Trump Era Market: Your Best Shot at Crypto?

30.01.2025

Vlad Svitanko

10 min

One of Trump’s latest executive orders is a bold declaration of intent, laying the foundation for a clear and decisive crypto policy and making good on his vow to make America the ‘crypto capital of the world.’

Last Thursday, Donald Trump signed one with a grand title Strengthening American Leadership in Digital Financial Technology, aimed to ‘support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy.’

The order establishes the President’s Working Group on Digital Asset Markets, led by newly appointed crypto and AI czar David Sacks.

Last Thursday, Donald Trump signed one with a grand title Strengthening American Leadership in Digital Financial Technology, aimed to ‘support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy.’

The order establishes the President’s Working Group on Digital Asset Markets, led by newly appointed crypto and AI czar David Sacks.

Donald Trump’s return to the White House has set the crypto world ablaze with optimism and possibilities.

Known for his unpredictable moves and headline-grabbing persona, Trump’s embrace of blockchain and AI serves as a powerful magnet for traditional institutions and retail investors alike.

The 45th—and now 47th—memecoin-wielding and highly controversial US president is poised to unleash the full potential of the web3 industry in the land of the free, eliminating the fears of crackdowns or outright prosecution that characterized the previous admin’s approach to legitimate innovation, communities, and investors.

Known for his unpredictable moves and headline-grabbing persona, Trump’s embrace of blockchain and AI serves as a powerful magnet for traditional institutions and retail investors alike.

The 45th—and now 47th—memecoin-wielding and highly controversial US president is poised to unleash the full potential of the web3 industry in the land of the free, eliminating the fears of crackdowns or outright prosecution that characterized the previous admin’s approach to legitimate innovation, communities, and investors.

Teng forecasts all-time market highs by the end of 2025, with clearer regulations under pro-crypto leadership, reducing hurdles for global expansion.

Conventional financial service providers are moving fast, many having prepared for this moment well in advance:

- Revolut (digital wallet or ‘neobank’) is reportedly launching a stablecoin.

- Stripe (payment processing platform) bought Bridge (stablecoinfor $1.1 billion.

- Visa launched its Tokenized Asset Platform.

One of the most significant shifts in the Trump era is the overhaul of the SEC.

Late Thursday, the SEC—now led by Acting Chair Mark Uyeda—decided to scrap SAB 121, the rule that treated customer-held crypto as liabilities and basically blocked banks from custodying digital assets.

Late Thursday, the SEC—now led by Acting Chair Mark Uyeda—decided to scrap SAB 121, the rule that treated customer-held crypto as liabilities and basically blocked banks from custodying digital assets.

So, another of the now President’s official say-sos does a total 180 on AI policy. He’s scrapping Biden-era restrictions and pushing for AI development ‘free from ideological bias’—which, in practice, means fewer regulatory chokeholds and more room for private-sector advancements.

This means AI devs no longer need to submit safety testing results for high-risk systems. Some see this as removing barriers to breakthroughs, others as rolling back protections—but either way, the US is making a definitive play to dominate AI under its new leadership.

On his second day in the Oval Office, the President issued a pardon for Ross Ulbricht, the founder of the Silk Road—a pioneering Tor and Bitcoin-powered marketplace.

The platform allowed users to trade goods, including drugs, aligning with Ulbricht’s libertarian beliefs, while excluding items like firearms. Ulbricht received two life sentences in prison without parole in 2015.

The platform allowed users to trade goods, including drugs, aligning with Ulbricht’s libertarian beliefs, while excluding items like firearms. Ulbricht received two life sentences in prison without parole in 2015.

On January 27, the United States Senate has also confirmed pro-crypto Scott Bessent as the new Treasury secretary.

Bessent is a strong advocate for crypto and blockchain adoption in financial markets. He has been outspoken in his opposition to a US CBDC (central bank digital currency) too.

Bessent is a strong advocate for crypto and blockchain adoption in financial markets. He has been outspoken in his opposition to a US CBDC (central bank digital currency) too.

For years, the Gary Gensler-led SEC’s (United States Securities and Exchange Commission) refusal to unambiguously define crypto asset categories, constant lawsuits, and vague regulations have stifled progress in the American crypto space—forcing projects offshore and leaving developers in limbo.

But Trump’s directives flip the script.

But Trump’s directives flip the script.

With the States leading the on-chain stage unshackled, other jurisdictions will have no choice but to join the Digital Gold Rush—or risk their financial culture becoming obsolete and simply unattractive to the new generation of asset holders.

For builders, investors, and enthusiasts, this is your signal. The stars are aligning, and the Trump era could mark the most exciting chapter for crypto yet.

For builders, investors, and enthusiasts, this is your signal. The stars are aligning, and the Trump era could mark the most exciting chapter for crypto yet.

Meanwhile, Bitcoin hit a new all-time high of $109,000.

About time.

Why It Matters

The release of Ross is a crucial assurance for trailblazing crypto founders: when building a product fueled by hope to create something disruptive, you won’t be held accountable for the misuse of your platform by users—especially when the decentralized nature of blockchain limits your control over their actions.

The release of Ross is a crucial assurance for trailblazing crypto founders: when building a product fueled by hope to create something disruptive, you won’t be held accountable for the misuse of your platform by users—especially when the decentralized nature of blockchain limits your control over their actions.

Richard Teng (Binance CEO)

The Endgame?

Silk Road Founder Freed

Cons

$TRUMP Implications

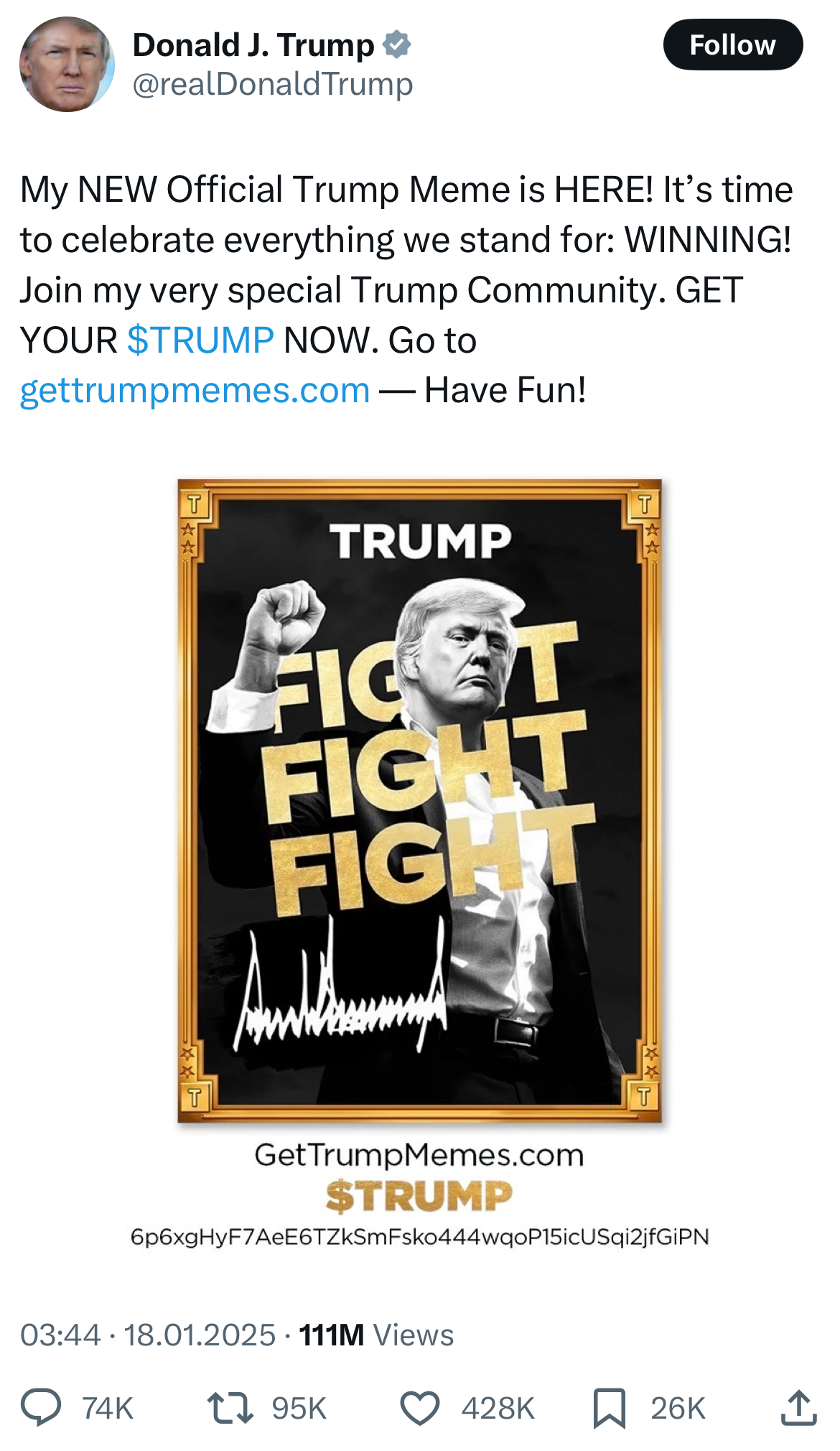

$TRUMP, Official US President Memecoin

Race to 50

Pro-Crypto Top Treasurer

Hype train or historic bull run? Time will tell—but the next four years look explosive for crypto.

- $1 billion raised in token sales, driven by the $TRUMP mania—despite initially falling short of the $300 million target with only $12.7m attracted —starting at an initial price of $0.05 as of January 2025.

Despite its ambitions, concerns exist around token non-transferability, insider influence, and transparency.

The reception of $TRUMP was either extremely positive or highly skeptical. So is it good or bad for crypto?

$TRUMP pumped 1,010% before a brutal sell-off (same for $MELANIA), proving once again that buzz and volatility are crypto’s power couple.

One by one, states are waking up to the reality of an unprecedented digital gold standard.

But the real kicker is that there simply isn’t enough Bitcoin to go around. As states buy in, the supply shrinks, and the market reacts. Hard.

But the real kicker is that there simply isn’t enough Bitcoin to go around. As states buy in, the supply shrinks, and the market reacts. Hard.

Trump’s idea of a US national Bitcoin reserve is gaining a ton of traction at the state level too.

So far, at least 15 states have proposed legislation to establish their own ones (not all are listed below):

So far, at least 15 states have proposed legislation to establish their own ones (not all are listed below):

With Trump dubbing himself the 'crypto president' and industry heavyweights bracing for massive green candles and reaching ever more people’s portfolios, why shouldn’t you be bullish too?

It’s also fair to assume that stablecoins are about to go fully mainstream, and Bitcoin may firmly settle beyond $100K.

It’s also fair to assume that stablecoins are about to go fully mainstream, and Bitcoin may firmly settle beyond $100K.

Key industry players are buzzing about the further impact of Trump's admin on crypto.

So what are they saying? Here’s the lowdown:

So what are they saying? Here’s the lowdown:

Some say the current U.S. government, looking to make the most of what crypto has to offer as technology, views stablecoins as a key tool for reinforcing dollar supremacy. Trump is playing hardball, using tariffs to push other economies away from CBDCs.

Buckle up—the tokenized dollar race is heating up.

Buckle up—the tokenized dollar race is heating up.

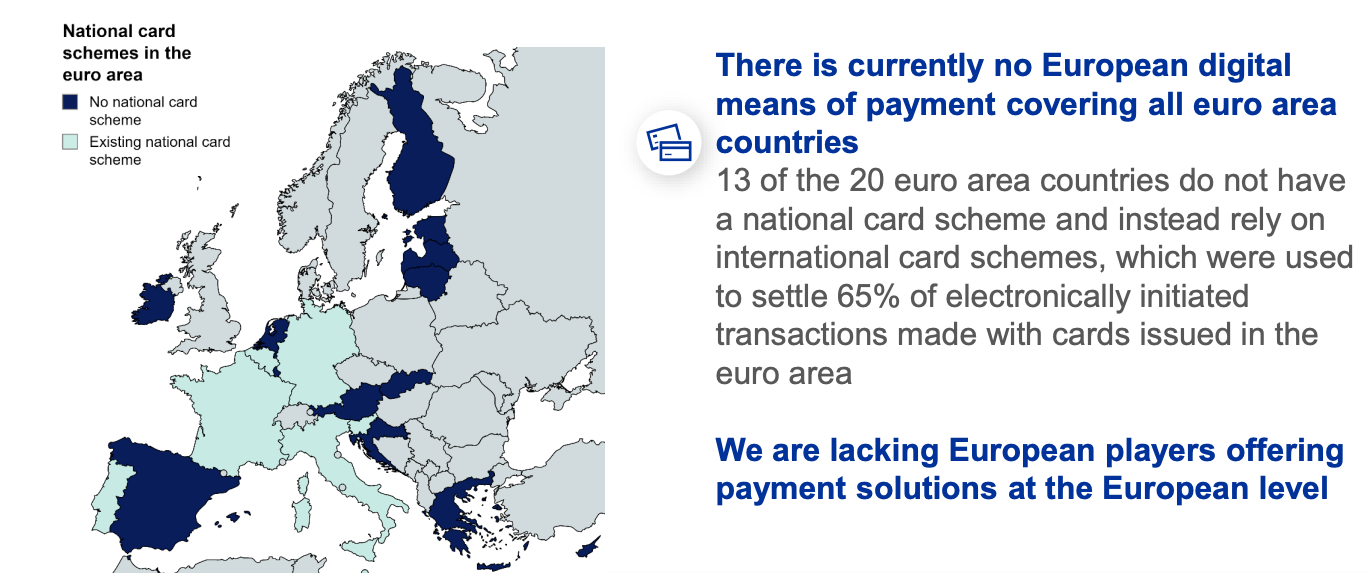

US-backed stablecoins already dominate 97% of the global market, so the European Union is pushing back with plans for a digital euro—CBDC, sigh…—to protect its financial autonomy, despite privacy concerns.

EU (Almost) Strikes Back

Now that Trump’s endorsement is in, issuers like Circle (USDC), Tether (USDT), and PayPal (PYUSD) are stepping up.

With even $BTC, $ETH, and $SOL—the three blue-chip coins—still too volatile for many payments, stablecoins pegged to assets like the US dollar provide much-needed predictability and stability while leading cryptos mature, integrate into TradFi (traditional finance), and reach broader everyday audience.

As we mentioned earlier, Trump just shook up the game on CBDCs—banning government-issued digital dollars and backing private dollar-backed stablecoins.

Under this revamped SEC, crypto projects will finally have an unobstructed path forward. Wall Street firms can explore tokenized securities, exchanges can confidently list tokens, and startups can focus on actually innovating rather than navigating regulatory ambiguity.

Donald Trump’s White House directed the development of an AI action plan within the next 6 months, led by OSTP (Office of Science and Technology Policy), OMB (Office of Management and Budget), the AI and crypto czar, and key presidential aides in national security, economic, and domestic policy.

The focus? ‘The policy of the United States to sustain and enhance America’s global AI dominance in order to promote human flourishing, economic competitiveness, and national security.’

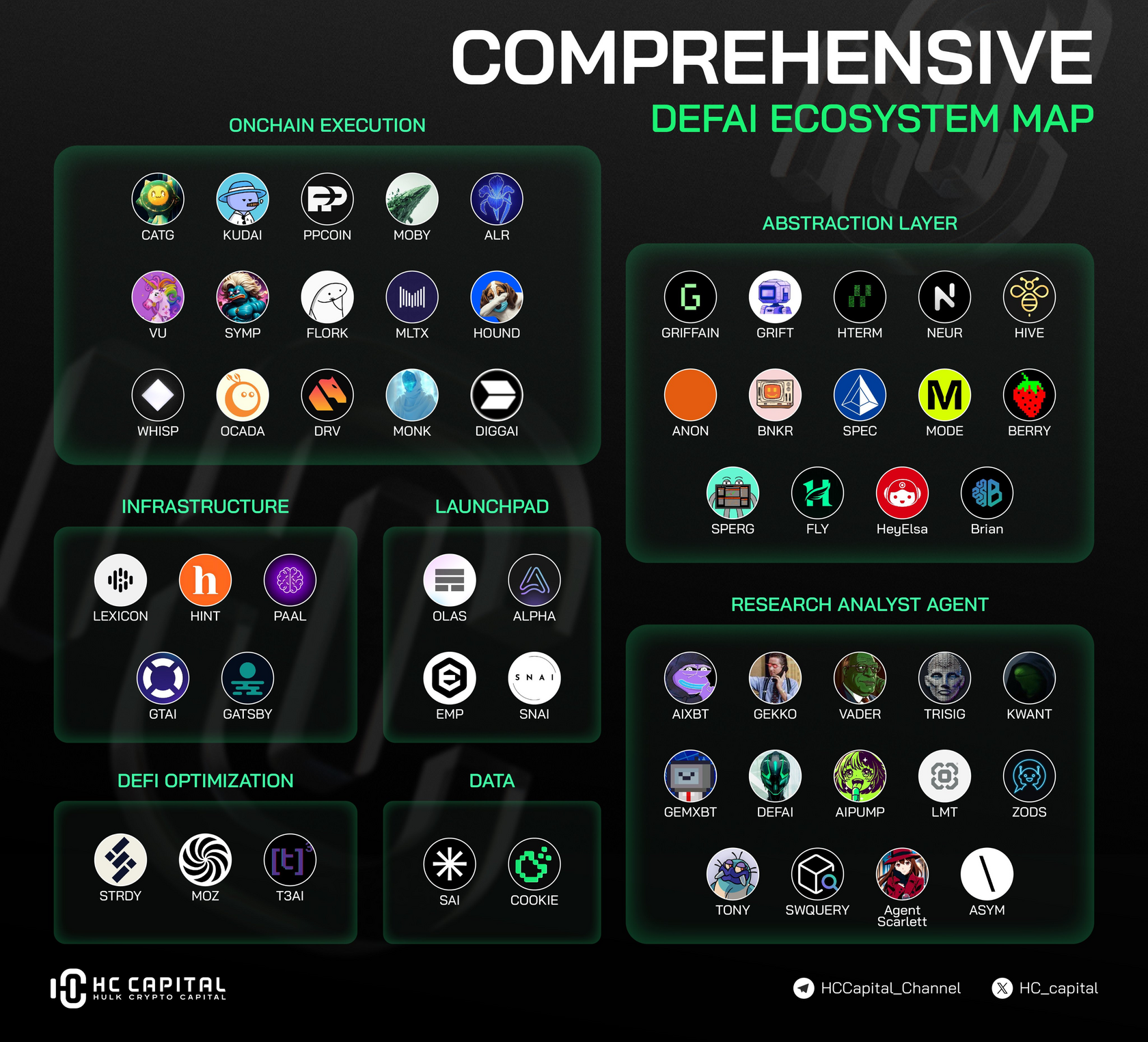

Right now, DeFAI builders are the ones commanding the strongest mindshare among both crypto retail and institutions.

With AI agent and engine coins surging to millions, practically becoming a brand-new memecoin segment, crypto has confirmed its status as THE launchpad for AI innovation.

Consider the arrest and conviction of a Tornado Cash co-founder—linked to a notorious crypto mixer used for both web privacy and, unfortunately, money laundering. One could argue that the risk of arbitrarily convicting someone who, by definition, lacks complete control over their on-chain product has significantly diminished today.

It provides the reassurance builders have been begging for while staying true to a pro-entrepreneurial ethos: whether you’re launching a community-driven token, building a DeFi (decentralized finance) protocol, or scaling a dApp (decentralized app), the US is finally set to address key issues like token classification and stablecoin guardrails, leveling the playing field for unrestrained growth.

Their mission? Craft a favorable federal regulatory framework for crypto and even explore the creation of a ‘national digital asset stockpile.’

US President’s Tokens - That’s a First

Strategic Bitcoin Reserves

Crypto Execs Bet Big

$tablecoin Might Cemented

SEC 2.0: Biblical Reboot

Billions for AI

Crypto Capital of the World

Source: CoinDesk

Source: Fortune

Source: Circle

Brian Armstrong (Coinbase CEO)

Come on in, the water’s nice!

And here’s the former Binance CEO and crypto OG—on par with Ethereum co-founder Vitalik Buterin—just quoted a guide on launching $TRUMP-like memecoins on BNB Chain.

- Massachusetts (Jan. 18): Proposed investing up to 10% of the rainy-day fund in Bitcoin.

- Wyoming (Jan. 18): Bill restricts Bitcoin investment to 3% of public funds, excluding other assets.

- Arizona (Jan. 27): Senate Finance Committee approved SB1025 to allocate up to 10% of public funds to BTC.

Senator Cynthia Lummis advocating for a national Bitcoin reserve, just like the ones for gold or oil:

- Buy 200,000 BTC annually for 5 years.

- Hold for at least 20 years.

- Goal: Halve the US national debt in 20 years.

- Pennsylvania (Nov. 2024): Proposed a bill to invest up to 10% of state funds in Bitcoin.

- Florida (Dec. 2024): Lawmakers and Gov. DeSantis support a Bitcoin reserve, expected by early 2025.

- Texas (Dec. 2024): Introduced SB 778 to establish a separate Bitcoin reserve and accept BTC donations.

- Ohio (Dec. 2024): Bill grants the State Treasurer authority to purchase Bitcoin anytime.

- North Dakota (Jan. 10): Proposed a resolution to allocate state funds to digital assets.

- New Hampshire (Jan. 10): Bill allows treasury investments in Bitcoin, with provisions for lending/staking.

- Oklahoma (Jan. 15): HB 1203 permits BTC and other digital assets with a $500M+ market cap.

- Utah (Jan. 21): Proposed 10% allocation to Bitcoin and stablecoins. House Committee approved 5%.

Armstrong foresees Bitcoin surpassing gold’s $18 trillion market cap within 5-10 years, fueled by a strategic US Bitcoin reserve.

He calls this the start of a digital arms race and expects major institutional adoption.

He calls this the start of a digital arms race and expects major institutional adoption.

Source: Circle

Executive Takeaway

Jeremy Allaire (Circle CEO)

Allaire predicts imminent crypto-friendly banking policies, including banks trading and holding crypto.

He’s pushing to ease SEC regulations and make stablecoins the bridge between crypto and fiat finance.

He’s pushing to ease SEC regulations and make stablecoins the bridge between crypto and fiat finance.

An excerpt from Piero Cipollone’s CBDC report issued on Jan. 17, 2025. Source: ECB

Source: B2BinPay

Source: Sequoia Capital

Source: CryptoNinjas

But here’s the real plot twist: the SEC just rolled out its own crypto task force to build a legit and functional regulatory framework.

And leading the charge? None other than Hester Peirce, aka Crypto Mom—one of the few regulators who’s actually been pro-crypto for quite a while.

And leading the charge? None other than Hester Peirce, aka Crypto Mom—one of the few regulators who’s actually been pro-crypto for quite a while.

Source: The Woodard Report

Source: BBC

Source: KOMO News

Trump’s team is putting a whopping $500 billion into AI research, dialing in on its integration with blockchain. This includes on-chain AI agents running predictive analytics, automating market research and trading, facilitating fraud detection, and much more—tangible use cases already reshaping DeFi into DeFAI (DeFi + AI).

Source: The White House Website

- Uncertain long-term sustainability.

- 80% of supply controlled by Trump's team.

- Potential for corruption, as per Vitalik Buterin, Ethereum co-founder.

In another Trump-linked bombshell, Trump Media & Technology Group (TMTG) yesterday shared that it’s making a $250 million bet on crypto with the launch of Truth.Fi, a fintech venture jumping into DeFi, BTC, and custom ETFs.

The firm—already deep in web3 waters with Truth Social and World Liberty Financial that we covered above—says this is just the next step in its ‘American-first’ approach to finance.

Thruth.Fi will collaborate with the Charles Schwab Corporation (financial services company), who will ‘broadly advise’ on investments and strategy, as well as custody the funds allocated by TMTG.

Devin Nunes, the group’s CEO, described the launch as ‘another step toward our goal of creating a robust ecosystem through which American patriots can protect themselves from the ever-present threat of cancellation, censorship, debanking, and privacy violations committed by Big Tech and woke corporations.’

The firm—already deep in web3 waters with Truth Social and World Liberty Financial that we covered above—says this is just the next step in its ‘American-first’ approach to finance.

Thruth.Fi will collaborate with the Charles Schwab Corporation (financial services company), who will ‘broadly advise’ on investments and strategy, as well as custody the funds allocated by TMTG.

Devin Nunes, the group’s CEO, described the launch as ‘another step toward our goal of creating a robust ecosystem through which American patriots can protect themselves from the ever-present threat of cancellation, censorship, debanking, and privacy violations committed by Big Tech and woke corporations.’

Truth.Fi

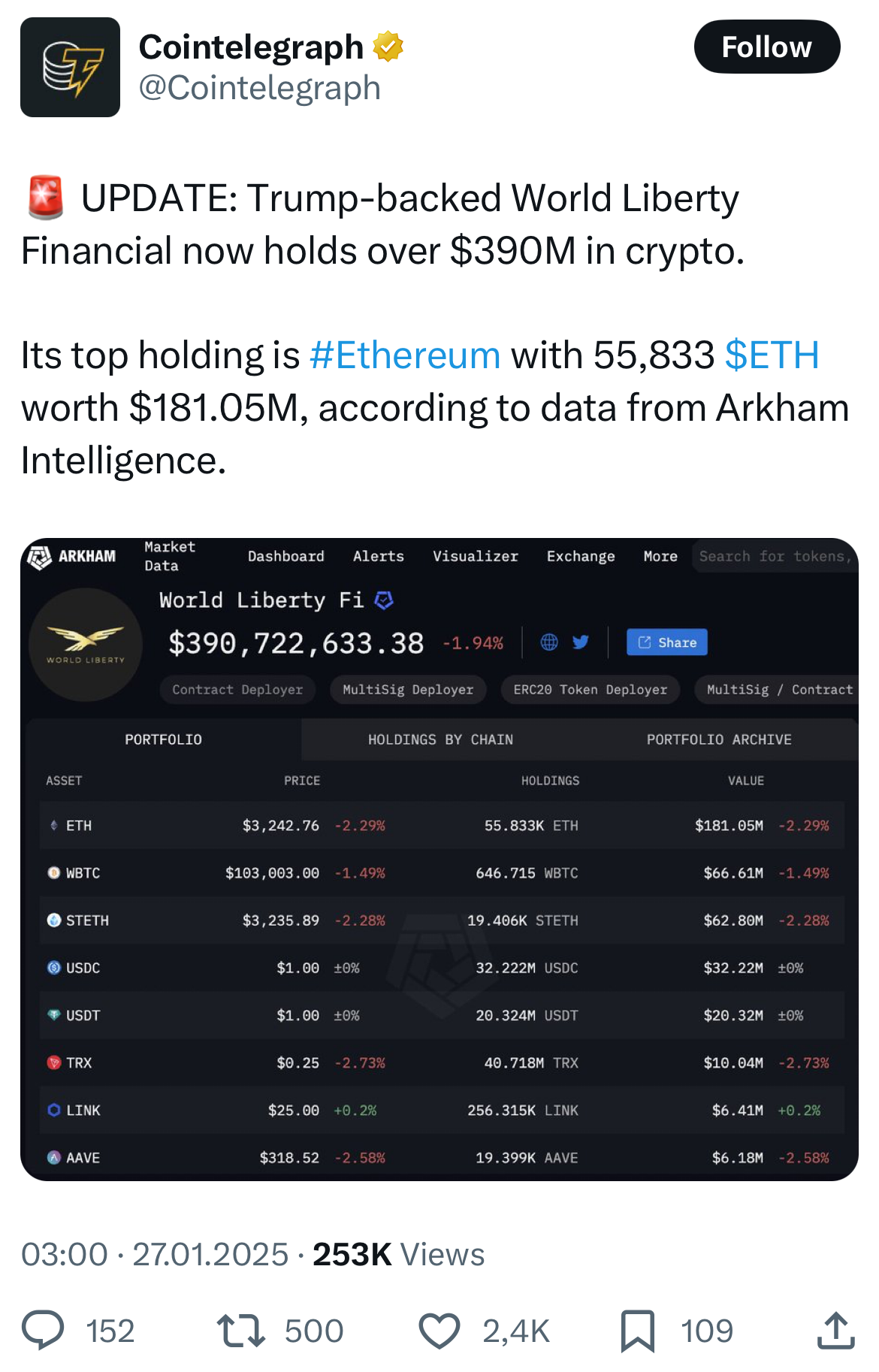

World Liberty Financial ($WLFI) is a decentralized lending and borrowing platform built on Aave v3 (renowned lending protocol), with a focus on promoting USD-pegged stablecoins and reinforcing America’s position in global finance.

While the project leverages the Trump brand for visibility, his role remains symbolic.

Key aspects of the platform:

While the project leverages the Trump brand for visibility, his role remains symbolic.

Key aspects of the platform:

- Governance-Focused Tokens Non-transferable, used solely for protocol decisions.

- Security Partnerships Collaborating with RWA tokenization facilitators like Chainlink for its oracle networks to secure lending markets and enable cross-chain connectivity, indicating a push toward broader DeFi integration.

- Major Market Activity Holding 62,902 ETH ($195 million) as part of its broader DeFi strategy, with a total Ethereum network portfolio valued at around $395 million.

$WLFI: DeFi, Trump-Style

- The most viral memecoin by mindshare, growth rate, and market cap.

- Brings mainstream attention (even your mechanic was asking about Solana, huh?)

- Serves as a gauge of Trump’s influence and performance.

Pros

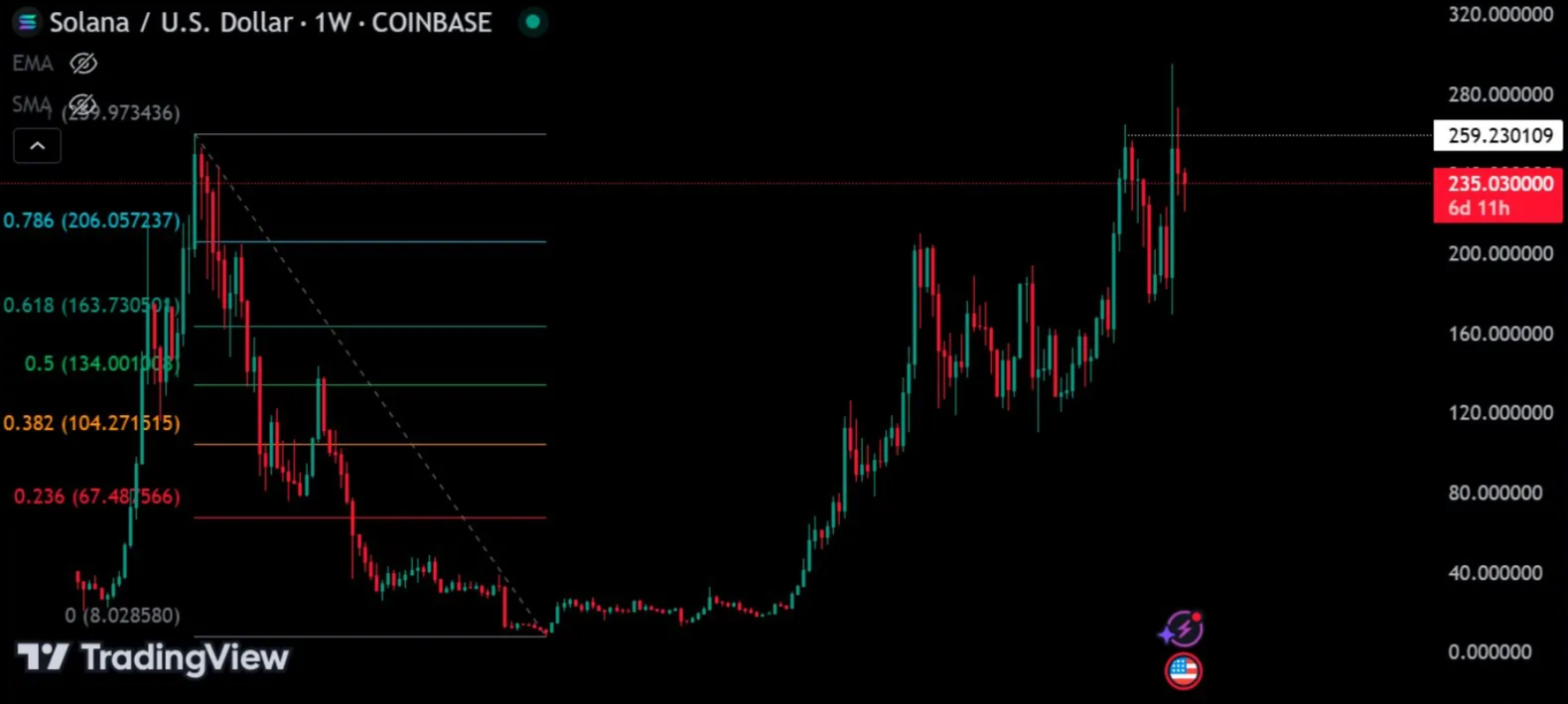

After the launch and into the Trump inauguration, $SOL skyrocketed, reaching a historical high of $296, before cooling off.

Meanwhile, the memeable madness didn’t stop there.

Enter $MELANIA, the First Lady’s own digital token, adding fuel to an already raging fire.

Enter $MELANIA, the First Lady’s own digital token, adding fuel to an already raging fire.

That kind of meme launch? Unheard of.

On January 17, Donald Trump did what nobody— not even the crypto community— seriously expected: he dropped his official memecoin.

Just days before his inauguration, the $TRUMP token launched on the Solana blockchain, sparking a trading frenzy that made both OG memes and the 2024 mania look tame.

The hype was instant. Rapid listings on tier-1 exchanges like Binance, Coinbase, and Bybit sent $TRUMP to a $75 ATH, a staggering $15 billion market cap, and nearly $73 billion in trading volume.

Just days before his inauguration, the $TRUMP token launched on the Solana blockchain, sparking a trading frenzy that made both OG memes and the 2024 mania look tame.

The hype was instant. Rapid listings on tier-1 exchanges like Binance, Coinbase, and Bybit sent $TRUMP to a $75 ATH, a staggering $15 billion market cap, and nearly $73 billion in trading volume.

Well, if 15 states weren’t enough, Fred Thiel, CEO of MARA Holdings (a leading BTC mining company), just announced a bold plan: Strategic Bitcoin Reserves in all 50 US states.

MARA Holdings is already teaming up with advocacy groups and collaborating with the Trump admin to make it happen.

MARA Holdings is already teaming up with advocacy groups and collaborating with the Trump admin to make it happen.

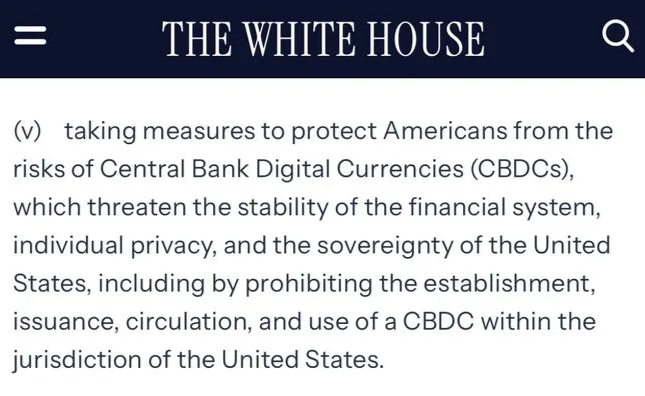

The outright rejection of any form of CBDC by the United States is one more key takeaway from Donald Trump’s recent executive orders, we should note.

Unlike stablecoins, launched by private companies, this type of digital dollar would enable government surveillance of every transaction, critics argue.

Unlike stablecoins, launched by private companies, this type of digital dollar would enable government surveillance of every transaction, critics argue.

CBDC Shall Not Pass

Source: Cointelegraph

Source: CDO Magazine

Source: HC - Capital on Twitter

Source: MSNBC

Also learn how to leverage the AI narrative in crypto to scale your project here: https://cryptorsy.io/blog/100m-launch

As Bitcoin rides toward new ATHs, the entire crypto market will follow suit before long, which is our main point here.

Translation: the US government might soon be holding (as opposed to mandatorily selling) seized BTC, Ethereum, and even tokens like $FTT from FTX’s infamous collapse.

A supreme boost for the latter.

Did you know how quickly Bitcoin is advancing toward DeFi inclusion?

Check it out here: https://cryptorsy.io/blog/bitcoin-ecosystem

Check it out here: https://cryptorsy.io/blog/bitcoin-ecosystem

About Bitcoin, just below.

Why It Matters

Trump’s decree fast-tracks stablecoin regulations and positions them as key payment tools, especially in emerging markets.

White House crypto czar David Sacks sees them extending the dollar’s global dominance.

Trump’s decree fast-tracks stablecoin regulations and positions them as key payment tools, especially in emerging markets.

White House crypto czar David Sacks sees them extending the dollar’s global dominance.

Read our in-depth take on AI agents here: https://cryptorsy.io/blog/ai-agents

AI-Fueled Crypto Supercycle Is Real

The crypto supercycle is here, and the window to dominate is now.

Got a killer meme idea, disruptive AI agent, or DeFi powerhouse? At Cryptorsy, we’ve got the expertise, AI-driven strategies, and firepower to get you there.

Don’t just watch DeFAI history unfold—be part of it.

See ya at the top!

Got a killer meme idea, disruptive AI agent, or DeFi powerhouse? At Cryptorsy, we’ve got the expertise, AI-driven strategies, and firepower to get you there.

Don’t just watch DeFAI history unfold—be part of it.

See ya at the top!

Eric Trump, the president’s son, recently teased the possibility of ZERO capital gains tax for US-based crypto projects like Ripple ($XRP) and Hedera ($HBAR). This would pave the way for bolder ventures and bigger profits with fewer tax burdens.

With pro-crypto policies, market momentum, and growing global interest—now’s the time to build, launch, scale… and ape, baby, ape!

With pro-crypto policies, market momentum, and growing global interest—now’s the time to build, launch, scale… and ape, baby, ape!

Let’s Build Together

Whether Trump is riding the sizzling hype fueled by the crypto and AI hope markets or genuinely captivated by decentralized community strength, tokenization, and DeFi, speculation abounds.

But this much is crystal clear: as the 'first Bitcoin president,' his globally viral personality and foray into the memecoin frenzy are onboarding unprecedented numbers of people from all walks of life into web3. Be honest—your neighbor, even the most 'normie' one, has probably been asking about it.

This is monumental for crypto believers, reminiscent of the 1848 Gold Rush.

This administration is the first to truly be laying the groundwork for a long-term on-chain supercycle.

With regulatory clarity, institutional adoption, retail mania, and Bitcoin reserves setting the stage, the US—as the leading market driving global crypto trends—will finally catch up.

But this much is crystal clear: as the 'first Bitcoin president,' his globally viral personality and foray into the memecoin frenzy are onboarding unprecedented numbers of people from all walks of life into web3. Be honest—your neighbor, even the most 'normie' one, has probably been asking about it.

This is monumental for crypto believers, reminiscent of the 1848 Gold Rush.

This administration is the first to truly be laying the groundwork for a long-term on-chain supercycle.

With regulatory clarity, institutional adoption, retail mania, and Bitcoin reserves setting the stage, the US—as the leading market driving global crypto trends—will finally catch up.

SUBSCRIBE TO OUR BLOG

RELATED

Share this post:

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL