$30T Industry by 2030: How Do You Grow There?

05.11.2024

Gleb Specter

25 min

This year, RWAs have steadily moved into the spotlight of the crypto world and, most importantly, gained traction beyond it.

They’ve become one of the industry’s hottest buzzwords, rivaling even the hype around vocal memecoins cults.

But what exactly are they?

They’ve become one of the industry’s hottest buzzwords, rivaling even the hype around vocal memecoins cults.

But what exactly are they?

The most technically accurate web3 term for these assets represented on-chain with crypto tokens is ‘tokenized RWAs,’ not just ‘RWAs’ alone.

Explaining the Sweeping Term

‘So, what if memecoins tokenize the combined power of a real-world community?’ you might ask—and that’s a solid point.

The advent of on-chain RWAs reflects a growing interest in crypto projects that deliver sustainable, long-term value, as opposed to the short-term hype of speculative memecoins.

Should you be able to load on some nickel if you think its value will shoot up? Absolutely!

RWA, short for ‘real-world asset,’ is a catch-all term initially coined within the crypto community to distinguish blockchain-native assets not backed by anything from on-chain tokens backed by assets of real-world value.

Examples of the former include the main coins of blockchain networks, like $ETH, $SOL, or $BNB, and most fungible tokens hosted on these networks.

Examples of the former include the main coins of blockchain networks, like $ETH, $SOL, or $BNB, and most fungible tokens hosted on these networks.

‘Over 350 Million Users Worldwide Have Already Adopted RWAs’ should be the title.

On-Chained Tangible Value

Let’s look at BlackRock, an investment giant with over 10 trillion (with a T!) AUM (assets under management) as the most prominent example of tokenized RWA adoption by institutions.

RWA tokenization, despite its potential to democratize asset ownership and increase liquidity, still faces significant regulatory challenges.

This spring, BlackRock led a $47 million strategic investment into Securitize.

Don’t believe us? Just look how much DeFi trading is happening with stablecoins so far.

But let’s focus on RWAs in their more conventional sense.

At one time, tokenizing real-world assets wasn’t much of a topic, despite the abundance of tokens being launched. So, when it did emerge, it called for a specific term to quickly convey the concept.

Back then, nobody thought of stablecoins (tokenized fiat - the most prominent example of tokenized RWAs) like Tether (USDT) this way, either.

Today $USDT, $USDC, and other stablecoins are the mainstay currency of crypto trading around the world.

Back then, nobody thought of stablecoins (tokenized fiat - the most prominent example of tokenized RWAs) like Tether (USDT) this way, either.

Today $USDT, $USDC, and other stablecoins are the mainstay currency of crypto trading around the world.

Do We Need Tokenization?

Tokenization makes real-world assets like realty, luxury goods, intellectual property, as well as securities and commodities accessible to a wider community of investors, from retail to institutional.

It allows RWAs to be traded or used in dApps (decentralized applications) and DeFi (decentralized finance), unlocking increased liquidity and flexibility in a potential round-the-clock market worth hundreds of trillions of dollars.

Fractional ownership, easy management within a self-custody wallet, and fraud reduction through transparent traceability are also among the top reasons to hop on-chain.

Fractional ownership, easy management within a self-custody wallet, and fraud reduction through transparent traceability are also among the top reasons to hop on-chain.

Stablecoins have shown us that RWAs have a powerful place in DeFi—they’re the backbone, providing liquidity, stability, and a tangible bridge for the real economy into the digital world powered by the blockchain.

Imagine real estate, treasury bonds, or even IP being integrated into DeFi markets, where they can be accessed, traded, and collateralized at scale.

Imagine real estate, treasury bonds, or even IP being integrated into DeFi markets, where they can be accessed, traded, and collateralized at scale.

As we advance, tokenizing a wider array of RWAs could mean a DeFi ecosystem where users can freely trade real assets against each other or leverage stablecoins to transact in everything from equity to precious metals.

What Do RWA Projects Look Like?

Before we start with our list, it’s important to mention that, as of now, both projects that are undertaking the tokenization of a particular real-world asset type and those providing the infrastructure to do it are both known as ‘RWA projects’.

So, when searching for tokens of tokenization firms to buy, you should remember that you could happen to invest in a company facilitating tokenization, not in one managing the assets or resources, or in the underlying RWA assets themselves.

Now, some noteworthy RWA project examples per Cryptorsy include:

So, when searching for tokens of tokenization firms to buy, you should remember that you could happen to invest in a company facilitating tokenization, not in one managing the assets or resources, or in the underlying RWA assets themselves.

Now, some noteworthy RWA project examples per Cryptorsy include:

Brickken ($BKN) - Suite of Tools for Tokenization and Management of RWAs

Brickken empowers businesses to tokenize and manage digital assets all on one powerful platform through its Token Suite, much like Shopify simplified e-commerce.

Companies can easily create, sell, and manage tokenized assets, reaching a broader market, accepting crypto and fiat, verifying KYC, and tracking campaigns in real time. Brickken also supports efficient on-chain management, handling earnings distribution, performance analytics, and treasury management.

Companies can easily create, sell, and manage tokenized assets, reaching a broader market, accepting crypto and fiat, verifying KYC, and tracking campaigns in real time. Brickken also supports efficient on-chain management, handling earnings distribution, performance analytics, and treasury management.

Source: Brickken Article

RealtyX DAO ($RX) - Tokenized Real Estate

RealtyX DAO is set to transform private real estate funds by digitizing investor onboarding and capital processes, creating a seamless experience for LPs, and opening up access to a broader pool of investors through tokenization.

By utilizing $RST tokens, users can earn rental income and actively participate in property governance, democratizing real estate investment and giving individuals a new way to benefit from property ownership without the usual capital barriers.

By utilizing $RST tokens, users can earn rental income and actively participate in property governance, democratizing real estate investment and giving individuals a new way to benefit from property ownership without the usual capital barriers.

Source: DappRadar Article

OpenEden Labs ($TBILL) - Tokenized US Treasury Bills

OpenEden’s $TBILL token represents short-dated U.S. Treasury Bills, offering stable yields with 24/7 accessibility and compliance with Singapore and BVI regulations.

With backing from Binance Labs and Ripple, OpenEden continues to expand its offerings in the DeFi space.

With backing from Binance Labs and Ripple, OpenEden continues to expand its offerings in the DeFi space.

Source: OpenEden Article

elmnts - Tokenized Mineral Rights Investments

elmnts enables retail and institutional investors to access funds backed by mineral rights royalties, a $700 billion market according to RBN Energy.

These royalties, earned when companies extract resources like oil or gas from fund-owned properties, provide predictable, long-term income but are often inaccessible to many.

These royalties, earned when companies extract resources like oil or gas from fund-owned properties, provide predictable, long-term income but are often inaccessible to many.

Above, we’ve highlighted just a few strong real-world asset (RWA) projects to give you a sense of what they offer.

Currently, there are dozens of other notable RWA projects in the mix, including MANTRA Chain (a security-focused Layer 1 blockchain for RWAs), Plume Network (a compliance-integrated Ethereum Layer 2 blockchain for RWAs), ONDO Finance (an institutional-grade cross-chain RWA tokenization platform), MakerDAO (issuer of the RWA-backed $DAI stablecoin), and Centrifuge (a tokenized credit platform).

The RWA space is becoming more dynamic, increasingly retail-friendly for Web2 users, and is drawing attention from major institutions.

Currently, there are dozens of other notable RWA projects in the mix, including MANTRA Chain (a security-focused Layer 1 blockchain for RWAs), Plume Network (a compliance-integrated Ethereum Layer 2 blockchain for RWAs), ONDO Finance (an institutional-grade cross-chain RWA tokenization platform), MakerDAO (issuer of the RWA-backed $DAI stablecoin), and Centrifuge (a tokenized credit platform).

The RWA space is becoming more dynamic, increasingly retail-friendly for Web2 users, and is drawing attention from major institutions.

RWAs and Institutions

The largest asset managers like BlackRock, JPMorgan, and Fidelity are more drawn to on-chain RWAs than ever before, recognizing the powerful combination of real-world utility and blockchain-enabled liquidity.

These firms are attracted by the idea that traditional assets like T-bills (US Treasury bills) and real estate can now be traded globally, 24/7, with blockchain security and transparency.

These firms are attracted by the idea that traditional assets like T-bills (US Treasury bills) and real estate can now be traded globally, 24/7, with blockchain security and transparency.

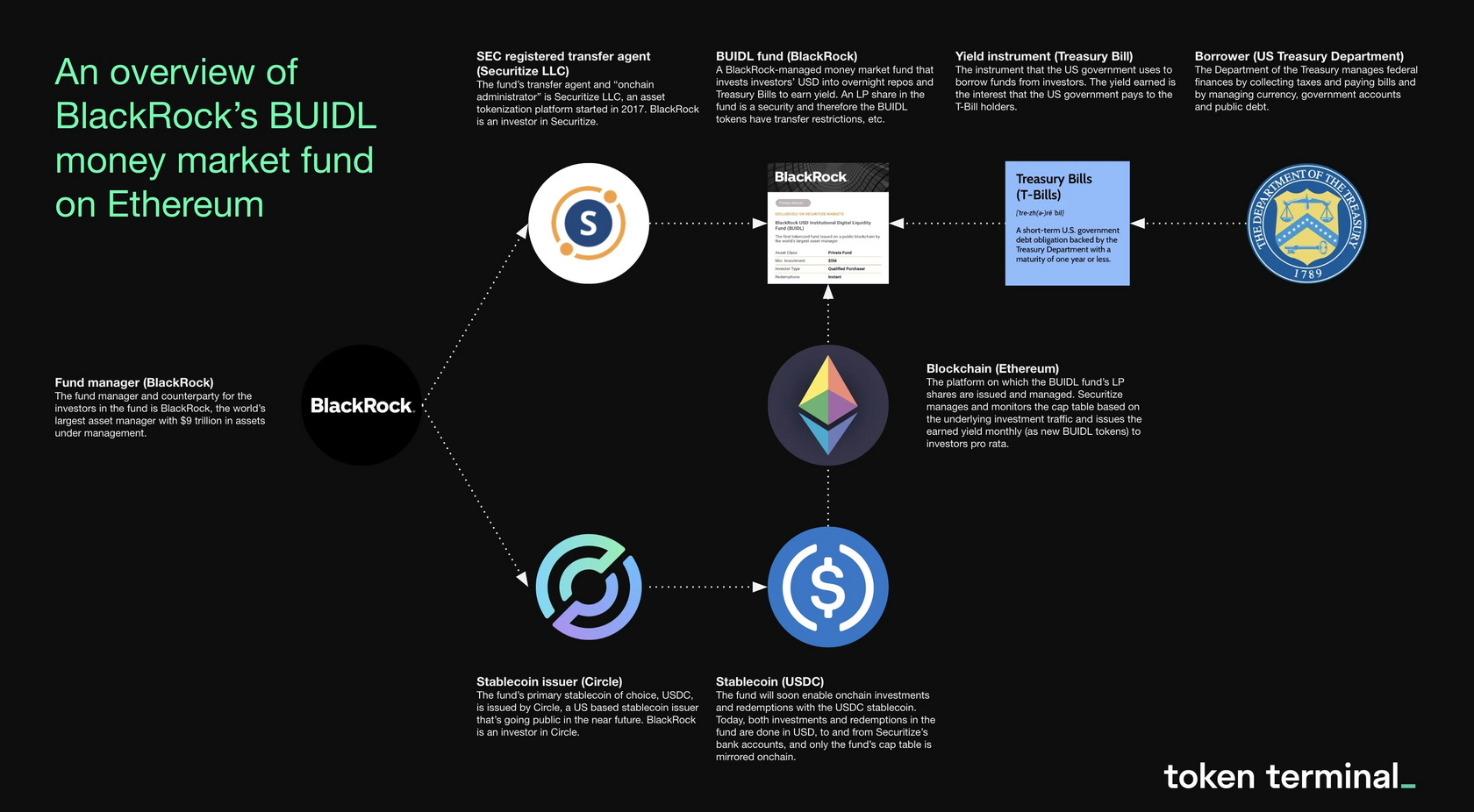

Blackrock’s BUIDL Fund

Source: Token Terminal

Namely, it’s BUIDL Fund.

It’s a pioneering money market fund issued on Ethereum in collaboration with Coinbase. The $BUIDL token pegged 1:1 to the U.S. dollar, invests in stable assets like U.S. Treasury bills, offering institutional investors a chance to earn yields on dollar-backed underlying assets, with dividends paid monthly.

Injective, a layer 1 blockchain optimized for DeFi, recently introduced the BUIDL Index, the first tokenized index for this fund, enabling users to access it through various dApps (decentralized applications) with competitive fees and rapid transactions. The BUIDL Index is a perpetual market tracking the supply of $BUIDL tokens.

It’s a pioneering money market fund issued on Ethereum in collaboration with Coinbase. The $BUIDL token pegged 1:1 to the U.S. dollar, invests in stable assets like U.S. Treasury bills, offering institutional investors a chance to earn yields on dollar-backed underlying assets, with dividends paid monthly.

Injective, a layer 1 blockchain optimized for DeFi, recently introduced the BUIDL Index, the first tokenized index for this fund, enabling users to access it through various dApps (decentralized applications) with competitive fees and rapid transactions. The BUIDL Index is a perpetual market tracking the supply of $BUIDL tokens.

BlackRock is also positioning $BUIDL as an alternative to traditional stablecoins, with talks of integrating it as collateral on major CEXs (centralized exchanges) like Binance and OKX. This move could cement $BUIDL’s role as a stable, yield-generating crypto asset, bridging the traditional and digital finance sectors.

Larry Fink, BlackRock CEO | Source: Bankless X

With over $533 million in assets under management since its launch, BUIDL is now the largest tokenized fund to date. Its success is supported by partnerships with Securitize (RWA tokenization firm) for token management and participation from notable firms like BitGo (digital asset trust/security company) and Fireblocks (enterprise-grade digital asset management platform).

BlackRock’s Engagement with Key RWA Innovators

Operating as a SaaS company, Securitize offers fintech (financial technology) services to digitize securities with the help of blockchain.

This September, Ethena announced its UStb stablecoin backed by Blackrock's BUIDL.

Reserves for UStb will be invested in BUIDL, which in turn holds U.S. dollars, U.S. T-bills, and repurchase agreements.

Last month, Ethena also picked BlackRock's BUIDL, among others for its $46M tokenized RWA Investment to earn a yield without leaving blockchain rails.

Reserves for UStb will be invested in BUIDL, which in turn holds U.S. dollars, U.S. T-bills, and repurchase agreements.

Last month, Ethena also picked BlackRock's BUIDL, among others for its $46M tokenized RWA Investment to earn a yield without leaving blockchain rails.

Ethena ($ENA)

A decentralized stablecoin protocol on the Ethereum network that offers a synthetic dollar, USDe.

This summer, BlackRock announced its plans to apply for MakerDAO's $1 billion Tokenized Treasury Investment Program via $BUIDL.

MakerDAO, aka Sky ($MKR)

Now known as Sky—most likely because of constant confusion with DAO Maker, a crypto launchpad—It’s a DeFi protocol on Ethereum that issues the $DAI stablecoin, backed by over-collateralized real-world assets like T-bonds.

Aave Labs unveils plan to stabilize $GHO, Aave Protocol's overcollateralized stablecoin, with BlackRock’s $BUIDL.

Aave ($AAVE)

A DeFi crypto lending platform.

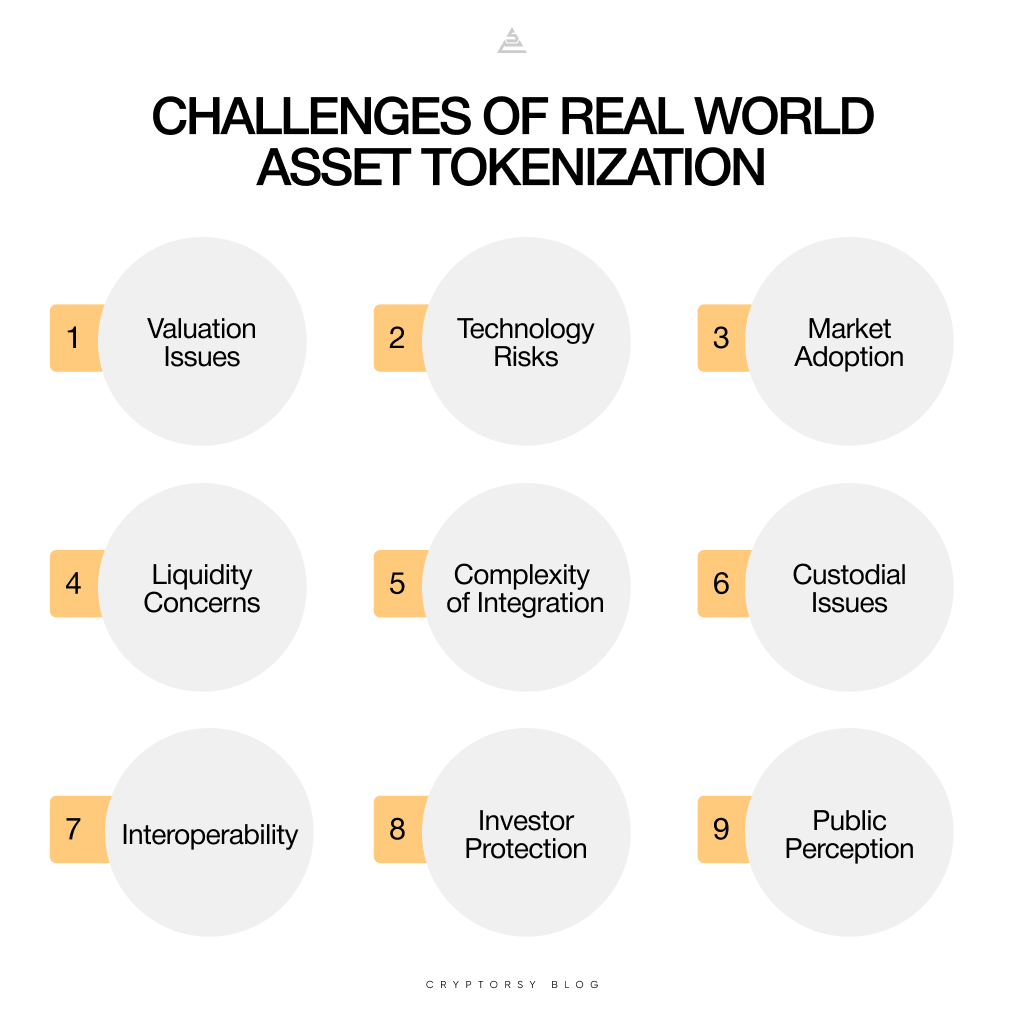

Overcoming Challenges in RWA Tokenization

We’re only just beginning here.

Regulatory discrepancies across the globe are one of the most prominent obstacles, as various jurisdictions have different interpretations and classifications of tokenized assets.

Some view RWA tokens as securities, others as cryptocurrencies (and then, are cryptos themselves securities or commodities?), while some see them as a new asset class backed by physical assets.

This leads to another question: 'Are RWA tokens the same entity as the underlying asset, or could there be circumstances where the two are considered separate?'

Some view RWA tokens as securities, others as cryptocurrencies (and then, are cryptos themselves securities or commodities?), while some see them as a new asset class backed by physical assets.

This leads to another question: 'Are RWA tokens the same entity as the underlying asset, or could there be circumstances where the two are considered separate?'

This regulatory inconsistency often causes confusion and delays, as each region’s legal framework must be carefully navigated to ensure compliance.

Moreover, some countries lack any regulatory provisions for digital asset transactions, and a handful even prohibit them, which stifles cross-border transactions and undermines the whole idea of worldwide liquidity, utility, and accessibility for tokenized assets like Treasury bills and private credit. It deters investors from entering markets where legal boundaries remain uncertain.

Moreover, some countries lack any regulatory provisions for digital asset transactions, and a handful even prohibit them, which stifles cross-border transactions and undermines the whole idea of worldwide liquidity, utility, and accessibility for tokenized assets like Treasury bills and private credit. It deters investors from entering markets where legal boundaries remain uncertain.

Additionally, compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements is necessary to mitigate fraud and illegal activities, but it complicates tokenization processes.

Meeting KYC standards requires thorough identity verification and ongoing monitoring, while AML regulations necessitate traceable and transparent transactions, both of which add layers of complexity.

Combined with an absence of standardized reporting and taxation protocols, these compliance demands create a fragmented regulatory environment, ultimately slowing the widespread adoption of RWA tokenization.

Meeting KYC standards requires thorough identity verification and ongoing monitoring, while AML regulations necessitate traceable and transparent transactions, both of which add layers of complexity.

Combined with an absence of standardized reporting and taxation protocols, these compliance demands create a fragmented regulatory environment, ultimately slowing the widespread adoption of RWA tokenization.

Blockchains like Plume Network are building universal KYC and AML features on the network level.

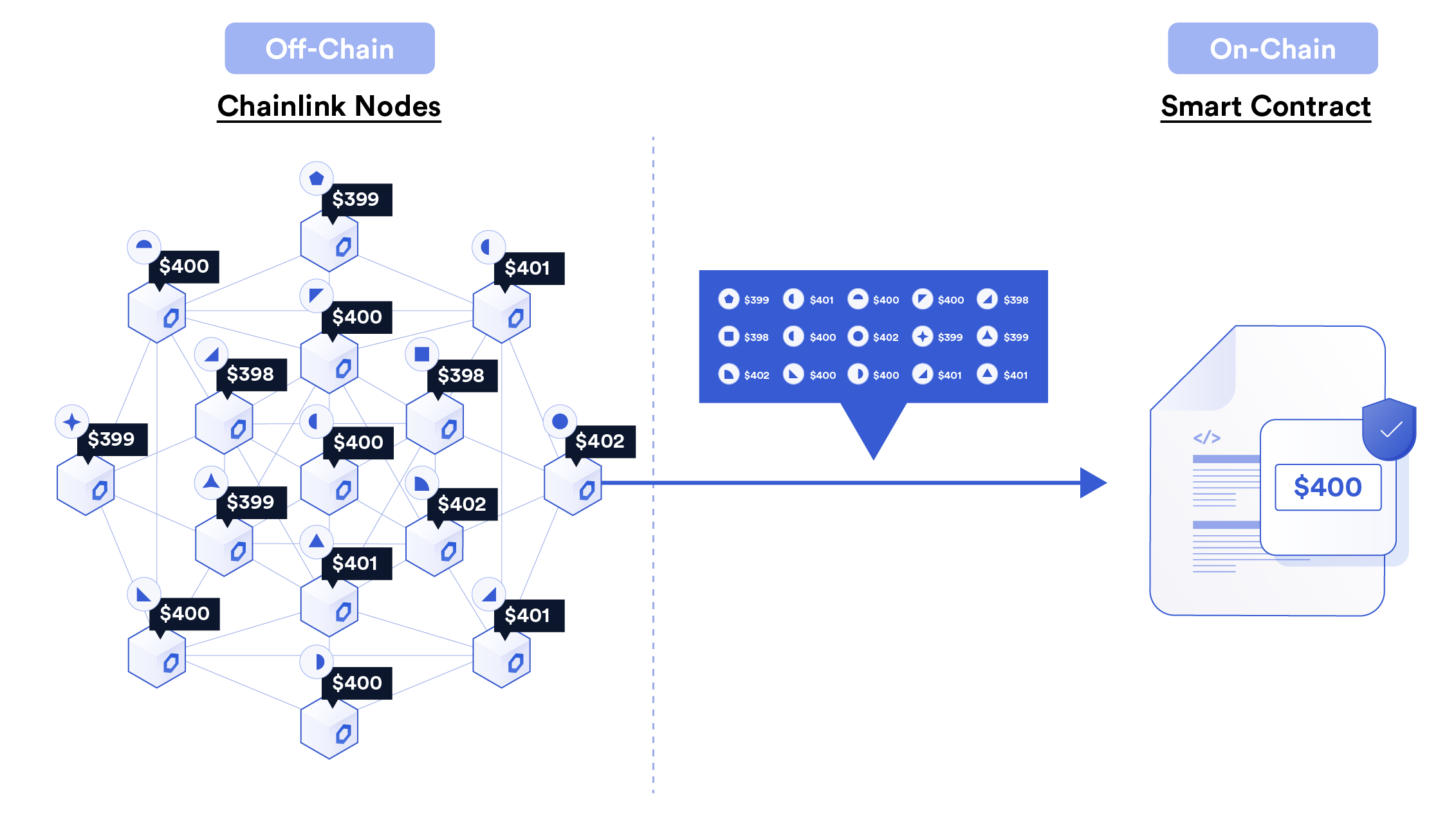

Yet another big hurdle for RWA projects is maintaining a token’s real-world value in sync with the actual asset it represents. To fully realize the benefits of enhanced transparency, security, and utility offered by tokenized RWAs, we must first address the ‘data problem.’

The data required to facilitate transactions involving tokenized assets—such as NAV (net asset value), proof of reserves, pricing information, and identity data—must be consistently available on-chain in a trusted and transparent manner, and robust audit frameworks and auditors are crucial in ensuring this data is consistently verified and trusted.

The data required to facilitate transactions involving tokenized assets—such as NAV (net asset value), proof of reserves, pricing information, and identity data—must be consistently available on-chain in a trusted and transparent manner, and robust audit frameworks and auditors are crucial in ensuring this data is consistently verified and trusted.

Chainlink leverages OCR (Off-Chain Reporting) to ensure decentralized data collection from off-chain sources.

To tackle this problem head-on, protocols like Chainlink act as real-world-to-chain bridges, syncing blockchain-based smart contracts with real-time data and external events.

How We Made Landshare Go Rockstar

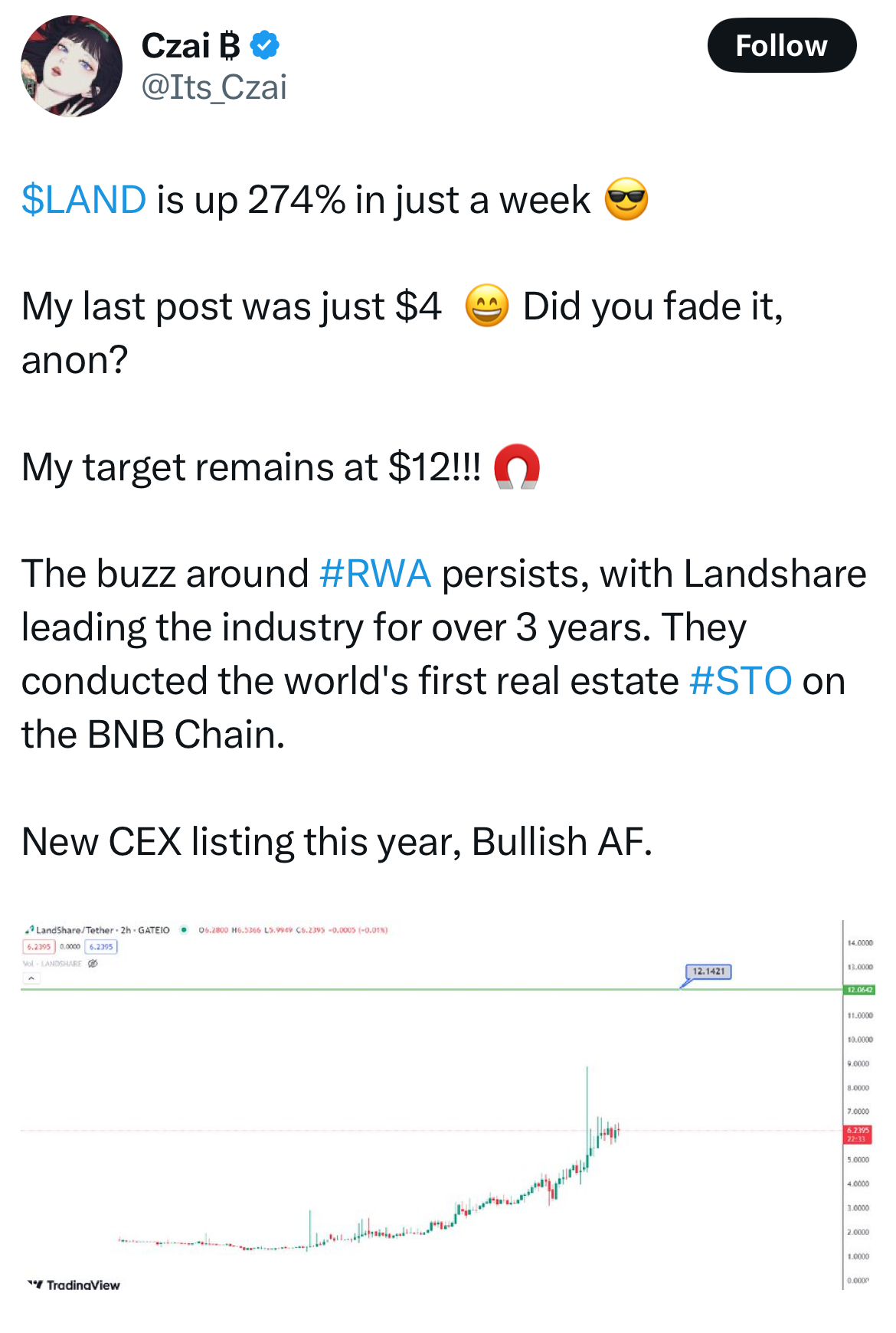

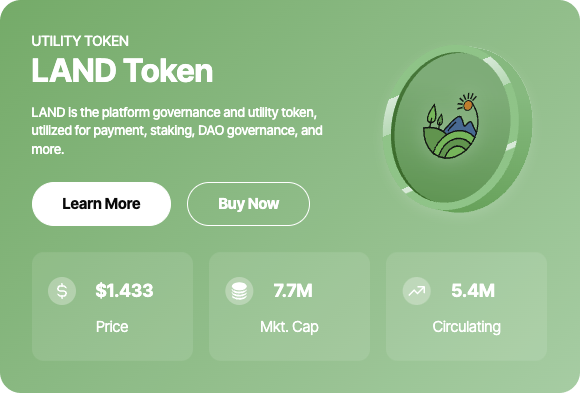

When we first partnered with Landshare, a real estate tokenization startup at the time, it began with 40,000 followers, an average daily trading volume of $13,800 for its $LAND utility token, and up to 1,000 total token holders.

By implementing a series of marketing initiatives, which we’re going to detail below, as well as securing a series of strategic partnerships, integrations, and collaborations with a range of notable RWA—and more broadly—web3 entities, Cryptorsy managed to give the project a remarkable surge.

By implementing a series of marketing initiatives, which we’re going to detail below, as well as securing a series of strategic partnerships, integrations, and collaborations with a range of notable RWA—and more broadly—web3 entities, Cryptorsy managed to give the project a remarkable surge.

Landshare integrated with Chainlink, a real-world data access network. | Source: Chainlink X

We grew Landshare to 250,000+ community members and $5 million in trading volume, with a tenfold increase in token price with an ATH at over $6.

That’s the demand your RWA initiative’s utility token could easily enjoy with the right strategy.

Strategic partnership with the leading Ethereum Layer 2 for RWAs | Source: Landshare Article

Five-Step Growth Hacking Funnel

Our growth strategy for Landshare was anchored in a comprehensive five-step funnel:

1. Traffic Generation

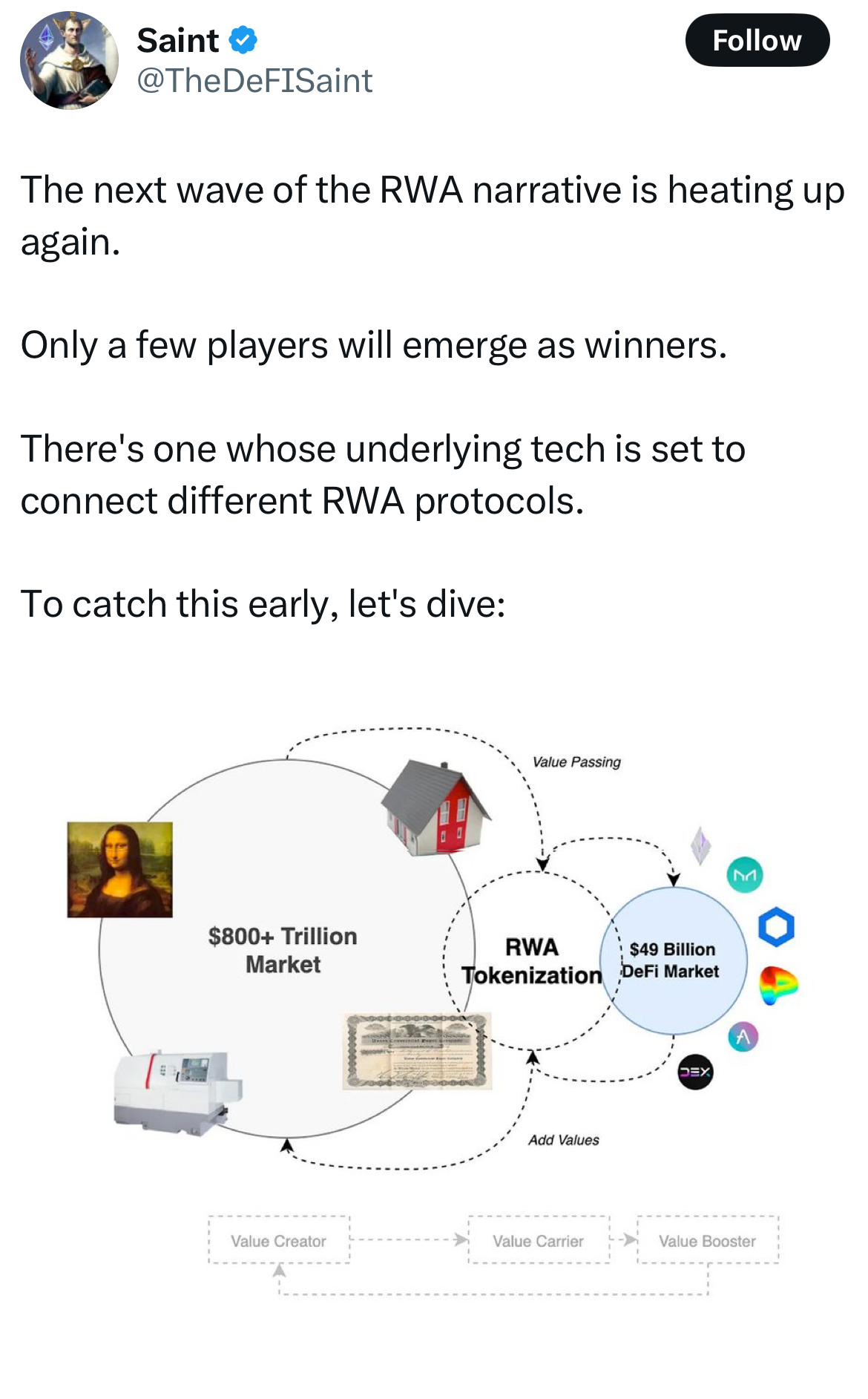

One of the most prominent parts here was having top minds from Cryptorsy’s KOL Syndicate and beyond break down Landshare for their audiences and shill it on CT (Crypto Twitter) on the whole.

They were vetted to fit the project’s real estate tokenization and yield-earning narrative.

In the Landshare case, those were the respected thought leaders dealing in decentralized finance and tokenization.

They were vetted to fit the project’s real estate tokenization and yield-earning narrative.

In the Landshare case, those were the respected thought leaders dealing in decentralized finance and tokenization.

The reach we drove through our KOLs for Landshare secured a substantial number of leads.

2. Lead Nurturing

To ensure the people we attracted through KOLs are encouraged to learn more about Landshare, we launched campaigns like Real World Explorers, where participants got hands-on experience with Landshare’s features and other well-known tokenization and crypto products like Stobox and Exodus.

We ran activities like Zealy sprints that invited leads to take Landshare quizzes and collaborate with projects, rewarding them for their involvement.

We ran activities like Zealy sprints that invited leads to take Landshare quizzes and collaborate with projects, rewarding them for their involvement.

This helped us give our new audience a clear idea of the project’s value. It was the first key step in turning them into more enthusiastic supporters, ready to do more for Landshare than just farming rewards.

3. User Activation

To activate users after nurturing their interest, we launched initiatives that encouraged UGC (user-generated content), such as the Story Contest and Shill Army campaigns.

These activities rewarded participants for creating and sharing content, effectively galvanizing them to promote Landshare.

These activities rewarded participants for creating and sharing content, effectively galvanizing them to promote Landshare.

A community you’ve invested a little time in convincing about your product’s feasibility—and that enjoys some nice rewards now and then—is your best Marketing Department on Steroids.

4. Retail Investment Attraction

This was the moment we could leverage the fact that our community was already well-informed about Landshare’s value prop and excited for what was next due to prior campaigns to attract retail investment.

Others could quickly get intrigued about the platform by simply scrolling through its X page, rich with community benefits.

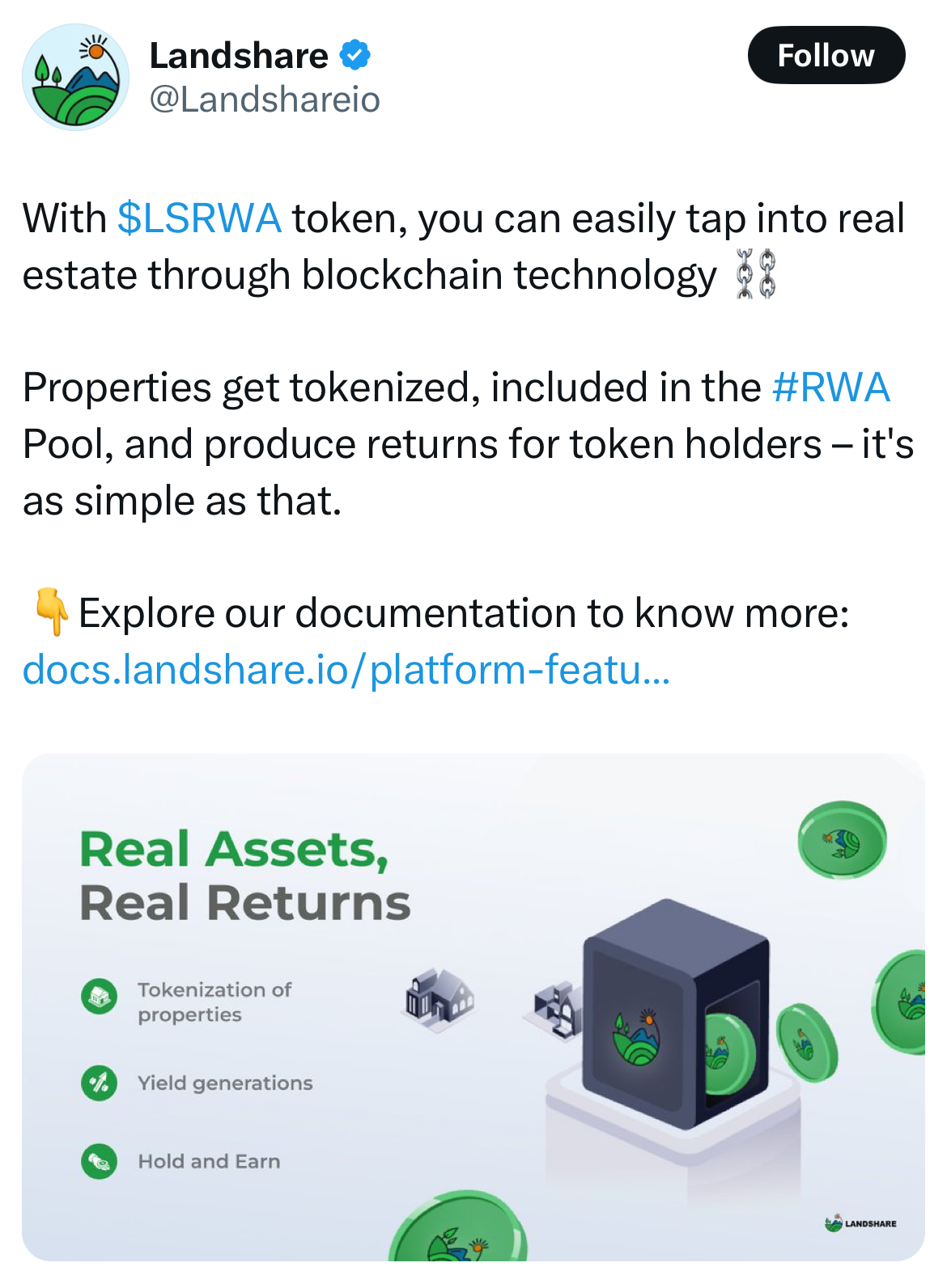

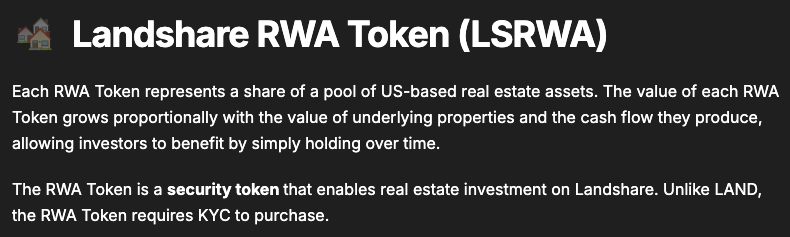

So a presale for $LSRWA, Landshare’s security/RWA token backed by real estate, was launched, taking advantage of this freshly gained interest.

Others could quickly get intrigued about the platform by simply scrolling through its X page, rich with community benefits.

So a presale for $LSRWA, Landshare’s security/RWA token backed by real estate, was launched, taking advantage of this freshly gained interest.

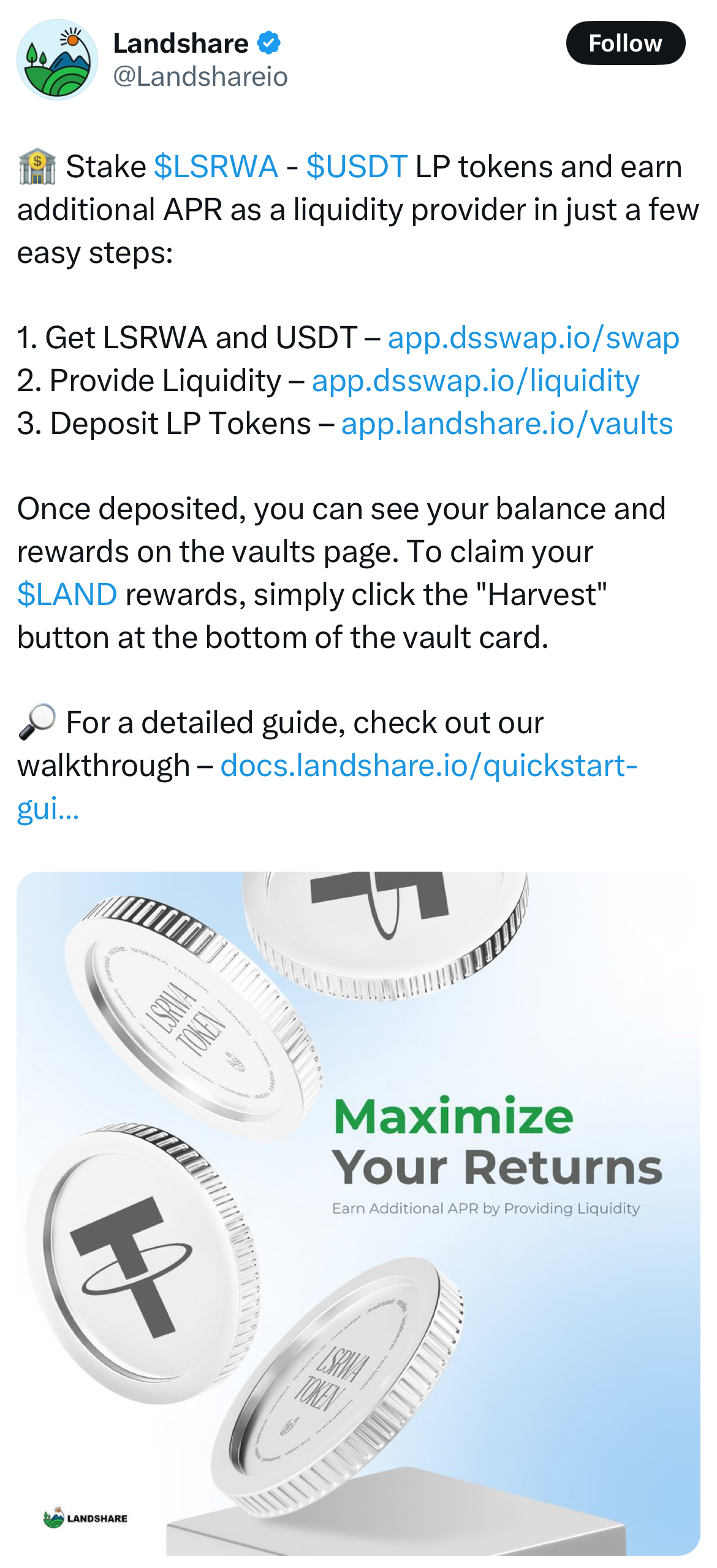

5. Retention and Long-Term Engagement

Lastly, to craft long-haul appeal, we made sure to highlight initiatives like the LSRWA/USDT LP token staking for additional APR across Landshare social media and launched multiple seasons of its Ambassador Program.

Check out our article breaking down the ins and outs of standout Ambassador Programs to get inspired.

The program incentivized loyal community members to create high-quality content and stay involved, fostering continuous support for Landshare.

RELATED

SUBSCRIBE TO OUR BLOG

Share this post:

Social media content is the backbone of any RWA startup’s marketing.

Without regular updates and some solid ‘bullposting,’ a tokenization project can quickly lose momentum and get buried in the constant flood of web3 content. With so many exciting launches and news breaking daily, CT is where you build that initial critical mass of supporters who are open to the idea of an on-chain project.

Without regular updates and some solid ‘bullposting,’ a tokenization project can quickly lose momentum and get buried in the constant flood of web3 content. With so many exciting launches and news breaking daily, CT is where you build that initial critical mass of supporters who are open to the idea of an on-chain project.

Dual-Token Model Leveraged

Prominent RWA projects like Landshare often use the dual-token model to scale successfully.

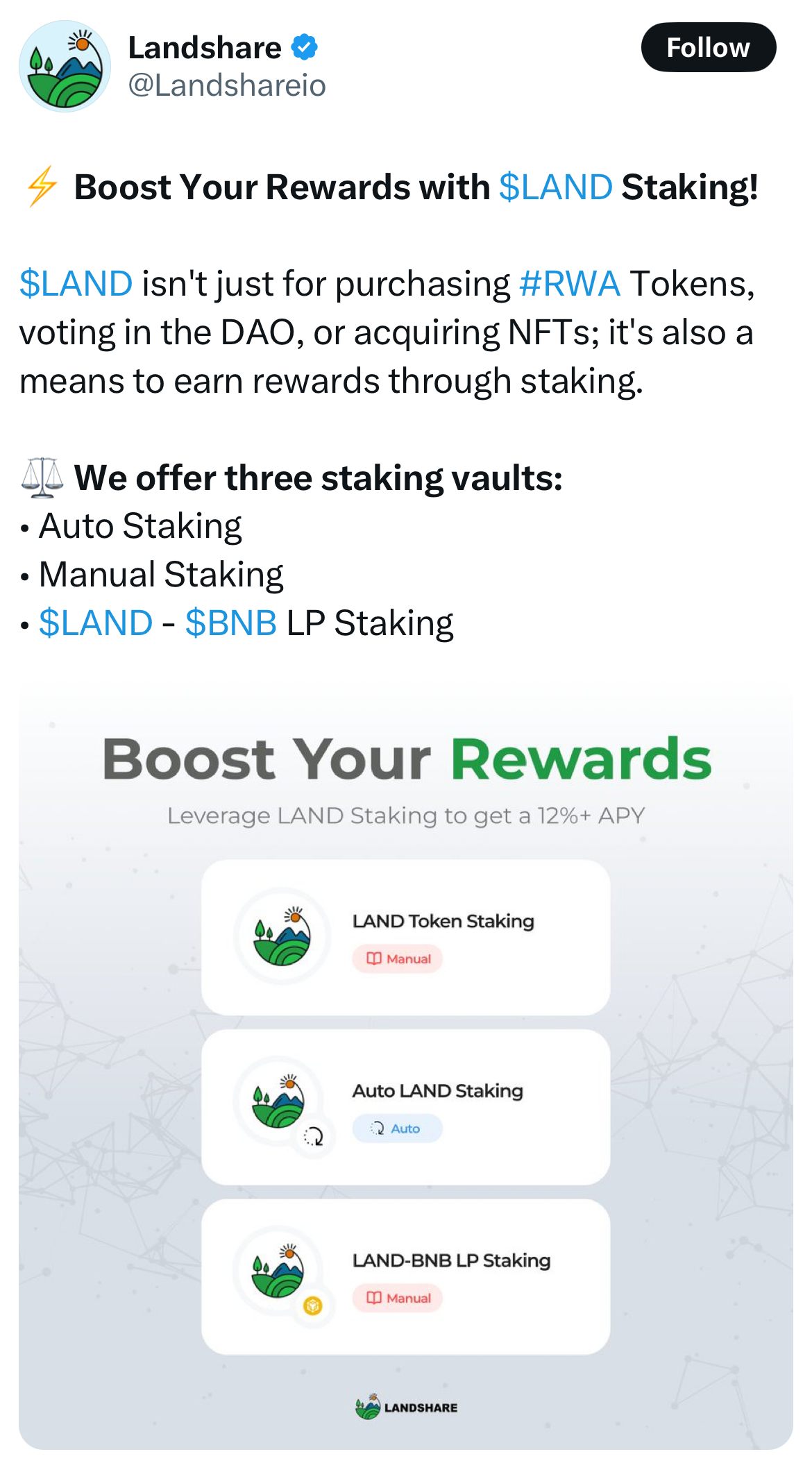

Utility Tokens

Provide additional benefits like discounts, governance rights, or rewards.

Provide additional benefits like discounts, governance rights, or rewards.

Tokens for Underlying Asset

Typically offer asset-backed returns such as APY (annual percentage yield) based on the equity represented by the token.

Typically offer asset-backed returns such as APY (annual percentage yield) based on the equity represented by the token.

Source: Landshare Website

Notably, the token representing the underlying real-world asset is often known as a security token, and its initial sale as an STO (Security Token Offering), depending on the legal structure of a particular company—like Landshare’s—undertaking the procurement, management, and often tokenization of an RWA.

Source: Landshare Medium

Both security and utility tokens should be spotlighted in social media posts to drive interest and engagement, as the dual-token model encourages user interaction and confidence in the company’s sustainability, allowing holders to participate in both speculative and long-term financial gains.

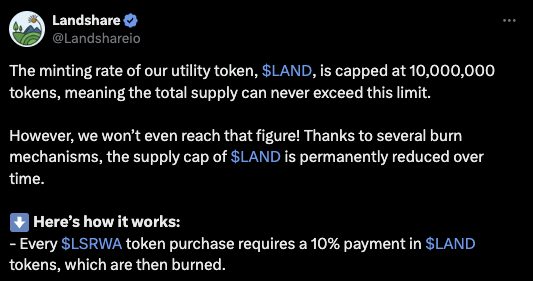

The Right Utility Will Take Your Token Places

The more your utility token is integrated into your product’s ecosystem, the more it contributes to its overall market value.

Especially during active marketing campaigns, like the ones we ran at Cryptorsy.

For example, Landshare employs a unique mechanism where its utility token, $LAND, plays a vital role in purchasing the security token $LSRWA. Buyers had to use 10% $LAND to purchase $LSRWA, which significantly increased $LAND’s liquidity as we built excitement around $LSRWA.

Especially during active marketing campaigns, like the ones we ran at Cryptorsy.

For example, Landshare employs a unique mechanism where its utility token, $LAND, plays a vital role in purchasing the security token $LSRWA. Buyers had to use 10% $LAND to purchase $LSRWA, which significantly increased $LAND’s liquidity as we built excitement around $LSRWA.

To buy Landshare’s $LSRWA (security token), you need to pay 10% in $LAND | Landshare Medium

Source: Landshare X

Source: Landshare X

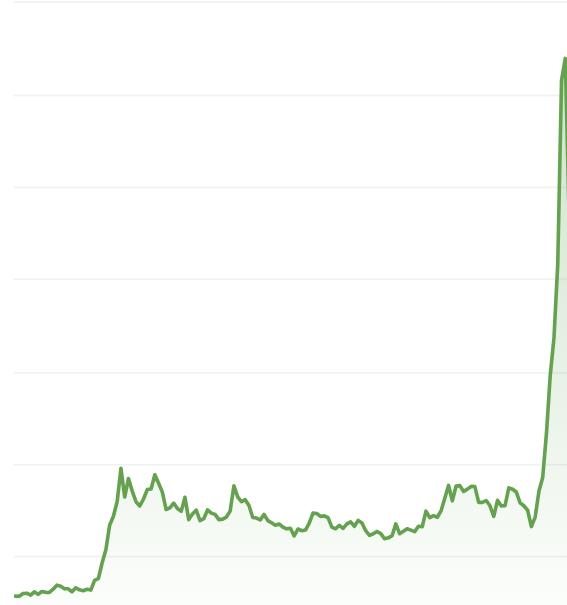

The Landshare chart in the lead-up to its surge to $6 earlier this year.

Landshare September Development Update, Published on Medium

Cryptorsy’s strategy for Landshare’s social media content highlights this effectively.

The project’s concise explanations, such as those detailing how RWA token value is calculated, play a crucial role in educating new retail investors and energizing existing stakeholders.

While blockchain-based tokenization is gaining momentum in web3, it remains unfamiliar to traditional investors and the general public.

Simplifying complex DeFi concepts aligns with the core mission of RWAs—to democratize access to real-world assets. This is why your storytelling should be tailored to retail investors, bridging the gap and transforming ‘dull’ tokenized real-world assets into relatable opportunities.

Landshare’s emphasis on emotional branding and long-term engagement demonstrates that even without the hype of memecoins, a solid narrative rooted in real-world value can resonate strongly in today’s web3 landscape.

The project’s concise explanations, such as those detailing how RWA token value is calculated, play a crucial role in educating new retail investors and energizing existing stakeholders.

While blockchain-based tokenization is gaining momentum in web3, it remains unfamiliar to traditional investors and the general public.

Simplifying complex DeFi concepts aligns with the core mission of RWAs—to democratize access to real-world assets. This is why your storytelling should be tailored to retail investors, bridging the gap and transforming ‘dull’ tokenized real-world assets into relatable opportunities.

Landshare’s emphasis on emotional branding and long-term engagement demonstrates that even without the hype of memecoins, a solid narrative rooted in real-world value can resonate strongly in today’s web3 landscape.

Gamify Your Tokenization

Gamification has proven to be an effective reinforcement to your growth strategy, even in traditionally serious fields like real estate.

With retail investors, you have to make the process of dealing with ‘boring assets’ like real estate or T-bills It is also a powerful tool to build your marketing around.

With retail investors, you have to make the process of dealing with ‘boring assets’ like real estate or T-bills It is also a powerful tool to build your marketing around.

For instance, Landshare’s Real Estate NFT ecosystem allows users to enhance their returns with yield-boosting NFTs. Each NFT, representing a 3D model of a real-world property, increases the yield multiplier for staked $LSRWA tokens, translating to greater $LAND rewards.

As you can see in the tweets above, this feature was incredibly useful for Cryptorsy in creating engaging content.

As you can see in the tweets above, this feature was incredibly useful for Cryptorsy in creating engaging content.

Tokenization:

Fading Isn't Advised

RWA tokenization is here to stay and that’s beyond any debate. It’s the bedrock of a financial shift that’s connecting traditional assets with the efficiency and transparency of blockchain.

Projects like Landshare show that with the right community-first strategy, clear educational content, and a dual-token model, there’s real potential for lasting impact in this soon-to-be $30 trillion market. As tokenized assets move from niche to mainstream, they’re poised to rewrite how investors engage with everything from real estate to treasury bills, and who the investors are and who gets to invest. The path ahead promises more growth, tighter regulatory integration, and broader adoption by both crypto natives and TradFi giants alike.

What’s next? Expect deeper cross-chain collaborations, gamified engagement models like Landshare’s, and a wave of strategic partnerships that continue to blur the line between DeFi and traditional finance.

Those ready to act now will be leading the charge when the dust settles and the tokenized future is fully realized.

Projects like Landshare show that with the right community-first strategy, clear educational content, and a dual-token model, there’s real potential for lasting impact in this soon-to-be $30 trillion market. As tokenized assets move from niche to mainstream, they’re poised to rewrite how investors engage with everything from real estate to treasury bills, and who the investors are and who gets to invest. The path ahead promises more growth, tighter regulatory integration, and broader adoption by both crypto natives and TradFi giants alike.

What’s next? Expect deeper cross-chain collaborations, gamified engagement models like Landshare’s, and a wave of strategic partnerships that continue to blur the line between DeFi and traditional finance.

Those ready to act now will be leading the charge when the dust settles and the tokenized future is fully realized.

Importance of Content and Community

A good content plan elucidates your project’s essence and keeps people interested through development updates, educational posts, and community efforts.

Educate, Simplify, Get Retail Excited

Remember: On-Chain Community Is Your Direct Stakeholder

This is especially true for real-world asset projects that launch their utility token early on.

As a web3 company with a token anyone can acquire, you need to stay consistently active, sharing every development to reinforce your product’s image and build user confidence in holding the token.

As a web3 company with a token anyone can acquire, you need to stay consistently active, sharing every development to reinforce your product’s image and build user confidence in holding the token.

Key Landshare Growth Strategy Highlights

Community Engaged EVERY Step of the Way

Incentive programs like Zealy Sprints, regular online events such as AMAs (ask-me-anything conversations) with RWA experts, and participation in panel discussions with RWA founders and executives have driven user interest and involvement in Landshare.

Content That Explains Value Prop Clearly

We emphasized storytelling and branding to clearly explain tokenized real estate and highlight the benefits of investing in it with Landshare.

Cross-Chain Integrations and Activities to Try It Out

Our strategy featured the expansion across multiple blockchains like Polygon, Arbitrum, and Plume Network, which boosted liquidity and visibility.

Make your token do something so marketing boosts it naturally.

Remember that $LAND rallied from just above $1 to $6 under our promotional management.

The most effective gamification for an RWA project is the kind that delivers real-world results as well.

Your RWAs Deserve to Shine Too

At Cryptorsy, we made Landshare the blueprint for turning RWA potential into results.

Ready to see your project skyrocket? Partner with us, and let’s push your initiative from promising to unstoppable.

Ready to see your project skyrocket? Partner with us, and let’s push your initiative from promising to unstoppable.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL