HOW INCENTIVE CAMPAIGNS DRIVE ENGAGEMENT IN WEB3?

05.08.2023

Vlad Svitanko

13 min

RELATED

SUBSCRIBE TO OUR BLOG

Introduction

Understanding Incentive Campaigns

Designing Incentives for Web3 Communities

We’ve heard time and again that Web3 brands need strong communities to succeed. Yet how exactly do you go about building a community, and what’s the best way to reward them and keep them engaged?

This is where incentive campaigns come into play – the powerful catalysts that fuel interaction, motivate participation, and forge strong bonds within Web3 communities. In this comprehensive guide, we will delve into the multifaceted world of incentive campaigns, exploring their intricacies, design strategies, and the keys to building sustainable Web3 ecosystems.

This is where incentive campaigns come into play – the powerful catalysts that fuel interaction, motivate participation, and forge strong bonds within Web3 communities. In this comprehensive guide, we will delve into the multifaceted world of incentive campaigns, exploring their intricacies, design strategies, and the keys to building sustainable Web3 ecosystems.

At the core of Web3 lies the concept of social tokens, unique assets created by communities to incentivize and reward members for their contributions. These tokens serve as tangible representations of involvement within the community, granting users a sense of pride and ownership. More than mere digital assets, they symbolize membership and hold real value within the community's ecosystem.

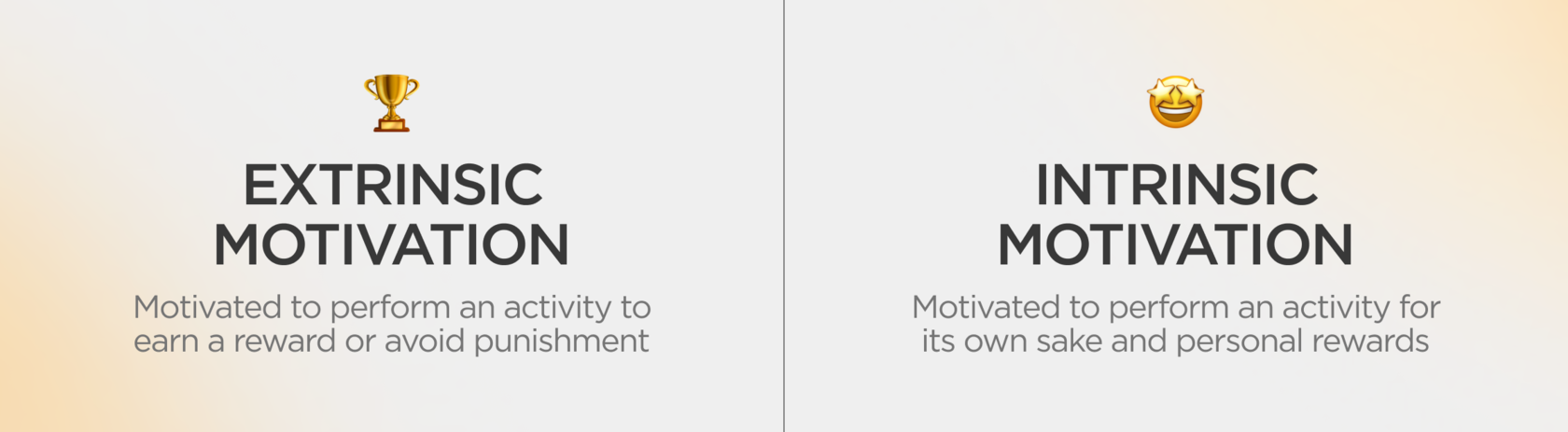

Incentive campaigns in Web3 are carefully crafted initiatives designed to motivate community members to participate actively and contribute meaningfully. While traditional financial incentives like tokens, airdrops, and staking rewards have proven to be effective, the true magic of incentive campaigns lies in tapping into intrinsic motivations. By creating a sense of achievement, purpose, and belonging, these campaigns foster deeper and more meaningful engagement.

Incentive campaigns in Web3 are carefully crafted initiatives designed to motivate community members to participate actively and contribute meaningfully. While traditional financial incentives like tokens, airdrops, and staking rewards have proven to be effective, the true magic of incentive campaigns lies in tapping into intrinsic motivations. By creating a sense of achievement, purpose, and belonging, these campaigns foster deeper and more meaningful engagement.

Crafting effective incentive campaigns requires a thoughtful approach, considering the community's goals, target audience, and desired behaviors. Here are some key aspects to ponder:

1. The Goal of Incentives: Determine the primary focus – increasing liquidity, enhancing community engagement, or strengthening governance.

2. Understanding the Target Audience: Define the 'contributor persona' and tailor incentives to cater to their preferences and motivations.

3. Types of Incentives: Explore a variety of incentives, including liquid tokens, NFTs, reputation points, voting power, and access to exclusive features.

4. Incentive Structure: Decide on the distribution model, vested periods, and tiered allocation to reward different levels of contributions.

5. Balance Extrinsic and Intrinsic Incentives: Strive for a delicate balance between extrinsic rewards for liquidity and intrinsic rewards for sustained engagement.

1. The Goal of Incentives: Determine the primary focus – increasing liquidity, enhancing community engagement, or strengthening governance.

2. Understanding the Target Audience: Define the 'contributor persona' and tailor incentives to cater to their preferences and motivations.

3. Types of Incentives: Explore a variety of incentives, including liquid tokens, NFTs, reputation points, voting power, and access to exclusive features.

4. Incentive Structure: Decide on the distribution model, vested periods, and tiered allocation to reward different levels of contributions.

5. Balance Extrinsic and Intrinsic Incentives: Strive for a delicate balance between extrinsic rewards for liquidity and intrinsic rewards for sustained engagement.

Share this post:

What is cool about token incentives?

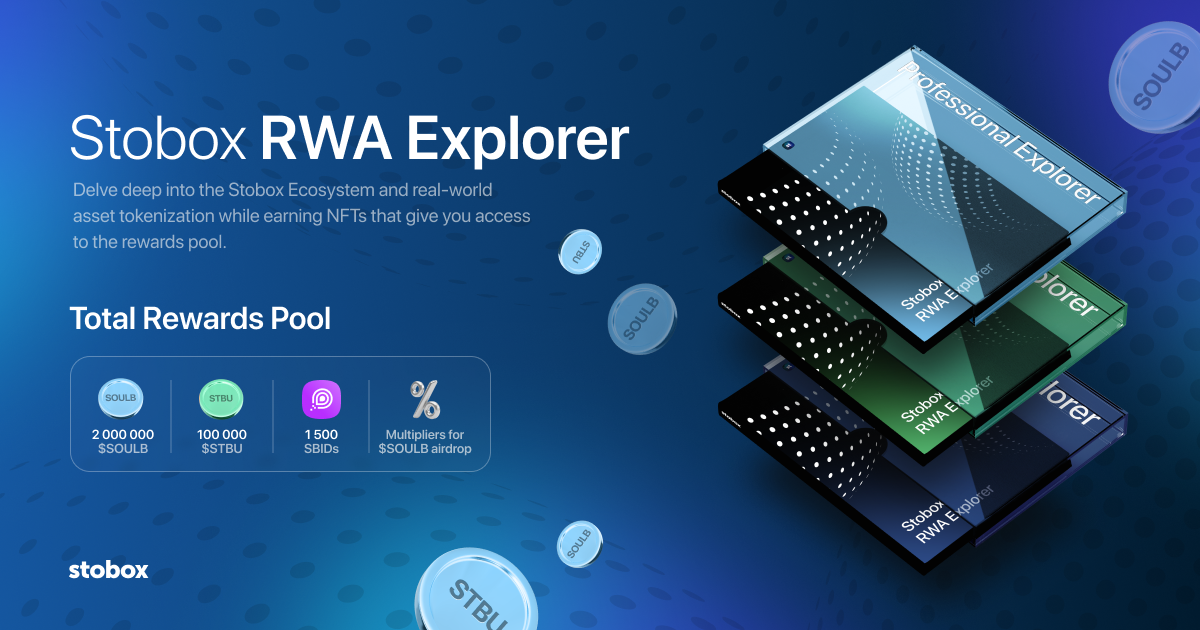

This campaign was created to educate new community members on what RWA is and how Stobox is revolutionizing the world through the tokenization of real-world assets.

Since we live in an era of rapid consumption, in order to keep the members on their toes with the amount of information and quests, we divided everything into 3 phases (2 weeks for each). It is also worth noting that new participants can still take part in the previous phases, after opening new ones - this way we increase the conversion rate for new users.

We have chosen Zealy as our platform. And also on Galxe participants can claim NFT.

For this campaign, we have prepared impressive prizes - a $100,000 total rewards pool.

In this way we:

Since we live in an era of rapid consumption, in order to keep the members on their toes with the amount of information and quests, we divided everything into 3 phases (2 weeks for each). It is also worth noting that new participants can still take part in the previous phases, after opening new ones - this way we increase the conversion rate for new users.

We have chosen Zealy as our platform. And also on Galxe participants can claim NFT.

For this campaign, we have prepared impressive prizes - a $100,000 total rewards pool.

In this way we:

- Educate new users on what is RWA and why is it the future.

- Explain who Stobox is, and give more information about the brand in portions so that people want to be involved.

- Motivate HODL tokens, as it gives cool utility for users.

Token distribution is the most popular way to get the community involved in a project. Let's dive deeper and try to understand why it works so well and how to use it.

Uniswap's UNI Airdrop

The Airdrop Model: More Than Free Tokens

Airdrops have emerged as popular methods to bootstrap communities and reward users for their involvement. However, the success of an airdrop campaign goes beyond the initial excitement; it lies in the long-term engagement and commitment of its recipients.

$RARE, $GTC, and $ENS are prime examples of airdrops that extended beyond financial utility. These tokens were carefully designed to empower the community, granting token holders a stake in governance and decision-making processes. Consequently, many recipients held onto their tokens and actively participated in shaping the respective projects.

$RARE, $GTC, and $ENS are prime examples of airdrops that extended beyond financial utility. These tokens were carefully designed to empower the community, granting token holders a stake in governance and decision-making processes. Consequently, many recipients held onto their tokens and actively participated in shaping the respective projects.

Extrinsic vs. Intrinsic Incentives

While extrinsic incentives like staking can drive short-term engagement, they may not foster long-term commitment. In contrast, intrinsic incentives can be potent motivators that extend beyond financial gains. Initiatives like freeRossDAO and ConstitutionDAO serve as prime examples of how intrinsic values can inspire community members to contribute selflessly to causes they believe in.

case Studies: Successful Incentive Campaigns in Web3

Uniswap, one of the leading decentralized exchanges, conducted an airdrop in 2020, distributing 400 UNI tokens to each user who had ever interacted with the protocol. This move resulted in a massive influx of users and liquidity to the platform. This is still considered one of the most successful Incentive Campaigns of all time on Web3.

Stobox x Cryptorsy: RWA Explorer campaign

- 1. Tokens: Better Than Cash

- 2. Tokens vs. ESOP

Outcomes that token incentives help achieve

Token incentives offer a range of positive outcomes for networks and users alike:

1. Low-Cost Network Bootstrapping: Instead of throwing money into uncertain ads, token incentives engage users by offering them ownership and involvement, leading to potential viral growth.

2. Great User Retention: Properly designed token incentives that align with users' needs encourage them to stay in the network for the long term.

3. Effective Community-Based Marketing: By aligning token incentives within the community, networks increase their chances of fast viral growth.

4. Driving High-Quality Content Creation: Incentivizing creators with tokens leads to valuable and engaging content, which is crucial for marketing success.

5. Financing: Token incentives attract "smart money" investors, providing more perks than traditional venture deals.

1. Low-Cost Network Bootstrapping: Instead of throwing money into uncertain ads, token incentives engage users by offering them ownership and involvement, leading to potential viral growth.

2. Great User Retention: Properly designed token incentives that align with users' needs encourage them to stay in the network for the long term.

3. Effective Community-Based Marketing: By aligning token incentives within the community, networks increase their chances of fast viral growth.

4. Driving High-Quality Content Creation: Incentivizing creators with tokens leads to valuable and engaging content, which is crucial for marketing success.

5. Financing: Token incentives attract "smart money" investors, providing more perks than traditional venture deals.

What are tokens given out for?

Conclusion

Co-development

Mining activity

Co-creation

Data sharing

Investment

Other “X-to-earn” activities

You can reward users for different activities. Here are some you should consider using.

Incentive campaigns lie at the heart of successful Web3 communities. By understanding the nuances of intrinsic and extrinsic motivations, communities can foster engagement, attract contributors, and build closed economies of value generators. As the Web3 ecosystem continues to evolve, well-designed incentives will define the culture and success of tomorrow's decentralized communities. Embrace the potential of incentives and design a future where everyone contributes, benefits, and truly owns their Web3 journey.

As the digital frontier expands, mastering the art of incentive campaigns will set you apart as a true champion in this electrifying Web3 era. So, embrace the power of incentives and embark on a journey of engagement, growth, and shared success!

As the digital frontier expands, mastering the art of incentive campaigns will set you apart as a true champion in this electrifying Web3 era. So, embrace the power of incentives and embark on a journey of engagement, growth, and shared success!

Network development can be categorized into three main groups based on the regularity and level of dedication: leading, active, and peripheral developers. Leading developers are those who play a guiding role in the project, have been consistently involved for a significant period, and have made substantial contributions. Active and peripheral developers, on the other hand, participate less frequently. Active developers regularly contribute new code to modify the source, whereas peripheral developers do so sporadically and primarily for specific task-solving purposes.

As of the current date, there are over 130,000 open-source blockchain projects available on GitHub for collaborative development. Each project employs different methods to incentivize developers, providing various motivations for their contributions.

As of the current date, there are over 130,000 open-source blockchain projects available on GitHub for collaborative development. Each project employs different methods to incentivize developers, providing various motivations for their contributions.

In proof-of-work (PoW)-related networks, miners usually receive two types of rewards: new coins created with each new block and transaction fees from all the transactions included in the block. To earn this reward, the miners compete to solve a complicated mathematical problem based on a cryptographic hash algorithm.

Well-written and captivating content plays a vital role in modern marketing. Content proves to be more effective in achieving better brand awareness, building strong user relationships, and converting them into loyal customers compared to traditional advertisements. Unlike ads, which lose their impact after the campaign period, content has a lasting and higher return on investment. Recognizing the tremendous potential of content, blockchain networks actively encourage digital creators to generate videos, photos, graphics, blogs, and other forms of content, distributing them across platforms like YouTube, Reddit, Discord, etc., to increase traffic. In addition to content creation, incentives are also provided for content promotion and moderation.

Co-creation extends beyond just content creation. It involves the act of sharing personal data, which significantly contributes to shaping and improving a network, fostering innovation, and generating income. Data sharing is crucial for the success of most network and platform projects.

Currently, there are limited ways of incentivizing investors in the crypto space. The most common methods include providing discounts during token sales and employing burning mechanics to increase the token value by reducing its supply.

However, a new form of investor reward has emerged recently, known as "success tokens." These tokens combine two elements: the project token and a call option on that token. Instead of offering a discount to VC investors, they are provided with a call option alongside their token purchase. This means that the option becomes valuable only if the project's token price rises significantly, aligning incentives with the project's success. In this approach, VC investors receive a "bonus" only when the project performs well, benefiting the entire community. This mechanism bears some resemblance to the convertible loan mechanism used in traditional venture deals.

Another strategy to incentivize investors is to offer the possibility of earning passive income on their holdings. Two popular methods in the DeFi segment are staking and yield farming.

However, a new form of investor reward has emerged recently, known as "success tokens." These tokens combine two elements: the project token and a call option on that token. Instead of offering a discount to VC investors, they are provided with a call option alongside their token purchase. This means that the option becomes valuable only if the project's token price rises significantly, aligning incentives with the project's success. In this approach, VC investors receive a "bonus" only when the project performs well, benefiting the entire community. This mechanism bears some resemblance to the convertible loan mechanism used in traditional venture deals.

Another strategy to incentivize investors is to offer the possibility of earning passive income on their holdings. Two popular methods in the DeFi segment are staking and yield farming.

The sky's the limit for the types of users' activities that can fall under incentivizing. Apart from those described above, the Web3 economy keeps constantly experimenting and offering new motivational designs that could be broadly named "x-to-earn" incentives.

These are participate/play/learn-to-earn) (network participants, community members), contribute-to-earn (bounty hunters, service contractors), invest-to-earn (token holders), work-to-earn, and the like. They are all examples of community members participating as individual value providers based on their unique skills and earning income for their contributions.

These are participate/play/learn-to-earn) (network participants, community members), contribute-to-earn (bounty hunters, service contractors), invest-to-earn (token holders), work-to-earn, and the like. They are all examples of community members participating as individual value providers based on their unique skills and earning income for their contributions.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL