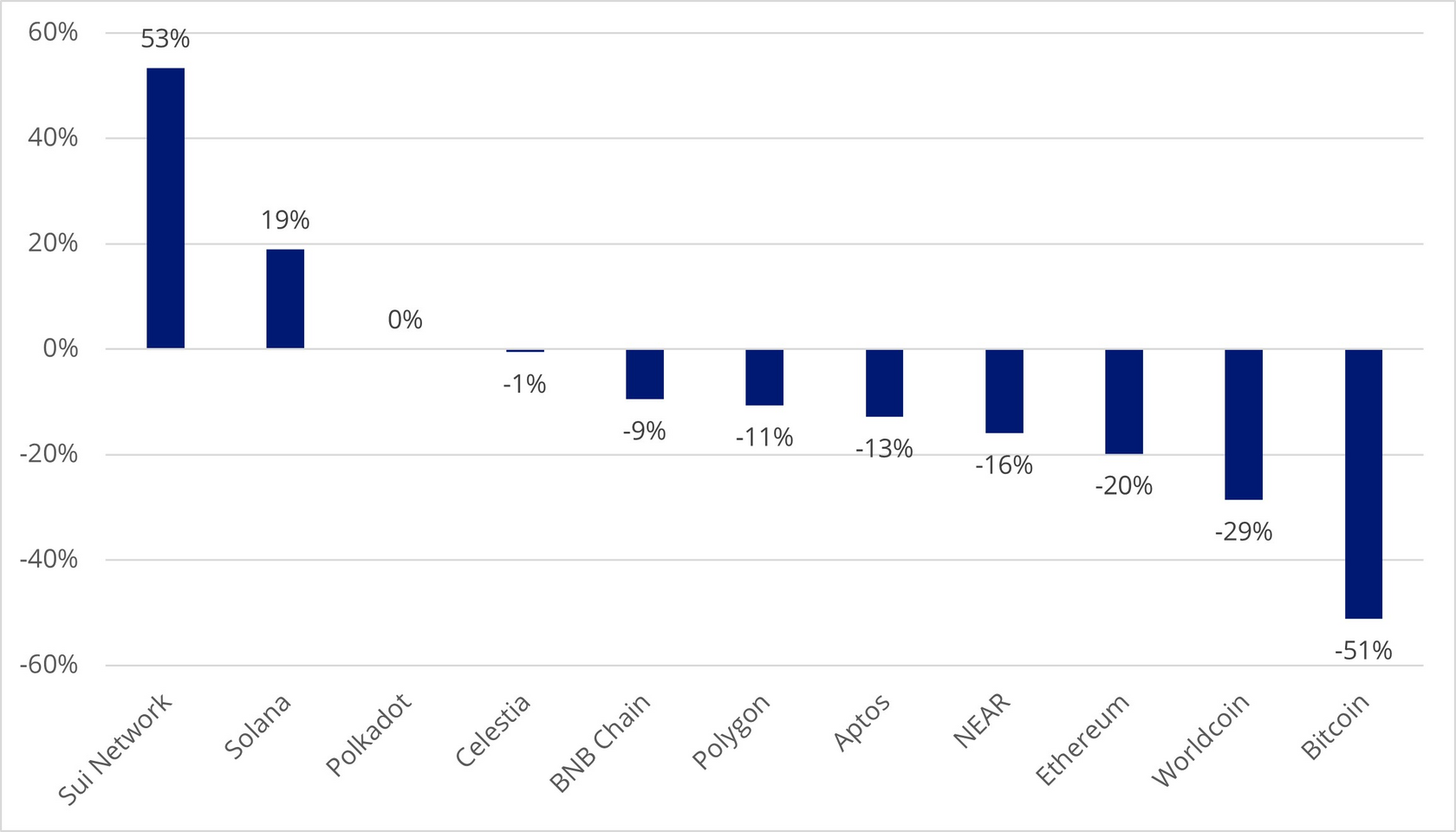

Source: VanEck Article & Artemis | Data as of October 29.

- Daily Transactions (% change YTD)

- Daily Active Users (% change YTD)

Source: VanEck Article & Artemis | Data as of October 29.

$SUI Price, TVL, Transaction & Other Booms

With over 2.58 billion total transactions on November 6, Sui just beat Ethereum’s 2.57 billion (since 2015) within a little more than a year of its mainnet operations—the cherry on top for Sui’s explosive growth.

Sui’s ecosystem is rapidly expanding, covering a range of DeFi, GameFi, NFT, and SocialFi applications.

Here’s some standout projects across categories:

Here’s some standout projects across categories:

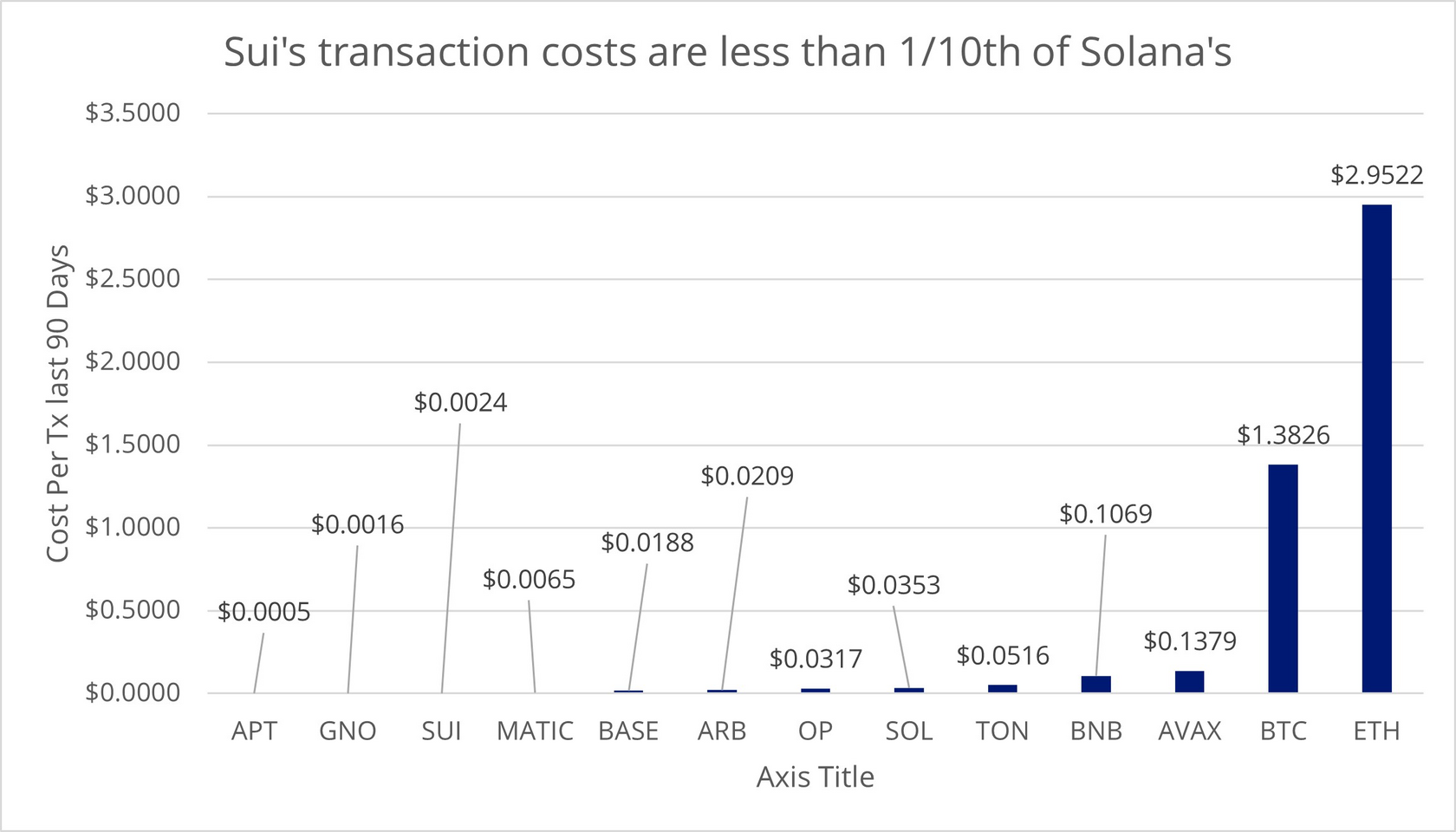

- Sui’s Transaction Costs are Just 1/10th of Solana’s

Source: VanEck Article & Artemis | Data as of October 29.

Source: Suilend Docs

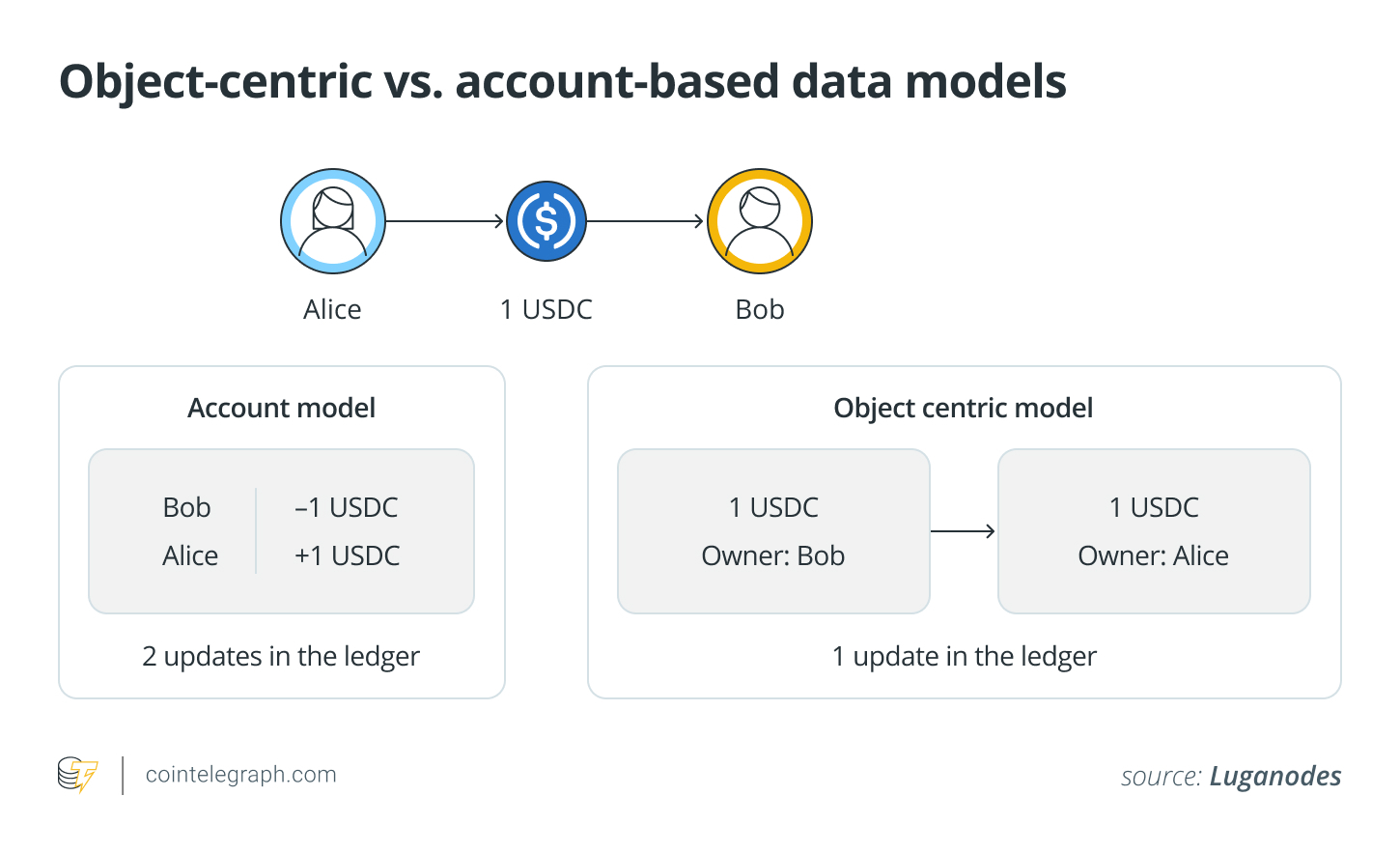

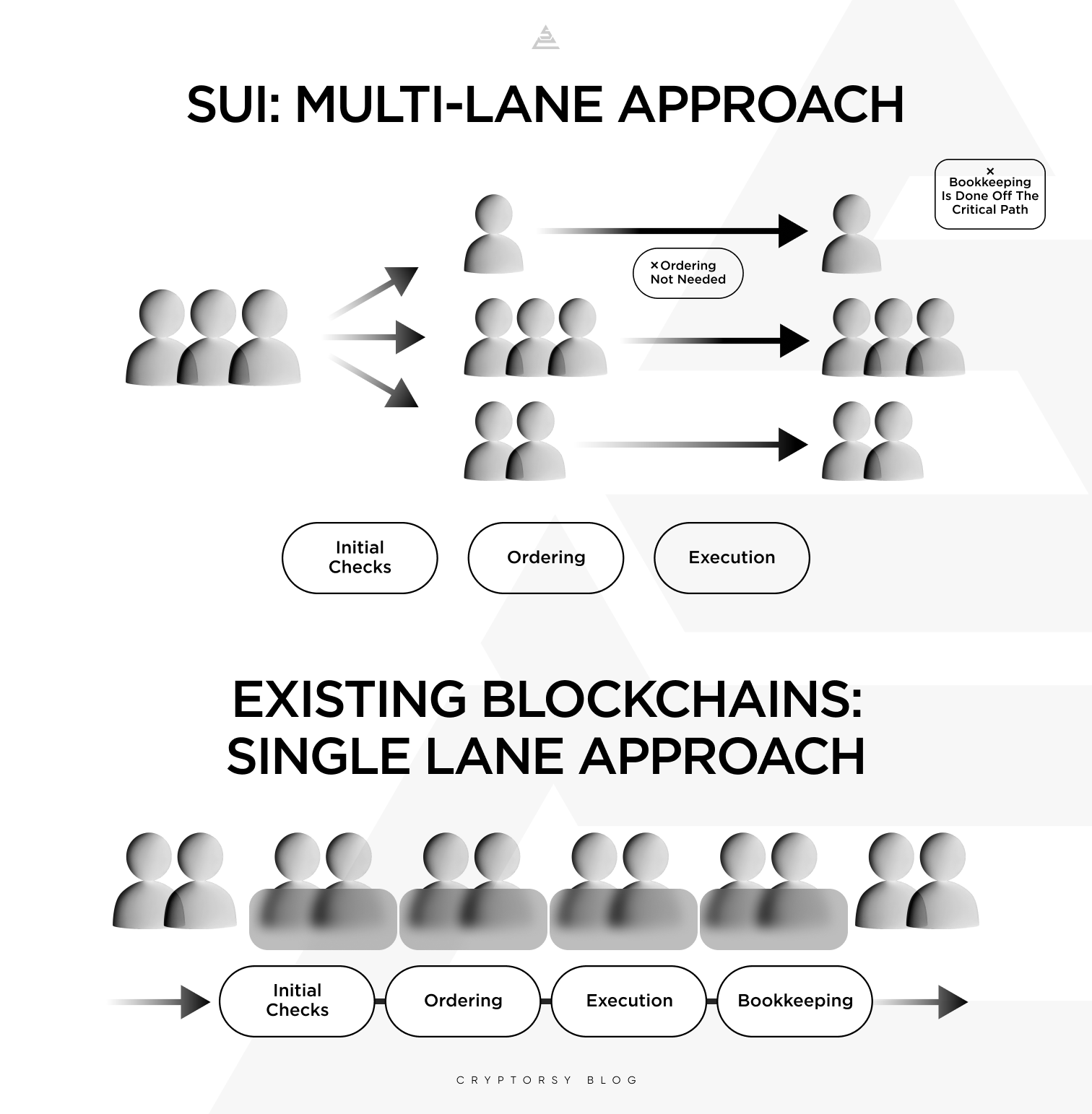

- Parallel Transaction Execution

For comparison, Ethereum can only handle transactions one at a time.

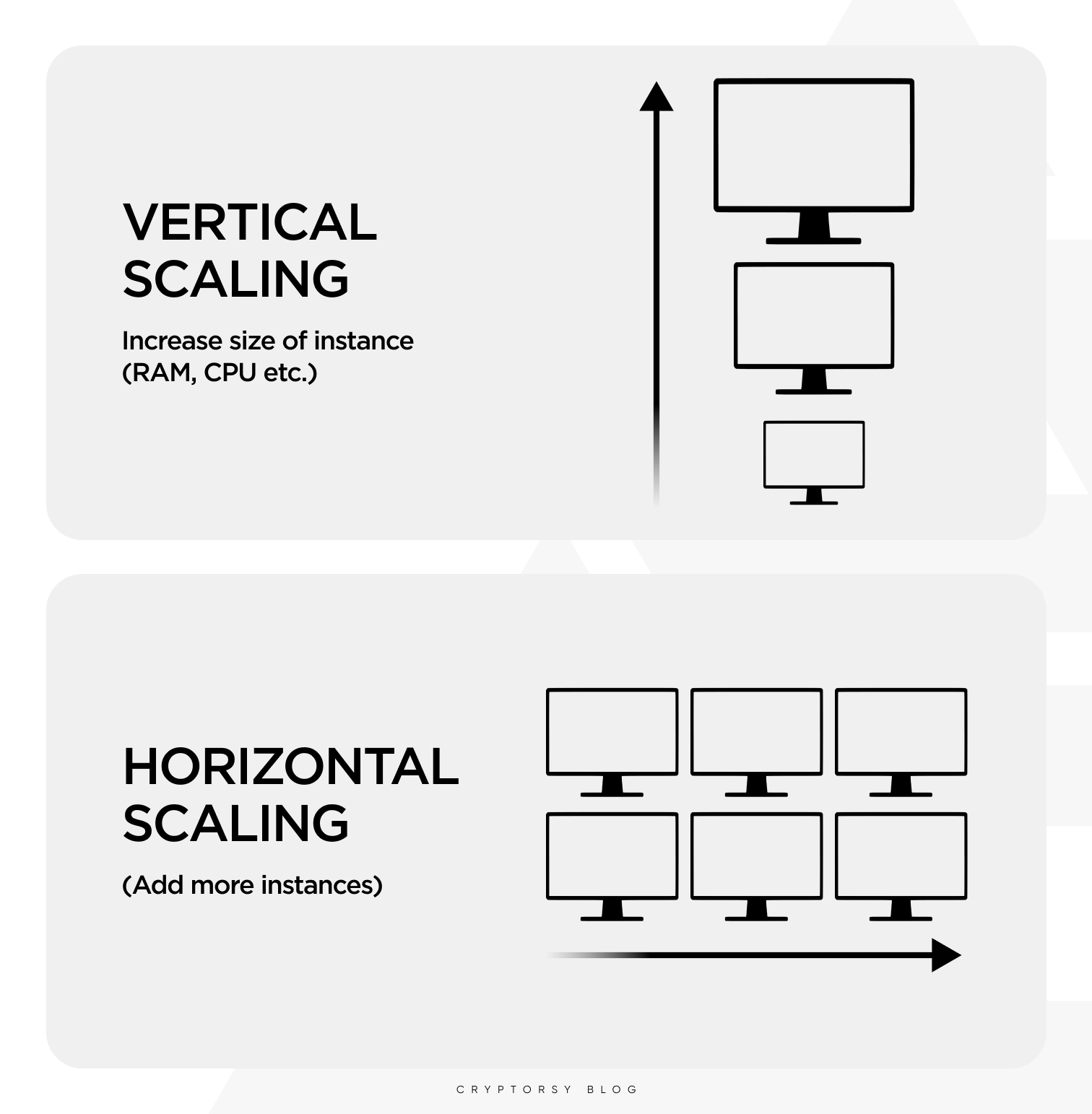

- Horizontal Scalability

By adding more resources—nodes—Sui can scale its capacity without sacrificing performance, ensuring it can handle an ever-increasing demand.

Ethereum, on the other hand, uses vertical scaling, relying on the power of a single chain.

Source: VanEck Article & Each Chain’s Docs | Data as of October 28.

Now that we’ve covered the impressive numbers Sui has attained, let’s dig deeper into why this is happening and what’s drawing both founders and retail investors to Sui.

Some Metrics on Sui’s Exceptional Appeal

Source: VanEck Article & Artemis

Remember, Solana is already among the most affordable blockchains to transact on—quite the opposite of ‘expensive.’

Back in August, Sui launched its new consensus protocol, Mysticeti, achieving sub-second latency with an 80% reduction.

The Best Are The Fastest

Source: Stakin Article

This upgrade is crucial for preparing the blockchain to handle higher throughput as it moves toward mainstream adoption.

Source: Sui Foundation Blog Article

Last September, Sui introduced zkLogin which leverages ZK (zero-knowledge) proofs to provide a secure and user-friendly registration process. Basically, it allows users to access Sui wallets by simply using their Google, Facebook, or other social media accounts.

This web2 compatibility is a game changer for lowering the entry barrier to web3 experiences that Sui enables, as it simplifies the onboarding experience, aligning with Sui’s goal of widespread adoption.

This web2 compatibility is a game changer for lowering the entry barrier to web3 experiences that Sui enables, as it simplifies the onboarding experience, aligning with Sui’s goal of widespread adoption.

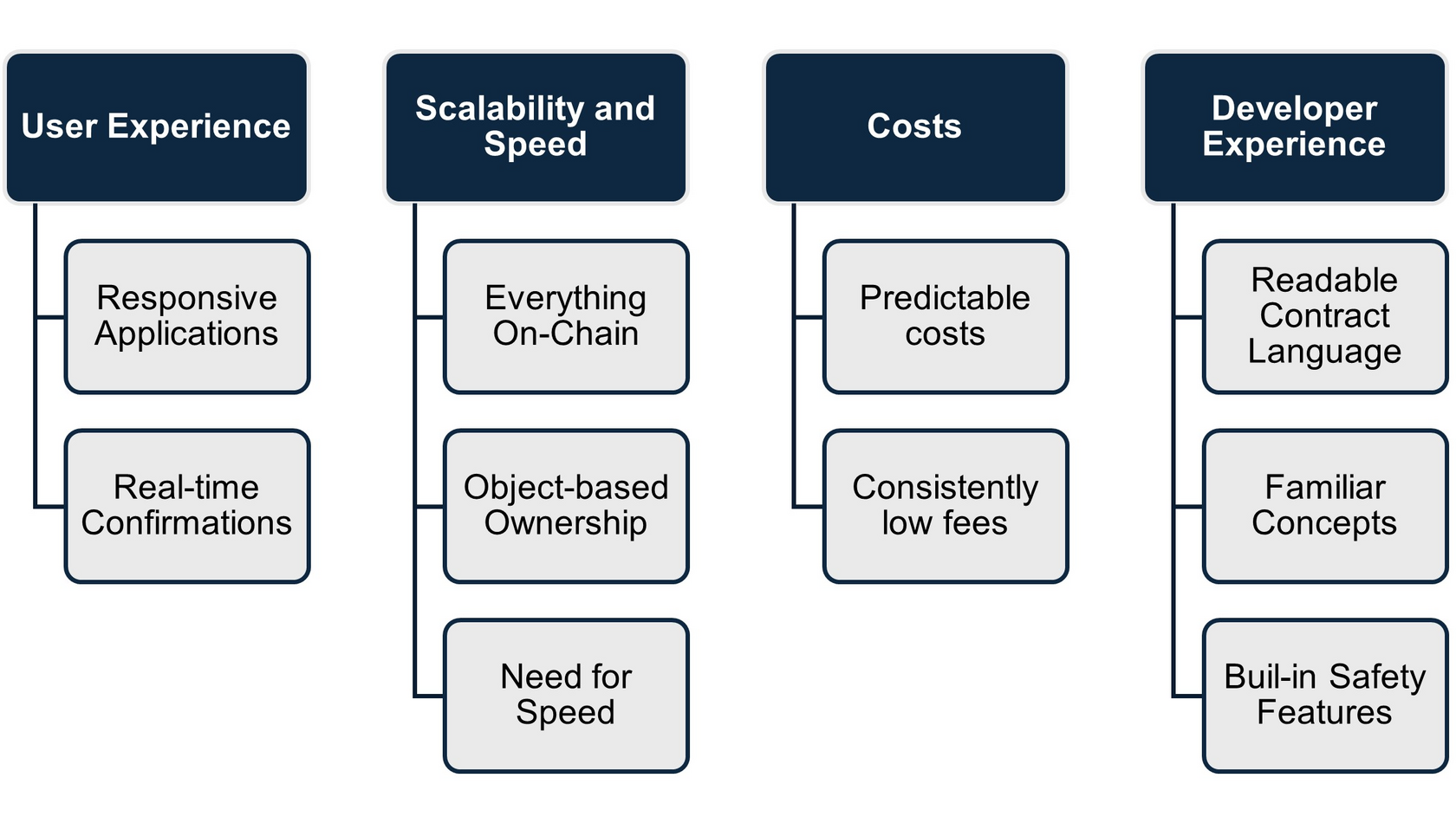

Sui’s Key Infrastructure Advantages

Blockchain devs are on the hunt for solutions that make it easy to deploy apps, with code that’s secure enough to handle high-value transactions.

Meanwhile, users want a web3 experience that feels like a better version of what they’re used to in web2—features like smooth onboarding, responsive real-time apps, and user-friendly options like human-readable credentials or social logins.

Additionally, developers need a contract language with built-in security features to protect users from mistakes and shield apps from potential exploits.

Meanwhile, users want a web3 experience that feels like a better version of what they’re used to in web2—features like smooth onboarding, responsive real-time apps, and user-friendly options like human-readable credentials or social logins.

Additionally, developers need a contract language with built-in security features to protect users from mistakes and shield apps from potential exploits.

Flirting with Web2

- Object-Centric Model

This design allows Sui to process multiple transactions simultaneously, as each asset transfer is handled independently, boosting transaction efficiency and security compared to account-based blockchains like Ethereum.

For example, Bluefin, which we covered a sec ago, leverages Pyth Network’s real-time price feeds to ensure precise pricing, which supports funding payments, liquidations, and low-slippage trading.

Pyth powers Sui’s DeFi ecosystem by offering over 500 price feeds and listing key ecosystem tokens like $DEEP (low-latency DEX) and $FUD (an OG Sui memecoin).

Pyth is set to expand with upcoming listings of LSTs and LRTs (liquidity redemption tokens), further strengthening Sui’s DeFi landscape.

Pyth powers Sui’s DeFi ecosystem by offering over 500 price feeds and listing key ecosystem tokens like $DEEP (low-latency DEX) and $FUD (an OG Sui memecoin).

Pyth is set to expand with upcoming listings of LSTs and LRTs (liquidity redemption tokens), further strengthening Sui’s DeFi landscape.

Source: VanEck Article

- Low Latency & Instant Finality

This leads to quick finality, so there’s no waits or uncertainty about any blockchain transactions anymore.

Notable Mention: Pyth Network $PYTH

First-Party Financial Oracle

First-Party Financial Oracle

Backed by high profiles like Polychain.

Bluefin’s founders aimed to create a high-performance, capitally efficient decentralized derivatives platform accessible to both institutional and retail users.

After a successful beta on Arbitrum, where users traded over $2.1 billion, they saw the potential of their DeFi vision but encountered technical limits.

Moving to Sui, they found the blockchain could meet their performance needs while offering exceptionally low fees.

After a successful beta on Arbitrum, where users traded over $2.1 billion, they saw the potential of their DeFi vision but encountered technical limits.

Moving to Sui, they found the blockchain could meet their performance needs while offering exceptionally low fees.

Developed by the team behind Solana’s Solend (now Save), Suilend offers a comprehensive DeFi suite, including lending, staking, and swaps on Sui, reaching nearly $325 million in TVL in under a year.

Pyth Network plays a key role in powering DeFi applications on Sui.

Bluefin ($BLUE - to be launched)

Orderbook DEX

Orderbook DEX

DeFi

BlueMove

NFT Marketplace

NFT Marketplace

Cetus $CETUS

DEX & Concentrated Liquidity Protocol

DEX & Concentrated Liquidity Protocol

Source: Cetus Protocol Medium

Known for its high trading volume, Cetus became a popular DEX within the Sui ecosystem with nearly $240 million in TVL, benefiting from the memecoin craze that spread to the Sui blockchain too.

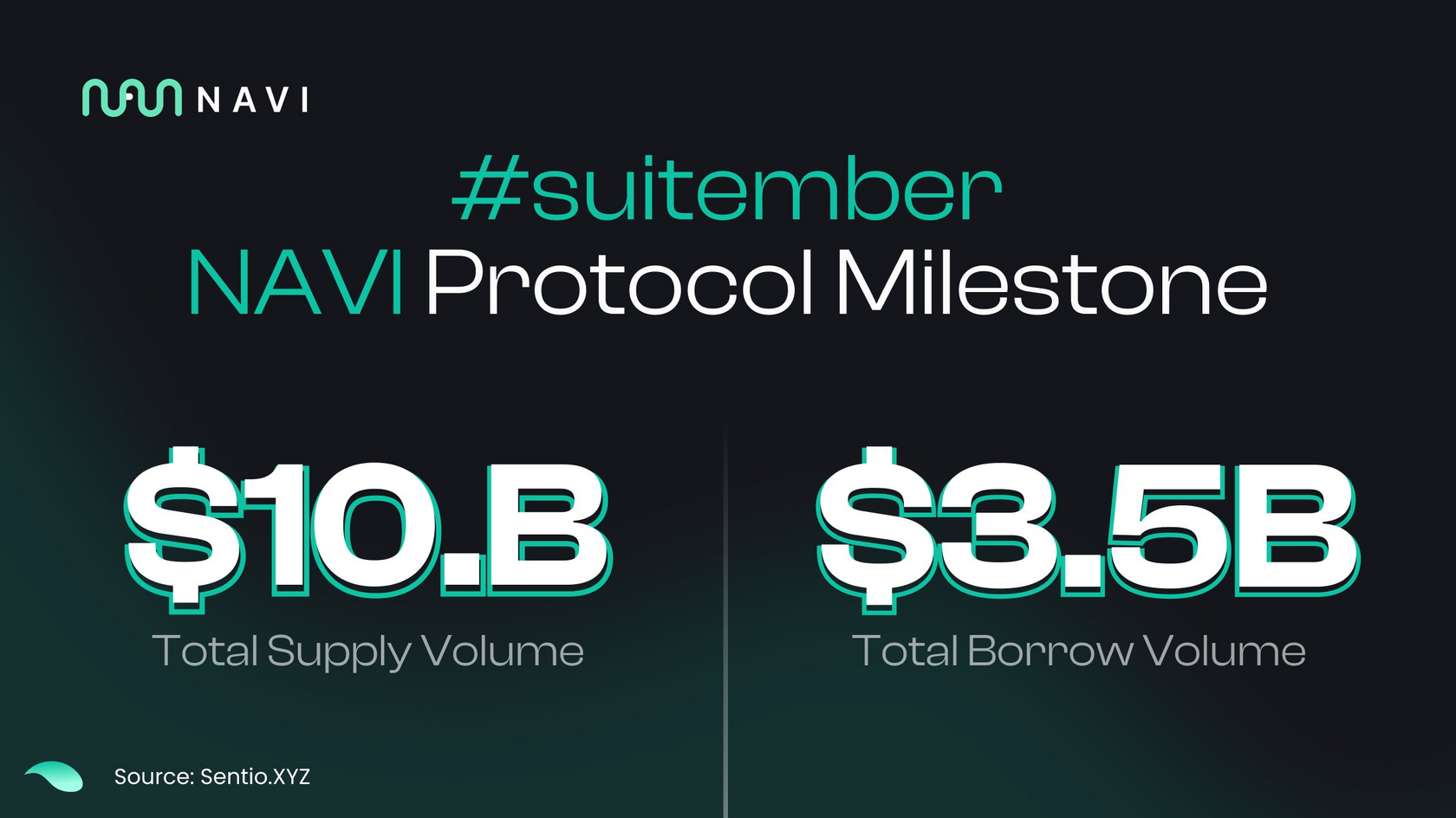

NAVI Protocol $NAVX

Lending Protocol

Lending Protocol

Source: NAVI Protocol X

As Sui’s leading DeFi platform, NAVI Protocol manages over $460 million in TVL.

The protocol offers lending with unique features like leveraged positions and supports multiple assets, including $CETUS (token of the eponymous DEX and concentrated liquidity protocol) and $vSUI (an LST—liquid staking token—representing $SUI staked with Volo, a DeFi platform and liquid staking protocol).

The platform’s success has drawn investments from major backers like OKX Ventures.

The protocol offers lending with unique features like leveraged positions and supports multiple assets, including $CETUS (token of the eponymous DEX and concentrated liquidity protocol) and $vSUI (an LST—liquid staking token—representing $SUI staked with Volo, a DeFi platform and liquid staking protocol).

The platform’s success has drawn investments from major backers like OKX Ventures.

Gaming

SuiPlay

Web3 Gaming Handheld Firm

Web3 Gaming Handheld Firm

Source: VentureBeat Article

Founded by the same parent company, Myten Labs, as Sui itself, SuiPlay is going to launch the first handheld console, 0x1, with native web3 capabilities, integrating $SUI games.

The SuiPlay team partnered with PLAYTRON, a gaming OS company with $10 million in funding, for the launch.

Pre-orders exceeded 2,000 within a week, indicating strong interest in a ‘web3 Steam Deck’ of sorts.

The SuiPlay team partnered with PLAYTRON, a gaming OS company with $10 million in funding, for the launch.

Pre-orders exceeded 2,000 within a week, indicating strong interest in a ‘web3 Steam Deck’ of sorts.

Blockus

Web3 Gaming Tech Stack

Web3 Gaming Tech Stack

Source: Grayscale Website

What is better described as ‘web 2.5’, Blockus is a platform simplifying onboarding for players and game devs.

Supports fiat onboarding, wallet-free play, and tokenized in-game assets.

Blockus also offers unique features like gas-free transactions and asset-based player rewards.

Supports fiat onboarding, wallet-free play, and tokenized in-game assets.

Blockus also offers unique features like gas-free transactions and asset-based player rewards.

Source: Eterna Capital Medium

Strategic Partnership with Google

A community-first NFT marketplace on Sui supporting staking, lending, and creator royalties.

Users can earn $MOVE tokens by trading, while creators receive royalties automatically.

BlueMove has essentially positioned itself as Sui’s version of OpenSea and Blur in their golden days—a leading NFT marketplace drawing in both collectors and creators.

Users can earn $MOVE tokens by trading, while creators receive royalties automatically.

BlueMove has essentially positioned itself as Sui’s version of OpenSea and Blur in their golden days—a leading NFT marketplace drawing in both collectors and creators.

In addition to its expanding user base and rising token value, Sui has seen robust growth in netflow.

Currently, Sui ranks third with a 1-month net inflow of nearly $160 million, just behind the heavyweight chains Solana and Base.

Notably, substantial capital was flowing into Sui even before the early November post-election optimism about a potential crypto-friendly future for the United States, a key player in the crypto economy.

This indicates strong investor confidence in Sui amid the recent market uncertainty.

Currently, Sui ranks third with a 1-month net inflow of nearly $160 million, just behind the heavyweight chains Solana and Base.

Notably, substantial capital was flowing into Sui even before the early November post-election optimism about a potential crypto-friendly future for the United States, a key player in the crypto economy.

This indicates strong investor confidence in Sui amid the recent market uncertainty.

Partnering with Pyth Network should be a top priority for any founder building on Sui.

By October 9, Grayscale officially opened the $SUI trust to investors, and within days, the AUM (assets managed) of the trust surpassed $3 million, reaching nearly $5.4 million currently.

This timely ‘endorsement’ from Grayscale has significantly boosted Sui’s credibility at a pivotal moment when its visibility was limited, sparking both institutional and retail interest in $SUI as the chain’s trajectory gains momentum.

This timely ‘endorsement’ from Grayscale has significantly boosted Sui’s credibility at a pivotal moment when its visibility was limited, sparking both institutional and retail interest in $SUI as the chain’s trajectory gains momentum.

Source: Suipiens Article

Source: Hotcoin Twitter

One of the best benchmarks of a blockchain’s popularity and social cred—or hipness, if you will—is the presence of hype kings, mass adoption powerhouses, and ultimate fun-infusers from the otherwise boring financial world: memecoins.

Sui’s definitely got its fair share of them gems.

Sui’s definitely got its fair share of them gems.

From DeFi to Memes—Sui’s Bustling Landscape

NFTs

Platforms like Hopdot.fun and Move Pump, Sui’s Pump.fun equivalents, emerged to facilitate the creation and trading of Sui memes.

Source: $FUD the Pug Website

Source: Sui Foundation Blog Article

Institutional Inroads: Grayscale Launches $SUI Trust

Per VanEck’s fresh research, Sui may be him.

$FUD, $HIPPO, $BLUB & Others

The Sui ecosystem has seen a surge in memecoins amid the broader memecoin hypercycle sweeping across major chains, from Solana to Ethereum—and even Tron.

The Sui ecosystem has seen a surge in memecoins amid the broader memecoin hypercycle sweeping across major chains, from Solana to Ethereum—and even Tron.

Evan Chen About Solidity:

“People talk about security, but they still use Solidity. From somebody with my background, Solidity will never be safe.

It hurts me: the first time I saw Solidity, I was like: ‘No way, this is wrong!’ The software is written in a programming language that allows dynamic behavior which is not analyzable … It’s too fundamentally broken.”

“People talk about security, but they still use Solidity. From somebody with my background, Solidity will never be safe.

It hurts me: the first time I saw Solidity, I was like: ‘No way, this is wrong!’ The software is written in a programming language that allows dynamic behavior which is not analyzable … It’s too fundamentally broken.”

Sui’s partnership with Google Cloud provides real-time blockchain data for AI and gaming to enhance user experiences.

This collab includes Sui blockchain data integration with BigQuery for better analytics, AI-powered tools for code generation and security audits, as well as zkLogin tech, which we mentioned above, enabling seamless web2cauthentication for web3.

Leveraging Google Cloud’s infrastructure, Sui will further ensure high transaction throughput and scalability.

This collab includes Sui blockchain data integration with BigQuery for better analytics, AI-powered tools for code generation and security audits, as well as zkLogin tech, which we mentioned above, enabling seamless web2cauthentication for web3.

Leveraging Google Cloud’s infrastructure, Sui will further ensure high transaction throughput and scalability.

Cross-Chain Inroads: $SUI Bridge & Ethereum Capital Inflow

On September, 30 Sui very strategically tapped into Ethereum’s liquidity by launching its ETH and WETH fee-free bridge.

Source: Grayscale Twitter

Sui became the first blockchain based on the Move programming language to support native USDC via Circle’s Cross-Chain Transfer Protocol.

$USDC Integration & CCTP

SUI’s ability to absorb nearly 47% of Ethereum outflows has been a remarkable shift this October, indicating investor confidence in Sui as a next-gen ecosystem.

Partly conducive, SUI’s co-founder, Evan Cheng, has openly criticized Ethereum’s security, arguing it is “not fit for purpose.”

Partly conducive, SUI’s co-founder, Evan Cheng, has openly criticized Ethereum’s security, arguing it is “not fit for purpose.”

Recent Developments Contributing to the Surge

CCTP enables users to move USDC quickly and securely between supported chains without needing a third-party bridge, which often presents security risks.

When a user transfers USDC via CCTP, the process is handled by burning USDC on the source chain and minting an equivalent amount on the destination chain. This mint-and-burn method ensures that the total USDC supply remains constant across chains, reducing fragmentation and minimizing risks associated with bridging.

When a user transfers USDC via CCTP, the process is handled by burning USDC on the source chain and minting an equivalent amount on the destination chain. This mint-and-burn method ensures that the total USDC supply remains constant across chains, reducing fragmentation and minimizing risks associated with bridging.

Source: Circle Article

As an aspiring founder you should know that Sui has initiatives launched such as:

- Sui Grants, under which they already provided $4.72 million in funding to 86 early-stage projects.

Source: Sui Grants Page

- The Sui Overflow hackhathon. Attracting over 2,000 builders, the 2024 event saw 350 project submissions, with 32 teams receiving awards for innovative developments like Pandora Finance (prediction platform), Hop (DEX aggregator), and Wave Wallet.

Sui Foundation Is Actively Nurturing Its Ecosystem

With the current bull run in full swing, you can count on even more robust grant programs coming from Sui, perfect for cryptopreneurs deciding on a supportive and convenient ecosystem.

RELATED

SUBSCRIBE TO OUR BLOG

Share this post:

Not Just Another Chain

While short-term price fluctuations may occur due to profit-taking—something crypto enthusiasts often enjoy as part of the industry—analysts are the ones enthusiastic about SUI’s long-term trajectory of a victor.

With an innovative infrastructure that includes parallel transaction processing (boosting speed and minimizing congestion) and horizontal scalability (allowing growth through additional validators), SUI is uniquely positioned to surpass both Ethereum and Solana in performance.

Strategic partnerships and active support for its developer community further bolster its ecosystem. These tech advancements are vital for creating a future-proof blockchain capable of handling diverse, everyday transactions—well beyond the occasional memecoin hype.

With continuous ecosystem growth and ongoing technological improvements, SUI is on track to become a key player in the drive toward mass crypto adoption.

With an innovative infrastructure that includes parallel transaction processing (boosting speed and minimizing congestion) and horizontal scalability (allowing growth through additional validators), SUI is uniquely positioned to surpass both Ethereum and Solana in performance.

Strategic partnerships and active support for its developer community further bolster its ecosystem. These tech advancements are vital for creating a future-proof blockchain capable of handling diverse, everyday transactions—well beyond the occasional memecoin hype.

With continuous ecosystem growth and ongoing technological improvements, SUI is on track to become a key player in the drive toward mass crypto adoption.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL