Jupiter Exchange Breakdown

06.03.2024

Gleb Specter

18 min

RELATED

HOW DID IT START?

DeFi projects frequently face challenges such as liquidity fragmentation and uneven token distribution. These issues can result in trading inefficiencies and raise concerns about centralization.

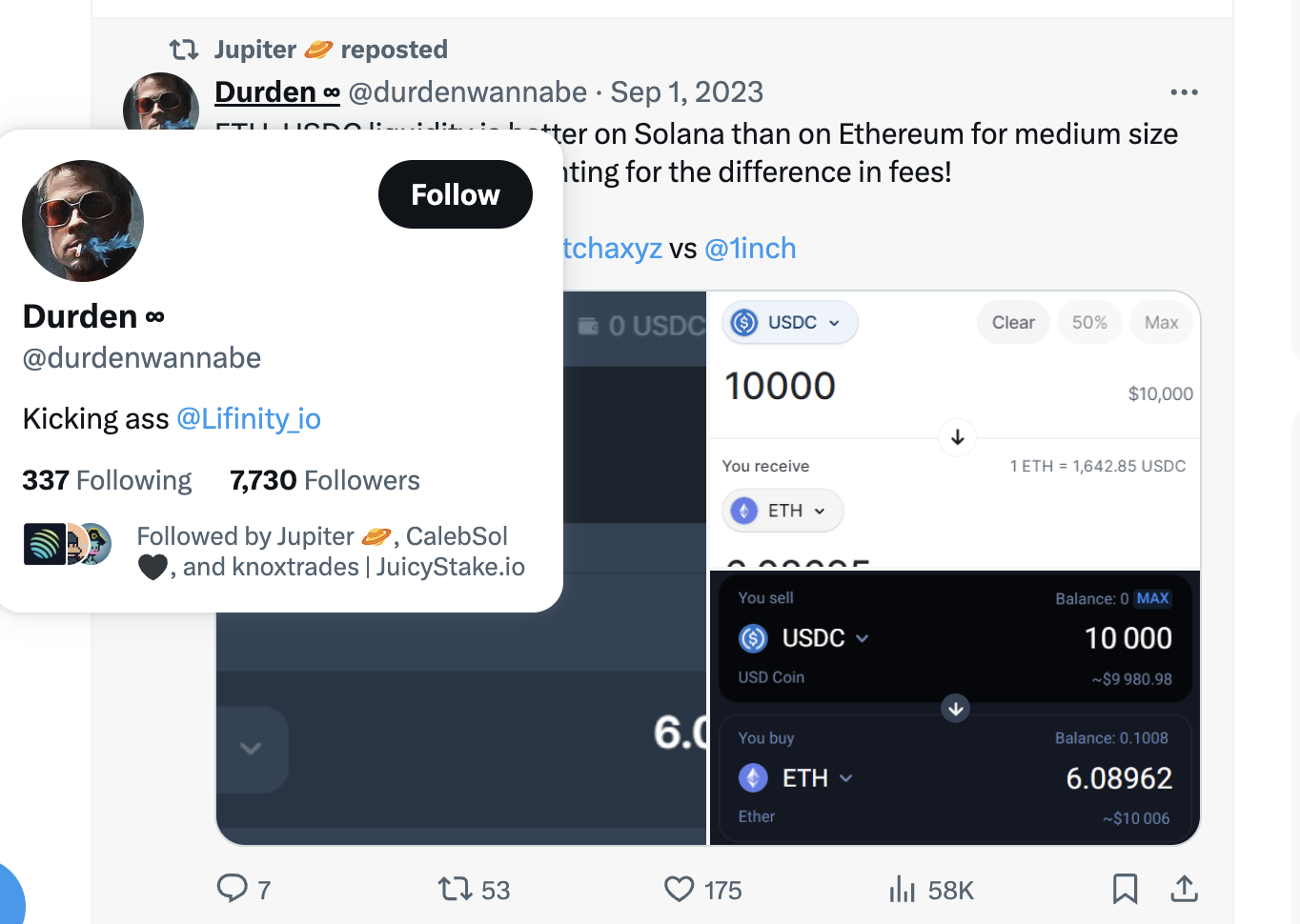

Jupiter, a liquidity aggregator built on Solana, addresses these challenges by consolidating liquidity from various decentralized exchanges. By doing so, it aims to enhance trade rates and minimize slippage for users. This strategy bears resemblance to that of 1inch, another popular liquidity aggregator, which also pools liquidity to optimize trades.

Jupiter, a liquidity aggregator built on Solana, addresses these challenges by consolidating liquidity from various decentralized exchanges. By doing so, it aims to enhance trade rates and minimize slippage for users. This strategy bears resemblance to that of 1inch, another popular liquidity aggregator, which also pools liquidity to optimize trades.

SUBSCRIBE TO OUR BLOG

Big demand + Existing ecosystem/Solutions = Growth opportunity

Share this post:

Jupiter emerged from New York in 2022 during a challenging market downturn, with Solana trading at $26. On May 27, 2022, Jupiter announced the closure of a $5 million seed funding round led by White Hilt Capital.

Interestingly, Jupiter secured additional funding from the same VC on October 10, 2023, when SOL was valued at $21 and on the brink of a significant surge.

It's worth noting White Hilt Capital, which isn't widely recognized as a top-tier fund. They have a modest portfolio, with only four investments to date, and primarily function as an asset management firm rather than a prolific venture capital firm.

So, we've dispelled rumors that suggest you need to secure investments from Tier 1 funds to lead an effective airdrop or generate hype.

Money, timing, and having an adequate core team are more than enough.

Interestingly, Jupiter secured additional funding from the same VC on October 10, 2023, when SOL was valued at $21 and on the brink of a significant surge.

It's worth noting White Hilt Capital, which isn't widely recognized as a top-tier fund. They have a modest portfolio, with only four investments to date, and primarily function as an asset management firm rather than a prolific venture capital firm.

So, we've dispelled rumors that suggest you need to secure investments from Tier 1 funds to lead an effective airdrop or generate hype.

Money, timing, and having an adequate core team are more than enough.

KICK-OFF

Right from the start, the Jupiter team's focus was on crafting a user-friendly product and making it accessible to all. They prioritized building a solid product foundation over generating hype.

Today, Jupiter is primarily a B2C product. However, their strategy of integrating existing platforms with liquidity and forging partnerships is evident and effective.

The effective marketing approach from the beginning has garnered Jupiter solid traction and invaluable feedback, refining the product to be sharp, relevant, and authentic.

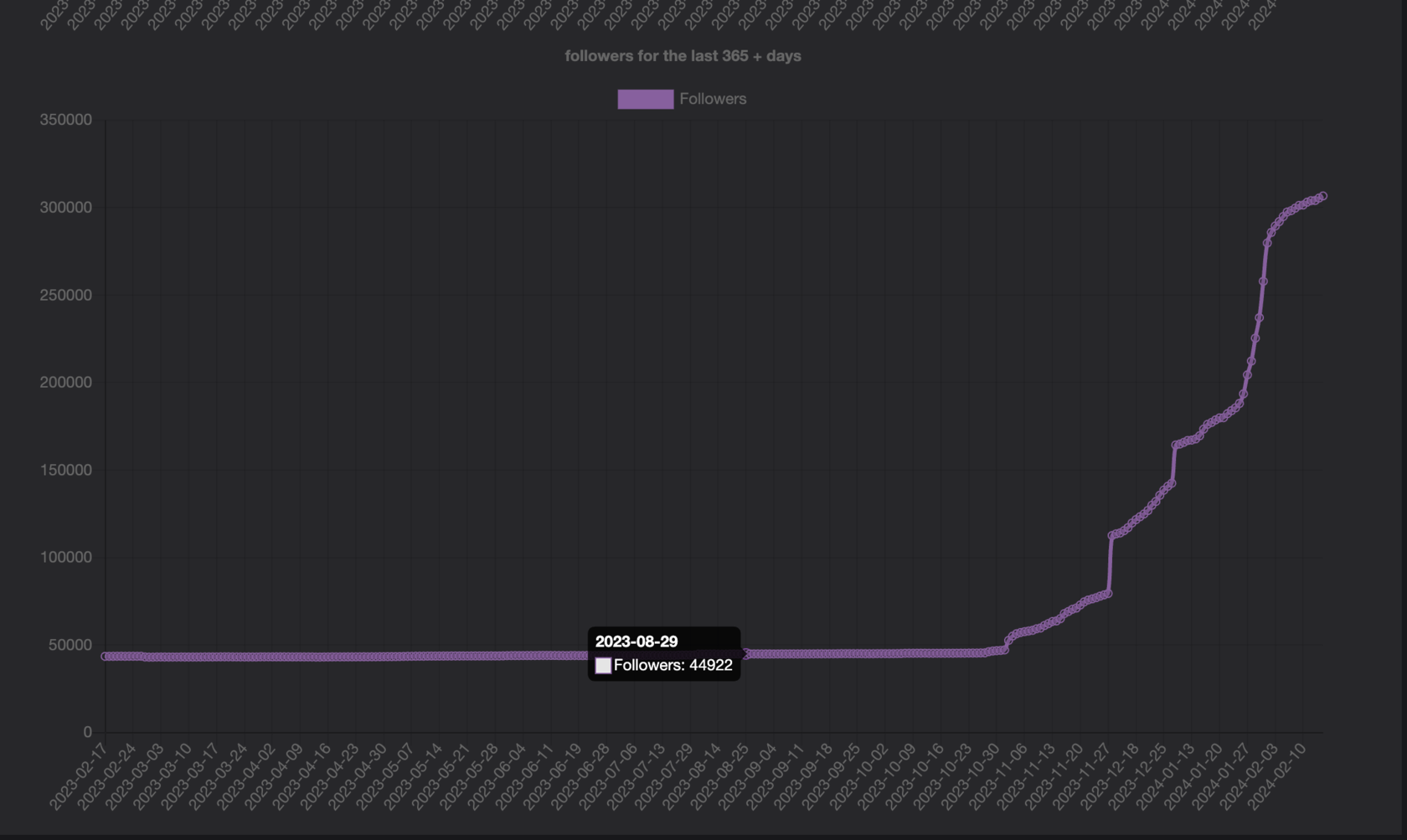

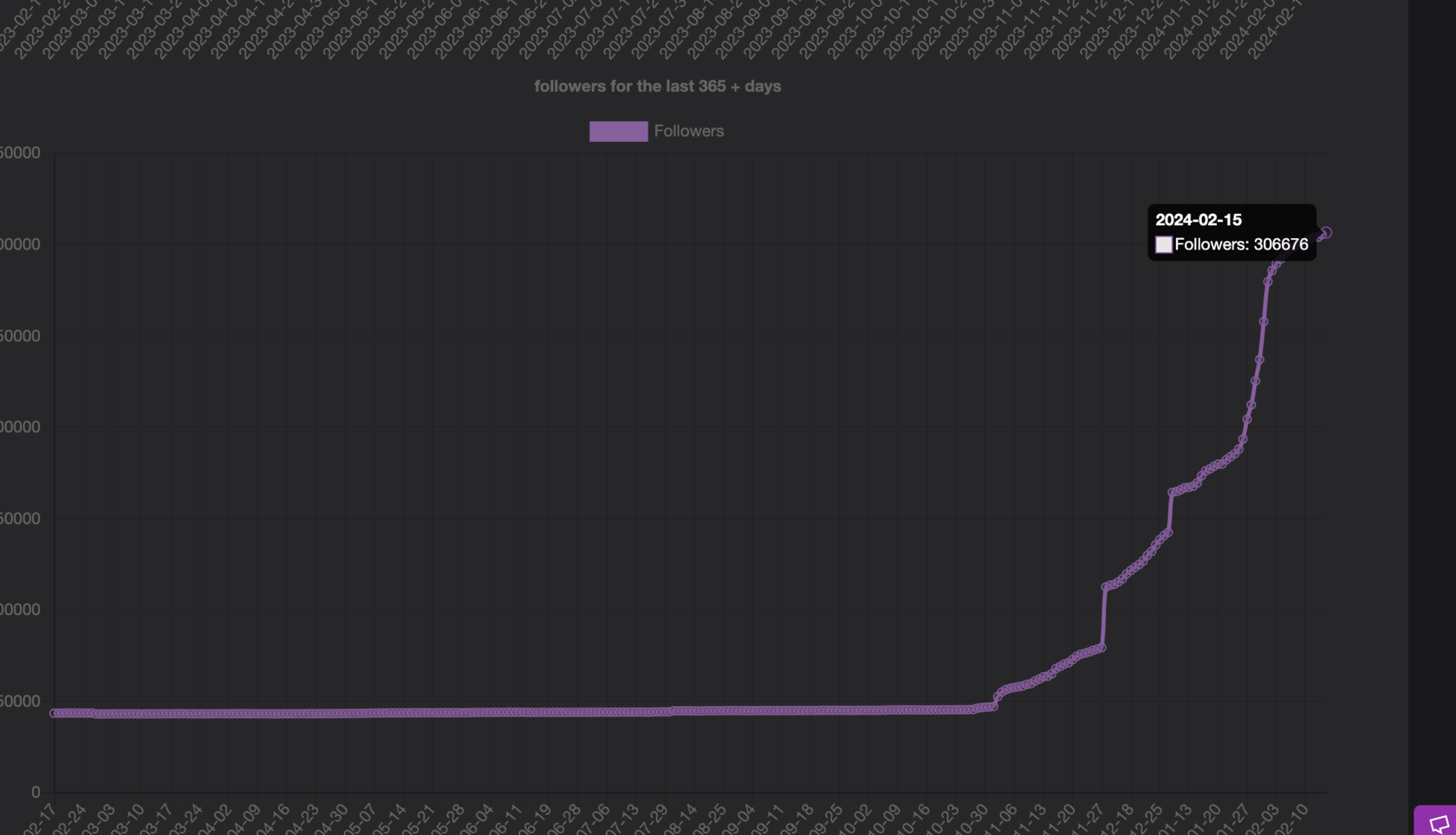

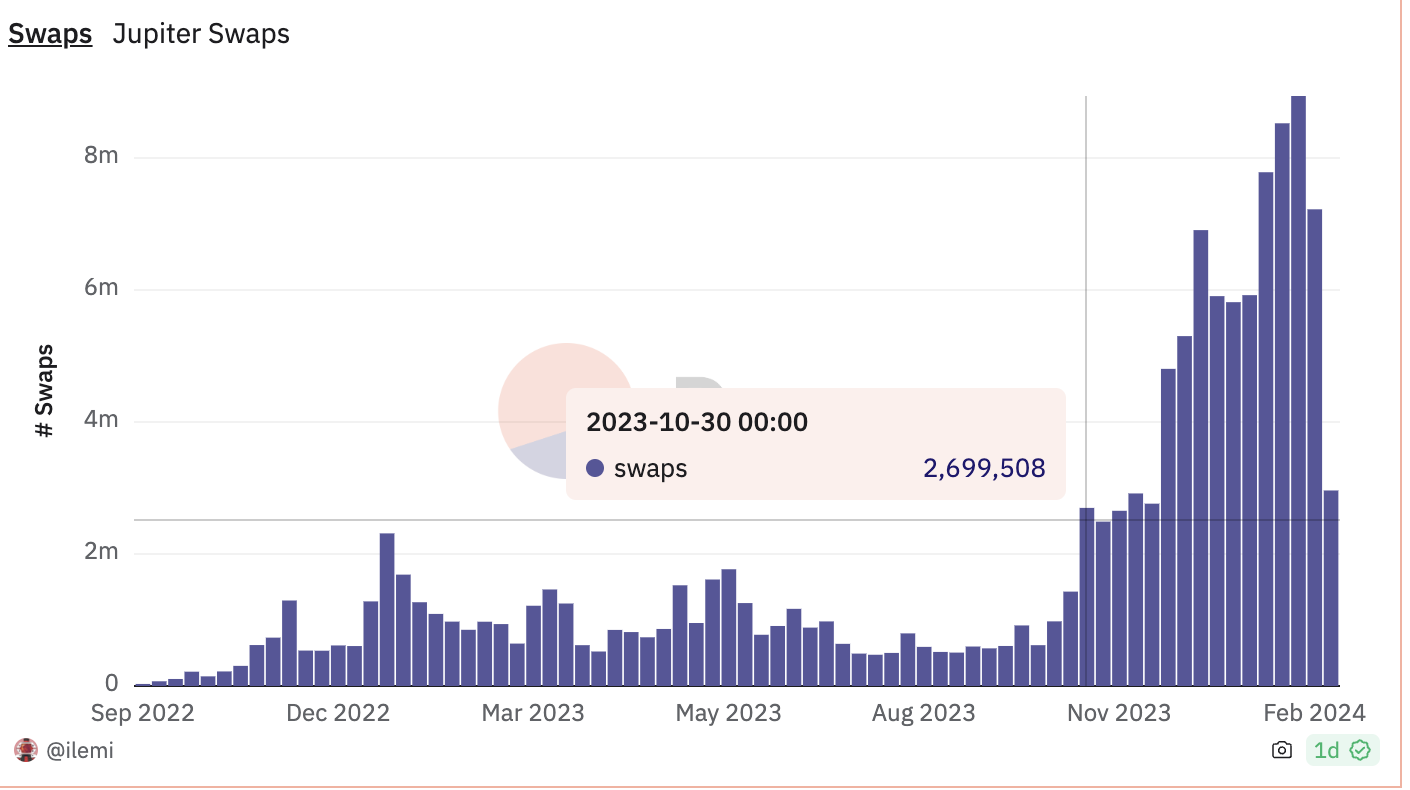

As you can see on the chart, Jupiter spent almost 9 months on the runway without any significant social exposure. The team knew at that time why it was necessary – it was just an accumulating phase.

Today, Jupiter is primarily a B2C product. However, their strategy of integrating existing platforms with liquidity and forging partnerships is evident and effective.

The effective marketing approach from the beginning has garnered Jupiter solid traction and invaluable feedback, refining the product to be sharp, relevant, and authentic.

As you can see on the chart, Jupiter spent almost 9 months on the runway without any significant social exposure. The team knew at that time why it was necessary – it was just an accumulating phase.

The Jupiter team demonstrated a keen understanding of the market sentiment and needs. They wisely streamlined their efforts, cutting out irrelevant actions and focusing solely on what truly mattered.

As the saying goes, "It’s hard to sell ice cream when it’s winter outside." They recognized the seasonality of demand and adapted their strategy accordingly.

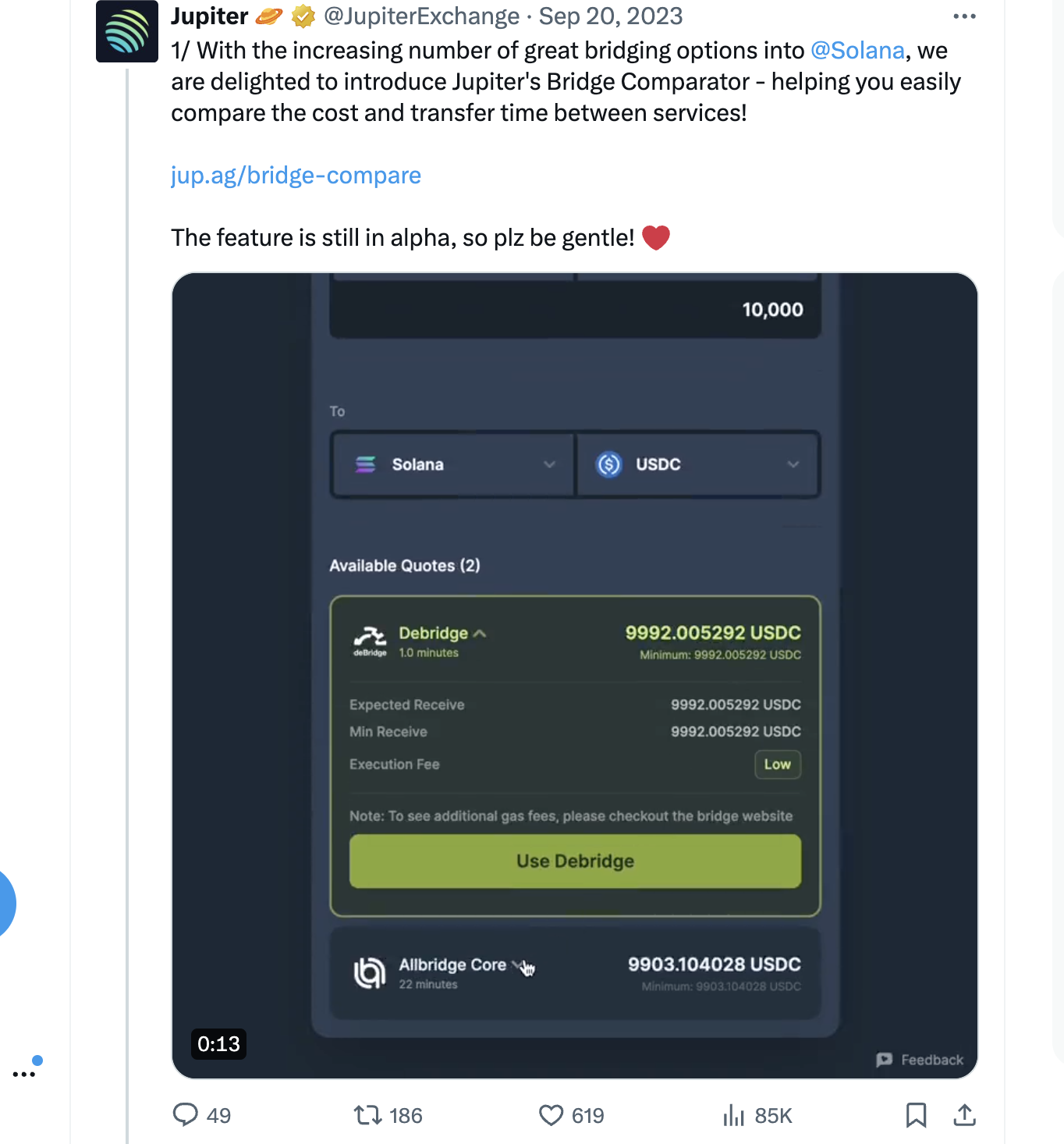

Their key focus? Bridging assets to and from Solana, especially when the DeFi traction on Solana was not yet established. Jupiter's integration across various platforms with their APIs and extensions served as a native bridge, enabling seamless routing of assets.

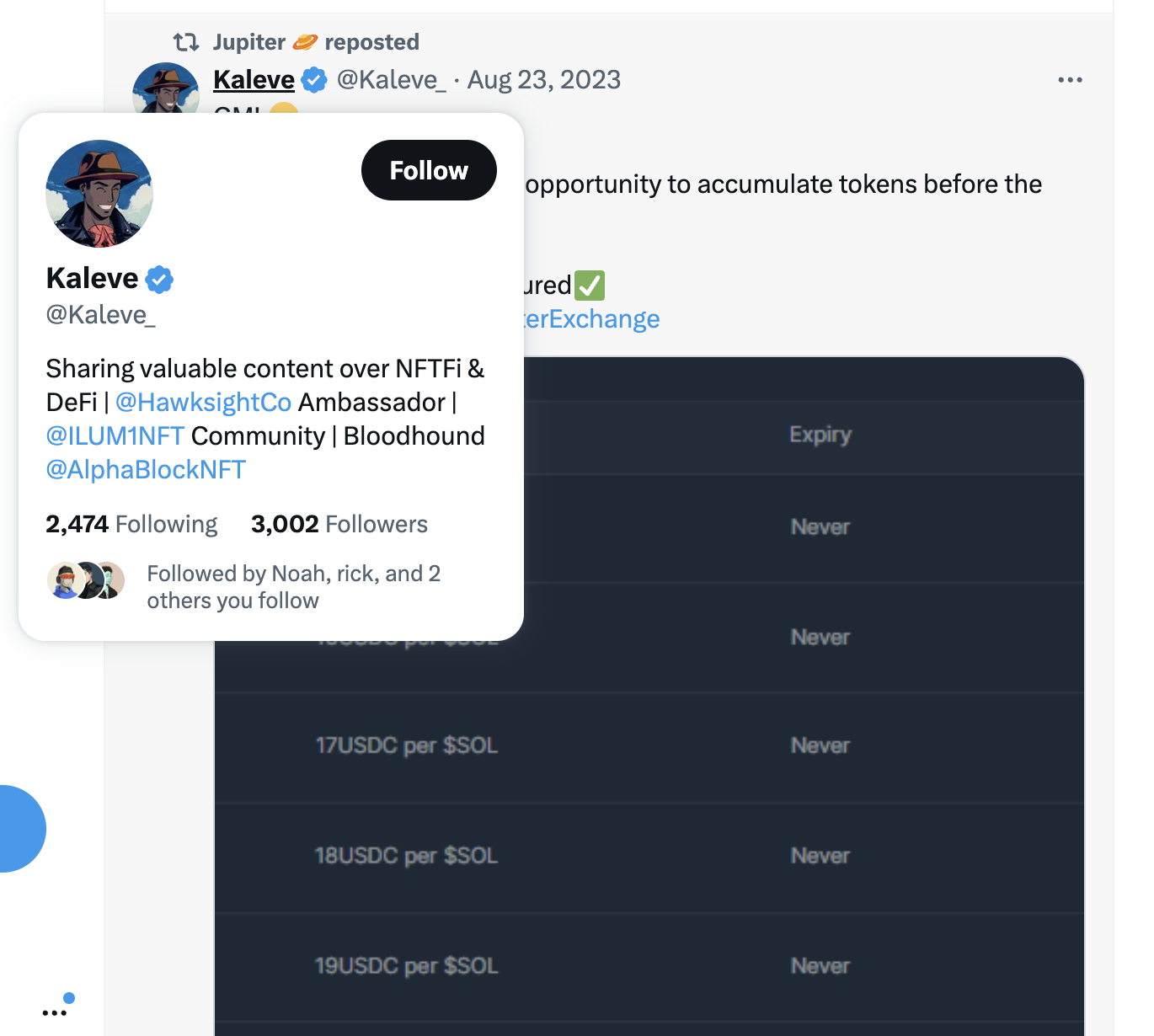

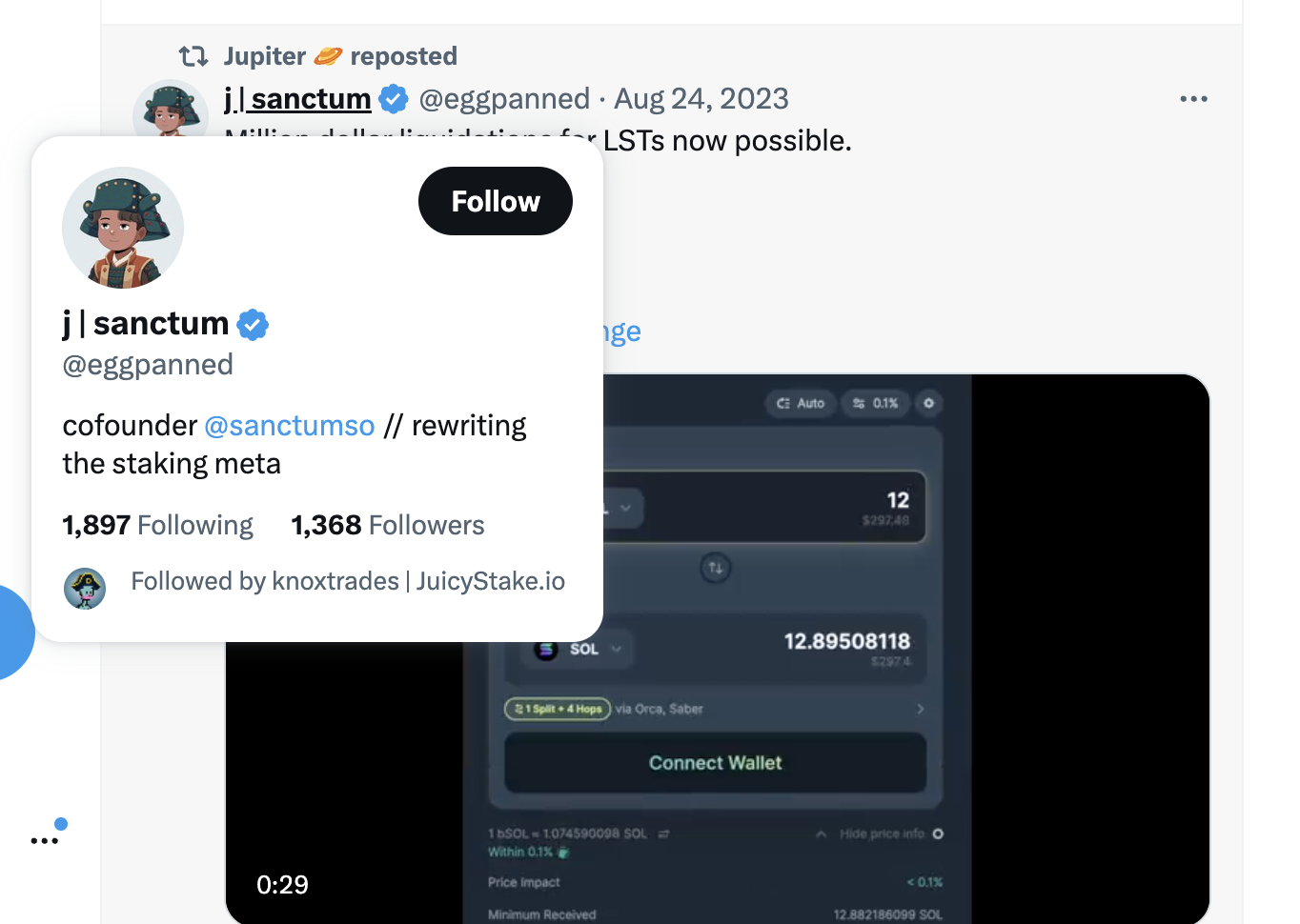

They leveraged free marketing opportunities through partnerships with BONK, SOLANA, SANCTUM, and others, maximizing their reach and exposure in the crypto community.

As the saying goes, "It’s hard to sell ice cream when it’s winter outside." They recognized the seasonality of demand and adapted their strategy accordingly.

Their key focus? Bridging assets to and from Solana, especially when the DeFi traction on Solana was not yet established. Jupiter's integration across various platforms with their APIs and extensions served as a native bridge, enabling seamless routing of assets.

They leveraged free marketing opportunities through partnerships with BONK, SOLANA, SANCTUM, and others, maximizing their reach and exposure in the crypto community.

Kudos once again for the laser-sharp focus on gaining initial traction so accurately and smoothly.

This leads us to a simple equation:

This leads us to a simple equation:

READY TO FLY

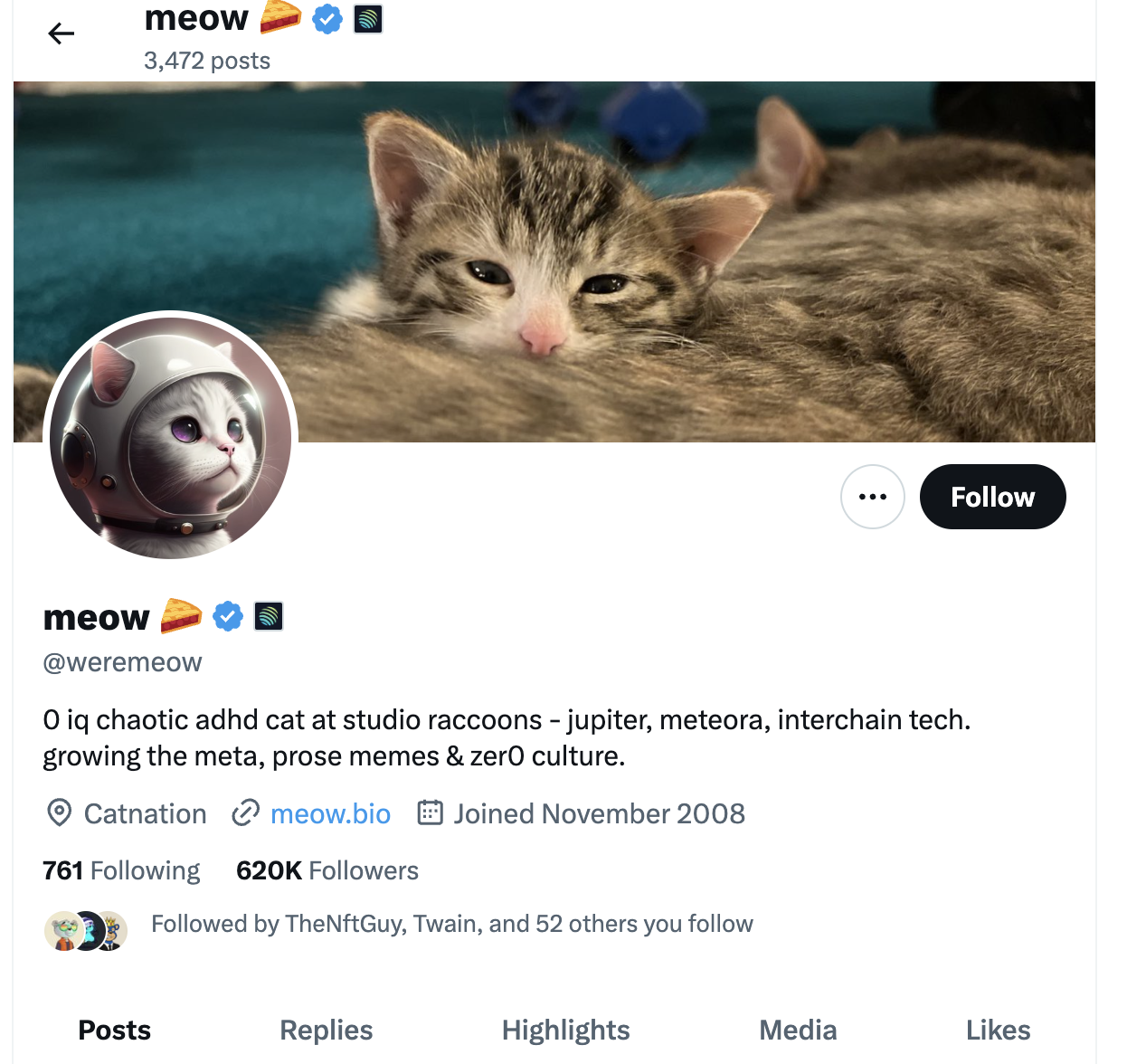

Nearly every hyped project boasts an authentic founder who shapes its narrative. In the case of Jupiter Exchange, that figure is Meow, the founder. He excels at stirring excitement, breaking boundaries, and forging his own path, disregarding conventional rules in favor of his own.

An intriguing aspect is that Meow was also part of the founding team of wBTC, which boasted an $8 billion market capitalization.

It appears that he approaches life with a gaming mindset, challenging seriousness at every turn.

Many of the initial tweets originated from him, and Jupiter Exchange frequently retweeted content from Meow's page. These posts often focused on Jupiter's ethos and updates, including its core values and other relevant information.

It appears that he approaches life with a gaming mindset, challenging seriousness at every turn.

Many of the initial tweets originated from him, and Jupiter Exchange frequently retweeted content from Meow's page. These posts often focused on Jupiter's ethos and updates, including its core values and other relevant information.

Check out how it affects Jupiter's Twitter growth:

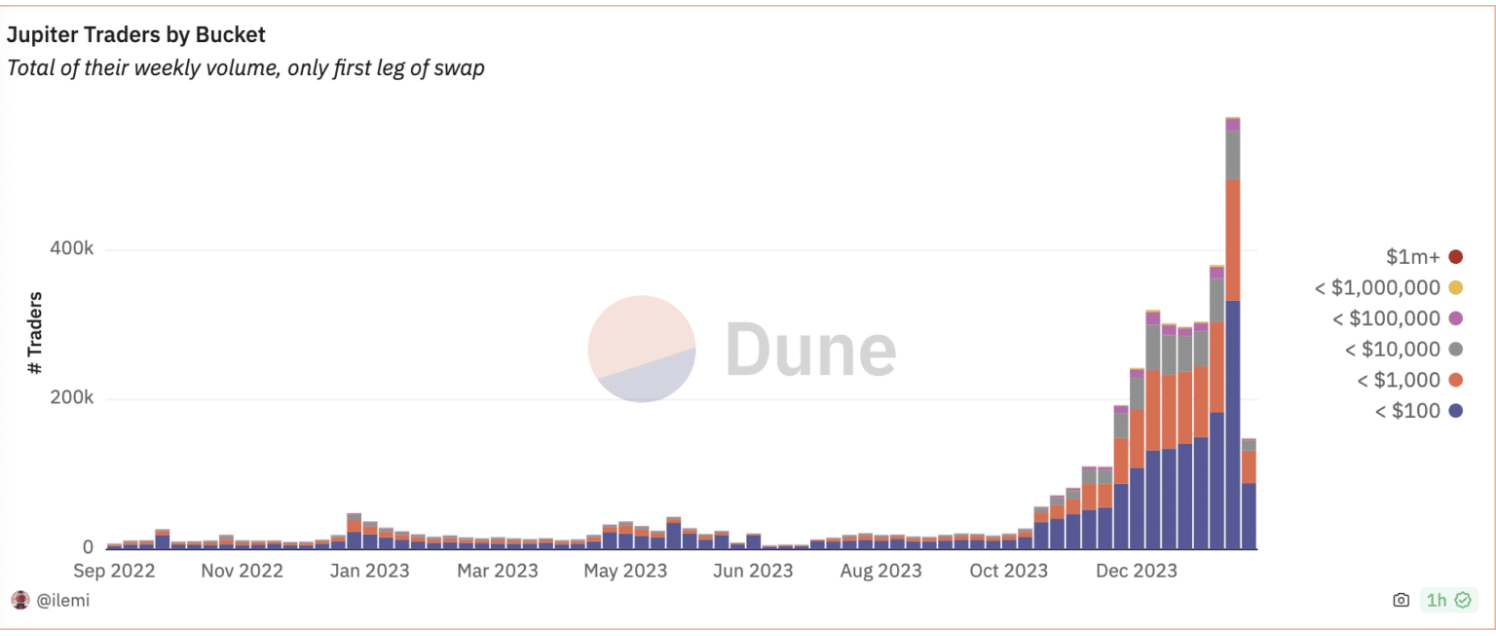

A large group of fans and micro-ambassadors were passionate about the Dollar-Cost Averaging (DCA) and spot liquidity aggregation features. They took it upon themselves to spread the word about the app they had grown to love.

This created a snowball effect that continued to grow. Free marketing was once again achieved through the early adopters and believers who were both users and supporters of the platform.

This created a snowball effect that continued to grow. Free marketing was once again achieved through the early adopters and believers who were both users and supporters of the platform.

Frequent product updates that are highly beneficial and well-received by the community, further enhancing its traction.

Liquidity-attracting campaigns were instrumental in Jupiter's success. With numerous assets integrated into the platform, Jupiter actively competed with reward pools for the most active trading. This increased traction for Jupiter, with funds from other projects fueling its growth.

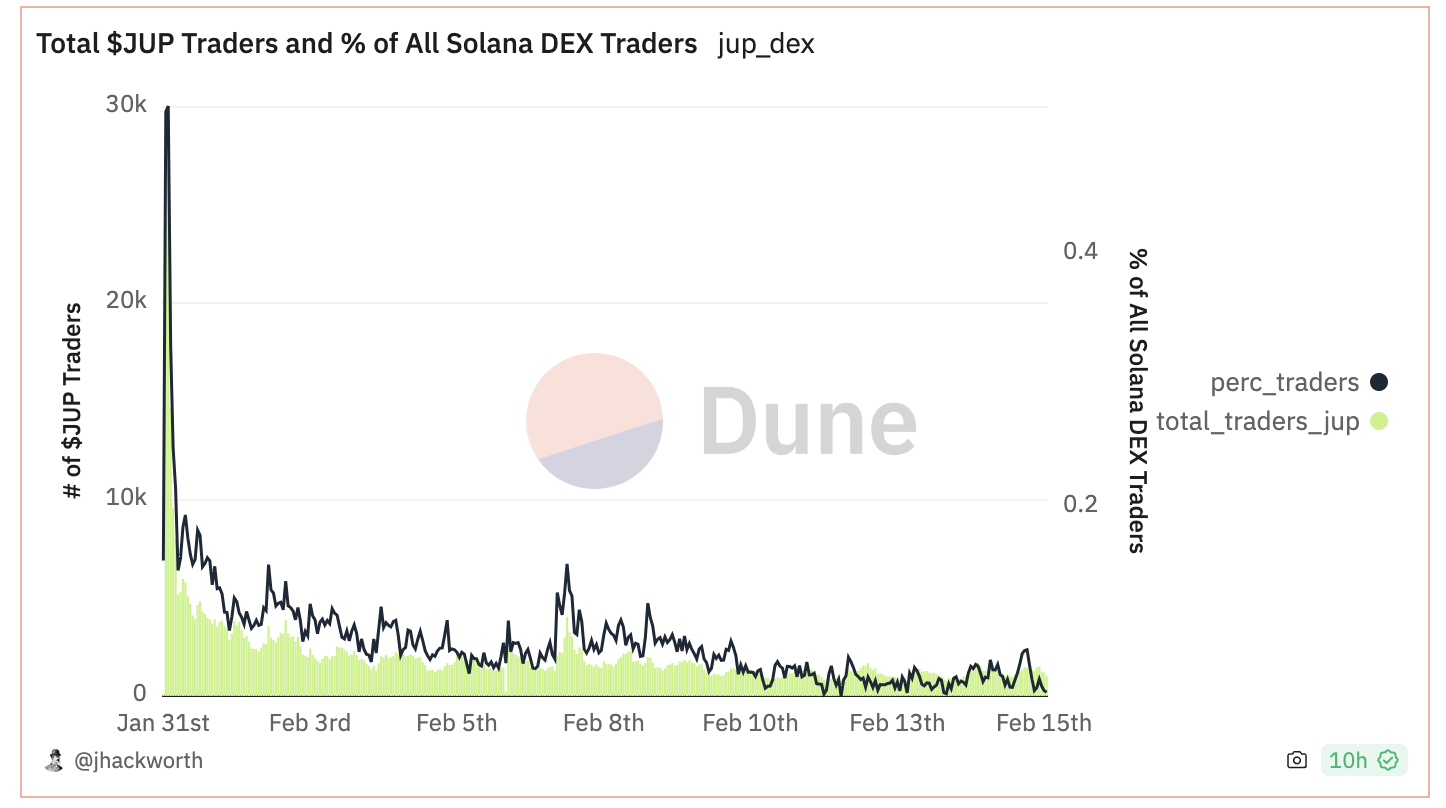

And eventually, rapid growth began to take off. Jupiter crossed 1M unique users.

$360M Airdrop

The beauty of Jupiter’s airdrop lies in its logic. Gone are the days of accidental drops of free money to accounts that participated in the “gleam campaign.” Instead, everything was based on contribution: the more you bring, the more you get.

This model surpasses traditional gleams and other “point collectibles” because it stands out and brings genuine authenticity to the crypto world.

Furthermore, Jupiter Exchange didn't promote the airdrop; it was the community that drove the excitement. The announcement was made in the form of a promise to reward dedicated users on the 31st of “Japuary.”

This approach makes sense because Jupiter already had around 1 million users and wallets, which they planned to airdrop alongside the fourth wave of airdrops in the future.

Therefore, the hype behind the Jupiter Airdrop was fueled by community members.

This model surpasses traditional gleams and other “point collectibles” because it stands out and brings genuine authenticity to the crypto world.

Furthermore, Jupiter Exchange didn't promote the airdrop; it was the community that drove the excitement. The announcement was made in the form of a promise to reward dedicated users on the 31st of “Japuary.”

This approach makes sense because Jupiter already had around 1 million users and wallets, which they planned to airdrop alongside the fourth wave of airdrops in the future.

Therefore, the hype behind the Jupiter Airdrop was fueled by community members.

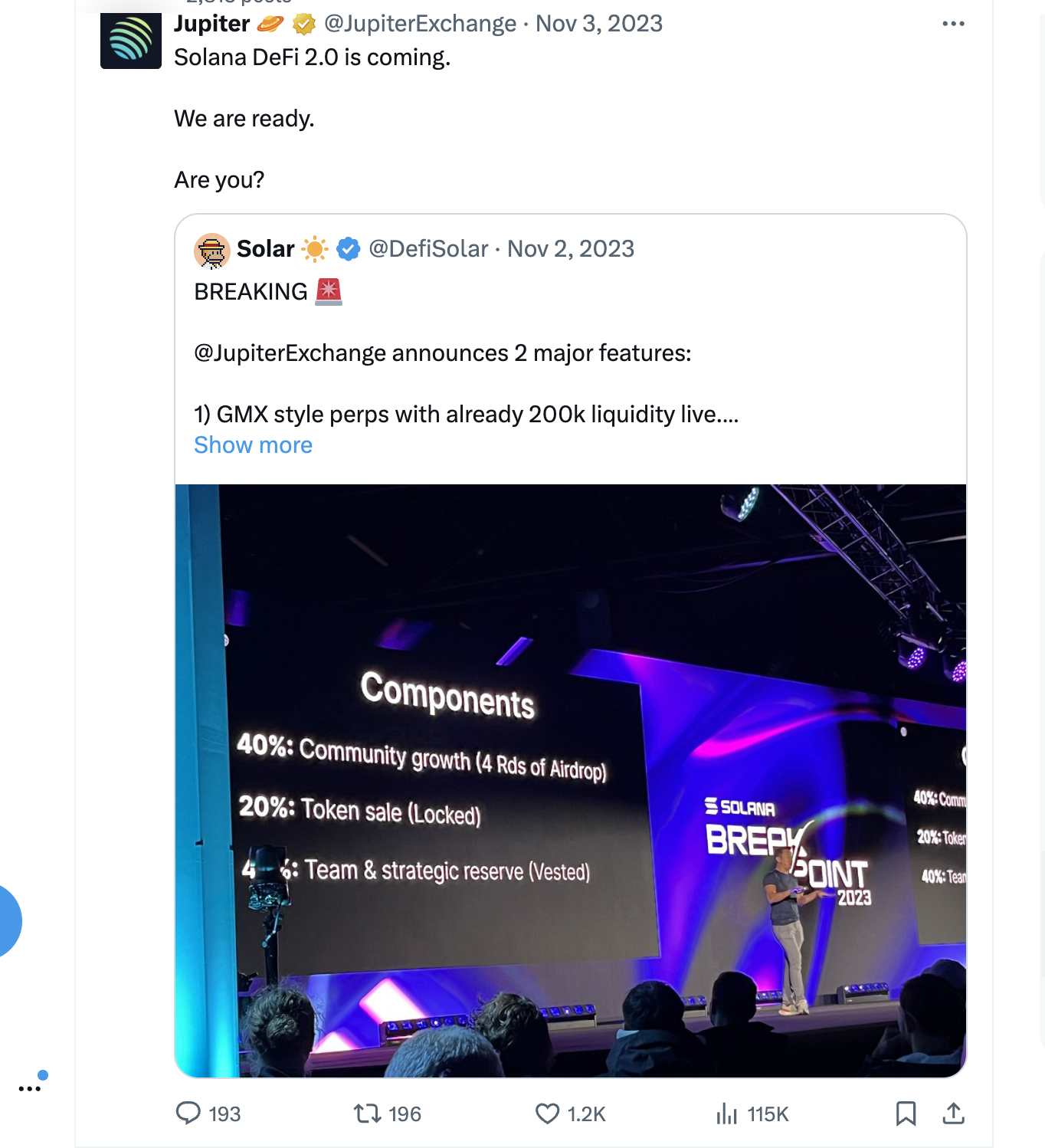

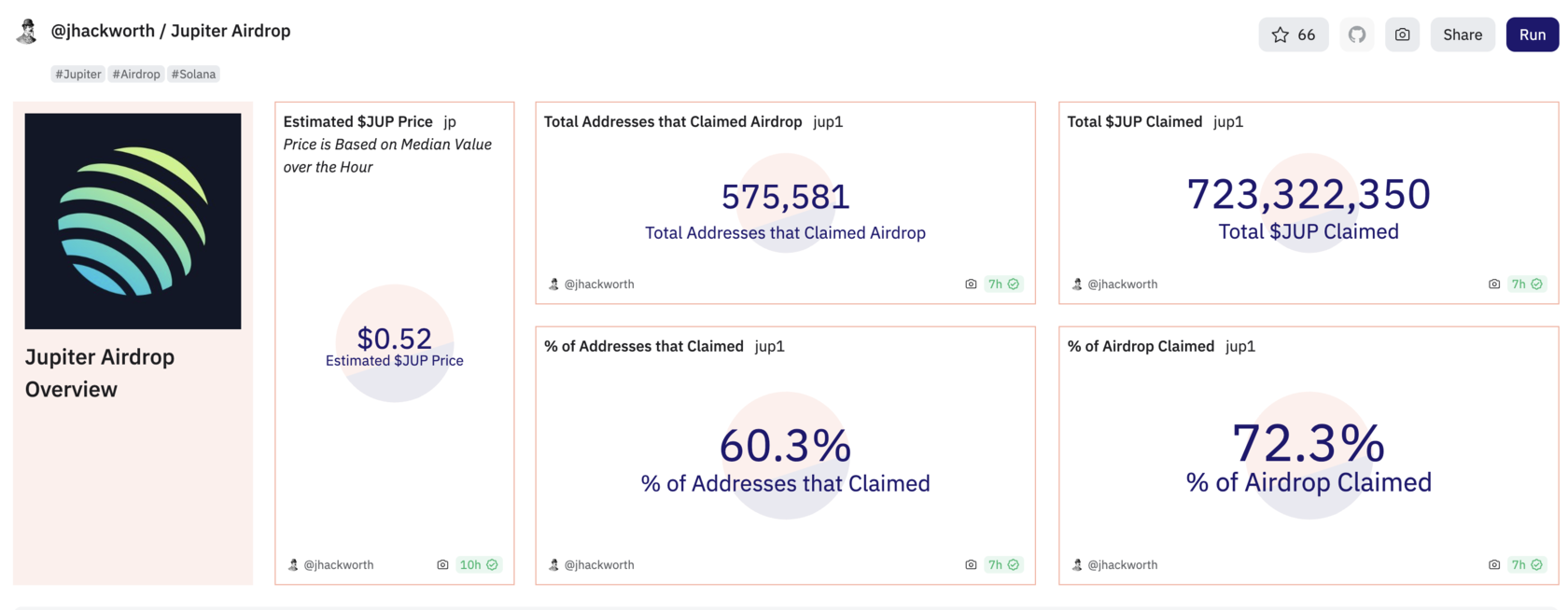

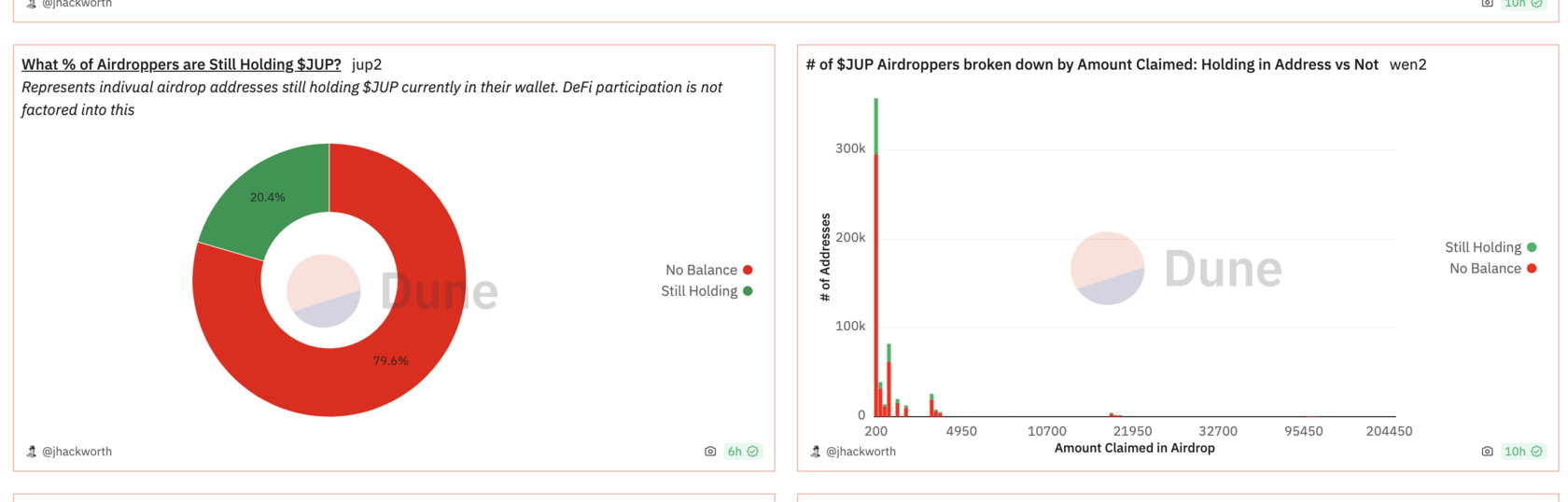

955,000 wallets that interacted with Jupiter directly before the 2nd of November, 2023 are eligible for the first JUP airdrop, which is one of the biggest to date.

“If you're not eligible for this JUP airdrop, don’t worry, there are more to come. For updates on future JUP airdrops, be sure to follow Jupiter on X. Also, keep in mind that airdrop rewards are generally tied to activity. So, the more you buy, sell, and trade on Jupiter, the higher your future JUP airdrop allocation will likely be.” - meow

Meanwhile, the "cats" are busy baking the pie, ensuring it's large enough to feed everyone.

“If you're not eligible for this JUP airdrop, don’t worry, there are more to come. For updates on future JUP airdrops, be sure to follow Jupiter on X. Also, keep in mind that airdrop rewards are generally tied to activity. So, the more you buy, sell, and trade on Jupiter, the higher your future JUP airdrop allocation will likely be.” - meow

Meanwhile, the "cats" are busy baking the pie, ensuring it's large enough to feed everyone.

On the other hand, the Jupiter Exchange community has been at the forefront of a crypto frenzy, showcasing remarkable advancements. According to Dune Analytics, colossal airdrops have become a hallmark of Jupiter’s strategy, attracting over 575,000 participants and distributing a substantial 723.25 million JUP tokens.

Of course, after each airdrop, there was a dump. However, the liquidity remained strong, so the project successfully weathered it.

CASE STUDY:

Meanwhile, data from Lookonchain revealed that a significant profit of $1.17 million was generated from the JUP airdrop. The wallet “7poJrJ” received 1.85 million JUP, which were distributed across approximately 9,246 wallets.

After the airdrop, the user sold 1.4 million JUP for $898,000 on a decentralized exchange (DEX) and deposited 121,000 JUP, equivalent to $77,000, into Bybit and MEXC. Currently, the wallet holds 319,000 JUP, valued at $196,000.

After the airdrop, the user sold 1.4 million JUP for $898,000 on a decentralized exchange (DEX) and deposited 121,000 JUP, equivalent to $77,000, into Bybit and MEXC. Currently, the wallet holds 319,000 JUP, valued at $196,000.

Certainly, there were some unexpected challenges that arose during the "Jupuary" event, but rather than dampening the excitement, they paradoxically fueled even more anticipation and interest in the event.

POSTLAUNCH ERA

Here are some remarkable achievements on January 31, 2024

- The most used trading platform in DeFi

- Direct 80% of organic volume

- The most used program in Solana

- Top 2 by vol on Coingecko

- The most integrated platform on Solana

- One of the top perp platforms ($1.4B volume last week)

Surpassing Uniswap

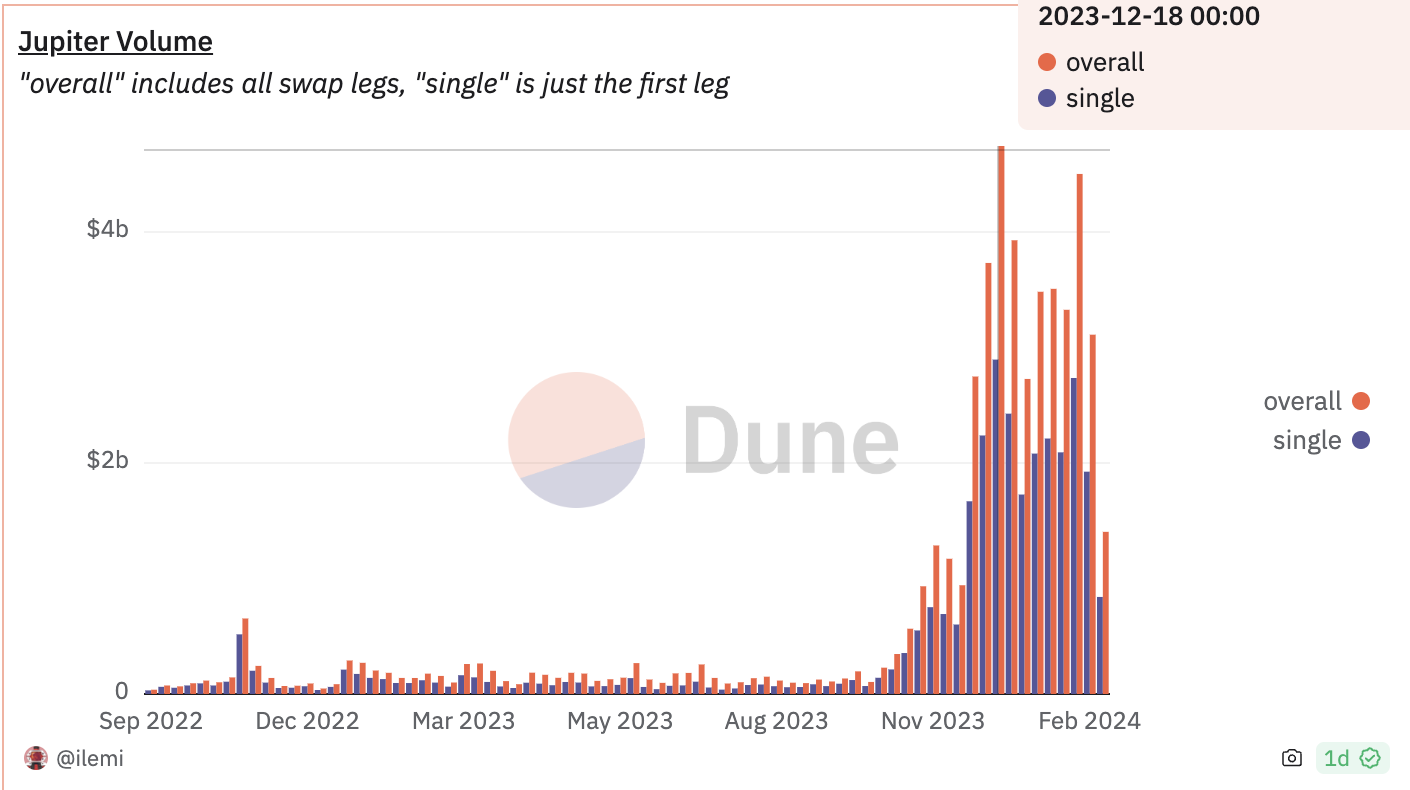

The surge in the number of traders last week preceded Jupiter temporarily becoming the biggest trading platform by 24-hour trading volume, surpassing Uniswap early Monday

The exchange recorded a 24-hour trading volume of $406 million, as reported by the Jupiter Aggregator. This figure exceeded that of Uniswap v2, which had a 24-hour trading volume of $108 million. However, it was still lower than Uniswap v3, which had a 24-hour trading volume of $801 million at the time of writing.

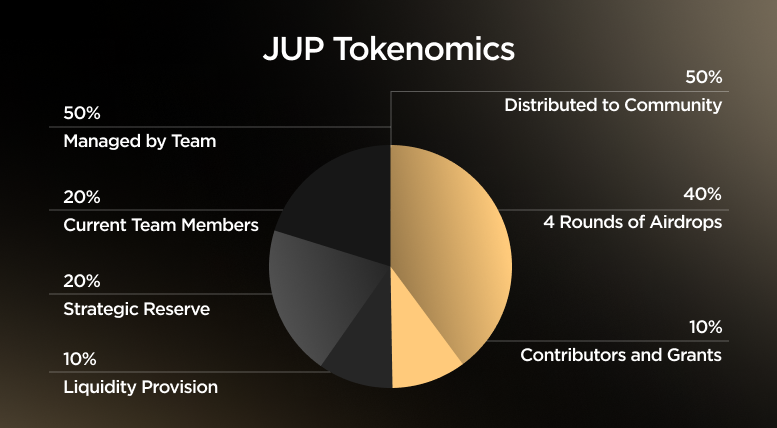

Breakdown of tokenomics

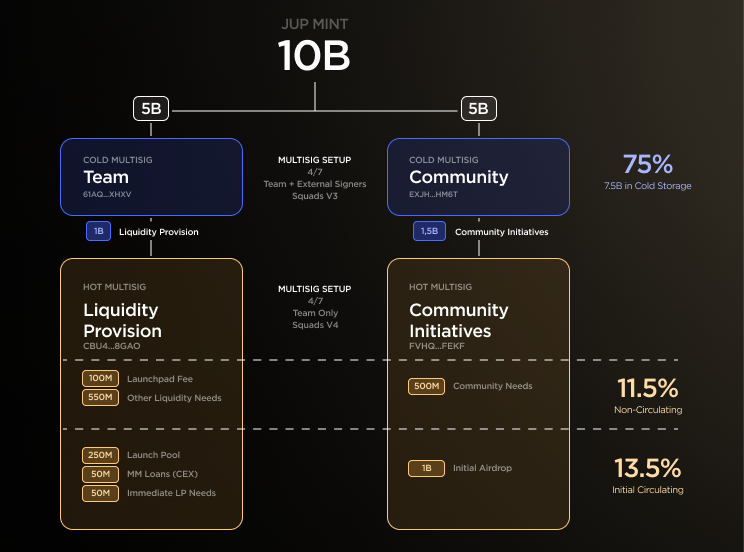

According to Jupiter's founder, the JUP token will have a total circulating supply of 10 billion.

The Jupiter team will oversee 50% of the token supply, while the remaining 50% will be distributed to the community, as outlined in the original green paper without a token sale. Of the team's allocation, 20% will be allocated to current members with a two-year vesting period, another 20% to a strategic reserve, and the remaining 10% for liquidity provision. These allocations will be governed by multisig controls and lock-up periods.

The remaining 1 billion JUP tokens will be available to community contributors through grants. These tokens will be held in a community 4/7 multisig hot wallet, as indicated by the associated Solana address. The Jupiter DAO will oversee the allocation of these funds.

The most controversial yet intriguing part begins here 👇🏼

The most controversial yet intriguing part begins here 👇🏼

Token Utility

It's noteworthy that the JUP token isn't primarily designed for utility purposes. In an AMA on Reddit, Meow, the founder of Jupiter, advised users against expecting significant utility from JUP.

"I believe that the notion that a token's utility determines its value is a myth, often used to justify its value by project founders. Most people are more concerned about the token's value than its utility," Meow wrote.

Additionally, the distribution plan for the JUP token includes a strategic airdrop to Solana wallet holders, with 20% distributed evenly, 70% based on engagement scoring, and 10% allocated for community members and developers. The circulating supply amounts to 1.35 billion tokens.

The founder clarified a unique approach to the token's launch pool: no selling is permitted after seven days.

"I believe that the notion that a token's utility determines its value is a myth, often used to justify its value by project founders. Most people are more concerned about the token's value than its utility," Meow wrote.

Additionally, the distribution plan for the JUP token includes a strategic airdrop to Solana wallet holders, with 20% distributed evenly, 70% based on engagement scoring, and 10% allocated for community members and developers. The circulating supply amounts to 1.35 billion tokens.

The founder clarified a unique approach to the token's launch pool: no selling is permitted after seven days.

BYTES OF POWER

As you can observe, Jupiter's launch strategy incorporates numerous key elements, highlighting the significance of thorough planning. Here are some of these essential components:

1. Generosity in reposting user-generated content, fostering further engagement.

2. Emphasis on authenticity.

3. Leveraging the personal brand of Meow.

4. Focus on the Theory of Fun (ToF).

5. Strong emphasis on the product's core features.

6. A community-centric mindset.

7. Achieving smooth early product traction.

8. Prioritizing UI/UX simplicity.

9. Embracing a forward-thinking concept that sells the future.

10. Implementation of on-chain marketing strategies.

And more.

2. Emphasis on authenticity.

3. Leveraging the personal brand of Meow.

4. Focus on the Theory of Fun (ToF).

5. Strong emphasis on the product's core features.

6. A community-centric mindset.

7. Achieving smooth early product traction.

8. Prioritizing UI/UX simplicity.

9. Embracing a forward-thinking concept that sells the future.

10. Implementation of on-chain marketing strategies.

And more.

This detailed breakdown was provided by Cryptorsy, a leading Web3 marketing studio. Over the years, through extensive collaboration with crypto projects and regular analysis of top contenders, our team has amassed unique experience and skills. Let's collaborate on the next big launch together.

How much does it cost to cooperate with a crypto marketing agency?

The cost of using a crypto digital marketing company will vary depending on the size and scope of your campaign. However, we believe that our prices are very competitive and offer excellent value for money. If you would like a more accurate quote, please contact us and we will be happy to provide you with a customized proposal to fit your budget.

What are the best marketing channels for my crypto offering?

The best advertising and marketing channels are the ones that will allow you to reach your target audience most effectively within your budget. This will vary depending on your type of cryptocurrency project - whether it’s an ICO or a more well-established offering. However, some of the most popular marketing channels for crypto projects include the following:

- SEO & Content Marketing

- PPC Ads

- Social Ads

- PR & Outreach

- Influencer Marketing

- Online Communities

- Press releases

From what and how exactly we can start a collaboration?

Sure thing, we start with a briefing and underlining your goals, to make it our main focus in the work progress, then we’ll give you a couple of gifts (secret), connect your personal marketing manager to your project and launch campaigns. Just beep us on telegram @cryptorsy_io_bot , email us at hello@cryptorsy.io, leave your request here or book a call on our website. We have a principal position: what starts perfectly, will go on perfectly. So be sure, the process of work will be perfect in detail.

How I can be sure that you’ll deliver results?

As a team of data-driven crypto digital marketers, we place a strong emphasis on ROI. We believe that transparency is key — that's the reason we’ll always keep you up to date with our progress, so you can check out the results at any time.

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

Our combination of experience, expertise, and flexibility makes us some of the best crypto marketing experts in the industry. Here are some of the ways we ensure our clients get the best results:

- We have a team of experts who are solely focused on marketing cryptocurrency.

- We stay up to date with the latest industry news and trends.

- We develop creative solutions that are designed to help our clients overcome the unique challenges present in the world of cryptocurrency.

- We are always monitoring our campaigns to ensure they are delivering the desired results.

- We always remain agile and adapt our cryptocurrency strategies as needed.

- We offer competitive pricing to fit your budget without sacrificing quality.

What makes Cryptorsy unique and super valuable to me?

All our benefits: gifts, personal marketing manager, free audit, all services on a high-quality level, super easy-to-take prices, perfect scenario and funnels for result getting, and our powerful web3 network, that we can connect to you (all our relations and guys, that can strengthen your performance).

What do I get if I accept your offer, and what do I lose if I refuse?

Shortly, you’ll lose your dedicated crypto marketing partners that could bring you the highest results in the space because they’ve done this a million times, and why don't we do that with you?

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

What do you get? You get a successful marketing launch and sustainability in your future because 21+ TOP-level experts will manage your marketing activities!

Want to hack the stunning growth formula for your project? Our team has prepared something extremely special for you, just leave your application to get yours!

GET A PROPOSAL